Decoding the Gold Worth Chart: A 12 months in Evaluation

Associated Articles: Decoding the Gold Worth Chart: A 12 months in Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the Gold Worth Chart: A 12 months in Evaluation. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the Gold Worth Chart: A 12 months in Evaluation

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

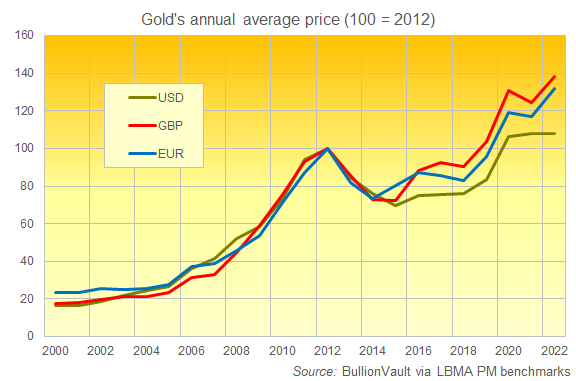

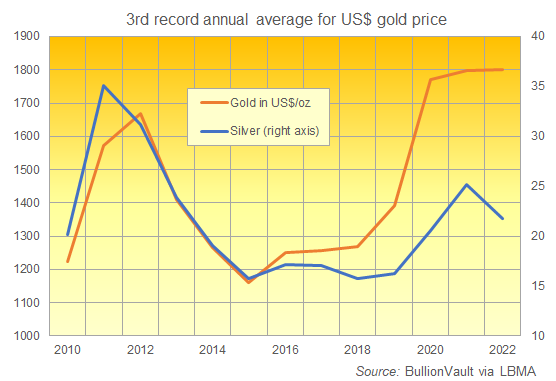

The gold worth chart, a consistently shifting panorama of highs and lows, presents a captivating glimpse into the worldwide financial system. Over the previous yr, it has painted a posh image, reflecting geopolitical tensions, inflationary pressures, and shifting investor sentiment. This in-depth evaluation will dissect the important thing actions within the gold worth over the previous twelve months, analyzing the underlying elements that drove these fluctuations and providing potential insights into future traits. We are going to analyze the chart by way of varied lenses, contemplating macroeconomic indicators, market sentiment, and geopolitical occasions to color a complete image of gold’s efficiency.

The 12 months in Evaluation: A Broad Overview

(Be aware: This part requires particular information to be related. Substitute the bracketed info with precise gold worth information from a good supply masking the final yr. For instance, use information from sources just like the World Gold Council, Bloomberg, or Kitco.)

The previous yr witnessed a [describe the overall trend – e.g., relatively stable, significant increase, substantial decline] in gold costs. Beginning at roughly $[Opening Price] per troy ounce in [Start Date], the worth [describe the initial movement – e.g., initially rose, experienced a steady decline, fluctuated wildly] earlier than reaching a [high/low] of $[High/Low Price] round [Date]. The value then [describe subsequent movements – e.g., consolidated, experienced a sharp rally, underwent a period of volatility] culminating in a present worth of roughly $[Current Price] as of [Current Date]. This total development could be attributed to a posh interaction of things, which we’ll discover intimately.

Macroeconomic Elements: Inflation, Curiosity Charges, and the Greenback

Gold’s efficiency is intrinsically linked to macroeconomic situations. Probably the most important influences over the previous yr has been [Describe the inflation environment – e.g., persistent high inflation, a period of disinflation, unexpected deflation]. Traditionally, gold has served as a hedge towards inflation, as its worth tends to rise when the buying energy of fiat currencies declines. [Explain how inflation impacted gold prices during the specified period. Did it drive prices up or down? Were there any unexpected reactions?].

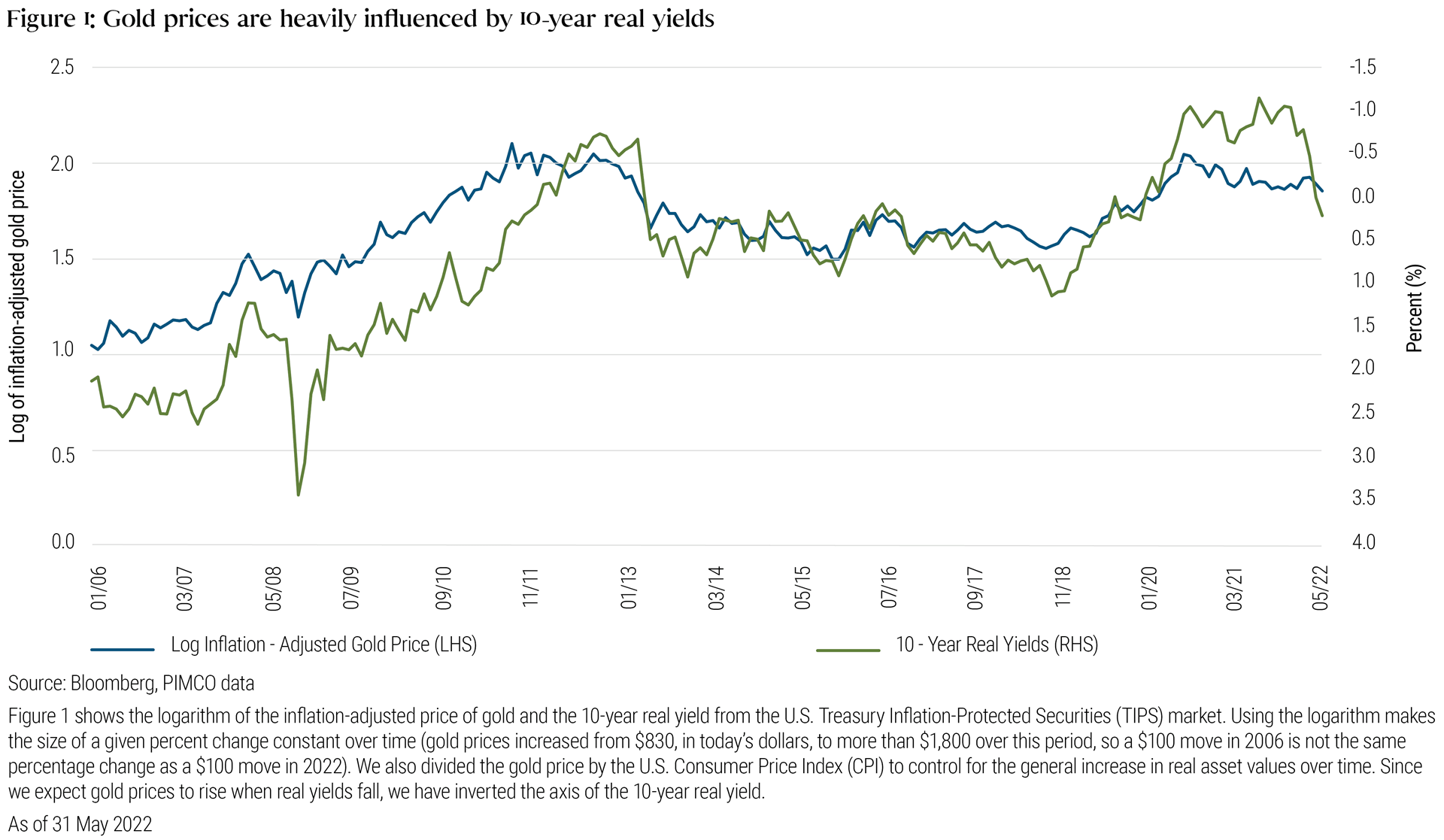

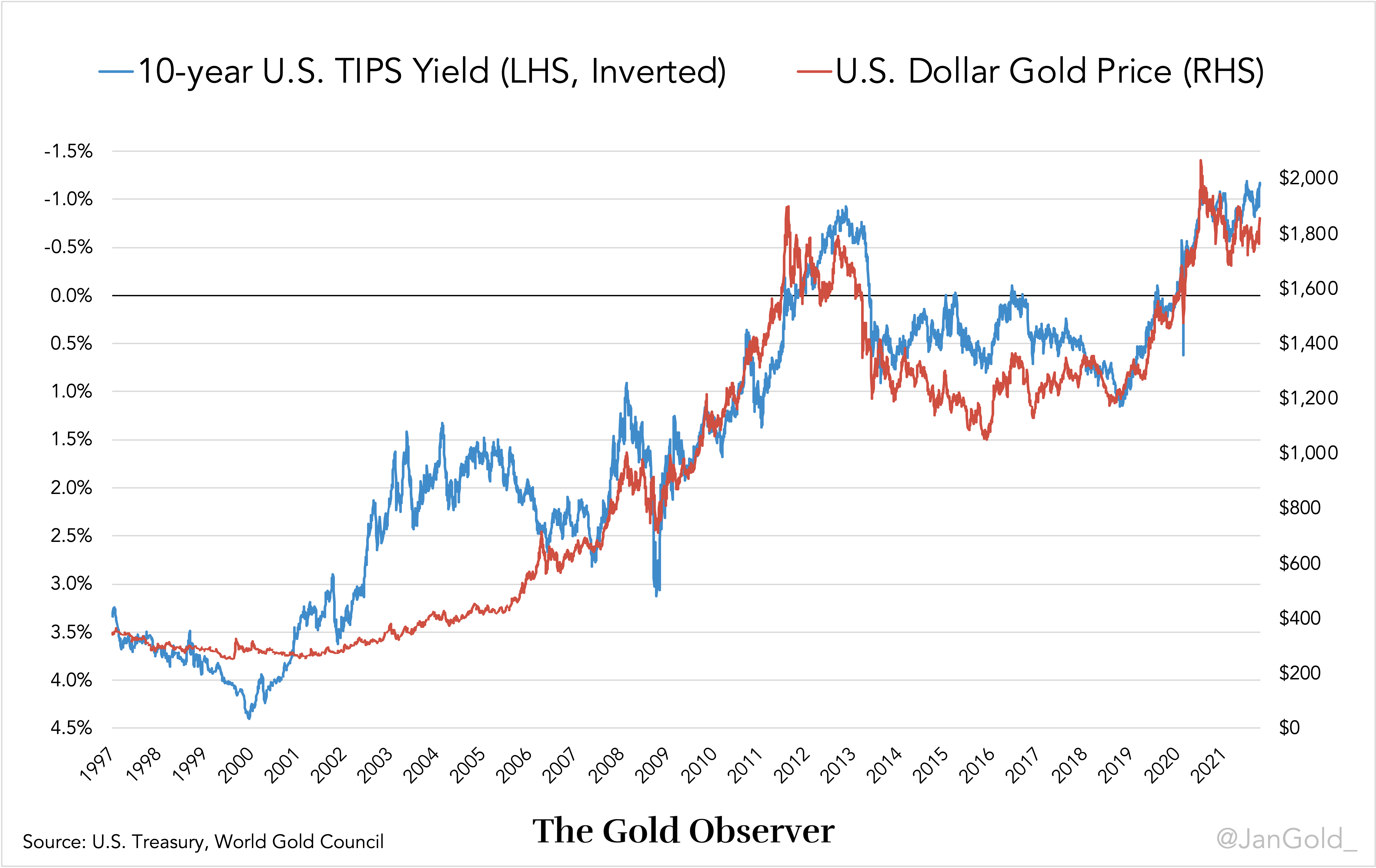

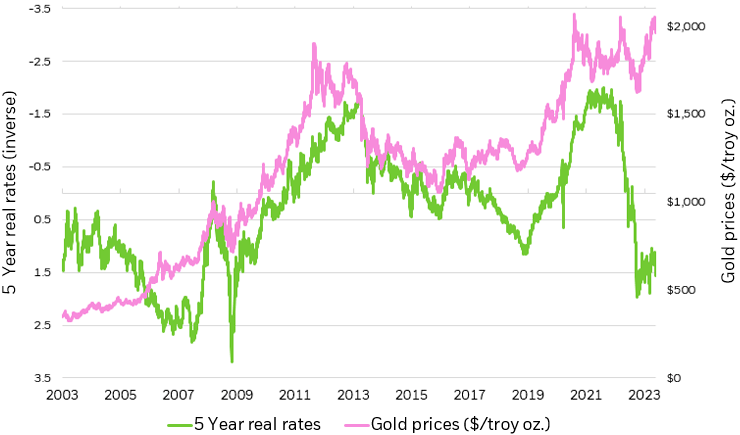

Rate of interest hikes by central banks, significantly the US Federal Reserve, have additionally performed a vital position. Increased rates of interest usually enhance the chance value of holding non-yielding belongings like gold, as buyers can earn increased returns from interest-bearing devices. [Explain the relationship between interest rate changes and gold prices over the past year. Did rate hikes lead to price drops? Were there periods where this relationship was less clear?].

The US greenback’s power additionally considerably impacts gold costs, as gold is often priced in USD. A stronger greenback makes gold costlier for holders of different currencies, probably dampening demand. [Analyze the relationship between the dollar’s strength and gold prices during the period. Did a strong dollar correlate with lower gold prices? Were there any exceptions?].

Geopolitical Occasions: A Catalyst for Volatility

Geopolitical occasions usually introduce important volatility into the gold market. [Identify and describe significant geopolitical events that occurred during the year and their impact on gold prices. Examples include wars, political instability, and international tensions]. As an example, the [Specific geopolitical event] led to a [Describe the impact on gold prices – e.g., surge in demand, flight to safety, temporary price dip]. This highlights gold’s position as a safe-haven asset throughout instances of uncertainty. Traders usually flock to gold as a retailer of worth when conventional markets expertise turmoil.

Market Sentiment and Investor Habits

The collective sentiment of buyers considerably influences gold costs. [Describe the overall investor sentiment toward gold during the year – e.g., bullish, bearish, cautious]. [Analyze any significant shifts in sentiment and their correlation with price movements]. For instance, durations of heightened threat aversion usually translate into elevated demand for gold, driving costs increased. Conversely, durations of optimism and confidence within the broader financial system could result in decreased gold funding, inflicting costs to fall.

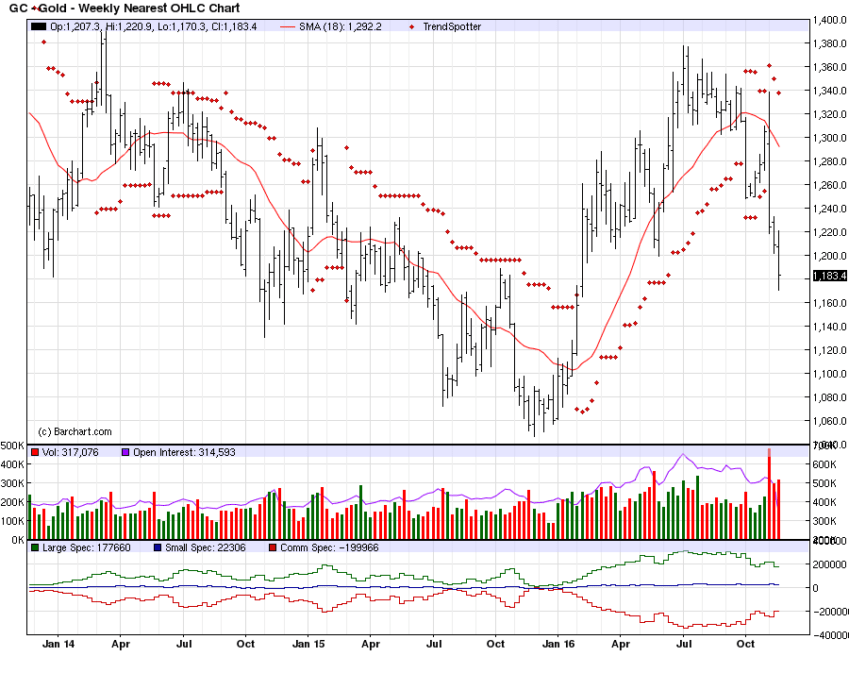

Technical Evaluation: Chart Patterns and Indicators

An intensive evaluation of the gold worth chart necessitates analyzing technical indicators. [Discuss relevant technical indicators like moving averages, support and resistance levels, RSI, MACD, etc., and how they played out during the year. Illustrate with chart examples if possible]. For instance, the breaking of a key help degree at $[Price] might have signaled a possible downward development, whereas the formation of a [Chart pattern, e.g., head and shoulders pattern] may need recommended a reversal in worth.

Provide and Demand Dynamics: Manufacturing and Consumption

The interaction of gold provide and demand additionally shapes worth actions. [Discuss factors influencing gold supply, such as mining production, recycling, and central bank sales. Also discuss factors influencing gold demand, such as jewelry consumption, investment demand (ETFs, bars, coins), and industrial applications]. [Analyze how changes in supply and demand impacted gold prices throughout the year]. For instance, a major enhance in jewellery demand from [Region] might have contributed to a worth rise, whereas a lower in mining output might have had the alternative impact.

Wanting Forward: Future Worth Predictions and Issues

Predicting future gold costs with certainty is inconceivable, however analyzing the previous yr’s traits and ongoing macroeconomic elements can provide some insights. [Offer a cautious outlook on future gold prices, considering potential scenarios based on your analysis of the previous points. Consider factors like inflation, interest rate trajectories, geopolitical stability, and investor sentiment]. For instance, continued excessive inflation may help increased gold costs, whereas a major strengthening of the greenback might put downward strain on the worth. It is essential to keep in mind that that is merely a possible outlook, and sudden occasions can considerably alter the trajectory of gold costs.

Conclusion:

The gold worth chart over the previous yr has been a dynamic reflection of a posh world panorama. By contemplating macroeconomic indicators, geopolitical occasions, market sentiment, and technical evaluation, we will acquire a deeper understanding of the elements that drove worth actions. Whereas predicting future costs with precision is inconceivable, a cautious evaluation of the previous gives helpful insights into potential future traits and the position of gold as a safe-haven asset and a hedge towards inflation in an ever-changing world. Steady monitoring of those elements is essential for anybody looking for to know and navigate the gold market.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Gold Worth Chart: A 12 months in Evaluation. We respect your consideration to our article. See you in our subsequent article!