Decoding the Gold Worth USD Chart: A Complete Evaluation

Associated Articles: Decoding the Gold Worth USD Chart: A Complete Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Gold Worth USD Chart: A Complete Evaluation. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Gold Worth USD Chart: A Complete Evaluation

Gold, a timeless image of wealth and stability, has captivated traders for millennia. Its value, nonetheless, is much from static, fluctuating primarily based on a posh interaction of financial, geopolitical, and market forces. Understanding the gold value USD chart requires extra than simply glancing on the each day numbers; it necessitates a deep dive into the elements driving its actions and the implications for traders. This text will present a complete evaluation of the gold value USD chart, exploring its historic developments, influencing elements, and potential future instructions.

Historic Perspective: A Century of Fluctuations

A glance again on the gold value USD chart reveals an interesting narrative of booms and busts. For a lot of the twentieth century, gold was pegged to the US greenback beneath the Bretton Woods system, sustaining a comparatively secure value. The collapse of this technique in 1971 unleashed gold’s value, permitting it to drift freely and reply to market dynamics. Since then, the chart reveals vital volatility, punctuated by durations of fast appreciation and sharp declines.

The Nineteen Seventies witnessed a dramatic surge in gold costs, fueled by inflation, the Vietnam Struggle, and a basic lack of confidence within the US greenback. The following many years noticed durations of each stability and volatility, reflecting shifts in international financial development, rates of interest, and geopolitical occasions. The late Nineties and early 2000s noticed comparatively subdued gold costs, however the 2008 monetary disaster marked a turning level, triggering a big rally as traders sought a protected haven asset.

The interval from 2008 to 2011 noticed gold costs attain report highs, exceeding $1,900 per ounce. This surge was pushed by a confluence of things, together with the worldwide monetary disaster, quantitative easing by central banks, and considerations concerning the US greenback’s worth. Following this peak, costs skilled a interval of consolidation and even decline, earlier than embarking on one other upward trajectory lately. The COVID-19 pandemic and subsequent financial uncertainty additional fueled gold’s enchantment as a safe-haven asset, driving costs greater.

Key Elements Influencing the Gold Worth USD Chart:

The gold value USD chart just isn’t merely a random stroll; its actions are influenced by quite a lot of interconnected elements:

-

US Greenback Power: The inverse relationship between the US greenback and gold costs is well-established. A stronger greenback makes gold dearer for holders of different currencies, lowering demand and placing downward strain on the worth. Conversely, a weaker greenback tends to spice up gold costs, because it turns into extra enticing to traders looking for to hedge towards forex devaluation.

-

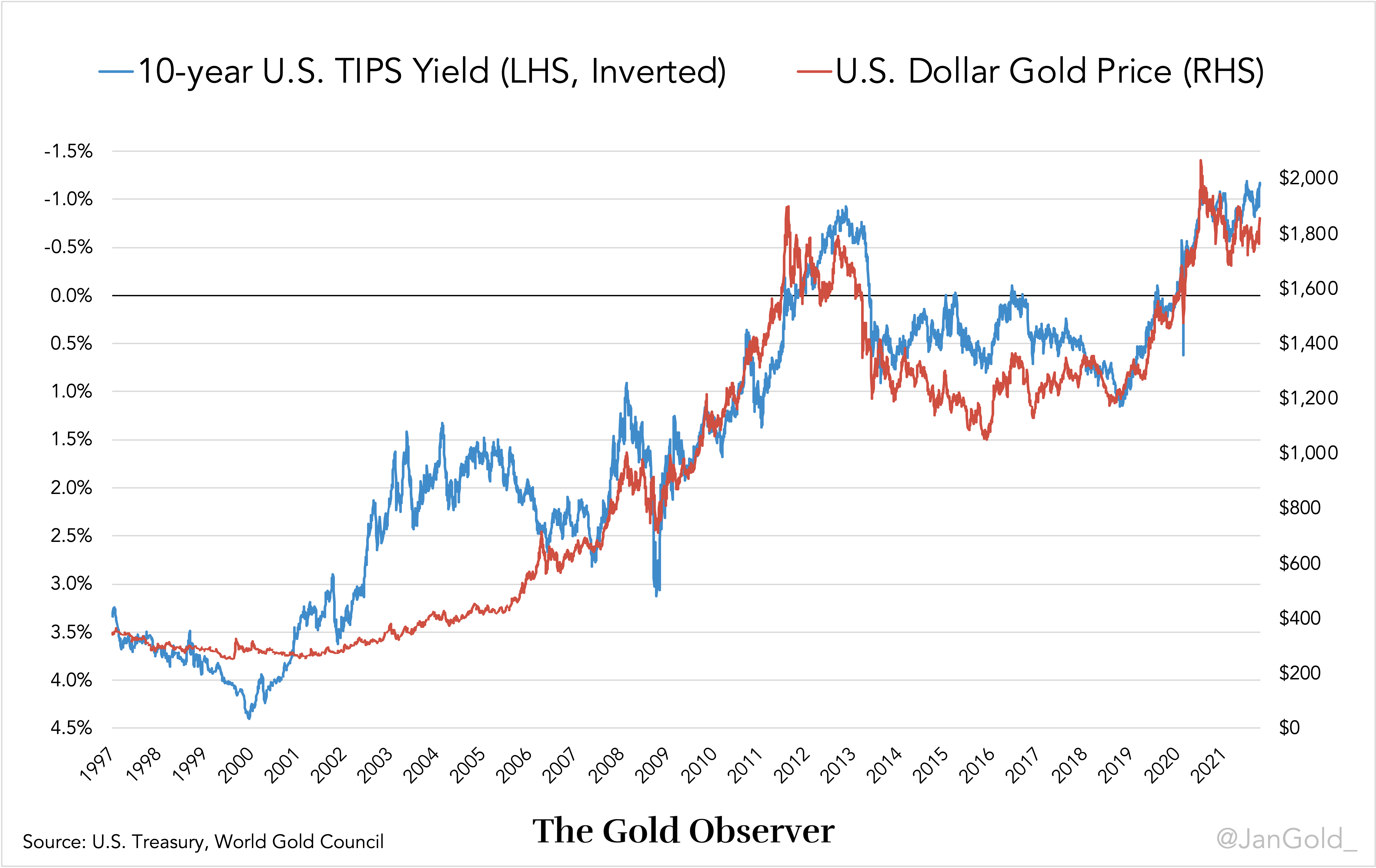

Curiosity Charges: Rates of interest and gold costs usually exhibit an inverse relationship. Increased rates of interest typically improve the chance price of holding non-interest-bearing property like gold, resulting in decrease demand. Conversely, decrease rates of interest could make gold extra enticing, because the return from holding bonds and different interest-bearing devices diminishes.

-

Inflation: Gold is usually considered as a hedge towards inflation. When inflation rises, the buying energy of fiat currencies declines, making gold a extra enticing funding to protect wealth. Due to this fact, durations of excessive inflation are typically related to greater gold costs.

-

Geopolitical Occasions: Geopolitical instability and uncertainty ceaselessly drive traders in the direction of safe-haven property like gold. Wars, political upheavals, and terrorist assaults can all set off a surge in gold demand, pushing costs greater.

-

Provide and Demand: Like all commodity, the worth of gold is finally decided by the interaction of provide and demand. Elements influencing provide embody mining manufacturing, recycling of gold, and central financial institution gross sales. Demand is pushed by funding, jewellery manufacturing, and industrial makes use of.

-

Market Sentiment: Investor sentiment performs an important function in shaping gold costs. Durations of optimism and financial development can result in decrease gold costs, as traders shift their focus to higher-yielding property. Conversely, durations of pessimism and uncertainty can enhance demand for gold as a protected haven, driving costs greater.

-

Central Financial institution Exercise: Central banks all over the world maintain vital gold reserves. Their shopping for and promoting actions can considerably affect the gold market. Massive-scale purchases by central banks can assist costs, whereas vital gross sales can put downward strain.

Analyzing the Gold Worth USD Chart: Technical and Elementary Approaches

Analyzing the gold value USD chart includes using each technical and elementary evaluation strategies:

-

Technical Evaluation: This strategy focuses on figuring out patterns and developments within the value chart to foretell future actions. Technical analysts use varied indicators, similar to shifting averages, relative power index (RSI), and candlestick patterns, to establish potential purchase and promote alerts.

-

Elementary Evaluation: This strategy includes evaluating the underlying financial and geopolitical elements that affect gold costs. Elementary analysts contemplate elements similar to inflation, rates of interest, US greenback power, and geopolitical dangers to evaluate the intrinsic worth of gold and predict future value actions.

Combining each technical and elementary evaluation gives a extra complete and nuanced understanding of the gold value USD chart. This built-in strategy permits traders to establish potential buying and selling alternatives whereas mitigating dangers.

Future Outlook: Predicting the Unpredictable

Predicting the longer term path of gold costs is inherently difficult, given the complicated interaction of things concerned. Nonetheless, a number of elements recommend potential future developments:

-

Persistent Inflation: If inflation stays elevated, gold is prone to stay a pretty hedge towards inflation, probably supporting greater costs.

-

Geopolitical Uncertainty: Ongoing geopolitical tensions and uncertainties might proceed to drive safe-haven demand for gold.

-

Central Financial institution Insurance policies: The actions of central banks will play an important function in shaping gold costs. Continued quantitative easing or different expansionary financial insurance policies might assist greater gold costs.

-

Technological Developments: Developments in gold mining know-how might affect provide, influencing value dynamics.

-

Funding Demand: The extent of investor curiosity in gold will stay a key determinant of future value actions.

Conclusion:

The gold value USD chart is a dynamic reflection of worldwide financial and geopolitical situations. Understanding the historic developments, influencing elements, and analytical strategies is essential for traders looking for to navigate this complicated market. Whereas predicting the longer term with certainty is unimaginable, a complete understanding of those components can considerably improve funding decision-making and danger administration. By combining technical and elementary evaluation, traders can develop a extra knowledgeable perspective on the gold market and probably capitalize on alternatives introduced by its fluctuations. Nonetheless, it is essential to do not forget that gold funding carries inherent dangers, and diversification inside a broader funding portfolio is all the time advisable. Common monitoring of the gold value USD chart and a eager consciousness of worldwide occasions are important for profitable gold investing.

:max_bytes(150000):strip_icc()/GOLD_2023-05-17_09-51-04-aea62500f1a249748eb923dbc1b6993b.png)

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Gold Worth USD Chart: A Complete Evaluation. We recognize your consideration to our article. See you in our subsequent article!