Decoding the Free Bar Replay Chart: A Complete Information for Merchants

Associated Articles: Decoding the Free Bar Replay Chart: A Complete Information for Merchants

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the Free Bar Replay Chart: A Complete Information for Merchants. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Free Bar Replay Chart: A Complete Information for Merchants

The world of choices buying and selling can really feel overwhelming, particularly for newcomers. Navigating the complexities of implied volatility, delta, gamma, and theta is difficult sufficient, however understanding the underlying worth actions of the underlying asset is essential for profitable buying and selling. That is the place the free bar replay chart turns into a useful software. Whereas not a magical resolution, it offers a visible illustration of worth motion, permitting merchants to research previous efficiency and doubtlessly predict future developments. This text delves into the intricacies of free bar replay charts, exploring their functionalities, advantages, limitations, and the right way to successfully make the most of them in your buying and selling technique.

Understanding the Free Bar Replay Chart:

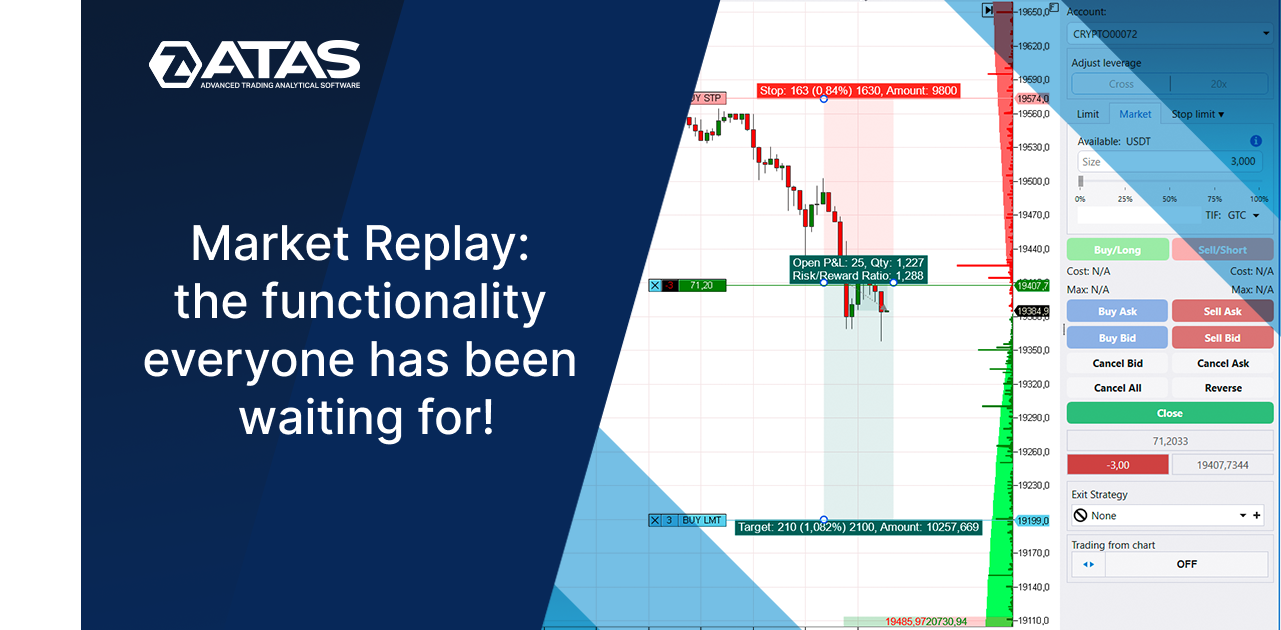

A free bar replay chart, in its easiest kind, is a dynamic chart that shows the worth motion of an asset over a selected time interval. In contrast to static charts that solely present the closing worth of every bar (candle), a free bar replay chart gives a real-time or close to real-time visualization of the worth fluctuations inside every bar. This implies you see the excessive, low, open, and shut (OHLC) information factors for every interval, in addition to the worth motion all through that interval. Consider it as watching a "replay" of the worth motion for the chosen timeframe, providing a a lot richer understanding of the market’s sentiment and momentum.

Many charting platforms supply free bar replay performance, usually built-in inside their broader charting packages. These platforms usually permit you to regulate the timeframe (from one-minute bars to day by day bars), zoom out and in, and add varied technical indicators to boost your evaluation. The "free" facet often refers back to the capability to replay the historic information with out incurring extra prices past the platform’s subscription price (if any).

Key Advantages of Utilizing a Free Bar Replay Chart:

-

Enhanced Market Understanding: By visualizing the intra-bar worth motion, merchants can achieve a deeper understanding of market dynamics. They will observe how worth reacted to information occasions, order circulation imbalances, and different elements which may not be evident from simply the closing worth. This granular view can enhance market timing and threat administration.

-

Improved Order Entry and Exit Methods: The replay operate permits merchants to simulate completely different entry and exit factors, serving to them determine optimum positions based mostly on worth habits. Observing how worth reacted to particular ranges up to now can inform future buying and selling choices, resulting in doubtlessly extra worthwhile trades.

-

Identification of Value Patterns and Reversals: Replaying worth motion may also help merchants determine refined worth patterns and reversals that could be missed on static charts. That is notably helpful for merchants who depend on technical evaluation, because it permits for a extra complete research of chart formations.

-

Backtesting Buying and selling Methods: Free bar replay charts facilitate the backtesting of buying and selling methods. Merchants can replay historic information and observe how their methods would have carried out in varied market situations. This helps refine methods and determine potential weaknesses.

-

Improved Threat Administration: By visualizing the worth volatility inside every bar, merchants can higher assess the danger related to a specific commerce. This granular view can result in extra knowledgeable choices concerning place sizing and stop-loss placement.

-

Understanding Order Stream: Whereas in a roundabout way exhibiting order circulation, the fast worth modifications inside a bar can usually trace at vital order circulation imbalances. Sudden spikes or drops can counsel massive purchase or promote orders coming into the market.

Limitations of Free Bar Replay Charts:

-

Knowledge Limitations: The accuracy of the replay depends upon the standard and frequency of the information supplied by the charting platform. Some platforms might need restricted historic information or information that isn’t completely correct.

-

Overfitting: Over-analyzing historic information can result in overfitting, the place a technique performs nicely in backtesting however poorly in dwell buying and selling. Merchants should be cautious about drawing conclusions from restricted historic information.

-

Not a Crystal Ball: Previous efficiency just isn’t indicative of future outcomes. Whereas replaying historic information can present beneficial insights, it doesn’t assure future worth actions. Free bar replay charts must be used along with different analytical instruments and threat administration methods.

-

Computational Sources: Replaying high-frequency information for prolonged intervals may be computationally intensive, particularly on much less highly effective computer systems. This would possibly result in lag or sluggish efficiency.

Efficient Use of Free Bar Replay Charts:

-

Mix with Technical Indicators: Improve the evaluation by including technical indicators corresponding to shifting averages, RSI, MACD, and Bollinger Bands to determine potential entry and exit factors.

-

Deal with Particular Timeframes: As an alternative of analyzing all timeframes concurrently, deal with the timeframe that aligns together with your buying and selling technique. For instance, a scalper would possibly deal with 1-minute or 5-minute bars, whereas a swing dealer would possibly deal with day by day or weekly bars.

-

Establish Key Assist and Resistance Ranges: Observe how worth reacted to key assist and resistance ranges up to now to anticipate potential future worth actions.

-

Analyze Quantity: Whereas in a roundabout way proven within the replay, correlate the worth motion with quantity information to determine intervals of excessive buying and selling exercise and potential breakouts.

-

Apply and Endurance: Mastering the usage of free bar replay charts takes time and follow. Begin with small, simulated trades to realize expertise earlier than risking actual capital.

-

Develop a Buying and selling Plan: Do not rely solely on the replay chart. Develop a complete buying and selling plan that comes with threat administration, place sizing, and clear entry and exit guidelines.

Conclusion:

The free bar replay chart is a robust software for choices merchants looking for to boost their market understanding and enhance their buying and selling methods. By visualizing the intra-bar worth motion, merchants can achieve beneficial insights into market dynamics, determine potential buying and selling alternatives, and refine their threat administration methods. Nevertheless, it is essential to do not forget that this software just isn’t a assured path to success. It must be used responsibly, along with different analytical instruments and a well-defined buying and selling plan, to maximise its advantages and decrease potential dangers. Do not forget that profitable buying and selling requires a mix of technical talent, disciplined threat administration, and a deep understanding of the markets. The free bar replay chart is just one piece of the puzzle, a beneficial software to boost your general buying and selling strategy.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Free Bar Replay Chart: A Complete Information for Merchants. We respect your consideration to our article. See you in our subsequent article!