Decoding the Nifty Midcap 150 Index Chart: A Deep Dive into India’s Development Story

Associated Articles: Decoding the Nifty Midcap 150 Index Chart: A Deep Dive into India’s Development Story

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Decoding the Nifty Midcap 150 Index Chart: A Deep Dive into India’s Development Story. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Nifty Midcap 150 Index Chart: A Deep Dive into India’s Development Story

The Nifty Midcap 150 index serves as a vital barometer of India’s burgeoning mid-cap market, a phase brimming with progress potential and inherent volatility. Understanding its chart, due to this fact, is paramount for buyers searching for publicity to this dynamic sector. This text gives a complete evaluation of the Nifty Midcap 150 index chart, exploring its historic efficiency, key tendencies, technical indicators, and implications for funding methods.

Understanding the Nifty Midcap 150 Index:

Earlier than delving into chart evaluation, it is essential to grasp what the Nifty Midcap 150 represents. It is a free-float market capitalization-weighted index comprising 150 mid-cap corporations listed on the Nationwide Inventory Trade of India (NSE). These corporations are sometimes bigger than small-cap corporations however smaller than large-cap corporations included within the Nifty 50. The index presents diversified publicity to numerous sectors, offering buyers with a broader illustration of the Indian economic system’s progress story past the established large-cap corporations. Its composition is reviewed periodically to make sure it displays the evolving market panorama.

Analyzing the Nifty Midcap 150 Chart: A Multi-faceted Method:

Analyzing the Nifty Midcap 150 chart requires a holistic method, incorporating varied technical indicators and elementary concerns. A easy worth chart alone does not inform the entire story; it must be complemented by:

-

Value Motion Evaluation: This entails observing the worth actions over totally different timeframes (day by day, weekly, month-to-month). Figuring out assist and resistance ranges, trendlines, and chart patterns (head and shoulders, double tops/bottoms, flags, pennants, and many others.) is essential for understanding potential future worth actions. Breakouts above resistance ranges usually sign bullish sentiment, whereas breakdowns beneath assist ranges point out bearish stress.

-

Transferring Averages: Transferring averages, such because the 50-day, 100-day, and 200-day shifting averages, clean out worth fluctuations and assist determine tendencies. A bullish pattern is usually characterised by the worth buying and selling above these shifting averages, whereas a bearish pattern exhibits the worth buying and selling beneath them. Crossovers between shifting averages (e.g., a 50-day MA crossing above a 100-day MA) can sign potential pattern reversals.

-

Relative Energy Index (RSI): The RSI is a momentum indicator that measures the magnitude of latest worth modifications to judge overbought or oversold situations. An RSI above 70 typically suggests an overbought market, indicating potential for a worth correction, whereas an RSI beneath 30 suggests an oversold market, hinting at a possible rebound.

-

MACD (Transferring Common Convergence Divergence): The MACD is a trend-following momentum indicator that exhibits the connection between two shifting averages. MACD crossovers (when the MACD line crosses the sign line) can sign potential purchase or promote alternatives. Divergence between the MACD and the worth motion may present beneficial insights into potential pattern reversals.

-

Quantity Evaluation: Analyzing buying and selling quantity alongside worth actions gives extra context. Excessive quantity throughout worth will increase confirms the power of the uptrend, whereas excessive quantity throughout worth decreases signifies a powerful downtrend. Low quantity throughout worth actions suggests weak conviction and potential for a pattern reversal.

Historic Efficiency and Key Traits:

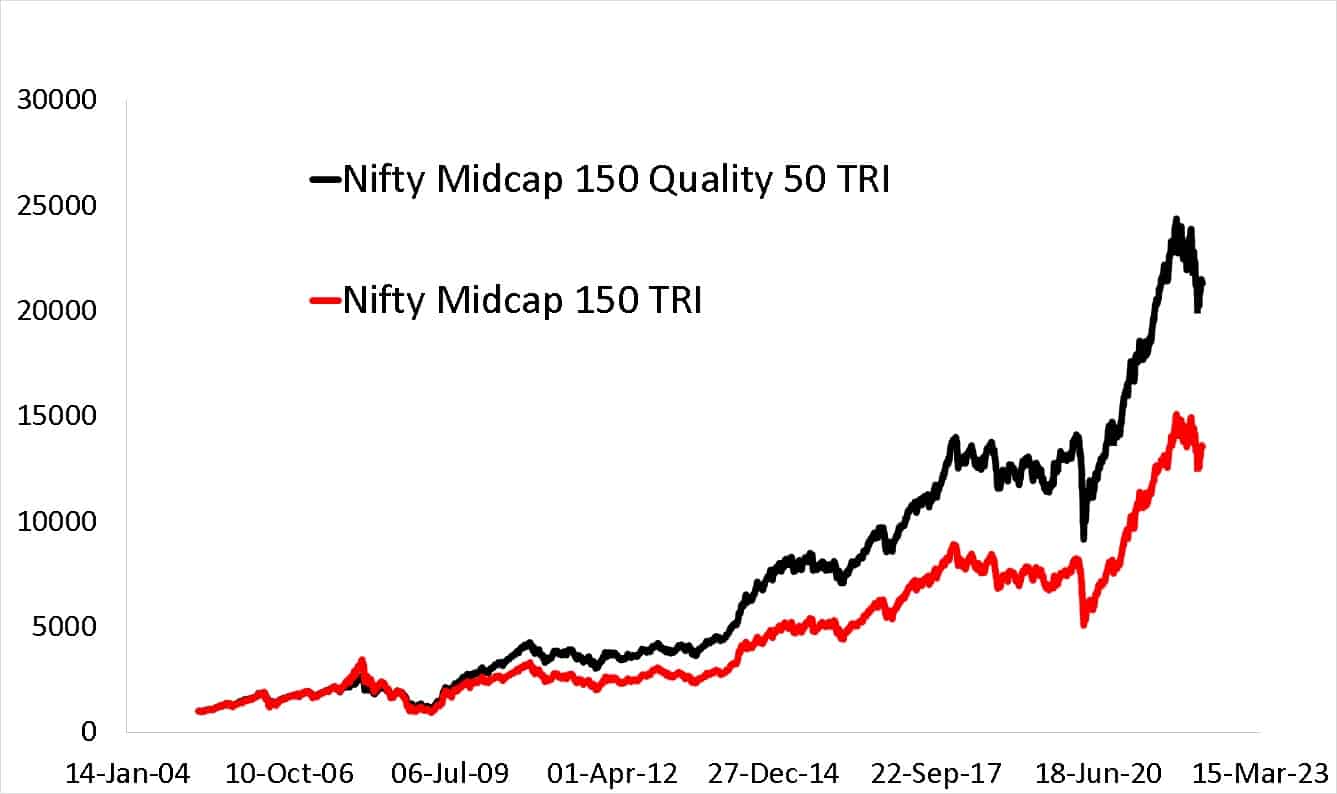

The Nifty Midcap 150 index has exhibited durations of great progress and volatility. Traditionally, it has outperformed the Nifty 50 index in the long run, reflecting the upper progress potential of mid-cap corporations. Nonetheless, it is also skilled sharper corrections throughout market downturns because of its greater threat profile. Analyzing historic information reveals key tendencies:

-

Cyclical Nature: The index usually follows cyclical patterns, influenced by macroeconomic components, sector-specific tendencies, and world market situations. Durations of sturdy financial progress often correlate with greater index efficiency, whereas financial slowdowns or world crises usually result in corrections.

-

Sectoral Influences: Efficiency is influenced by the efficiency of varied sectors represented within the index. Sturdy efficiency in particular sectors (e.g., know-how, prescribed drugs, client items) can drive general index progress, whereas underperformance in sure sectors can negatively affect the index.

-

Authorities Insurance policies: Authorities insurance policies and laws can considerably affect the mid-cap area. Initiatives selling entrepreneurship, infrastructure improvement, and ease of doing enterprise can increase the expansion of mid-cap corporations and positively affect the index.

Funding Implications and Methods:

Understanding the Nifty Midcap 150 chart is essential for formulating efficient funding methods. Buyers ought to take into account:

-

Threat Tolerance: Investing in mid-cap shares entails greater threat in comparison with large-cap shares. Buyers ought to fastidiously assess their threat tolerance earlier than allocating funds to this phase.

-

Lengthy-term Perspective: Mid-cap shares are typically extra risky within the brief time period however can supply vital returns in the long run. An extended-term funding horizon is essential for mitigating short-term fluctuations.

-

Diversification: Diversification inside the mid-cap area and throughout asset courses is crucial to scale back portfolio threat. Investing in a diversified portfolio of mid-cap shares throughout varied sectors will help mitigate the affect of underperformance in particular sectors.

-

Basic Evaluation: Whereas technical evaluation is useful, it is essential to enhance it with elementary evaluation. Understanding the monetary well being, progress prospects, and administration high quality of particular person corporations is crucial for making knowledgeable funding selections.

-

Energetic vs. Passive Administration: Buyers can select between actively managed funds or passively managed index funds that observe the Nifty Midcap 150. Energetic administration presents the potential for outperformance however comes with greater charges, whereas passive administration gives broad market publicity at decrease prices.

Conclusion:

The Nifty Midcap 150 index chart presents a captivating glimpse into the dynamism of India’s mid-cap market. By combining technical and elementary evaluation, buyers can acquire beneficial insights into potential funding alternatives and handle dangers successfully. Nonetheless, it is essential to do not forget that previous efficiency just isn’t indicative of future outcomes, and investing in mid-cap shares inherently entails the next diploma of threat. Thorough analysis, a long-term funding horizon, and a well-defined threat administration technique are important for navigating the complexities of this dynamic market phase and reaping the potential rewards it presents. Often reviewing the chart and adapting funding methods primarily based on evolving market situations is vital to success on this thrilling however risky area. Bear in mind to at all times seek the advice of with a certified monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Nifty Midcap 150 Index Chart: A Deep Dive into India’s Development Story. We recognize your consideration to our article. See you in our subsequent article!