Decoding the Language of the Market: A Complete Information to Candlestick Chart Patterns

Associated Articles: Decoding the Language of the Market: A Complete Information to Candlestick Chart Patterns

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Language of the Market: A Complete Information to Candlestick Chart Patterns. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Language of the Market: A Complete Information to Candlestick Chart Patterns

Candlestick charts, a visible illustration of value actions over time, are a cornerstone of technical evaluation. Their potential to succinctly convey market sentiment and potential future value motion makes them invaluable instruments for merchants of all expertise ranges. Whereas particular person candlestick patterns supply insights, combining them into recognizable formations – chart patterns – elevates the predictive energy of technical evaluation. This text delves into the world of candlestick chart patterns, exploring their formation, interpretation, and sensible utility in buying and selling.

Understanding the Constructing Blocks: Particular person Candlesticks

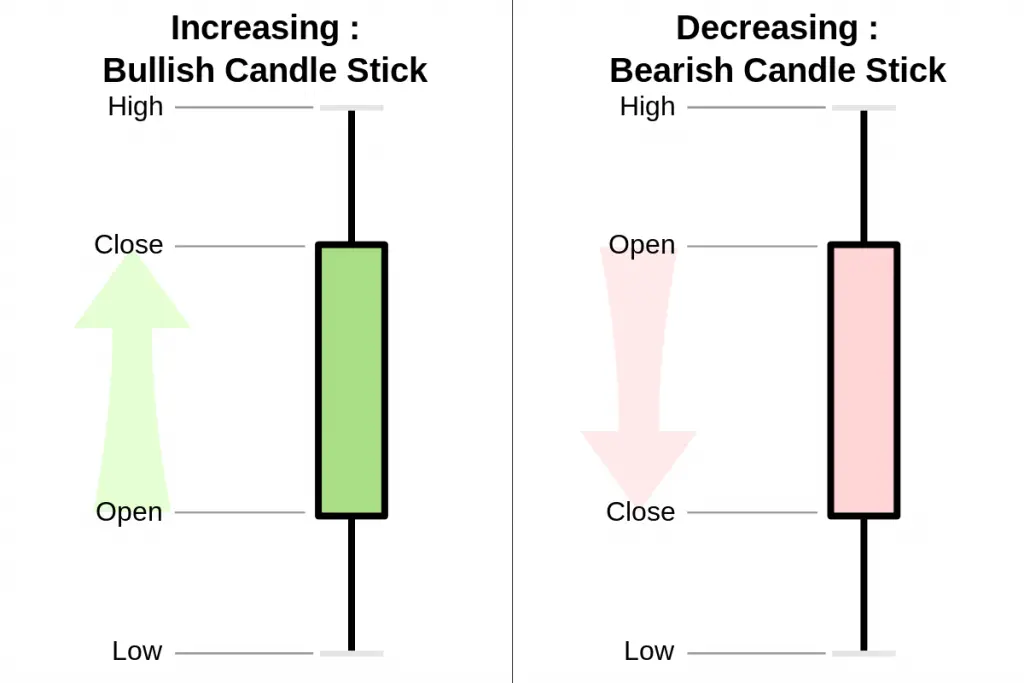

Earlier than exploring complicated chart patterns, it is essential to grasp the elements of a single candlestick. Every candlestick represents a selected time interval (e.g., in the future, one hour, one minute). It includes:

- Open: The worth originally of the interval.

- Excessive: The very best value reached through the interval.

- Low: The bottom value reached through the interval.

- Shut: The worth on the finish of the interval.

A candlestick’s physique represents the distinction between the open and shut costs. A inexperienced (or white) physique signifies a closing value larger than the opening value (bullish), whereas a purple (or black) physique signifies a closing value decrease than the opening value (bearish). The wicks (or shadows) extending above and beneath the physique present the excessive and low costs reached through the interval, respectively. The size of the physique and the wicks present essential details about the energy of the value motion and the prevailing market sentiment.

Frequent Candlestick Chart Patterns: Recognizing the Alerts

Candlestick chart patterns emerge from the sequential association of particular person candlesticks. These patterns usually sign potential reversals or continuations of present developments. A few of the most well known patterns embody:

Reversal Patterns: These patterns counsel a possible change within the prevailing development.

-

Hammer: A small physique with a protracted decrease wick, suggesting patrons stepped in to stop additional value decline. It is a bullish reversal sign, usually showing on the backside of a downtrend. A "hanging man" is its bearish counterpart, showing on the high of an uptrend.

-

Inverted Hammer: Much like a hammer, however with a protracted higher wick and a small physique. This means sellers tried to push the value down however patrons prevented a major drop. It’s a bullish reversal sign, usually seen on the backside of a downtrend.

-

Capturing Star: A small physique with a protracted higher wick, indicating sellers overwhelmed patrons close to the excessive of the interval. It’s a bearish reversal sign, usually showing on the high of an uptrend.

-

Engulfing Sample: A two-candlestick sample the place the second candle utterly engulfs the physique of the primary. A bullish engulfing sample happens when a big inexperienced candle follows a purple candle, suggesting patrons have taken management. A bearish engulfing sample is the alternative, with a big purple candle following a inexperienced candle.

-

Morning Star: A 3-candlestick bullish reversal sample. It consists of a downtrending candle, adopted by a small physique (doji or small vary candle), after which a big bullish candle.

-

Night Star: The bearish counterpart of the morning star. It includes an uptrending candle, adopted by a small physique, after which a big bearish candle.

Continuation Patterns: These patterns counsel the present development will seemingly proceed.

-

Three White Troopers: Three consecutive bullish candles with every candle’s open above the earlier candle’s shut. This indicators robust shopping for stress and a continuation of the uptrend.

-

Three Black Crows: The bearish counterpart of the three white troopers, indicating robust promoting stress and a continuation of the downtrend.

-

Bullish/Bearish Harami: A two-candlestick sample the place the second candle’s physique is fully contained inside the physique of the primary candle. A bullish harami suggests a possible pause in a downtrend, whereas a bearish harami signifies a possible pause in an uptrend. They’re thought-about much less dependable reversal indicators than engulfing patterns.

-

Piercing Line: A two-candlestick bullish sample the place a big purple candle is adopted by a inexperienced candle that closes at the least midway up the purple candle’s physique. This indicators a possible reversal of a downtrend.

-

Darkish Cloud Cowl: The bearish counterpart of the piercing line, suggesting a possible reversal of an uptrend.

Affirmation and Context are Key

Whereas candlestick patterns present helpful insights, they’re only when used along side different technical indicators and basic evaluation. Affirmation from different indicators, similar to shifting averages, RSI, or MACD, can considerably improve the reliability of a candlestick sample sign.

Moreover, the context of the sample is essential. A sample’s significance will depend on its location inside the total development. A bullish reversal sample showing close to the underside of a long-term downtrend is prone to be extra vital than the identical sample showing throughout a short-term correction inside an uptrend.

Sensible Utility in Buying and selling:

Figuring out candlestick patterns is barely step one. Profitable buying and selling includes understanding the right way to use this information to make knowledgeable selections.

-

Danger Administration: All the time use stop-loss orders to restrict potential losses. The position of your stop-loss will depend upon the precise sample and the general market context.

-

Place Sizing: Decide the suitable quantity to speculate based mostly in your danger tolerance and the potential reward.

-

Entry and Exit Methods: Develop clear entry and exit methods based mostly on the sample’s traits and affirmation from different indicators.

-

Backtesting: Backtesting your buying and selling technique utilizing historic knowledge is essential to judge its effectiveness and refine your method.

Past the Fundamentals: Superior Candlestick Sample Evaluation

Mastering candlestick patterns includes extra than simply recognizing particular person formations. Superior strategies embody:

-

Sample Mixtures: Combining a number of patterns can present stronger indicators. For instance, a hammer adopted by a bullish engulfing sample can considerably strengthen the bullish reversal sign.

-

Sample Recognition in Totally different Timeframes: Analyzing patterns throughout a number of timeframes (e.g., day by day, hourly, and minute charts) can present a extra complete view of the market.

-

Understanding Market Context: Take into account broader market situations, financial information, and geopolitical occasions when decoding candlestick patterns.

Conclusion:

Candlestick chart patterns supply a robust visible language for decoding market sentiment and predicting potential value actions. Whereas they aren’t foolproof predictors, mastering their interpretation, mixed with sound danger administration and a holistic method to technical evaluation, can considerably improve a dealer’s potential to navigate the complexities of the market. Steady studying, observe, and adaptation are important for growing proficiency on this helpful facet of technical evaluation. Keep in mind that constant self-discipline and danger administration are paramount to profitable buying and selling, whatever the technical instruments employed. The secret’s to make use of candlestick patterns as one piece of a bigger puzzle, integrating them with different indicators and a deep understanding of market dynamics.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Language of the Market: A Complete Information to Candlestick Chart Patterns. We hope you discover this text informative and helpful. See you in our subsequent article!