Decoding the Nationwide Gasoline Worth Common Chart: A 20-Yr Retrospective and Future Outlook

Associated Articles: Decoding the Nationwide Gasoline Worth Common Chart: A 20-Yr Retrospective and Future Outlook

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Nationwide Gasoline Worth Common Chart: A 20-Yr Retrospective and Future Outlook. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the Nationwide Gasoline Worth Common Chart: A 20-Yr Retrospective and Future Outlook

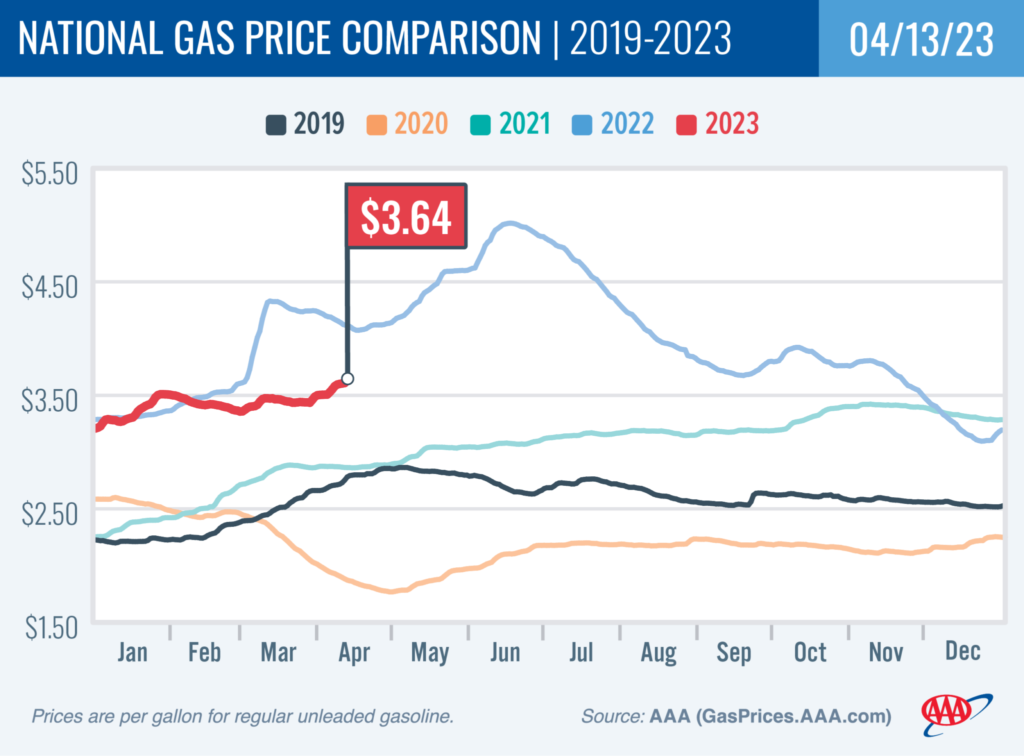

The nationwide common worth of gasoline is a extremely unstable and intently watched financial indicator, reflecting a posh interaction of worldwide occasions, home insurance policies, and seasonal fluctuations. Understanding the traits depicted in a nationwide fuel worth common chart requires analyzing a mess of things, from crude oil costs and refinery capability to geopolitical instability and client demand. This text will delve into the historic context of fuel costs in the USA, analyzing key intervals of fluctuation and the elements driving them, in the end providing a perspective on potential future traits.

A Historic Overview (2000-Current):

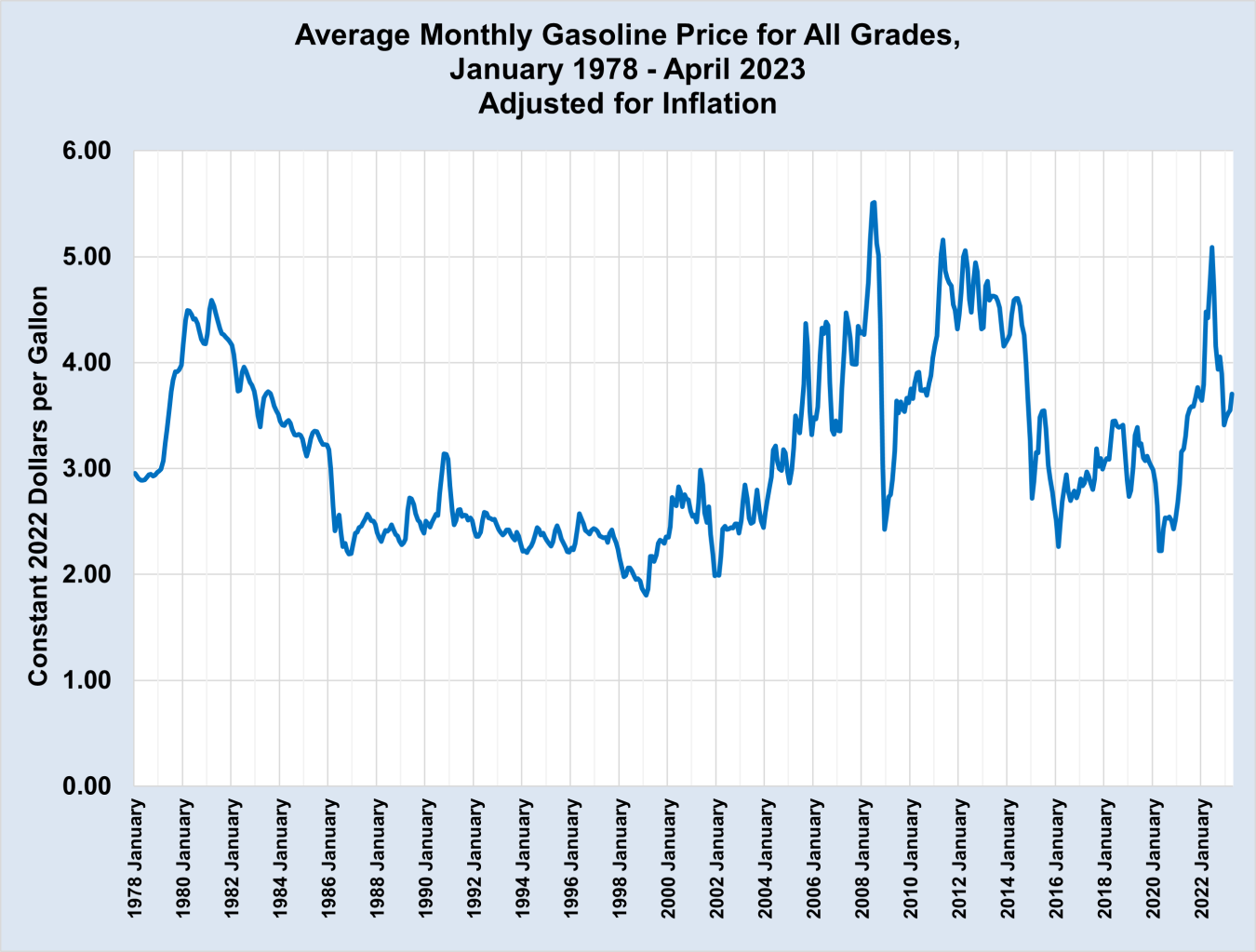

To successfully interpret a nationwide fuel worth common chart spanning the final twenty years, we should section it into distinct intervals characterised by particular driving forces. Whereas exact knowledge factors would require a selected chart, we are able to talk about the final traits and their underlying causes.

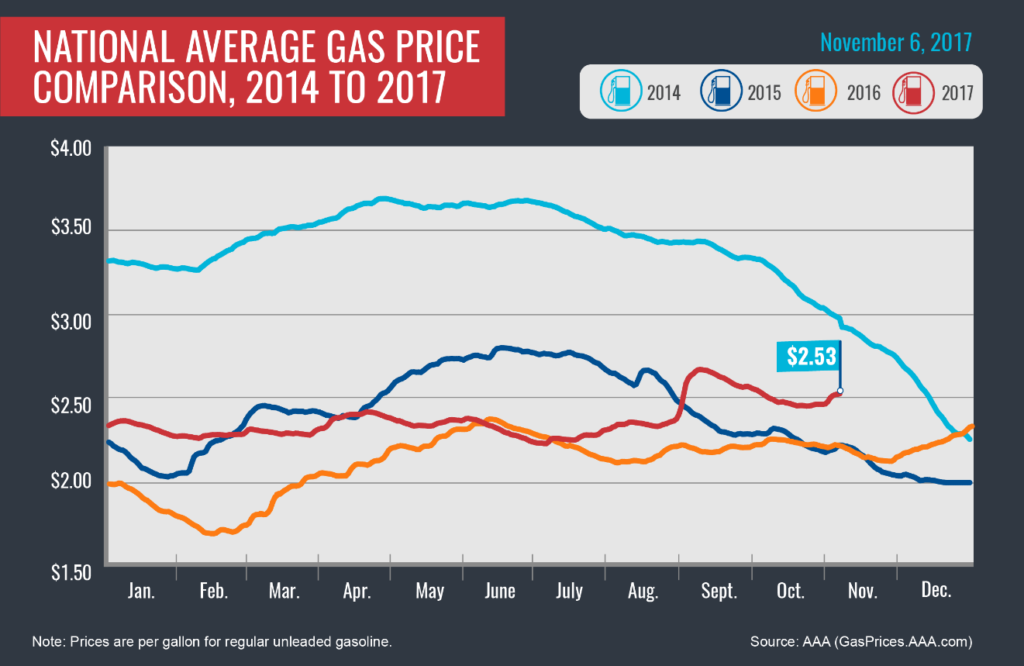

The 2000s: A Interval of Relative Stability and Gradual Enhance:

The early 2000s noticed a comparatively gradual improve in fuel costs, punctuated by occasional spikes associated to particular occasions. For instance, the Iraq Conflict in 2003 considerably impacted oil costs, resulting in a corresponding rise in gasoline prices. Nevertheless, total, the last decade was marked by a sluggish, regular climb, largely pushed by rising world demand for oil, notably from quickly creating economies like China and India. This era additionally noticed comparatively steady home manufacturing, with the impression of fluctuating oil costs being the dominant issue influencing fuel costs.

The 2010s: Volatility and the Shale Revolution:

The 2010s witnessed a interval of considerably larger volatility. The Nice Recession of 2008 initially brought on a pointy decline in fuel costs as a consequence of diminished demand. Nevertheless, this was adopted by a interval of fluctuating costs, influenced by a number of key elements:

- The Arab Spring: Political instability within the Center East, a significant oil-producing area, created uncertainty and contributed to cost spikes.

- The Rise of Shale Oil: The event of hydraulic fracturing ("fracking") and horizontal drilling applied sciences spurred a home shale oil increase in the USA, considerably rising home oil manufacturing. This finally led to a lower in reliance on overseas oil and, consequently, a interval of decrease fuel costs.

- OPEC’s Affect: The Group of the Petroleum Exporting Nations (OPEC) continued to exert vital affect on world oil costs by way of its manufacturing quotas and agreements. Durations of diminished OPEC manufacturing typically resulted in greater fuel costs.

This decade showcases the advanced interaction between world occasions, technological developments, and geopolitical elements influencing the nationwide fuel worth common chart.

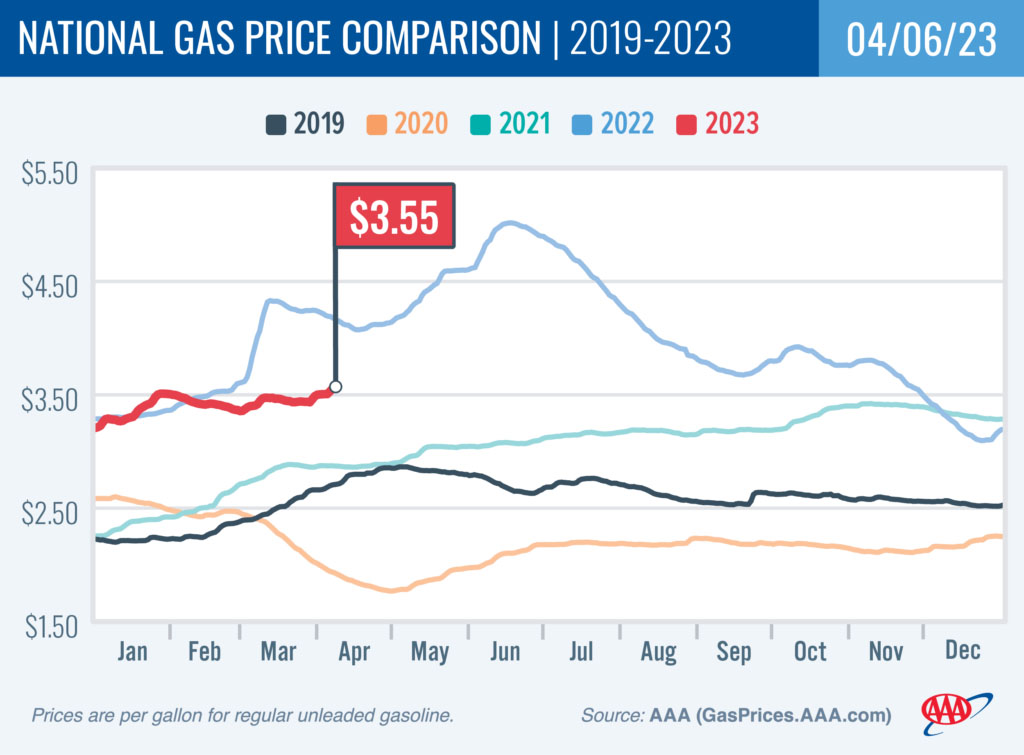

The 2020s: Pandemic, Geopolitics, and Power Transition:

The 2020s have introduced a singular set of challenges. The COVID-19 pandemic initially brought on a dramatic drop in fuel costs as a consequence of diminished journey and financial exercise. Nevertheless, the next world financial restoration, coupled with geopolitical occasions, led to a major surge in costs.

- The Russian Invasion of Ukraine: The 2022 invasion drastically disrupted world power markets, as Russia is a significant oil and pure fuel exporter. Sanctions imposed on Russia led to provide chain disruptions and a dramatic improve in world power costs, translating instantly into greater fuel costs in the USA.

- Inflationary Pressures: Broader inflationary pressures throughout the worldwide economic system contributed to rising power prices.

- Power Transition Issues: Rising considerations about local weather change and the transition to renewable power sources are additionally impacting the power market. Whereas the long-term impression continues to be unfolding, investments in renewable power infrastructure and insurance policies geared toward lowering carbon emissions can affect power costs within the brief time period.

This era highlights the rising interconnectedness of worldwide occasions and their speedy impression on power costs. The nationwide fuel worth common chart for this decade displays a unstable market formed by each surprising occasions and long-term structural modifications.

Components Affecting the Nationwide Gasoline Worth Common:

Analyzing the nationwide fuel worth common chart requires understanding the assorted elements contributing to its fluctuations:

- Crude Oil Costs: The worth of crude oil is the only most vital issue influencing gasoline costs. Crude oil accounts for a considerable portion of the price of producing gasoline. International provide and demand dynamics, geopolitical occasions, and OPEC insurance policies all instantly impression crude oil costs.

- Refinery Capability and Operation: The capability and effectivity of refineries play an important function. Refining crude oil into gasoline is a posh course of, and disruptions at refineries, whether or not as a consequence of upkeep, unexpected occasions, or capability limitations, can have an effect on gasoline provide and costs.

- Seasonal Demand: Gasoline demand usually will increase throughout the summer time driving season, resulting in greater costs. Conversely, demand tends to be decrease within the winter months.

- Taxes and Rules: Federal, state, and native taxes contribute considerably to the ultimate worth customers pay on the pump. Environmental laws and insurance policies additionally impression the price of producing and distributing gasoline.

- Distribution and Transportation Prices: The price of transporting gasoline from refineries to fuel stations influences the ultimate worth. Gasoline transportation prices can range relying on elements like gas costs themselves, and infrastructure limitations.

- Hypothesis and Market Sentiment: Investor sentiment and hypothesis within the oil and fuel markets can even impression costs. Futures contracts and different monetary devices permit buyers to guess on future worth actions, which might affect present costs.

- Geopolitical Instability: Political instability in main oil-producing areas can disrupt provide chains and result in worth will increase. Wars, sanctions, and political unrest can all create uncertainty and volatility out there.

Predicting Future Tendencies:

Predicting future fuel costs is inherently difficult because of the multitude of interacting elements. Nevertheless, a number of elements counsel potential traits:

- Continued International Demand: International demand for oil is predicted to stay sturdy, notably in creating economies. This sustained demand will probably exert upward strain on costs.

- Power Transition: The transition to renewable power sources is predicted to proceed, probably lowering long-term demand for oil and gasoline. Nevertheless, this transition is gradual, and its impression on fuel costs will probably unfold over a number of a long time.

- Geopolitical Dangers: Geopolitical dangers stay a major issue, with potential for disruptions to grease provide from varied areas.

- Technological Developments: Continued developments in oil and fuel extraction applied sciences might affect provide and costs.

- Financial Progress: Sturdy financial development usually results in elevated power demand, whereas financial downturns can cut back demand and costs.

Conclusion:

The nationwide fuel worth common chart is a dynamic illustration of a posh and interconnected system. Understanding the historic traits and the assorted elements influencing fuel costs is essential for policymakers, companies, and customers alike. Whereas predicting the longer term with certainty is not possible, analyzing historic knowledge and contemplating the assorted elements outlined above offers a framework for understanding potential future traits. The interaction between world occasions, home insurance policies, and technological developments will proceed to form the nationwide fuel worth common chart for years to come back, demanding steady monitoring and evaluation. The chart serves not solely as a mirrored image of financial circumstances but additionally as a barometer of worldwide stability and the continued power transition.

![Historical Gas Prices By Year: What Affects Them [1978-2022] (2023)](https://axlewise.com/wp-content/uploads/2022/02/20-year-gas-prices.jpeg)

Closure

Thus, we hope this text has offered helpful insights into Decoding the Nationwide Gasoline Worth Common Chart: A 20-Yr Retrospective and Future Outlook. We hope you discover this text informative and useful. See you in our subsequent article!