Decoding the Kitco Gold Chart: A Complete Information for Traders

Associated Articles: Decoding the Kitco Gold Chart: A Complete Information for Traders

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Kitco Gold Chart: A Complete Information for Traders. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Kitco Gold Chart: A Complete Information for Traders

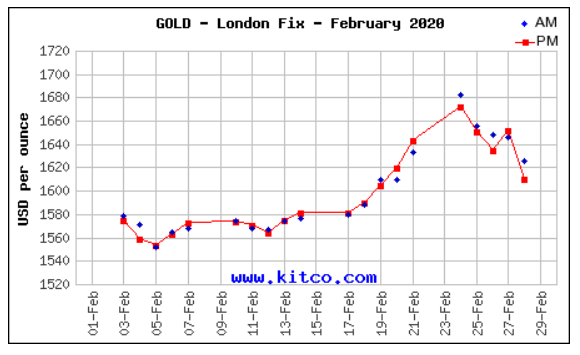

The Kitco gold chart, a extensively adopted real-time illustration of gold costs, serves as a vital instrument for buyers navigating the advanced world of treasured metals. Understanding its nuances, nevertheless, requires greater than only a cursory look. This text delves deep into the Kitco gold chart, exploring its options, deciphering its knowledge, and analyzing its significance in funding methods.

Understanding the Fundamentals: What the Kitco Chart Exhibits

The Kitco gold chart primarily shows the spot worth of gold, which is the present market worth for quick supply. This worth fluctuates consistently, reflecting the interaction of provide and demand, geopolitical occasions, financial indicators, and investor sentiment. The chart usually presents this knowledge in a visually accessible format, normally a line graph, displaying worth actions over varied timeframes, starting from intraday to many years.

Kitco gives a number of variations of its gold chart, permitting customers to customise their view. These customizations embody:

- Timeframe: Traders can choose totally different time durations, from minutes to years, permitting them to investigate short-term volatility or long-term tendencies.

- Chart Kind: Past the usual line graph, customers would possibly select candlestick charts (offering open, excessive, low, and shut worth knowledge), bar charts, or space charts, every providing distinctive visible views on worth motion.

- Technical Indicators: Kitco typically permits the combination of assorted technical indicators like transferring averages (easy transferring common – SMA, exponential transferring common – EMA), relative power index (RSI), and Bollinger Bands, which assist in figuring out potential help and resistance ranges, pattern reversals, and overbought/oversold circumstances.

- Forex: The gold worth is often quoted in US {dollars}, however Kitco would possibly provide choices to view the value in different currencies, offering a broader perspective for worldwide buyers.

Decoding the Information: Key Components Influencing Gold Costs

The Kitco gold chart’s fluctuations are influenced by a large number of things, making its interpretation a fancy but rewarding endeavor. These components could be broadly categorized as:

-

Macroeconomic Circumstances: International financial development, inflation charges, and rate of interest insurance policies considerably influence gold’s worth. In periods of financial uncertainty or excessive inflation, gold typically acts as a safe-haven asset, driving up demand and costs. Conversely, rising rates of interest could make gold much less engaging in comparison with interest-bearing belongings, doubtlessly miserable its worth.

-

Geopolitical Occasions: Political instability, wars, and worldwide tensions ceaselessly result in elevated gold funding as buyers search refuge from uncertainty. Main geopolitical occasions could cause dramatic short-term worth swings on the Kitco chart.

-

US Greenback Energy: Gold is often priced in US {dollars}. A powerful greenback usually places downward strain on gold costs, because it turns into costlier for holders of different currencies to buy gold. Conversely, a weakening greenback tends to spice up gold costs.

-

Provide and Demand: The interaction of gold mining manufacturing, jewellery demand, and funding demand considerably influences costs. A scarcity of provide relative to demand will usually push costs greater, whereas an oversupply can result in worth declines.

-

Investor Sentiment: Market sentiment performs a vital function. Optimistic outlooks have a tendency to cut back demand for safe-haven belongings like gold, whereas pessimism can drive buyers in direction of gold, pushing costs upward. This sentiment is usually mirrored within the chart’s volatility.

Using Technical Evaluation with the Kitco Gold Chart

Technical evaluation, the examine of previous worth actions to foretell future tendencies, is a well-liked technique for deciphering the Kitco gold chart. Traders use varied technical indicators to determine potential buying and selling alternatives:

-

Transferring Averages: Transferring averages easy out worth fluctuations, serving to to determine tendencies. A crossing of short-term and long-term transferring averages can sign a possible pattern change.

-

Relative Energy Index (RSI): The RSI measures the magnitude of current worth modifications to guage overbought or oversold circumstances. An RSI above 70 typically suggests an overbought market, doubtlessly indicating a worth correction, whereas an RSI beneath 30 could sign an oversold market, doubtlessly suggesting a worth rebound.

-

Bollinger Bands: Bollinger Bands show worth volatility by normal deviation bands round a transferring common. Value actions exterior these bands can point out potential breakouts or reversals.

-

Assist and Resistance Ranges: These are worth ranges the place the value has traditionally struggled to interrupt by. Assist ranges signify worth flooring, whereas resistance ranges signify worth ceilings. Breaks above resistance or beneath help can sign important worth actions.

-

Candlestick Patterns: Candlestick charts provide useful insights into worth motion by visible representations of open, excessive, low, and shut costs. Particular candlestick patterns, like hammer, engulfing patterns, and doji, can sign potential pattern reversals or continuations.

The Limitations of the Kitco Gold Chart

Whereas the Kitco gold chart supplies useful info, it is essential to acknowledge its limitations:

-

Lagging Indicator: The chart displays previous worth actions, not future predictions. Whereas technical evaluation makes an attempt to forecast future tendencies, it is not a foolproof technique.

-

Exterior Components: The chart does not account for all components influencing gold costs. Unexpected occasions, like pure disasters or sudden geopolitical shifts, can considerably influence costs no matter technical indicators.

-

Manipulation: Whereas much less probably in a market as giant as gold, manipulation is all the time a theoretical risk. Massive institutional buyers might doubtlessly affect costs within the brief time period.

-

Emotional Bias: Traders ought to pay attention to their very own emotional biases when deciphering the chart. Concern and greed can cloud judgment, resulting in impulsive choices.

Integrating the Kitco Gold Chart into Your Funding Technique

The Kitco gold chart is a strong instrument, but it surely should not be the only foundation for funding choices. A complete funding technique ought to incorporate:

-

Basic Evaluation: Think about macroeconomic components, geopolitical occasions, and supply-demand dynamics alongside the chart’s technical evaluation.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout totally different asset courses to mitigate threat.

-

Threat Administration: Set up clear threat tolerance ranges and stick with your buying and selling plan. Keep away from emotional buying and selling based mostly solely on short-term worth fluctuations.

-

Lengthy-Time period Perspective: Gold is usually seen as a long-term funding. Do not be swayed by short-term volatility.

Conclusion:

The Kitco gold chart is a useful useful resource for buyers keen on treasured metals. By understanding its options, deciphering its knowledge successfully, and integrating it with a broader funding technique, buyers can leverage its insights to make knowledgeable choices and doubtlessly maximize their returns. Nevertheless, do not forget that the chart is just one piece of the puzzle. Thorough analysis, cautious evaluation, and disciplined threat administration are essential for achievement within the dynamic world of gold funding. At all times seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has supplied useful insights into Decoding the Kitco Gold Chart: A Complete Information for Traders. We hope you discover this text informative and helpful. See you in our subsequent article!