Decoding the EURUSD Reside Chart on TradingView: A Complete Information

Associated Articles: Decoding the EURUSD Reside Chart on TradingView: A Complete Information

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the EURUSD Reside Chart on TradingView: A Complete Information. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Decoding the EURUSD Reside Chart on TradingView: A Complete Information

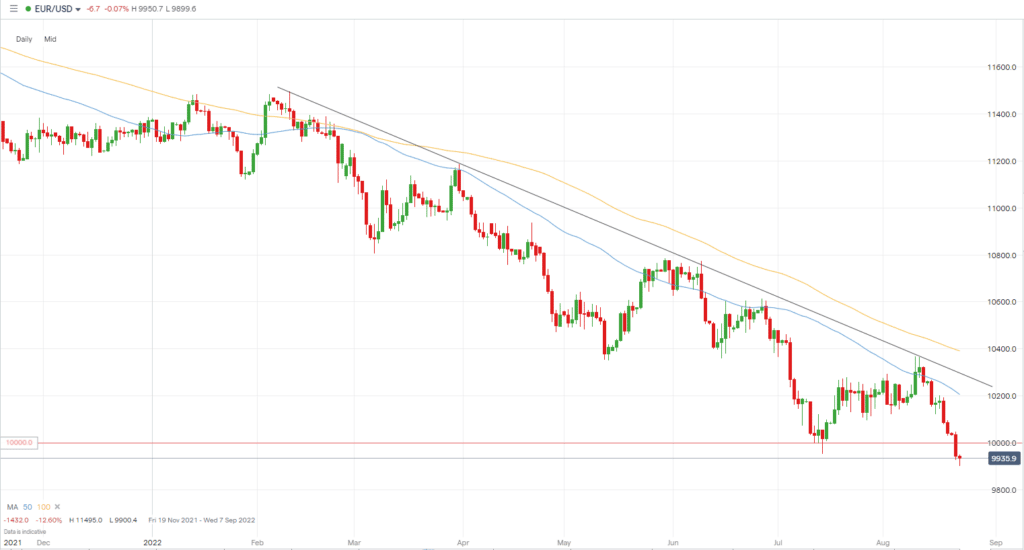

The EURUSD, or Euro/US Greenback, is essentially the most actively traded forex pair globally. Its value fluctuations mirror the complicated interaction of financial elements, geopolitical occasions, and market sentiment. Understanding and successfully using the EURUSD stay chart on TradingView is usually a highly effective software for each seasoned merchants and people simply starting their foreign exchange journey. This text delves deep into analyzing the EURUSD stay chart on TradingView, exploring numerous technical indicators, chart patterns, and methods that can assist you navigate this dynamic market.

Understanding the TradingView Platform:

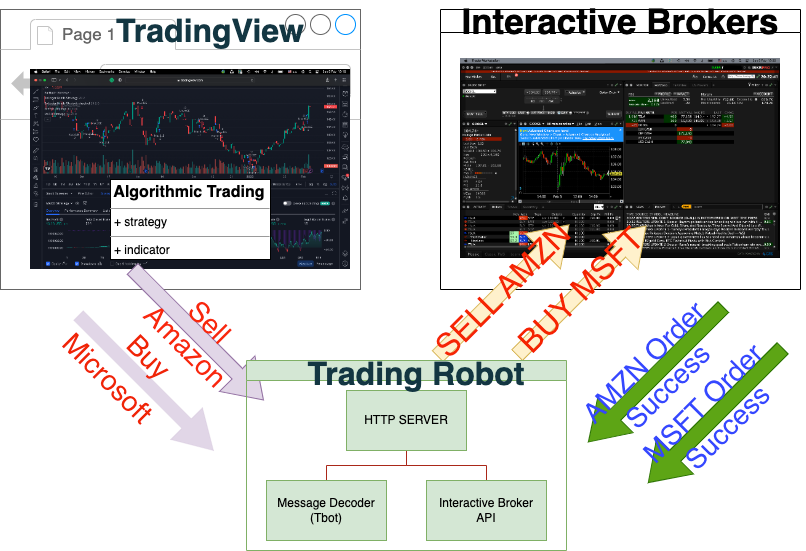

TradingView is a well-liked on-line charting platform providing a wealth of instruments and options for technical evaluation. Its intuitive interface permits merchants to entry real-time value knowledge, customise charts, apply numerous indicators, and even share their analyses with others. The EURUSD stay chart on TradingView offers a dynamic illustration of the pair’s value motion, continuously updating with the most recent market knowledge. This real-time knowledge is essential for making knowledgeable buying and selling selections, notably within the fast-paced foreign exchange market.

Key Parts of the EURUSD Reside Chart:

Earlier than diving into superior evaluation, let’s assessment the basic elements of the EURUSD stay chart on TradingView:

- Worth Axis (Y-axis): Shows the worth of the EURUSD pair, sometimes in USD per EUR.

- Time Axis (X-axis): Represents the timeframe, starting from seconds to years, permitting you to investigate value actions over completely different intervals.

- Candlesticks/Bars: These visible representations of value motion show the open, excessive, low, and shut (OHLC) costs for a particular interval. Candlestick patterns present invaluable insights into market sentiment and potential value actions.

- Quantity: Signifies the buying and selling exercise throughout a particular interval. Excessive quantity usually accompanies important value actions, whereas low quantity could counsel a interval of consolidation.

- Transferring Averages (MAs): Easy out value fluctuations, highlighting traits and potential help/resistance ranges. Widespread MAs embody the 20-period, 50-period, and 200-period shifting averages.

- Technical Indicators: A big selection of indicators, similar to RSI (Relative Power Index), MACD (Transferring Common Convergence Divergence), Stochastic Oscillator, Bollinger Bands, and others, present further indicators and insights into market momentum, overbought/oversold circumstances, and potential development reversals.

Analyzing the EURUSD Chart with Technical Indicators:

The ability of TradingView lies in its capability to mix a number of technical indicators for a complete evaluation. Listed below are a number of standard mixtures:

-

Transferring Averages and RSI: Utilizing shifting averages to establish traits and the RSI to gauge momentum can present a strong buying and selling technique. A bullish development confirmed by a rising RSI above 50 suggests a robust upward momentum. Conversely, a bearish development with an RSI under 50 signifies weakening momentum.

-

MACD and Bollinger Bands: The MACD helps establish momentum shifts and potential crossovers, whereas Bollinger Bands spotlight value volatility and potential breakout alternatives. A MACD crossover above the sign line, coupled with a value breakout above the higher Bollinger Band, might sign a robust bullish breakout.

-

Stochastic Oscillator and Quantity: The Stochastic Oscillator identifies overbought and oversold circumstances, whereas quantity evaluation confirms the power of those indicators. A bearish divergence (value making increased highs whereas the Stochastic Oscillator makes decrease highs) accompanied by reducing quantity might sign a possible development reversal.

Recognizing Chart Patterns:

Chart patterns present visible clues about potential value actions. TradingView makes it simple to establish these patterns on the EURUSD stay chart. Some widespread patterns embody:

- Head and Shoulders: A reversal sample suggesting a possible development change from bullish to bearish.

- Inverse Head and Shoulders: A reversal sample suggesting a possible development change from bearish to bullish.

- Triangles (Symmetrical, Ascending, Descending): Consolidation patterns that usually precede a breakout in both course.

- Flags and Pennants: Continuation patterns indicating a short lived pause in a prevailing development.

- Double Tops and Double Bottoms: Reversal patterns signaling potential development adjustments.

Figuring out these patterns requires apply and expertise. Nevertheless, TradingView’s drawing instruments make it simpler to pinpoint and analyze these formations on the chart.

Basic Evaluation and its Affect on the EURUSD:

Whereas technical evaluation focuses on value charts, elementary evaluation considers financial and political elements impacting the EURUSD. Key elements to observe embody:

- Eurozone Financial Knowledge: GDP development, inflation charges, unemployment figures, and manufacturing PMI considerably affect the Euro’s worth.

- US Financial Knowledge: Comparable financial indicators from the US, similar to non-farm payrolls, shopper confidence, and rate of interest selections by the Federal Reserve, have an effect on the US greenback’s worth.

- Geopolitical Occasions: Political instability within the Eurozone or the US, worldwide conflicts, and international commerce tensions can affect the EURUSD.

- Central Financial institution Insurance policies: Financial coverage selections by the European Central Financial institution (ECB) and the Federal Reserve (Fed) immediately affect rates of interest and forex values.

Understanding these elementary elements and their potential affect on the EURUSD is essential for making knowledgeable buying and selling selections. Combining elementary and technical evaluation offers a extra holistic strategy to buying and selling.

Danger Administration and Buying and selling Methods:

Profitable EURUSD buying and selling requires a disciplined strategy to danger administration:

- Place Sizing: Decide the suitable quantity to danger on every commerce, limiting potential losses.

- Cease-Loss Orders: Set stop-loss orders to mechanically exit a commerce if the worth strikes in opposition to your place, minimizing potential losses.

- Take-Revenue Orders: Set take-profit orders to mechanically exit a commerce when your revenue goal is reached, securing earnings.

- Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout completely different property to scale back general danger.

Varied buying and selling methods may be employed when buying and selling the EURUSD, together with:

- Development Following: Figuring out and buying and selling within the course of the prevailing development.

- Imply Reversion: Buying and selling based mostly on the idea that costs will revert to their common.

- Scalping: Benefiting from small value actions inside quick timeframes.

- Swing Buying and selling: Holding positions for a number of days or even weeks, capitalizing on bigger value swings.

Conclusion:

The EURUSD stay chart on TradingView provides a robust platform for analyzing and buying and selling the world’s most liquid forex pair. By mastering the usage of technical indicators, chart patterns, and elementary evaluation, and by using sound danger administration methods, merchants can enhance their probabilities of success on this dynamic market. Do not forget that constant studying, apply, and adaptation are key to turning into a proficient EURUSD dealer. The knowledge supplied right here is for academic functions and shouldn’t be thought of monetary recommendation. All the time conduct thorough analysis and take into account looking for skilled recommendation earlier than making any funding selections.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the EURUSD Reside Chart on TradingView: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!