Decoding the Gold and Silver Worth Chart: A Complete Information for Buyers

Associated Articles: Decoding the Gold and Silver Worth Chart: A Complete Information for Buyers

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Gold and Silver Worth Chart: A Complete Information for Buyers. Let’s weave fascinating info and provide contemporary views to the readers.

Desk of Content material

Decoding the Gold and Silver Worth Chart: A Complete Information for Buyers

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

Gold and silver, two valuable metals with a historical past stretching again millennia, proceed to carry a big place within the world monetary panorama. Their costs, nevertheless, are removed from static, fluctuating primarily based on a posh interaction of financial, geopolitical, and market-driven elements. Understanding the dynamics behind these fluctuations, as mirrored within the gold and silver worth chart, is essential for anybody contemplating investing in these property. This text offers a complete overview of the gold and silver worth chart, exploring its historic developments, influencing elements, and the implications for traders.

Historic Perspective: A Glimpse into the Previous

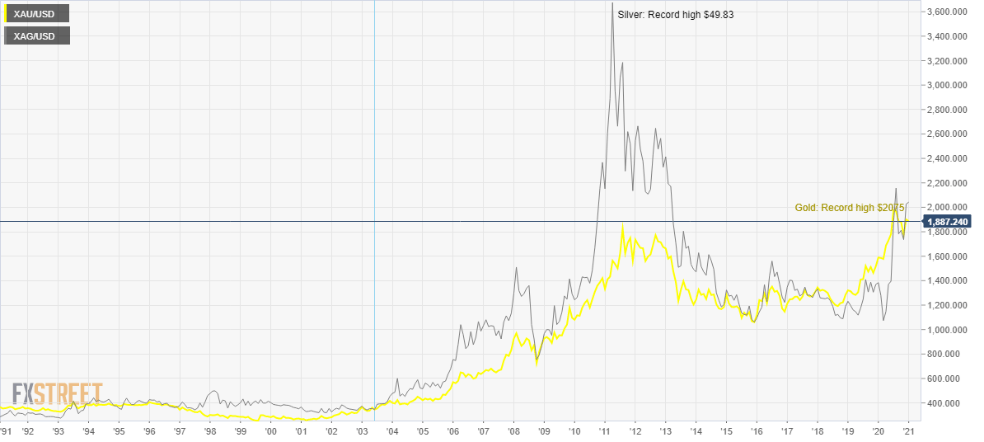

Inspecting the historic gold and silver worth chart reveals fascinating patterns and long-term developments. Whereas each metals have skilled durations of great worth appreciation and depreciation, their worth actions are sometimes correlated, though not at all times completely synchronized. As an example, each metals skilled a dramatic surge in worth throughout the inflationary durations of the Nineteen Seventies, reflecting their position as protected haven property throughout occasions of financial uncertainty. Nevertheless, their relative worth ratios – the value of silver relative to gold – have fluctuated significantly over time, reflecting shifts in industrial demand and investor sentiment.

The early 2000s witnessed a interval of comparatively subdued worth development for each metals, adopted by a pointy improve within the mid-2000s fueled by elements comparable to elevated world demand from rising markets, significantly China and India, and weakening US greenback. The 2008 monetary disaster additional propelled gold and silver costs upward, as traders sought refuge from the turmoil in conventional monetary markets. The next decade noticed durations of volatility, with costs influenced by varied world occasions, together with the European sovereign debt disaster, quantitative easing applications by central banks, and geopolitical tensions.

Extra lately, the COVID-19 pandemic initially brought on a surge in costs, once more reflecting their safe-haven enchantment. Nevertheless, subsequent financial restoration and rising rates of interest have led to some worth corrections, highlighting the sensitivity of valuable steel costs to macroeconomic circumstances. Analyzing historic worth charts, coupled with understanding the concurrent financial occasions, offers worthwhile insights into the potential future worth actions.

Key Components Influencing Gold and Silver Costs:

A number of interconnected elements contribute to the every day fluctuations and long-term developments noticed within the gold and silver worth chart. These embrace:

-

Inflation and Curiosity Charges: Gold and silver are sometimes considered as hedges in opposition to inflation. When inflation rises, the buying energy of fiat currencies declines, driving up demand for valuable metals as a retailer of worth. Conversely, rising rates of interest can dampen demand for gold and silver, as increased returns on interest-bearing property make them extra enticing alternate options. The inverse relationship between rates of interest and gold costs is commonly noticed, though different elements can override this dynamic.

-

US Greenback Energy: The US greenback is the world’s reserve foreign money, and its worth considerably impacts the costs of gold and silver, that are sometimes priced in USD. A stronger greenback typically places downward strain on valuable steel costs, making them dearer for consumers holding different currencies. Conversely, a weaker greenback typically boosts costs.

-

World Financial Development: Intervals of sturdy world financial development can generally result in decrease demand for safe-haven property like gold and silver, as traders shift their focus to riskier, higher-return investments. Nevertheless, unexpectedly slowing development or recessionary fears can reverse this pattern, inflicting costs to rise.

-

Geopolitical Uncertainty: Political instability, wars, and different geopolitical occasions typically drive traders in direction of the security of gold and silver, main to cost will increase. This "flight to security" phenomenon is a big driver of worth volatility, particularly in occasions of disaster.

-

Industrial Demand: Silver, in contrast to gold, has vital industrial purposes in varied sectors, together with electronics, images, and photo voltaic vitality. Fluctuations in industrial demand can considerably influence silver costs, generally independently of gold worth actions. Adjustments in technological developments or industrial manufacturing could cause shifts in silver demand.

-

Funding Demand: The funding demand for gold and silver, pushed by exchange-traded funds (ETFs), central financial institution purchases, and particular person traders, performs an important position in figuring out costs. Elevated funding demand can result in worth appreciation, whereas decreased demand can have the other impact.

-

Provide and Demand Dynamics: The fundamental ideas of provide and demand additionally apply to valuable metals. A scarcity of provide relative to demand will sometimes push costs upward, whereas an oversupply can result in worth declines. Components like mining manufacturing, recycling charges, and authorities rules affect the general provide.

Analyzing the Gold and Silver Worth Chart: Sensible Suggestions for Buyers:

Deciphering the gold and silver worth chart requires a nuanced understanding of the elements talked about above. Buyers ought to keep away from relying solely on short-term worth fluctuations and as an alternative deal with long-term developments and elementary evaluation. Listed here are some sensible ideas:

-

Think about Technical Evaluation: Technical evaluation entails finding out worth charts to establish patterns and predict future worth actions. Indicators like shifting averages, relative energy index (RSI), and help and resistance ranges can present worthwhile insights, however must be used along side elementary evaluation.

-

Elementary Evaluation is Key: Understanding the macroeconomic elements influencing gold and silver costs is essential. Staying knowledgeable about inflation charges, rate of interest insurance policies, geopolitical occasions, and industrial demand is crucial for making knowledgeable funding selections.

-

Diversification is Essential: Investing in gold and silver must be a part of a well-diversified portfolio. Do not put all of your eggs in a single basket. Treasured metals can function a hedge in opposition to different asset courses, however they aren’t immune to cost fluctuations.

-

Lengthy-Time period Perspective: Investing in gold and silver is commonly thought-about a long-term technique. Quick-term worth volatility mustn’t deter traders with a long-term horizon.

-

Think about Totally different Funding Automobiles: Buyers have a number of choices for investing in gold and silver, together with bodily bullion, gold and silver ETFs, and mining firm shares. Every automobile has its personal benefits and downsides concerning liquidity, storage prices, and threat publicity.

Conclusion:

The gold and silver worth chart is a dynamic reflection of world financial and geopolitical circumstances. Understanding the interaction of things influencing these costs is essential for traders in search of to capitalize on alternatives throughout the valuable metals market. By combining historic evaluation, technical indicators, and a radical understanding of elementary financial ideas, traders can develop a extra knowledgeable funding technique and navigate the complexities of the gold and silver market. Nevertheless, do not forget that investing in valuable metals carries inherent dangers, and it is essential to conduct thorough analysis and search skilled monetary recommendation earlier than making any funding selections. The knowledge offered on this article is for academic functions solely and shouldn’t be thought-about as monetary recommendation.

![Decoding Gold, Silver, and crude trading strategies [Video]](https://editorial.fxstreet.com/miscelaneous/image-638278582309375802.png)

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Gold and Silver Worth Chart: A Complete Information for Buyers. We hope you discover this text informative and useful. See you in our subsequent article!