Decoding the F Inventory Worth Historical past Chart: A Complete Evaluation

Associated Articles: Decoding the F Inventory Worth Historical past Chart: A Complete Evaluation

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the F Inventory Worth Historical past Chart: A Complete Evaluation. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the F Inventory Worth Historical past Chart: A Complete Evaluation

Ford Motor Firm (F), an automotive large with a century-long historical past, boasts a inventory value historical past chart that displays the tumultuous nature of the automotive {industry}, broader financial tendencies, and the corporate’s personal inner struggles and triumphs. Analyzing this chart reveals precious insights into the corporate’s efficiency, the components influencing its valuation, and potential future trajectories. This in-depth evaluation will discover key intervals, important occasions, and the underlying forces shaping Ford’s inventory value over time.

Early Years and the Publish-Battle Growth (Pre-Eighties):

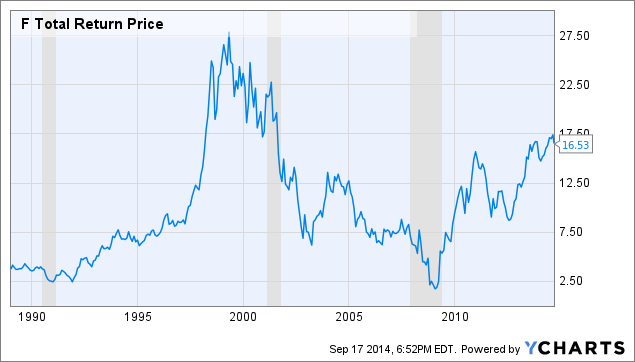

The early a long time of Ford’s historical past, mirrored in its pre-Eighties inventory efficiency, showcase a usually upward development, punctuated by intervals of progress and stagnation. The post-World Battle II period noticed a surge in demand for cars, resulting in a major enhance in Ford’s inventory value. This era was characterised by comparatively steady manufacturing, constant income, and a robust market place within the US. The chart throughout this time would reveal a comparatively easy, upward sloping line, reflecting the strong financial surroundings and Ford’s dominant place out there. Nevertheless, even throughout this era, financial downturns and industry-specific challenges would trigger momentary dips, indicating the inherent volatility even in seemingly steady occasions. Information from this period can be much less available in detailed, simply accessible chart codecs, however historic data would illustrate the overall tendencies.

The Eighties and Nineteen Nineties: Challenges and Diversifications:

The Eighties and Nineteen Nineties introduced Ford with important challenges. The rise of Japanese automakers, significantly Toyota and Honda, with their give attention to gasoline effectivity and high quality, severely impacted Ford’s market share and profitability. The inventory value chart throughout this era would probably present elevated volatility, with intervals of decline interspersed with intervals of restoration. Elements such because the oil crises, financial recessions, and elevated competitors contributed to this instability. The chart would replicate Ford’s efforts to adapt, together with the introduction of recent fashions and applied sciences, however the total trajectory is likely to be much less steep than within the earlier a long time, highlighting the wrestle to keep up its dominant place. This period underlines the significance of adapting to altering shopper preferences and world competitors in shaping an organization’s inventory efficiency.

The 2000s: The Dot-Com Bubble and the Monetary Disaster:

The early 2000s noticed the burst of the dot-com bubble, which had a ripple impact throughout varied sectors, together with the automotive {industry}. Ford’s inventory value chart would replicate this downturn. Nevertheless, the true check got here with the 2008-2009 monetary disaster, a interval of extreme financial contraction that hit the automotive {industry} significantly arduous. The chart throughout this era would showcase a dramatic plunge in Ford’s inventory value, reflecting the decline in gross sales, the necessity for presidency bailouts for some rivals (although Ford prevented this), and the overall uncertainty out there. This era emphasizes the systemic danger related to macroeconomic occasions and the vulnerability of even established firms throughout occasions of extreme financial misery. The restoration from this disaster can be a key aspect of the chart’s narrative, exhibiting the resilience of Ford and the gradual return to profitability.

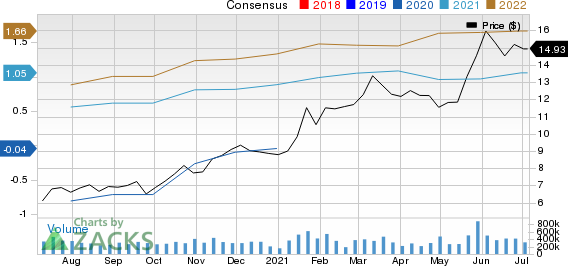

The 2010s and Past: Restructuring and the Rise of EVs:

The 2010s marked a interval of restructuring and strategic repositioning for Ford. The corporate targeted on enhancing effectivity, streamlining operations, and investing in new applied sciences. The inventory value chart throughout this decade would replicate a extra gradual, however usually constructive, development. Nevertheless, this era additionally noticed the emergence of recent challenges, together with the rise of electrical autos (EVs) and the growing competitors from Tesla and different rising EV producers. The chart would probably present intervals of volatility as buyers assessed Ford’s progress in adapting to this altering panorama. The investments in EV expertise and autonomous driving can be essential components influencing the inventory value, indicating the corporate’s efforts to stay aggressive in a quickly evolving {industry}. The later a part of the last decade would probably present a extra pronounced upward development as Ford’s restructuring efforts started to yield tangible outcomes.

Analyzing Key Elements Influencing the Chart:

A number of key components have persistently influenced Ford’s inventory value:

- Financial Situations: Normal financial progress or recession considerably impacts shopper spending on cars, straight influencing Ford’s gross sales and profitability.

- Gasoline Costs: Fluctuations in gasoline costs have an effect on shopper demand for fuel-efficient autos, impacting Ford’s gross sales combine and profitability.

- Competitors: The aggressive panorama, together with the rise of recent entrants and the methods of established rivals, performs a vital position in shaping Ford’s market share and profitability.

- Technological Developments: Ford’s capability to adapt to technological developments, such because the shift in the direction of EVs and autonomous driving, is essential for its long-term success and inventory efficiency.

- Administration Selections: Strategic choices made by Ford’s administration crew, together with product improvement, pricing methods, and operational effectivity, considerably influence the corporate’s efficiency and inventory value.

- Geopolitical Occasions: International occasions, resembling commerce wars, pandemics, and political instability, can create uncertainty and influence Ford’s operations and inventory value.

Deciphering the Chart’s Future Trajectory:

Predicting the longer term trajectory of Ford’s inventory value is inherently speculative. Nevertheless, analyzing historic tendencies and contemplating present components offers precious insights. The continued transition to electrical autos and autonomous driving can be a significant determinant of Ford’s future success. The corporate’s capability to efficiently navigate this transition, handle its provide chain, and compete successfully with established and rising gamers can be essential. Moreover, macroeconomic components, resembling inflation, rates of interest, and world financial progress, will proceed to affect Ford’s efficiency. Traders ought to rigorously take into account these components when assessing the potential future trajectory of Ford’s inventory value. Analyzing the chart together with monetary statements, {industry} stories, and professional opinions can present a extra nuanced understanding of the corporate’s prospects.

Conclusion:

The F inventory value historical past chart is a wealthy tapestry woven from financial cycles, technological disruptions, and the corporate’s personal strategic decisions. By understanding the historic context and the important thing components influencing Ford’s efficiency, buyers can achieve precious insights into the corporate’s potential and make knowledgeable funding choices. Whereas previous efficiency will not be indicative of future outcomes, finding out the chart offers a vital basis for understanding the complicated dynamics that form the valuation of this automotive large. The journey of Ford’s inventory value displays not solely the corporate’s historical past but additionally the broader evolution of the automotive {industry} and the worldwide economic system, making its chart a compelling case examine in enterprise and finance. Steady monitoring of the chart, together with a deep understanding of the underlying components, is important for any investor contemplating Ford as a part of their portfolio.

Closure

Thus, we hope this text has offered precious insights into Decoding the F Inventory Worth Historical past Chart: A Complete Evaluation. We recognize your consideration to our article. See you in our subsequent article!