Decoding the Double High Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the Double High Chart Sample: A Complete Information for Merchants

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Double High Chart Sample: A Complete Information for Merchants. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Double High Chart Sample: A Complete Information for Merchants

The double prime chart sample is a traditional reversal sample in technical evaluation, signaling a possible shift from an uptrend to a downtrend. Acknowledged for its distinct visible traits, the double prime supplies merchants with a priceless software for figuring out potential short-selling alternatives or managing present lengthy positions. Understanding its formation, affirmation, and limitations is essential for profitable implementation in buying and selling methods. This text delves deep into the double prime sample, masking its identification, interpretation, and sensible purposes.

Understanding the Formation of a Double High

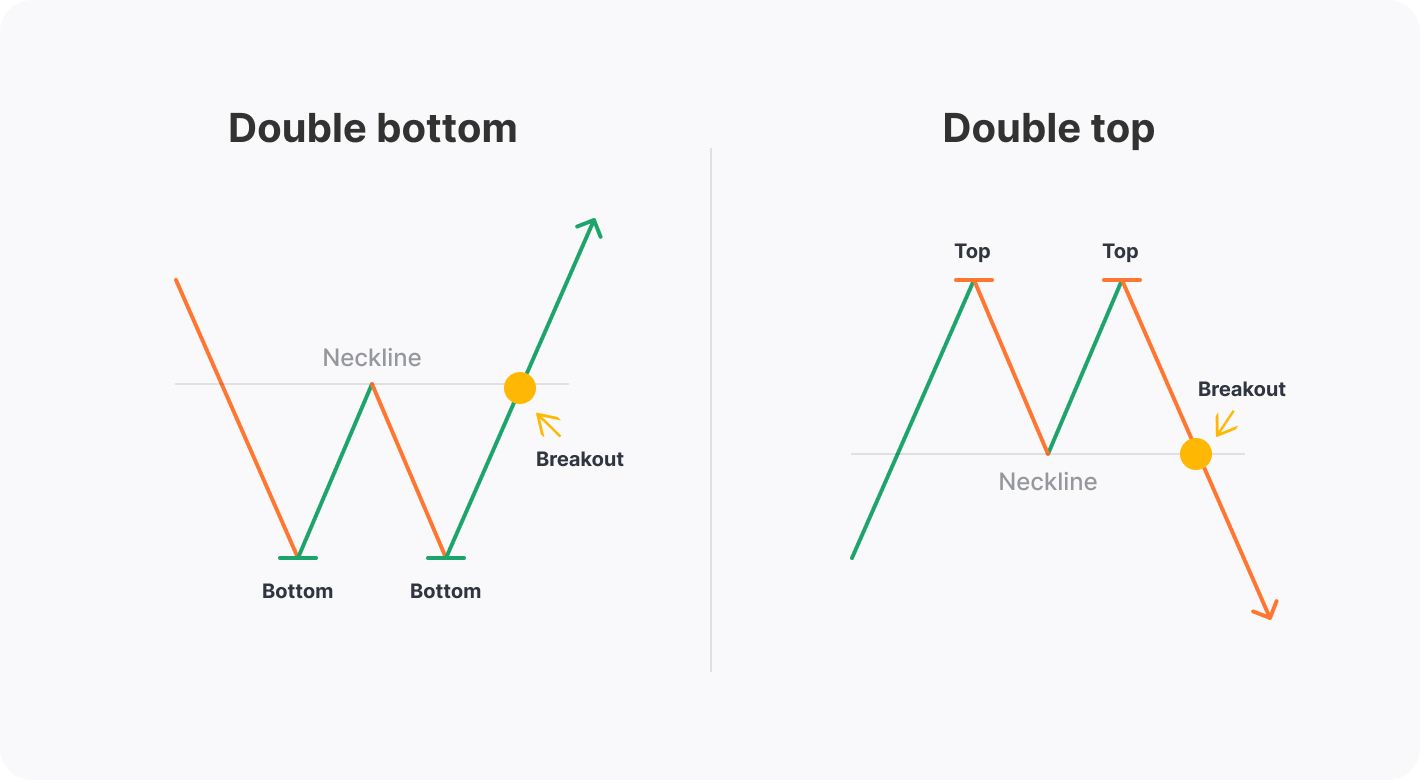

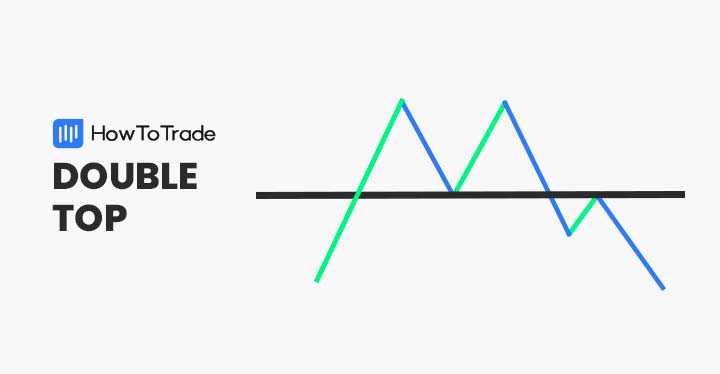

The double prime sample is characterised by two distinct worth peaks (the "tops") of roughly equal peak, adopted by a subsequent decline. These peaks are separated by a trough, forming a "W" or "M" formed sample on the worth chart. The sample’s significance lies out there’s incapability to interrupt above the resistance degree established by the 2 peaks. This resistance, typically a earlier excessive or a big psychological degree, acts as a barrier to additional worth appreciation.

Key Elements of a Double High:

- Two Peaks (Tops): The 2 peaks needs to be comparatively shut in worth and time. A slight variation (inside an affordable share, usually 3-5%) is suitable, however important discrepancies can weaken the sample’s reliability.

- Neckline: The neckline is a trendline connecting the lows between the 2 peaks. This line acts as essential assist in the course of the uptrend previous the sample and serves as a important breakout degree as soon as the sample is shaped. A break beneath the neckline confirms the sample and indicators the potential begin of a downtrend.

- Quantity: Quantity performs a big function in confirming the validity of a double prime. Sometimes, larger quantity accompanies the formation of the 2 peaks, indicating sturdy promoting stress. Conversely, decrease quantity in the course of the subsequent decline can counsel a weaker sample.

- Time Body: The time-frame for the formation of a double prime can differ considerably. It may kind over days, weeks, months, and even years, relying on the asset and the market circumstances.

Figuring out a Double High: A Step-by-Step Method

-

Establish the Two Peaks: Find two distinct worth peaks of roughly equal peak. Take note of the proximity of those peaks by way of each worth and time.

-

Draw the Neckline: Join the lows between the 2 peaks utilizing a trendline. This trendline represents the neckline. Make sure the trendline is comparatively constant and connects the lows easily.

-

Observe Quantity: Analyze the quantity related to the formation of the peaks and the next worth motion. Excessive quantity on the peaks and comparatively decrease quantity in the course of the decline strengthens the sample’s validity.

-

Affirm the Breakout: A decisive break beneath the neckline confirms the sample. This breakout ought to ideally be accompanied by elevated quantity, reinforcing the bearish sign.

Affirmation of the Double High Sample:

Whereas the visible formation of the double prime is essential, affirmation by means of different technical indicators strengthens the buying and selling sign. A number of strategies can assist affirm a double prime:

-

Shifting Averages: A bearish crossover of short-term and long-term shifting averages (e.g., 50-day and 200-day MA) can affirm the downtrend initiated by the double prime breakout.

-

Relative Power Index (RSI): A bearish divergence between worth and RSI can affirm the weakening momentum. This happens when the worth makes larger highs, however the RSI fails to make larger highs, suggesting a lack of shopping for stress.

-

MACD (Shifting Common Convergence Divergence): A bearish crossover of the MACD strains (MACD and sign line) can affirm the change in momentum and assist the bearish sign from the double prime.

-

Quantity Evaluation: As talked about earlier, excessive quantity in the course of the formation of the peaks and decrease quantity in the course of the decline provides credence to the sample. Elevated quantity on the breakout beneath the neckline additional solidifies the affirmation.

Measuring the Potential Draw back:

As soon as the double prime sample is confirmed, merchants can estimate the potential draw back transfer utilizing the sample’s measurements. A typical methodology is to measure the vertical distance between the neckline and the very best peak. This distance is then projected downwards from the breakout level to estimate the potential goal worth. That is also known as the "measuring the hole" method. It is essential to keep in mind that that is simply an estimation, and the precise worth motion might differ.

Limitations and Issues:

Whereas the double prime sample is a strong software, it is not foolproof. A number of limitations needs to be thought of:

-

False Breakouts: The worth might quickly break beneath the neckline earlier than recovering, making a false sign. Merchants ought to await a decisive and sustained break beneath the neckline earlier than getting into a brief place.

-

Sample Recognition Subjectivity: Figuring out the precise peaks and the neckline could be subjective, resulting in variations in interpretation. Completely different merchants might establish the sample otherwise, leading to discrepancies in buying and selling indicators.

-

Market Situations: The effectiveness of the double prime sample depends upon the general market circumstances. In extremely unstable markets, the sample could also be much less dependable.

-

Affirmation is Essential: Relying solely on the visible identification of the double prime is dangerous. Affirmation from different technical indicators and quantity evaluation is essential to reduce false indicators.

Buying and selling Methods with the Double High Sample:

Merchants can make use of numerous methods when encountering a double prime sample:

-

Brief Promoting: As soon as the sample is confirmed by a break beneath the neckline, merchants can enter a brief place, aiming to revenue from the anticipated worth decline. Cease-loss orders needs to be positioned above the neckline to restrict potential losses in case of a false breakout.

-

Hedging Lengthy Positions: Merchants holding lengthy positions would possibly take into account partially or totally hedging their positions by getting into brief positions as soon as the double prime is confirmed. This technique reduces potential losses if the worth declines as predicted.

-

Trailing Cease-Loss: As soon as a brief place is established, a trailing stop-loss order can be utilized to guard income as the worth declines. This order mechanically adjusts the stop-loss degree as the worth strikes favorably, locking in income.

Conclusion:

The double prime chart sample is a priceless software for skilled merchants to establish potential reversals out there. Nevertheless, it is essential to grasp its formation, affirmation strategies, and limitations. Combining the visible identification of the sample with affirmation from different technical indicators and quantity evaluation considerably improves the accuracy of buying and selling indicators. Do not forget that no technical sample ensures success, and danger administration is paramount in any buying and selling technique. All the time follow accountable buying and selling and take into account consulting with a monetary advisor earlier than making any funding choices. Thorough analysis and understanding of market dynamics are important for profitable utility of the double prime sample in your buying and selling method.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Double High Chart Sample: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!