Decoding the Dynamics of Wholesale Gasoline Costs: A Complete Chart Evaluation

Associated Articles: Decoding the Dynamics of Wholesale Gasoline Costs: A Complete Chart Evaluation

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Dynamics of Wholesale Gasoline Costs: A Complete Chart Evaluation. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the Dynamics of Wholesale Gasoline Costs: A Complete Chart Evaluation

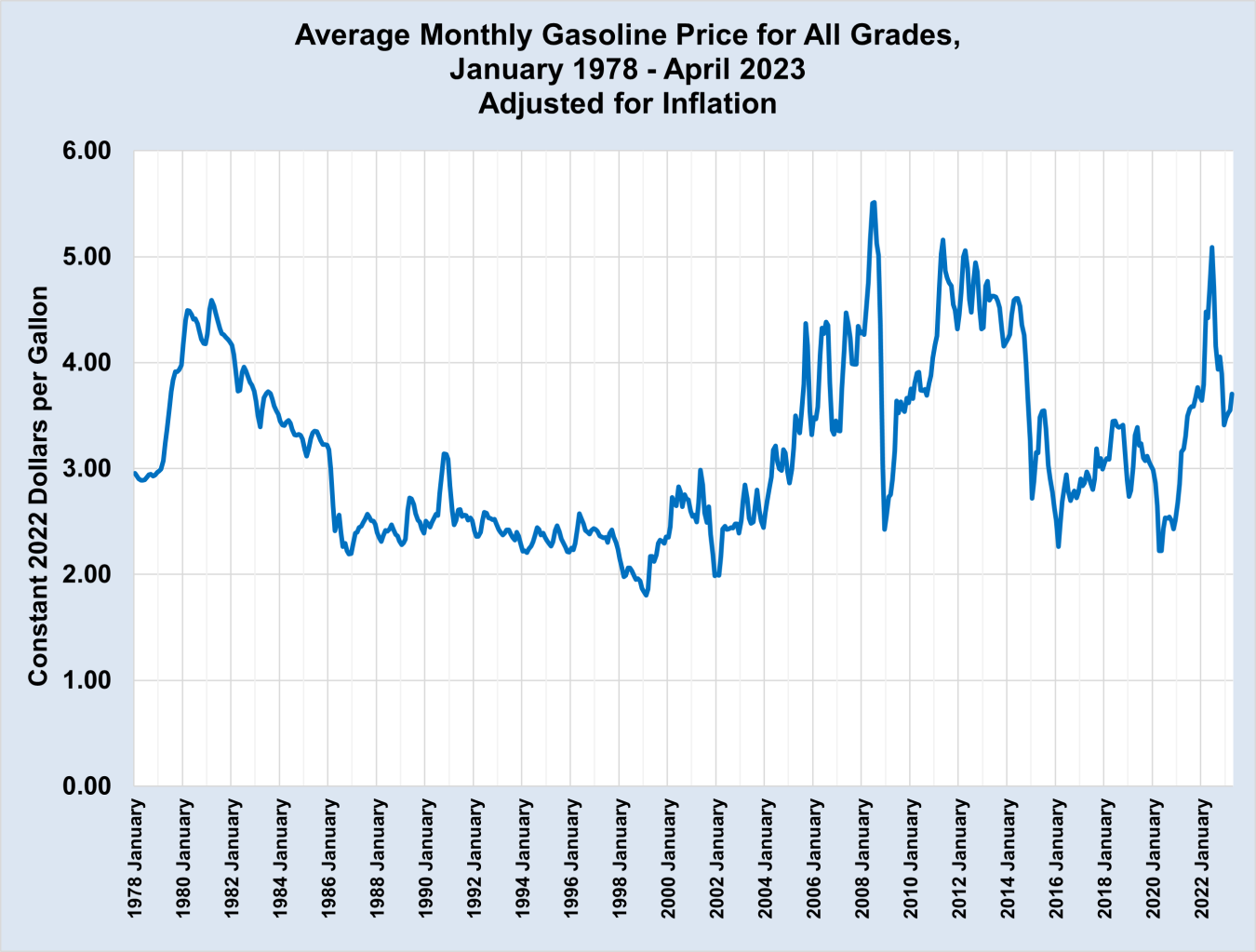

The worth of gasoline on the pump is a ubiquitous issue influencing shopper spending and financial exercise. Nonetheless, the value shoppers see is barely the tip of the iceberg. Underlying that retail worth is a posh internet of things, with wholesale gasoline costs taking part in a vital, typically neglected, position. Understanding the fluctuations in wholesale gasoline costs is essential to comprehending the broader vitality market and its impression on people and the economic system. This text will delve into the intricacies of wholesale gasoline costs, using a hypothetical chart as a framework for evaluation, exploring the important thing drivers behind worth actions, and discussing the implications for numerous stakeholders.

A Hypothetical Wholesale Gasoline Value Chart (2010-2023): Decoding the Tendencies

(Word: As a result of impossibility of making a real-time, interactive chart inside this textual content format, we are going to describe a hypothetical chart showcasing key traits and worth fluctuations. Readers are inspired to seek the advice of respected sources just like the EIA (Power Info Administration) for precise knowledge.)

Our hypothetical chart shows the wholesale worth of gasoline (per gallon) within the US from 2010 to 2023. A number of distinct intervals are evident:

-

2010-2014: Relative Stability with Gradual Enhance: The chart reveals a interval of comparatively steady costs with a slight upward development. This era is characterised by average financial progress and comparatively steady crude oil costs. Minor fluctuations are seen, possible reflecting seasonal demand adjustments and geopolitical occasions with minimal impression.

-

2014-2016: Sharp Decline: A big drop in wholesale gasoline costs is clear, mirroring the worldwide oil worth crash pushed by elevated shale oil manufacturing and lowered world demand. This era highlights the robust correlation between crude oil and gasoline costs. The chart may present a lag impact, with gasoline costs responding barely later than crude oil costs.

-

2016-2018: Gradual Restoration: A gradual and regular restoration is noticed, reflecting a rebound in world oil demand and OPEC manufacturing cuts. The chart may present some volatility, influenced by elements akin to refinery outages and surprising geopolitical occasions.

-

2018-2020: Volatility and Pandemic Influence: This era depicts elevated volatility, with costs fluctuating extra considerably. The chart would clearly illustrate the sharp decline in demand and costs on the onset of the COVID-19 pandemic, adopted by a interval of uncertainty and restoration. The impression of presidency stimulus packages and altering journey patterns could be seen.

-

2020-2023: Publish-Pandemic Surge and Geopolitical Affect: The chart would possible present a considerable post-pandemic surge in wholesale gasoline costs, pushed by resurgent demand and provide chain disruptions. Additional worth spikes is perhaps linked to particular geopolitical occasions, such because the warfare in Ukraine, impacting world vitality markets and considerably influencing costs. This era would showcase the interaction of demand, provide, and geopolitical danger.

Key Drivers of Wholesale Gasoline Value Fluctuations:

A number of elements work together to form wholesale gasoline costs:

-

Crude Oil Costs: That is probably the most important driver. Gasoline is refined from crude oil, so adjustments within the worth of crude oil straight impression the price of manufacturing and, consequently, wholesale gasoline costs. International provide and demand dynamics, OPEC insurance policies, geopolitical instability, and speculative buying and selling all affect crude oil costs.

-

Refinery Capability and Operations: The capability and effectivity of refineries play a vital position. Refining margins, the distinction between the value of crude oil and the value of refined gasoline, fluctuate primarily based on refinery utilization charges, upkeep schedules, and technological developments. Sudden refinery outages can result in localized and even nationwide worth spikes.

-

Seasonal Demand: Gasoline demand sometimes will increase through the hotter months as a result of elevated driving for leisure and trip journey. This seasonal variation can affect wholesale costs, resulting in greater costs throughout peak seasons and decrease costs throughout off-peak seasons.

-

Authorities Rules and Taxes: Authorities insurance policies, together with environmental rules and taxes on gasoline manufacturing and distribution, can impression wholesale costs. Modifications in gas effectivity requirements or carbon taxes can have an effect on refinery operations and the ultimate worth.

-

Geopolitical Occasions: Political instability in oil-producing areas, sanctions, and wars can considerably disrupt provide chains and result in worth volatility. These occasions typically create uncertainty out there, driving costs greater.

-

Financial Progress and Client Demand: Robust financial progress usually results in elevated shopper spending, together with gasoline consumption, driving up demand and probably costs. Conversely, financial downturns can scale back demand and put downward strain on costs.

-

Hypothesis and Market Sentiment: Wholesale gasoline costs are additionally influenced by market hypothesis and investor sentiment. Futures contracts and choices buying and selling can amplify worth actions, notably during times of uncertainty.

Implications for Numerous Stakeholders:

Understanding wholesale gasoline worth fluctuations is essential for a variety of stakeholders:

-

Fuel Stations: Retail fuel costs are straight influenced by wholesale costs. Fluctuations in wholesale costs straight impression fuel station profitability and their potential to compete.

-

Transportation Corporations: Trucking, delivery, and airline firms are closely reliant on gasoline and diesel gas. Wholesale worth will increase can considerably have an effect on their working prices and profitability, probably resulting in greater transportation prices for shoppers.

-

Customers: Finally, fluctuations in wholesale gasoline costs are handed on to shoppers on the pump. Value will increase can scale back shopper spending energy and impression total financial exercise.

-

Power Corporations: Oil and fuel firms are straight impacted by wholesale gasoline costs. Value volatility can have an effect on their revenues, funding choices, and profitability.

-

Governments: Governments are involved about vitality safety and the impression of gasoline costs on inflation and shopper welfare. They might implement insurance policies to mitigate worth volatility or present assist to affected industries.

Conclusion:

Wholesale gasoline costs are a dynamic and sophisticated indicator reflecting a large number of interconnected elements. Analyzing historic traits and understanding the important thing drivers is essential for navigating the vitality market and anticipating future worth actions. By commonly consulting dependable sources just like the EIA and staying knowledgeable about world occasions and financial circumstances, people and companies can higher perceive and put together for the inevitable fluctuations on this important commodity’s worth. The hypothetical chart described above serves as a simplified illustration of those advanced interactions, emphasizing the significance of steady monitoring and evaluation of real-time knowledge to realize a complete understanding of the wholesale gasoline market.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Dynamics of Wholesale Gasoline Costs: A Complete Chart Evaluation. We recognize your consideration to our article. See you in our subsequent article!