Decoding the Nifty Tick Chart: A Deep Dive into Market Microstructure

Associated Articles: Decoding the Nifty Tick Chart: A Deep Dive into Market Microstructure

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Nifty Tick Chart: A Deep Dive into Market Microstructure. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

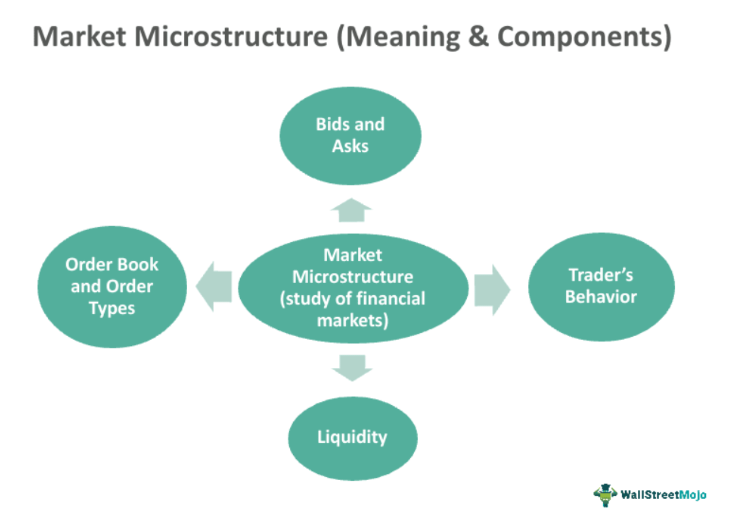

Decoding the Nifty Tick Chart: A Deep Dive into Market Microstructure

The Nifty 50 index, a benchmark for Indian equities, gives a wealth of knowledge for merchants and analysts. Whereas candlestick charts and bar charts present a macro view of value motion, the Nifty tick chart gives a granular perspective, revealing the underlying market microstructure and offering insights typically missed by higher-level visualizations. This text will delve into the intricacies of Nifty tick charts, exploring their building, interpretation, and sensible purposes in buying and selling and evaluation.

Understanding Tick Information:

A tick is the smallest increment of value motion in a monetary instrument. For the Nifty 50, a tick usually represents a change of 0.05 factors (although this could differ barely relying on the trade and particular instrument). A tick chart plots the value of the Nifty 50 in opposition to the variety of ticks, fairly than time. Every knowledge level represents a brand new tick – a change in value, whatever the time elapsed between value modifications. This basically differentiates it from time-series charts like candlestick or bar charts.

Building of a Nifty Tick Chart:

A Nifty tick chart is constructed by plotting the value of the Nifty 50 index on the vertical axis and the cumulative variety of ticks on the horizontal axis. Every new tick ends in a brand new knowledge level on the chart. Subsequently, the horizontal axis would not characterize time, however fairly the amount of value modifications. Which means that durations of excessive volatility might be represented by a quickly rising horizontal axis, whereas durations of low volatility will present a slower development.

Key Options and Interpretations:

A number of key options of a Nifty tick chart present beneficial insights into market dynamics:

-

Slope: The slope of the road on a tick chart signifies the route and power of the value motion. A steep upward slope signifies sturdy shopping for stress, whereas a steep downward slope signifies sturdy promoting stress. A flat line suggests a interval of consolidation or indecision.

-

Acceleration and Deceleration: Modifications within the slope reveal acceleration or deceleration of the value motion. A progressively steeper upward slope signifies accelerating shopping for stress, probably signaling a powerful development. Conversely, a flattening upward slope might counsel weakening shopping for stress, probably foreshadowing a development reversal.

-

Quantity of Ticks: The full variety of ticks over a given interval displays the general market exercise. A excessive variety of ticks suggests elevated buying and selling quantity and probably larger volatility. A low variety of ticks signifies low buying and selling quantity and probably decrease volatility. This can be a key differentiator from conventional quantity indicators that depend on the variety of shares traded.

-

Help and Resistance Ranges: Just like different chart varieties, tick charts can establish assist and resistance ranges. These are value ranges the place the value has constantly struggled to interrupt by, both to the upside or draw back. These ranges can be utilized to anticipate potential value reversals or breakouts.

-

Pattern Identification: Tick charts are notably efficient in figuring out developments. Constant upward slopes point out an uptrend, whereas constant downward slopes point out a downtrend. The steepness of the slope displays the power of the development.

-

Figuring out Market Regime Shifts: Sudden modifications within the slope or quantity of ticks can typically sign vital shifts in market regime. As an illustration, a pointy transition from a sluggish upward development to a fast downward development may point out a sudden change in market sentiment.

Benefits of Utilizing Nifty Tick Charts:

-

Concentrate on Worth Motion: Tick charts prioritize value motion, filtering out the noise launched by time-based intervals. This permits merchants to deal with the pure dynamics of provide and demand.

-

Excessive Decision Evaluation: The granular nature of tick knowledge supplies a high-resolution view of market microstructure, revealing refined modifications in momentum and sentiment that may be missed on higher-level charts.

-

Early Pattern Detection: Tick charts can typically detect developments sooner than time-based charts, as they reply immediately to cost modifications.

-

Goal Evaluation: Tick charts are much less vulnerable to subjective interpretation than different chart varieties, as they depend on goal value knowledge.

-

Identification of Hidden Divergences: Tick charts can reveal hidden divergences between value and momentum, offering early warning indicators of potential development reversals.

Disadvantages of Utilizing Nifty Tick Charts:

-

Information Depth: Tick charts require a considerable amount of knowledge, which will be difficult to handle and course of effectively.

-

Complexity: Decoding tick charts will be extra advanced than decoding conventional time-series charts, requiring a deeper understanding of market microstructure.

-

Noise: Whereas tick charts filter out time-based noise, they will nonetheless be vulnerable to noise generated by high-frequency buying and selling (HFT) algorithms. Cautious filtering and interpretation are essential to keep away from deceptive indicators.

-

Lack of Time Context: The absence of a time axis could make it difficult to narrate value actions to particular occasions or information.

Sensible Functions in Buying and selling and Evaluation:

Nifty tick charts can be utilized in numerous buying and selling methods and analytical approaches:

-

Scalping: Tick charts are notably well-suited for scalping methods, which purpose to revenue from small value actions over quick durations. The excessive decision of tick knowledge permits scalpers to establish and capitalize on fleeting alternatives.

-

Day Buying and selling: Tick charts will also be used for day buying and selling methods, offering an in depth view of intraday value motion.

-

Swing Buying and selling: Whereas much less generally used for swing buying and selling (longer-term methods), tick charts may help establish key reversal factors and potential breakout ranges.

-

Algorithmic Buying and selling: Tick knowledge is important for algorithmic buying and selling techniques, offering the uncooked enter for stylish buying and selling algorithms.

-

Market Regime Evaluation: Tick charts may help establish shifts in market regimes, permitting merchants to regulate their methods accordingly.

Combining Tick Charts with Different Indicators:

Whereas tick charts present beneficial insights on their very own, combining them with different technical indicators can improve their effectiveness. As an illustration, combining a tick chart with quantity indicators (like On-Steadiness Quantity or Chaikin Cash Movement) can present a extra complete image of market dynamics. Equally, utilizing transferring averages or different momentum indicators may help verify development route and establish potential reversal factors.

Conclusion:

Nifty tick charts supply a singular and highly effective perspective on market microstructure, offering insights typically missed by conventional chart varieties. Whereas their interpretation requires a deeper understanding of market dynamics, the granular nature of tick knowledge permits for high-resolution evaluation and early development detection. By rigorously learning the slope, acceleration, and quantity of ticks, merchants and analysts can achieve a big edge in navigating the complexities of the Nifty 50 index. Nonetheless, it’s essential to do not forget that tick charts must be used at the side of different analytical instruments and threat administration methods for a holistic method to buying and selling and funding. The usage of tick charts is just not a standalone answer however a robust addition to a complete buying and selling arsenal. Understanding their strengths and limitations is vital to successfully leveraging the data they supply.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Nifty Tick Chart: A Deep Dive into Market Microstructure. We hope you discover this text informative and helpful. See you in our subsequent article!