Decoding the M-Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the M-Chart Sample: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the M-Chart Sample: A Complete Information for Merchants. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the M-Chart Sample: A Complete Information for Merchants

The world of technical evaluation is replete with chart patterns, every providing insights into potential market actions. Amongst these, the M-chart sample stands out as a big reversal sample, signaling a possible shift from an uptrend to a downtrend. Understanding its nuances, nonetheless, requires extra than simply recognizing its form; it calls for a grasp of its formation, affirmation methods, and potential pitfalls. This text delves deep into the M-pattern, offering a complete information for merchants of all ranges.

Understanding the M-Sample’s Anatomy:

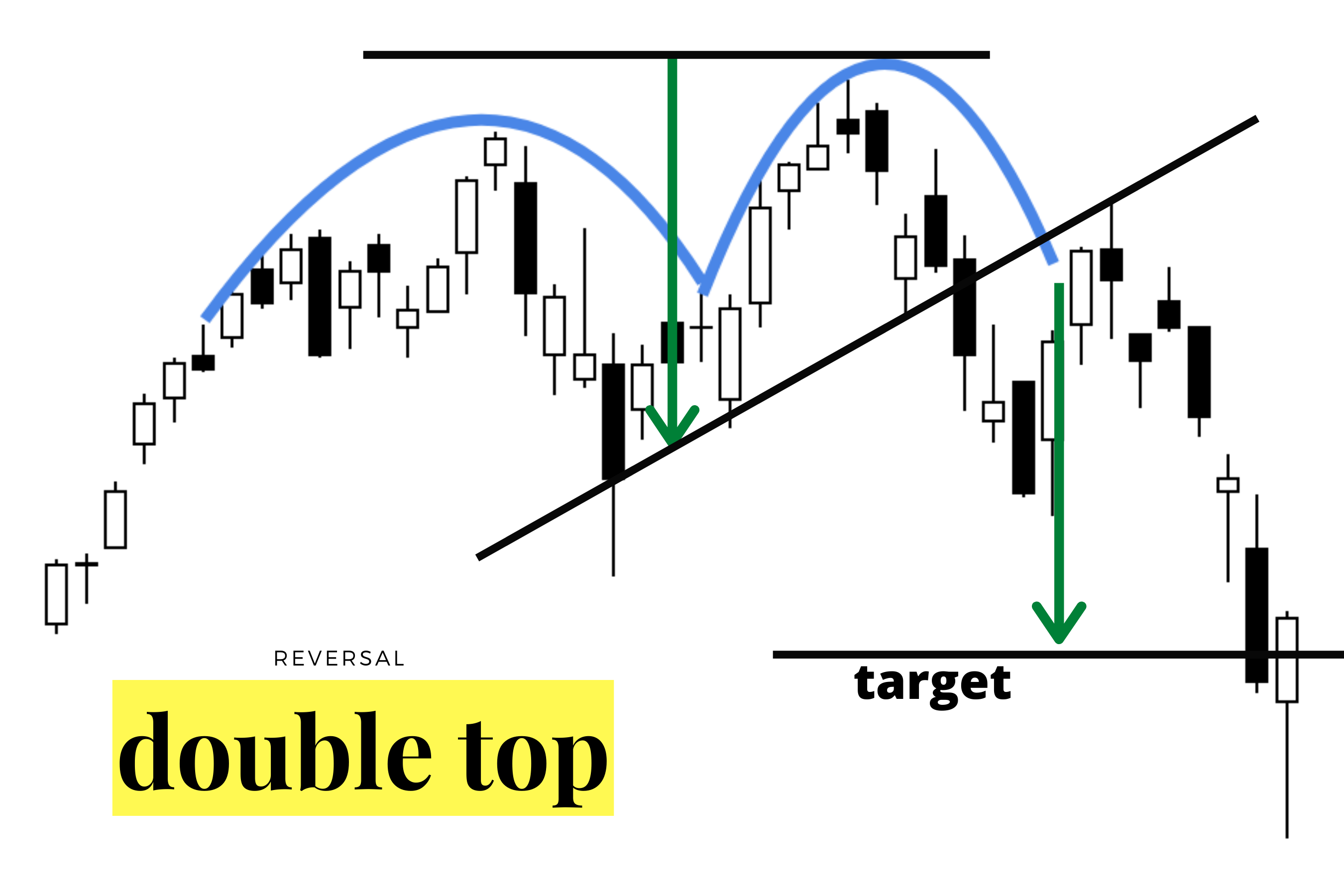

The M-pattern, also called a double prime, is a bearish reversal sample characterised by two distinct peaks ("tops") linked by a trough ("backside"). Visually, it resembles the letter "M," therefore its identify. Its formation suggests a lack of shopping for momentum, with the value failing to surpass a earlier excessive, hinting at a possible reversal.

Here is a breakdown of its key parts:

-

Peak 1 (Left Shoulder): This marks the preliminary excessive of the uptrend. It represents the purpose the place shopping for stress was strongest earlier than a short lived pullback.

-

Trough (Neckline): The connecting line between the 2 peaks kinds the neckline. It is a essential help degree. A break under this neckline confirms the sample’s bearish sign. The neckline is often a trendline connecting swing lows.

-

Peak 2 (Proper Shoulder): That is the second peak, ideally reaching roughly the identical peak as Peak 1. This reveals a failed try to interrupt above the earlier excessive, additional indicating weakening bullish momentum.

-

Breakout: The affirmation of the M-pattern happens when the value decisively breaks under the neckline. This breakout often indicators a big bearish transfer.

Formation and Significance:

The formation of an M-pattern is a gradual course of, typically taking a number of weeks and even months to completely develop. Its formation signifies a shift in market sentiment, from bullish to bearish. A number of components contribute to its emergence:

-

Revenue-taking: As the value approaches Peak 1, merchants who purchased earlier might begin taking earnings, resulting in a decline.

-

Weakening Shopping for Strain: The failure to interrupt above Peak 1 signifies waning shopping for curiosity. Sellers are gaining the higher hand.

-

Elevated Promoting Strain: As the value reaches Peak 2, promoting stress intensifies, pushing the value down under the neckline.

The importance of the M-pattern lies in its predictive energy. As soon as confirmed, it suggests a possible value decline of roughly the identical magnitude as the space between Peak 1 (or Peak 2) and the neckline. This measurement is usually used as a possible value goal for the following downtrend.

Affirmation Methods:

Whereas the visible resemblance to an "M" is a place to begin, relying solely on the sample’s form is dangerous. Affirmation methods are essential to mitigate false indicators. A number of strategies can improve the reliability of an M-pattern identification:

-

Quantity Evaluation: Observe quantity modifications through the sample’s formation. Reducing quantity through the rise to Peak 2 can counsel weakening shopping for stress, strengthening the bearish sign. Conversely, elevated quantity on the breakout under the neckline confirms the sample’s validity.

-

Technical Indicators: Using technical indicators just like the Relative Power Index (RSI) or Shifting Common Convergence Divergence (MACD) can present extra affirmation. A bearish divergence (value making larger highs, however the indicator making decrease highs) previous the formation of Peak 2 reinforces the bearish sign. A bearish crossover within the MACD may also be a confirming issue.

-

Breakout Affirmation: The breakout under the neckline must be decisive and sustained. A quick dip under the neckline adopted by a direct rebound generally is a false sign. Search for a transparent and sustained break under the neckline with elevated quantity.

-

Help and Resistance Ranges: Think about different help and resistance ranges to gauge the potential impression of the breakout. A robust help degree under the neckline might restrict the draw back potential.

Potential Pitfalls and False Indicators:

Regardless of its significance, the M-pattern just isn’t infallible. A number of components can result in false indicators or inaccurate predictions:

-

Incomplete Formation: A sample that does not absolutely develop can result in deceptive indicators. The 2 peaks must be comparatively related in peak, and the neckline must be clearly outlined.

-

False Breakouts: A quick break under the neckline adopted by a fast restoration generally is a false sign. Search for sustained breaks with elevated quantity.

-

Market Circumstances: The effectiveness of the M-pattern might be influenced by broader market situations. In periods of excessive volatility, false indicators are extra possible.

-

Timeframe Issues: The sample’s reliability can differ relying on the timeframe. Patterns fashioned on shorter timeframes are typically much less dependable than these fashioned on longer timeframes.

M-Sample vs. Different Chart Patterns:

It is essential to distinguish the M-pattern from different chart patterns that may look related:

-

W-Sample (Double Backside): The W-pattern is the bullish counterpart of the M-pattern. It signifies a possible reversal from a downtrend to an uptrend.

-

Head and Shoulders Sample: Whereas each are reversal patterns, the pinnacle and shoulders sample entails three peaks (head and two shoulders) and is mostly thought of a extra highly effective bearish sign.

-

Triangles: Triangles are continuation patterns, indicating a pause within the present pattern moderately than a reversal.

Sensible Functions and Buying and selling Methods:

As soon as an M-pattern is confirmed, merchants can make use of a number of methods:

-

Quick Promoting: A brief promote place might be initiated upon affirmation of the breakout under the neckline.

-

Cease-Loss Orders: Place a stop-loss order above the neckline to restrict potential losses if the sample fails to materialize.

-

Goal Value: The potential value decline is usually estimated as the space between Peak 1 (or Peak 2) and the neckline.

-

Threat Administration: At all times use applicable danger administration strategies, comparable to place sizing and stop-loss orders, to guard capital.

Conclusion:

The M-chart sample, whereas a robust software, requires cautious interpretation and affirmation. Relying solely on the visible illustration might be deceptive. By incorporating quantity evaluation, technical indicators, and a radical understanding of market situations, merchants can considerably enhance the accuracy of their predictions and decrease the chance of false indicators. The M-pattern, when appropriately recognized and confirmed, generally is a invaluable addition to any dealer’s technical evaluation arsenal, providing insights into potential market reversals and guiding knowledgeable buying and selling choices. Nevertheless, do not forget that no chart sample ensures success, and diligent danger administration stays paramount.

![[PDF] Chart Patterns by Thomas N. Bulkowski 9781119274926](https://book-extracts.perlego.com/991588/images/ec01f001-plgo-compressed.webp)

Closure

Thus, we hope this text has offered invaluable insights into Decoding the M-Chart Sample: A Complete Information for Merchants. We respect your consideration to our article. See you in our subsequent article!