Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success

Associated Articles: Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success

The inventory market, a fancy ecosystem of shopping for and promoting, can seem formidable to the uninitiated. Nonetheless, mastering the artwork of chart studying can considerably improve your understanding of market tendencies and enhance your funding selections. Whereas no system ensures success, chart studying, when mixed with elementary evaluation, gives a robust instrument for navigating the complexities of the market. This text serves as a complete information, exploring numerous chart sorts, indicators, and methods that will help you unlock the secrets and techniques hidden inside worth actions.

Understanding the Fundamentals: Chart Varieties and Timeframes

Earlier than delving into intricate patterns and indicators, it is essential to know the elemental chart sorts and timeframes utilized in technical evaluation. The most typical sorts are:

-

Line Charts: These charts join the closing costs of a safety over a selected interval. They supply a easy visible illustration of worth tendencies, superb for figuring out long-term actions. Nonetheless, they lack the element of different chart sorts.

-

Bar Charts: These charts show the excessive, low, open, and shutting costs for a given interval (often a day). The vertical bar represents the value vary, with a small horizontal line indicating the opening and shutting costs. Bar charts supply a extra detailed image than line charts, permitting for a greater understanding of worth volatility.

-

Candlestick Charts: These are arguably the preferred chart kind amongst merchants. Just like bar charts, they show the excessive, low, open, and shutting costs. Nonetheless, the visible illustration is extra intuitive. A "physique" represents the vary between the open and shutting costs, whereas "wicks" (or "shadows") lengthen from the physique to the excessive and low costs. The colour of the physique sometimes signifies whether or not the closing worth was greater (inexperienced or white, typically indicating bullish sentiment) or decrease (crimson or black, typically indicating bearish sentiment) than the opening worth. Candlestick charts enable for straightforward identification of varied patterns and formations.

Timeframes: The timeframe of a chart considerably impacts its interpretation. Frequent timeframes embrace:

-

Intraday: Charts exhibiting worth actions inside a single buying and selling day (e.g., 1-minute, 5-minute, 15-minute charts). These are primarily utilized by short-term merchants.

-

Every day: Charts displaying worth actions over a single day. These are broadly utilized by each short-term and medium-term merchants.

-

Weekly: Charts exhibiting worth actions over every week. These are generally used for medium-term to long-term evaluation.

-

Month-to-month: Charts displaying worth actions over a month. These are primarily used for long-term evaluation.

Selecting the suitable timeframe is dependent upon your funding horizon and buying and selling fashion. Quick-term merchants sometimes use intraday charts, whereas long-term buyers typically deal with weekly or month-to-month charts.

Key Chart Patterns: Recognizing Market Sentiment

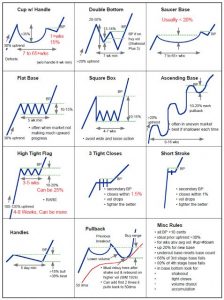

Chart patterns are recurring formations that may point out potential future worth actions. Recognizing these patterns can present helpful insights into market sentiment and potential buying and selling alternatives. Some widespread patterns embrace:

-

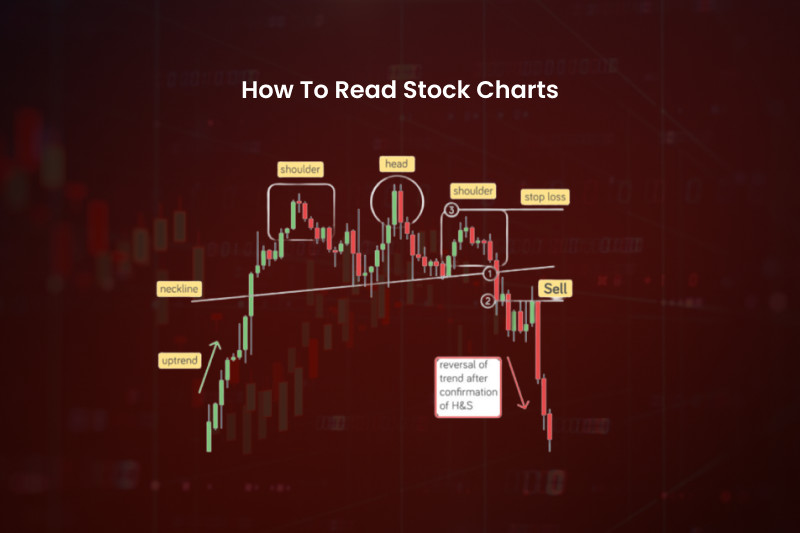

Head and Shoulders: A bearish reversal sample characterised by three peaks, with the center peak (the "head") being the very best. A neckline connects the troughs on both aspect of the top. A break beneath the neckline typically alerts a worth decline.

-

Inverse Head and Shoulders: A bullish reversal sample, mirroring the top and shoulders sample. A break above the neckline suggests a possible worth enhance.

-

Double Tops and Double Bottoms: These patterns point out potential reversals. A double prime types when a worth reaches the same excessive twice, adopted by a decline. Conversely, a double backside types when a worth reaches the same low twice, adopted by a rise.

-

Triangles: These patterns symbolize intervals of consolidation. Symmetrical triangles counsel a continuation of the present development, whereas ascending and descending triangles counsel bullish and bearish breakouts, respectively.

-

Flags and Pennants: These patterns symbolize momentary pauses in a powerful development. Flags are characterised by an oblong consolidation, whereas pennants are triangular consolidations. Breakouts from these patterns typically sign a continuation of the underlying development.

Technical Indicators: Enhancing Chart Evaluation

Whereas chart patterns present helpful insights, technical indicators supply quantitative measurements to substantiate or refute potential buying and selling alerts. Some broadly used indicators embrace:

-

Shifting Averages: These indicators easy out worth fluctuations, highlighting the general development. Generally used transferring averages embrace easy transferring averages (SMA) and exponential transferring averages (EMA). Crossovers between totally different transferring averages (e.g., a 50-day SMA crossing above a 200-day SMA) can generate purchase or promote alerts.

-

Relative Power Index (RSI): This momentum indicator measures the magnitude of current worth adjustments to guage overbought or oversold situations. RSI values above 70 typically counsel an overbought market, whereas values beneath 30 counsel an oversold market.

-

MACD (Shifting Common Convergence Divergence): This trend-following momentum indicator identifies adjustments within the energy, path, momentum, and length of a development. Crossovers of the MACD line above the sign line typically point out bullish alerts, whereas crossovers beneath point out bearish alerts.

-

Bollinger Bands: These bands plot customary deviations round a transferring common, visualizing worth volatility. Value actions outdoors the bands can counsel potential overbought or oversold situations.

-

Quantity: Analyzing buying and selling quantity alongside worth actions can present helpful context. Excessive quantity throughout worth will increase confirms the energy of the uptrend, whereas excessive quantity throughout worth decreases confirms the energy of the downtrend.

Combining Chart Studying with Basic Evaluation:

Whereas technical evaluation, together with chart studying, gives helpful insights into worth actions, it should not be utilized in isolation. Basic evaluation, which entails evaluating an organization’s monetary well being, administration group, and trade place, gives essential context for funding selections. Combining each technical and elementary evaluation gives a extra complete method to inventory market investing. A robust elementary outlook mixed with optimistic technical alerts considerably will increase the likelihood of profitable investments.

Danger Administration and Self-discipline:

Chart studying is a talent that requires observe and persistence. It is essential to develop a disciplined method to buying and selling and implement strong threat administration methods. This consists of setting stop-loss orders to restrict potential losses, diversifying your portfolio, and solely investing capital you may afford to lose. By no means rely solely on chart patterns or indicators; all the time think about the broader market context and your personal threat tolerance.

Conclusion:

Chart studying is a robust instrument for understanding market tendencies and bettering funding selections. By mastering the fundamentals of chart sorts, patterns, and indicators, and mixing this data with elementary evaluation and disciplined threat administration, you may considerably improve your possibilities of success within the dynamic world of inventory market investing. Keep in mind that steady studying and adapting to market situations are essential for long-term success. Follow, persistence, and a well-defined buying and selling plan are important components for navigating the complexities of the market and reaching your funding targets. Contemplate searching for steering from skilled monetary advisors to additional improve your understanding and refine your buying and selling methods. The inventory market presents each alternatives and dangers; thorough analysis and a well-informed method are paramount to navigating this difficult but rewarding panorama.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Market: A Complete Information to Chart Studying for Inventory Market Success. We hope you discover this text informative and useful. See you in our subsequent article!