Decoding the Double Prime Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the Double Prime Chart Sample: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Double Prime Chart Sample: A Complete Information for Merchants. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Double Prime Chart Sample: A Complete Information for Merchants

The double high chart sample is a widely known and extensively used reversal sample in technical evaluation. It indicators a possible shift from an uptrend to a downtrend, providing merchants a invaluable alternative to determine potential quick promoting entries or to guard present lengthy positions. Understanding its formation, affirmation, and implications is essential for profitable buying and selling. This text delves deep into the double high sample, exploring its nuances, variations, and sensible purposes.

Understanding the Formation of a Double Prime

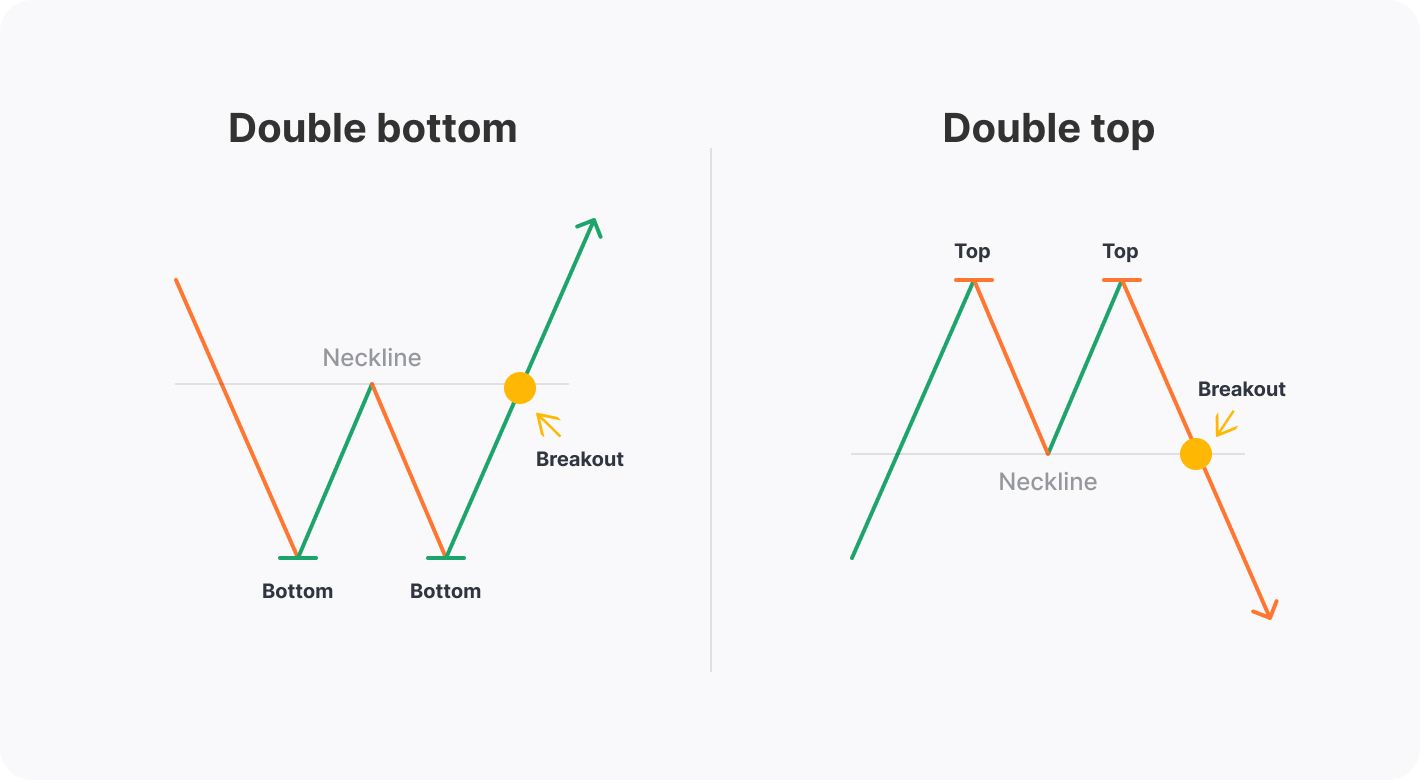

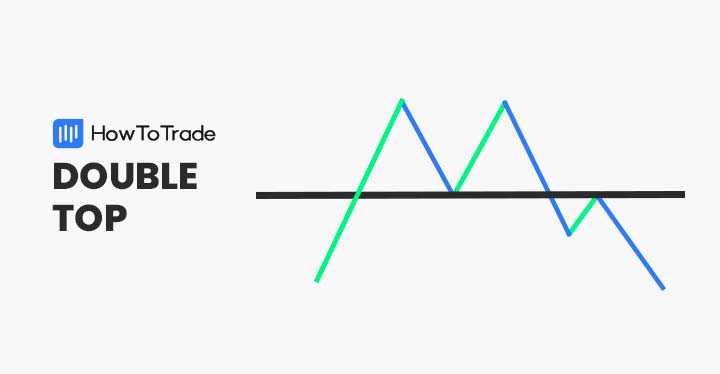

The double high sample is characterised by two distinct peaks of roughly equal top, adopted by a neckline connecting the troughs between the peaks. These peaks symbolize resistance ranges the place the upward momentum stalls, suggesting a possible change in market sentiment. The neckline acts as a vital assist stage. A break under this neckline confirms the sample and indicators a possible value decline.

Let’s break down the important thing elements:

-

Two Peaks (Resistance Ranges): These are the 2 highest factors within the value motion, ideally shut in value and comparatively close to in time. The nearer the peaks in value and time, the stronger the sample is taken into account. Important divergence between the peaks weakens the sample’s predictive energy.

-

Neckline (Assist Degree): It is a trendline connecting the troughs (lowest factors) between the 2 peaks. It represents a vital assist stage. A break under this neckline confirms the sample and triggers the bearish sign. The neckline’s slope can present further data; a steeper downward slope suggests stronger bearish strain.

-

Proper Shoulder (Second Peak): The second peak normally kinds after a interval of consolidation or a slight pullback from the primary peak. The quantity traded in the course of the formation of the second peak is commonly decrease than the amount on the first peak, indicating weakening shopping for strain.

-

Quantity Affirmation: Whereas not strictly a element of the sample formation, quantity evaluation can considerably strengthen its predictive energy. Excessive quantity in the course of the formation of the primary peak and decrease quantity in the course of the second peak typically accompany a robust double high sample. This means waning shopping for curiosity. Conversely, a break under the neckline with elevated quantity additional confirms the bearish sign.

Figuring out a Legitimate Double Prime Sample:

Not each occasion of two peaks adopted by a trough constitutes a sound double high sample. A number of components must be thought-about:

-

Peak Similarity: The 2 peaks ought to be comparatively shut in value. A big distinction weakens the sample’s reliability. A normal rule of thumb is that the peaks ought to be inside 3-5% of one another.

-

Neckline Readability: The neckline ought to be clearly outlined and simply identifiable. A imprecise or ambiguous neckline reduces the sample’s predictive energy.

-

Timeframe: The timeframe used to determine the sample influences its interpretation. A double high recognized on a each day chart can have completely different implications than one recognized on a weekly or month-to-month chart. Longer timeframes typically point out stronger, extra vital value actions.

-

Contextual Evaluation: Think about the broader market circumstances and the precise asset’s basic components. A double high sample showing throughout a robust general market uptrend may be much less dependable than one showing throughout a bearish market surroundings.

Affirmation and Goal Worth Projection:

The affirmation of a double high sample happens when the worth breaks under the neckline. This break usually entails elevated buying and selling quantity, reinforcing the bearish sign. As soon as the neckline is damaged, the sample is taken into account confirmed, and merchants can provoke quick positions.

Figuring out the potential goal value for a double high sample entails measuring the gap between the neckline and the very best peak (both peak is suitable). This distance is then projected downwards from the neckline to estimate the potential value decline. This projection just isn’t a assured value goal, however fairly a sign of the potential magnitude of the worth motion. Different components, corresponding to market sentiment and general financial circumstances, can affect the precise value motion.

Variations of the Double Prime Sample:

Whereas the traditional double high sample is definitely identifiable, variations exist:

-

Rounded Double Prime: This variation options smoother, much less pronounced peaks, making a extra rounded look. The interpretation and affirmation stay much like the traditional sample.

-

Broadening Double Prime: This variation options widening peaks, indicating growing volatility. The neckline stays the essential assist stage for affirmation.

-

Asymmetrical Double Prime: The 2 peaks are usually not of equal top. Whereas nonetheless a bearish sign, the predictive energy may be barely weaker in comparison with a symmetrical double high.

False Breakouts and Limitations:

It is essential to acknowledge that not all double high patterns result in vital value declines. False breakouts under the neckline can happen, resulting in whipsaws and potential losses for merchants who enter quick positions prematurely. Subsequently, it is important to make use of further affirmation indicators, corresponding to quantity evaluation, indicators like RSI or MACD, and general market sentiment earlier than initiating a commerce based mostly on a double high sample.

Combining the Double Prime with Different Technical Indicators:

Utilizing the double high sample along side different technical indicators can improve its predictive energy and cut back the chance of false indicators. Some helpful indicators embrace:

-

Shifting Averages: A bearish crossover of a fast-moving common (e.g., 50-day MA) under a slow-moving common (e.g., 200-day MA) can verify the bearish pattern indicated by the double high sample.

-

Relative Energy Index (RSI): An RSI studying above 70 signifies overbought circumstances, suggesting a possible value reversal. A bearish divergence between value and RSI can even verify the double high sample.

-

Shifting Common Convergence Divergence (MACD): A bearish MACD crossover can reinforce the bearish sign from the double high sample.

Threat Administration and Buying and selling Methods:

Buying and selling based mostly on the double high sample requires cautious danger administration. Setting applicable stop-loss orders is essential to restrict potential losses in case the sample fails to materialize. Merchants also needs to think about using trailing stop-loss orders to guard income as the worth strikes of their favor. Place sizing is one other very important facet of danger administration; keep away from over-leveraging your trades.

A number of buying and selling methods may be employed utilizing the double high sample:

-

Quick Promoting: Enter a brief place after a confirmed break under the neckline, with a stop-loss order positioned above the neckline.

-

Hedging Lengthy Positions: If already holding lengthy positions, a double high sample may point out a possible value decline. Think about decreasing your place measurement or hedging your danger by coming into a brief place.

-

Possibility Methods: Put choices can be utilized to revenue from a possible value decline indicated by the double high sample.

Conclusion:

The double high chart sample is a invaluable instrument for merchants to determine potential value reversals. Nonetheless, it is not a foolproof indicator, and false indicators can happen. Thorough evaluation, together with consideration of quantity, different technical indicators, and general market circumstances, is important to enhance the accuracy of buying and selling selections based mostly on this sample. By understanding its formation, affirmation, variations, and limitations, merchants can successfully use the double high sample to reinforce their buying and selling methods and enhance their danger administration. Bear in mind to at all times observe accountable buying and selling and by no means make investments greater than you may afford to lose.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Double Prime Chart Sample: A Complete Information for Merchants. We respect your consideration to our article. See you in our subsequent article!