Decoding the Inverted Head and Shoulders Sample: A Complete Information for Merchants

Associated Articles: Decoding the Inverted Head and Shoulders Sample: A Complete Information for Merchants

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Inverted Head and Shoulders Sample: A Complete Information for Merchants. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the Inverted Head and Shoulders Sample: A Complete Information for Merchants

The Inverted Head and Shoulders (IHS) sample is a robust chart formation that indicators a possible bullish reversal in a downtrend. Acknowledged for its distinct visible traits and comparatively excessive likelihood of success, it is a staple within the technical analyst’s toolkit. Nevertheless, understanding its nuances, correct identification, and efficient implementation requires a deeper dive past a superficial look on the chart. This text offers a complete exploration of the IHS sample, encompassing its formation, identification, affirmation methods, threat administration, and customary pitfalls.

Understanding the Sample’s Anatomy

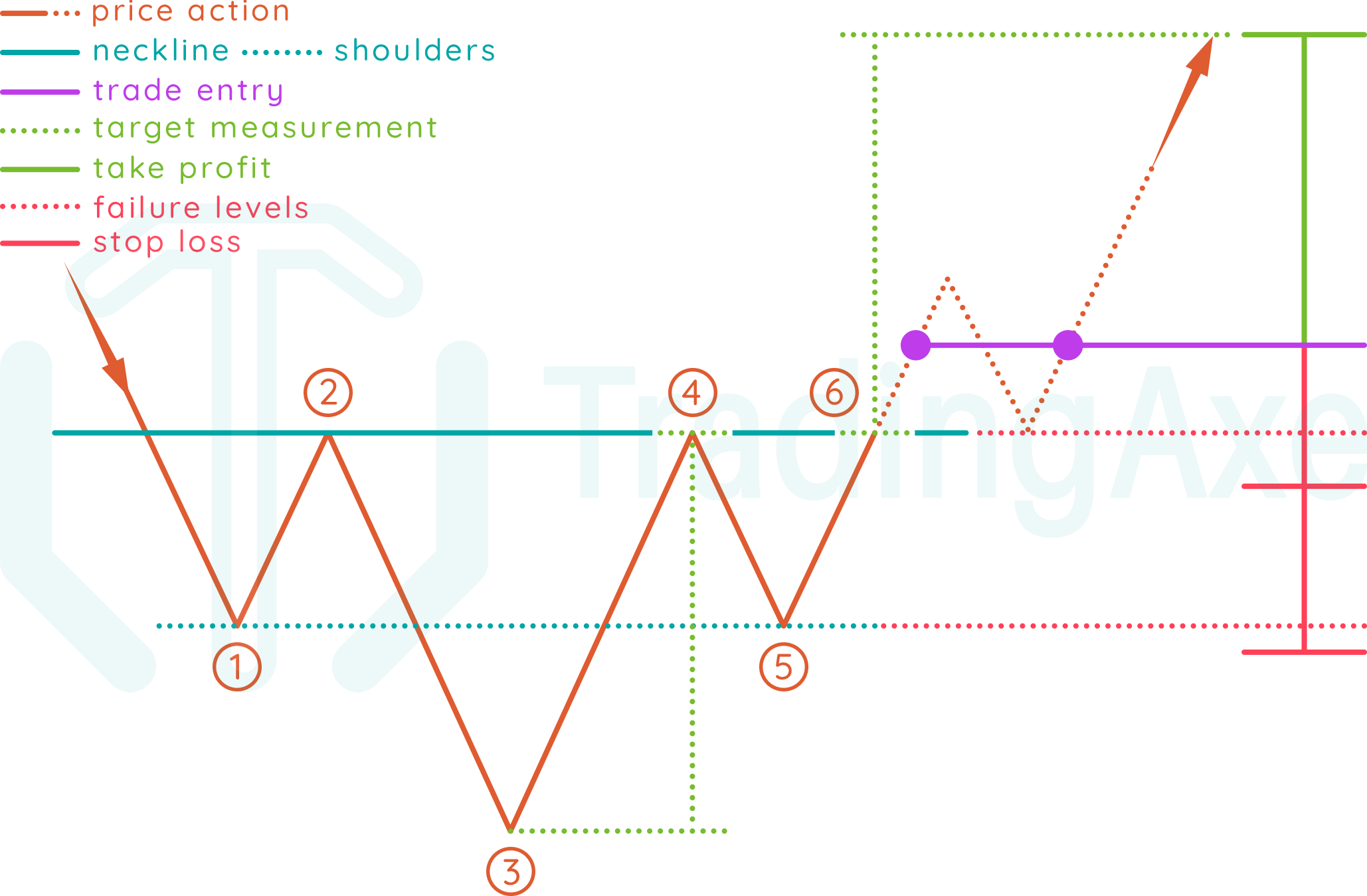

The IHS sample, the inverse of the traditional Head and Shoulders, is characterised by three distinct troughs (or valleys) forming a "W" form. The central trough, representing the "head," is considerably decrease than the 2 outer troughs, that are referred to as the "shoulders." The sample is confirmed when the value breaks above the neckline, a trendline connecting the highs of the 2 shoulders.

Let’s dissect the parts:

-

Left Shoulder: The preliminary trough, marking the start of the potential reversal. It signifies a weakening downtrend, with sellers dropping momentum. The quantity related to this shoulder is commonly comparatively low, suggesting waning promoting strain.

-

Head: That is the bottom level within the sample, signifying a major worth drop. It represents a degree of most pessimism and capitulation out there. Quantity through the head’s formation is usually larger than through the shoulders, indicating elevated buying and selling exercise.

-

Proper Shoulder: The second trough, mirroring the left shoulder in form and sometimes comparable in depth. This shoulder signifies a short lived resurgence of promoting strain, however finally weaker than the top. Quantity right here is normally decrease than the top, reflecting diminishing promoting energy.

-

Neckline: An important ingredient, the neckline is a trendline drawn connecting the highs of the left and proper shoulders. A decisive break above this neckline confirms the sample and triggers the bullish reversal sign. The neckline’s slope could be upward, downward, or horizontal, every carrying barely totally different implications for the value projection.

-

Quantity Affirmation: Observing quantity adjustments throughout the sample is essential. Decrease quantity through the shoulders in comparison with the top reinforces the sample’s validity, suggesting exhaustion of promoting strain. Elevated quantity accompanying the neckline breakout additional validates the sign.

Figuring out a Legitimate Inverted Head and Shoulders Sample

Whereas the visible illustration is essential, correct identification requires meticulous evaluation. A number of components decide the validity and reliability of an IHS sample:

-

Clear Formation: The sample’s parts (shoulders, head, and neckline) ought to be well-defined and simply identifiable. Ambiguous formations ought to be averted.

-

Shoulder Symmetry: Whereas good symmetry is not necessary, the left and proper shoulders ought to exhibit an affordable diploma of similarity in depth and period. Vital discrepancies can weaken the sample’s sign.

-

Head Depth: The pinnacle ought to be noticeably decrease than the shoulders, signifying a major worth decline. This depth underscores the extent of the bearish sentiment earlier than the reversal.

-

Neckline Integrity: The neckline ought to be clearly outlined and unbroken earlier than the breakout. A damaged neckline invalidates the sample.

-

Timeframe Concerns: The timeframe of the sample formation issues. An extended timeframe (e.g., weekly or month-to-month chart) usually suggests a extra important and dependable reversal.

-

Contextual Evaluation: At all times contemplate the broader market context. A bullish IHS sample in a strongly bearish market is likely to be much less dependable than one in a consolidating or barely bearish market.

Affirmation Methods: Past the Neckline Breakout

A neckline breakout alone shouldn’t be ample affirmation. Merchants ought to make use of extra affirmation methods to extend the likelihood of success:

-

Quantity Affirmation: As talked about earlier, elevated quantity accompanying the neckline breakout offers robust help for the sample’s validity. This means robust shopping for strain pushing the value above the resistance degree.

-

Worth Motion Affirmation: Search for bullish candlestick patterns (e.g., engulfing patterns, hammer, morning star) on the neckline breakout level. These patterns reinforce the bullish momentum.

-

Shifting Common Affirmation: A break above a major transferring common (e.g., 20-day or 50-day MA) after the neckline breakout offers additional affirmation. This means a shift within the short-term development.

-

RSI and MACD Affirmation: Overbought situations within the RSI or a bullish crossover within the MACD after the breakout help the bullish reversal. These indicators present extra momentum affirmation.

-

Help Ranges: Verify that the neckline acts as help after the breakout. A retest of the neckline, which now acts as help, strengthens the bullish sign.

Measuring the Potential Worth Goal

As soon as the IHS sample is confirmed, merchants usually use the sample’s depth to mission the potential worth goal. The measurement is usually calculated by measuring the vertical distance between the top’s low and the neckline’s breakout level. This distance is then added to the breakout level to estimate the potential worth goal. That is only a potential goal, and the precise worth motion could fluctuate considerably.

Danger Administration and Cease-Loss Placement

Efficient threat administration is essential when buying and selling the IHS sample. A well-defined stop-loss order is crucial to restrict potential losses. A typical technique is to position the stop-loss order barely under the neckline. This protects in opposition to a false breakout and limits potential losses to a manageable degree. The stop-loss placement ought to be adjusted based mostly on the dealer’s threat tolerance and the general market volatility.

Frequent Pitfalls and Misinterpretations

A number of widespread pitfalls can result in incorrect interpretations of the IHS sample:

-

False Breakouts: The value would possibly briefly break above the neckline however fail to maintain the transfer, leading to a false sign. This highlights the significance of affirmation methods.

-

Ambiguous Formations: Poorly outlined shoulders or a imprecise neckline can result in misinterpretations. Solely commerce clearly identifiable patterns.

-

Ignoring Context: Failing to contemplate the broader market situations can result in inaccurate predictions. A bullish IHS sample in a powerful bear market is much less prone to succeed.

-

Over-reliance on the Sample: The IHS sample is a probabilistic indicator, not a assure. Combining it with different technical indicators and elementary evaluation improves accuracy.

Conclusion:

The Inverted Head and Shoulders sample is a worthwhile device for figuring out potential bullish reversals. Nevertheless, profitable buying and selling requires a radical understanding of the sample’s anatomy, correct identification, strong affirmation methods, and disciplined threat administration. By combining technical evaluation with elementary insights and a well-defined buying and selling plan, merchants can leverage the IHS sample to enhance their buying and selling outcomes. Keep in mind that no sample ensures success, and steady studying and adaptation are very important for long-term success within the dynamic world of buying and selling. At all times follow accountable buying and selling and by no means make investments greater than you may afford to lose.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the Inverted Head and Shoulders Sample: A Complete Information for Merchants. We respect your consideration to our article. See you in our subsequent article!