Decoding the Market’s Pulse: A Complete Information to Inventory Market Cash Movement Charts

Associated Articles: Decoding the Market’s Pulse: A Complete Information to Inventory Market Cash Movement Charts

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Market’s Pulse: A Complete Information to Inventory Market Cash Movement Charts. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Market’s Pulse: A Complete Information to Inventory Market Cash Movement Charts

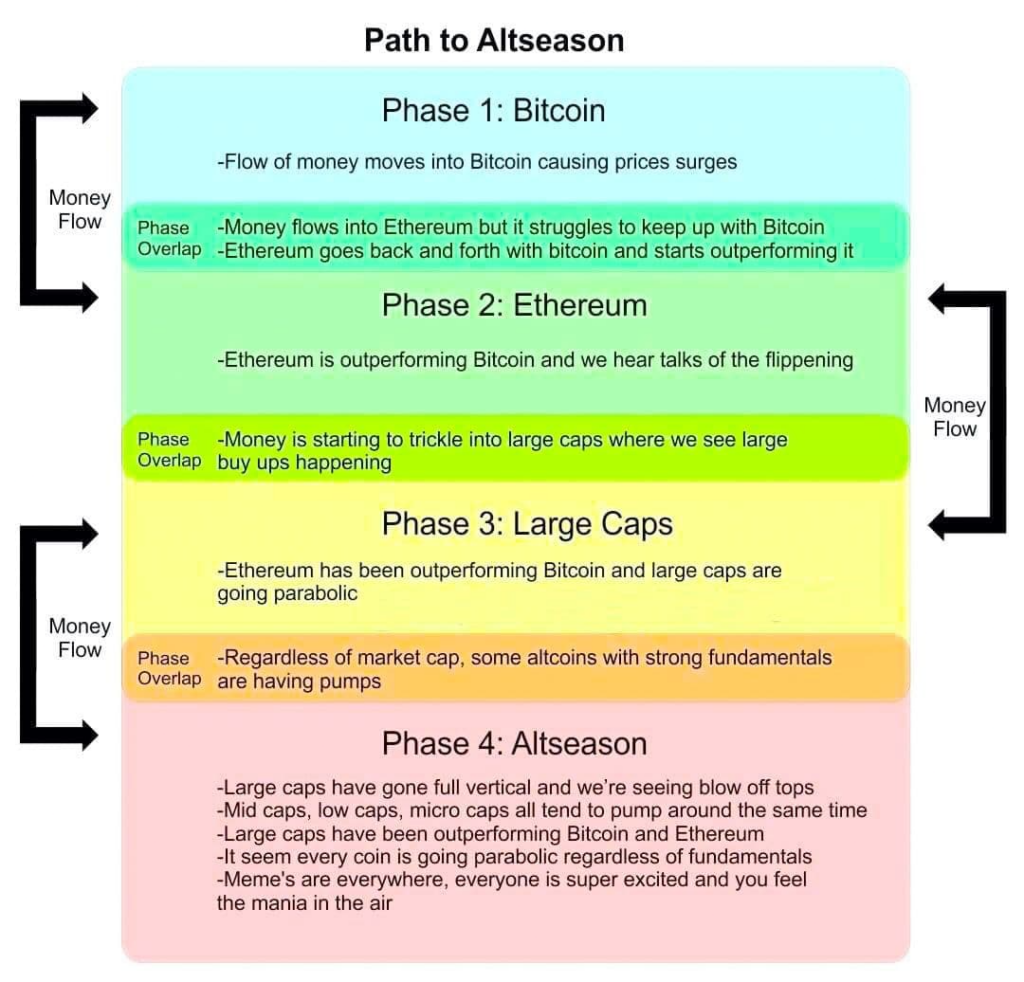

The inventory market, a posh ecosystem of shopping for and promoting, can really feel like navigating a turbulent sea with out a compass. Whereas quite a few indicators exist to assist buyers chart a course, understanding the circulation of cash – the place it is coming from and the place it is going – is arguably essentially the most essential side of profitable investing. That is the place cash circulation charts turn into invaluable. They provide a visible illustration of the market’s underlying energy and weak point, offering insights typically missed by conventional indicators. This text delves deep into the world of inventory market cash circulation charts, explaining their development, interpretation, and sensible functions.

Understanding the Fundamentals: What’s Cash Movement?

Earlier than diving into charts, let’s outline cash circulation. Merely put, it represents the cumulative shopping for and promoting stress inside a given interval, often a day or per week. Not like quantity, which merely signifies the variety of shares traded, cash circulation considers each quantity and worth modifications. This important distinction permits for a extra nuanced understanding of market sentiment. A excessive quantity with a rising worth signifies robust shopping for stress, whereas a excessive quantity with a falling worth suggests vital promoting stress. Cash circulation basically quantifies this stress.

Calculating Cash Movement:

The commonest technique for calculating cash circulation makes use of the next method:

*Cash Movement = [(High + Low + Close) / 3] Quantity**

This method takes the typical of the excessive, low, and shutting costs for a given interval (e.g., a day) and multiplies it by the quantity traded throughout that interval. This produces a "typical worth" weighted by the quantity, offering a extra correct reflection of the market’s energy than quantity alone.

Developing the Cash Movement Chart:

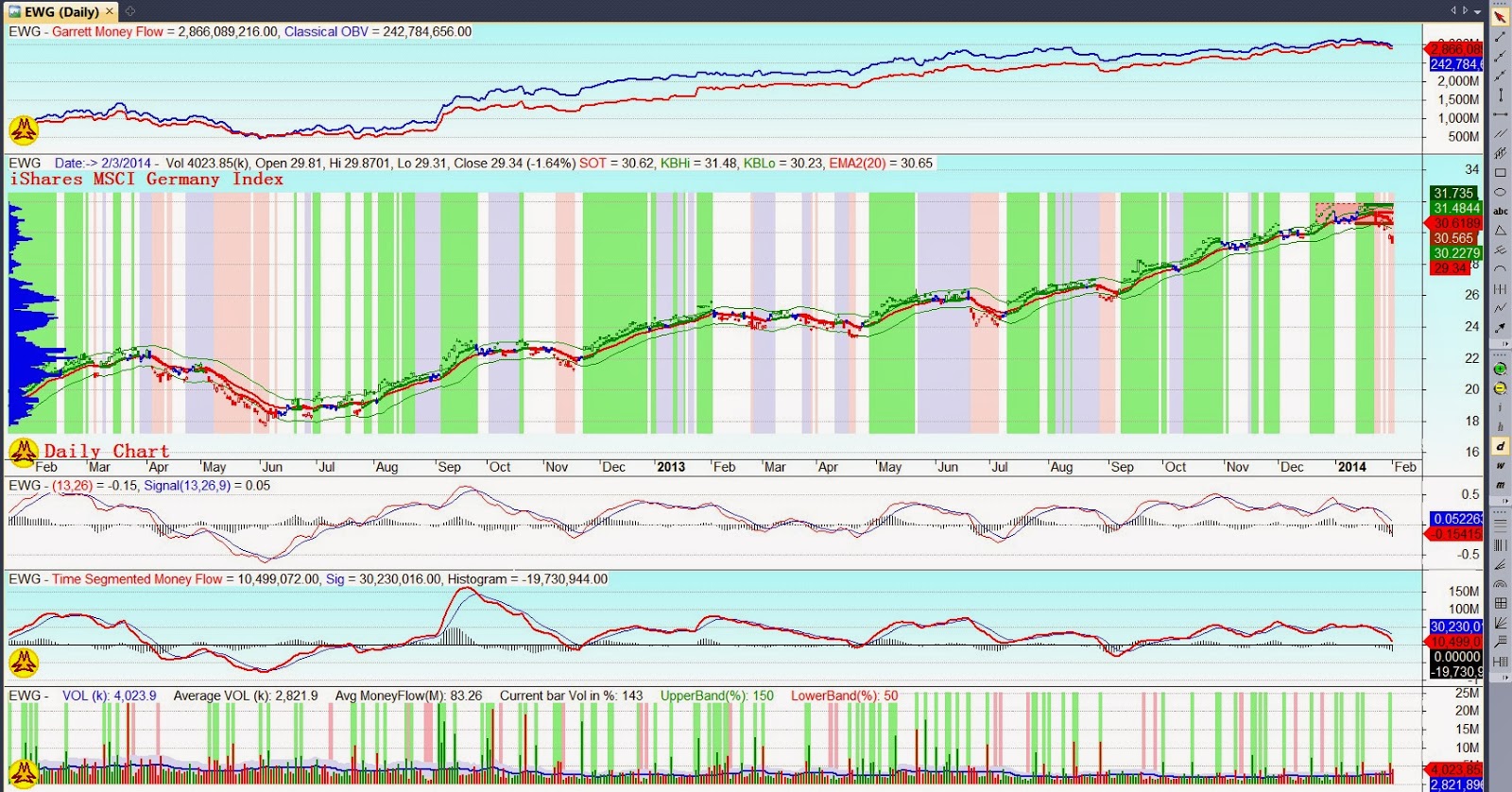

As soon as the cash circulation is calculated for every interval, it is plotted on a chart, often alongside the value chart of the asset. This visible illustration permits buyers to determine tendencies and patterns in cash circulation that may not be obvious from the value chart alone. The chart itself will be fairly easy: the x-axis represents time, and the y-axis represents the cash circulation worth. Optimistic cash circulation values point out internet shopping for stress, whereas detrimental values point out internet promoting stress.

Key Indicators inside Cash Movement Charts:

A number of key indicators emerge from analyzing cash circulation charts:

-

Optimistic Cash Movement Divergence: This happens when the value of an asset is declining, however the cash circulation is growing or remaining comparatively excessive. This means that regardless of the value drop, patrons are nonetheless actively collaborating available in the market, probably indicating a bullish reversal.

-

Destructive Cash Movement Divergence: The alternative of constructive divergence, this happens when the value of an asset is rising, however the cash circulation is declining or remaining comparatively low. This means weakening shopping for stress, probably foreshadowing a worth correction or reversal.

-

Cash Movement Index (MFI): The MFI is a momentum indicator derived from cash circulation. It is calculated equally to the Relative Energy Index (RSI) however makes use of cash circulation as a substitute of worth modifications. The MFI oscillates between 0 and 100, with readings above 80 usually thought-about overbought and readings beneath 20 thought-about oversold. These ranges can sign potential worth reversals.

-

Assist and Resistance Ranges: Cash circulation charts may help determine help and resistance ranges. Persistent constructive cash circulation at a selected worth degree suggests robust shopping for help, whereas persistent detrimental cash circulation at a degree signifies robust promoting stress or resistance.

-

Development Affirmation: Cash circulation charts can verify or contradict worth tendencies. A powerful uptrend accompanied by constantly constructive cash circulation strengthens the bullish sign, whereas a downtrend with constantly detrimental cash circulation confirms the bearish sentiment.

Benefits of Utilizing Cash Movement Charts:

-

Early Warning Indicators: Cash circulation charts can present early warning indicators of potential worth reversals, permitting buyers to regulate their positions proactively.

-

Affirmation of Traits: They assist verify or deny the validity of present worth tendencies, including one other layer of confidence to buying and selling choices.

-

Figuring out Hidden Energy/Weak spot: Cash circulation can reveal hidden energy in a market that may not be evident in worth motion alone. As an illustration, a inventory may be consolidating sideways, however robust constructive cash circulation might point out accumulating shopping for stress, hinting at a future breakout.

-

Decreased Emotional Buying and selling: By specializing in goal knowledge like cash circulation, buyers can cut back emotional decision-making and keep away from impulsive trades primarily based solely on worth fluctuations.

-

Improved Danger Administration: Understanding cash circulation helps determine potential dangers and permits for higher danger administration methods. For instance, a major drop in cash circulation throughout an uptrend might sign a weakening market and immediate a discount in publicity.

Limitations of Cash Movement Charts:

-

Lagging Indicator: Like many different technical indicators, cash circulation is a lagging indicator. It displays previous market exercise slightly than predicting future actions.

-

Sensitivity to Quantity: The accuracy of cash circulation calculations is closely reliant on correct quantity knowledge. Inaccurate or manipulated quantity knowledge can distort the cash circulation readings.

-

Subjectivity in Interpretation: Whereas the calculations are goal, the interpretation of cash circulation charts will be subjective. Completely different merchants would possibly draw completely different conclusions from the identical chart.

-

Not a Standalone Indicator: Cash circulation charts shouldn’t be used as a standalone indicator. They’re simplest when mixed with different technical evaluation instruments and basic evaluation to type a complete buying and selling technique.

Sensible Purposes of Cash Movement Charts:

Cash circulation charts are invaluable instruments for varied buying and selling methods:

-

Swing Buying and selling: Figuring out constructive and detrimental divergences may help swing merchants pinpoint potential entry and exit factors.

-

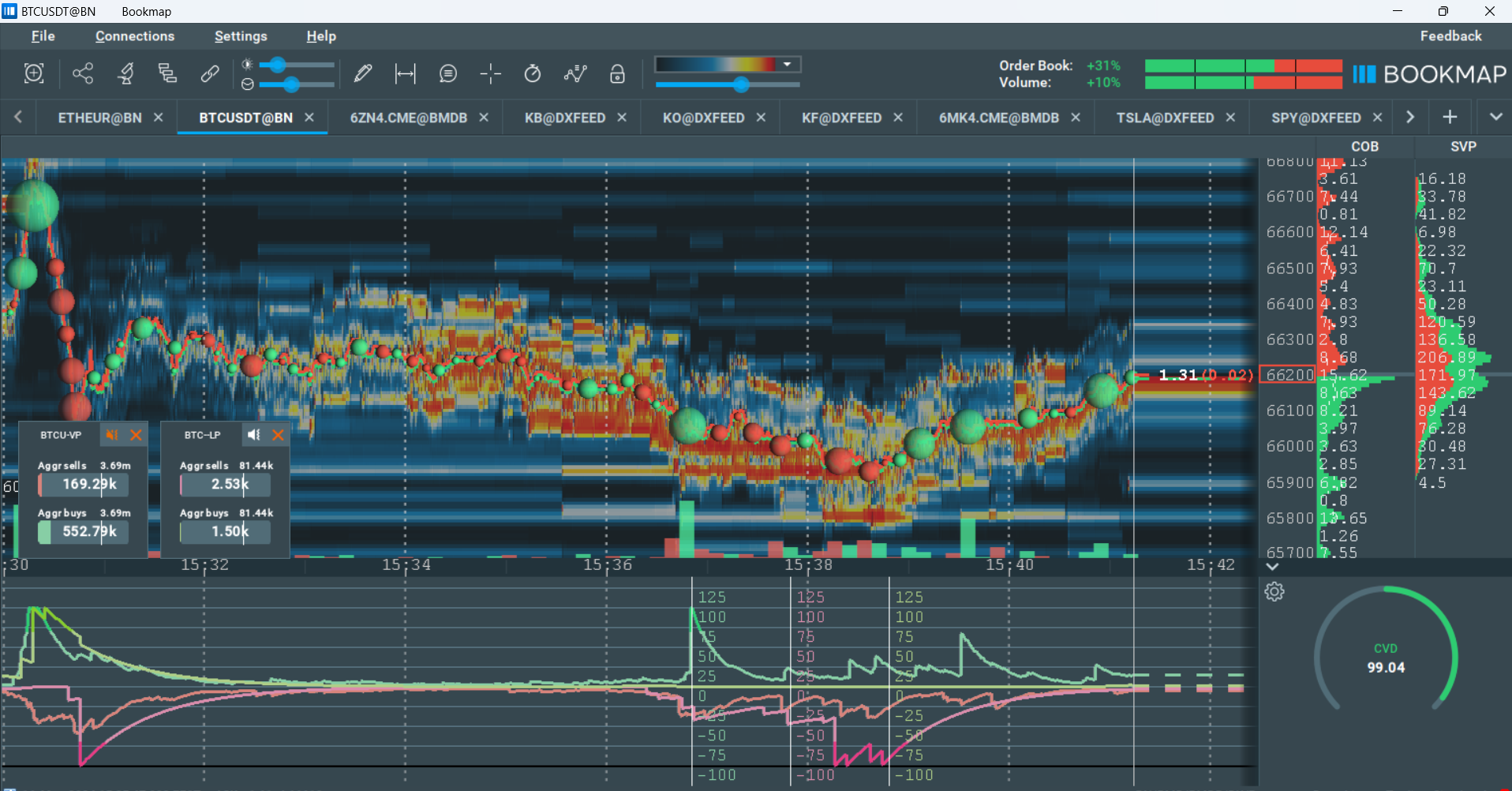

Day Buying and selling: Monitoring intraday cash circulation can present invaluable insights into short-term worth actions.

-

Place Buying and selling: Lengthy-term buyers can use cash circulation to evaluate the underlying energy of a pattern and make knowledgeable choices about holding or promoting positions.

-

Portfolio Administration: Analyzing cash circulation throughout completely different property in a portfolio may help optimize asset allocation and danger administration.

Conclusion:

Cash circulation charts supply a strong lens via which to view the inventory market. By incorporating quantity and worth right into a single metric, they supply a richer understanding of market dynamics than worth motion alone. Whereas not a crystal ball, understanding and using cash circulation charts, along with different analytical instruments and sound danger administration, can considerably enhance an investor’s decision-making course of and contribute to extra profitable buying and selling outcomes. Keep in mind that mastering the interpretation of cash circulation charts requires observe and expertise. Combining this data with basic evaluation and a well-defined buying and selling plan is essential for navigating the complexities of the inventory market successfully.

![Million Dollar Trading Profit Stock Market Pattern [8 CHARTS] Timothy](https://www.timothysykes.com/wp-content/uploads/2010/12/bpsr-day-1-copy.jpg)

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Market’s Pulse: A Complete Information to Inventory Market Cash Movement Charts. We admire your consideration to our article. See you in our subsequent article!