Decoding the Numbers: A Complete Information to Credit score Score Which means and Charts

Associated Articles: Decoding the Numbers: A Complete Information to Credit score Score Which means and Charts

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the Numbers: A Complete Information to Credit score Score Which means and Charts. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Numbers: A Complete Information to Credit score Score Which means and Charts

Understanding your credit standing is essential for navigating the monetary world. It is the invisible rating that influences all the things from mortgage approvals and rates of interest to insurance coverage premiums and even job alternatives. This text delves deep into the which means of credit score scores, exploring the completely different scoring programs, how they’re calculated, what the completely different ranges signify, and how one can interpret the knowledge introduced in credit standing charts.

What’s a Credit score Score?

A credit standing is a numerical illustration of your creditworthiness, reflecting your skill and willingness to repay borrowed cash. Lenders use these scores to evaluate the danger related to lending you funds. The next credit score rating signifies decrease danger, making you a extra engaging borrower and doubtlessly qualifying you for higher mortgage phrases. Conversely, a decrease rating suggests increased danger, doubtlessly resulting in increased rates of interest, mortgage denials, or much less favorable monetary presents.

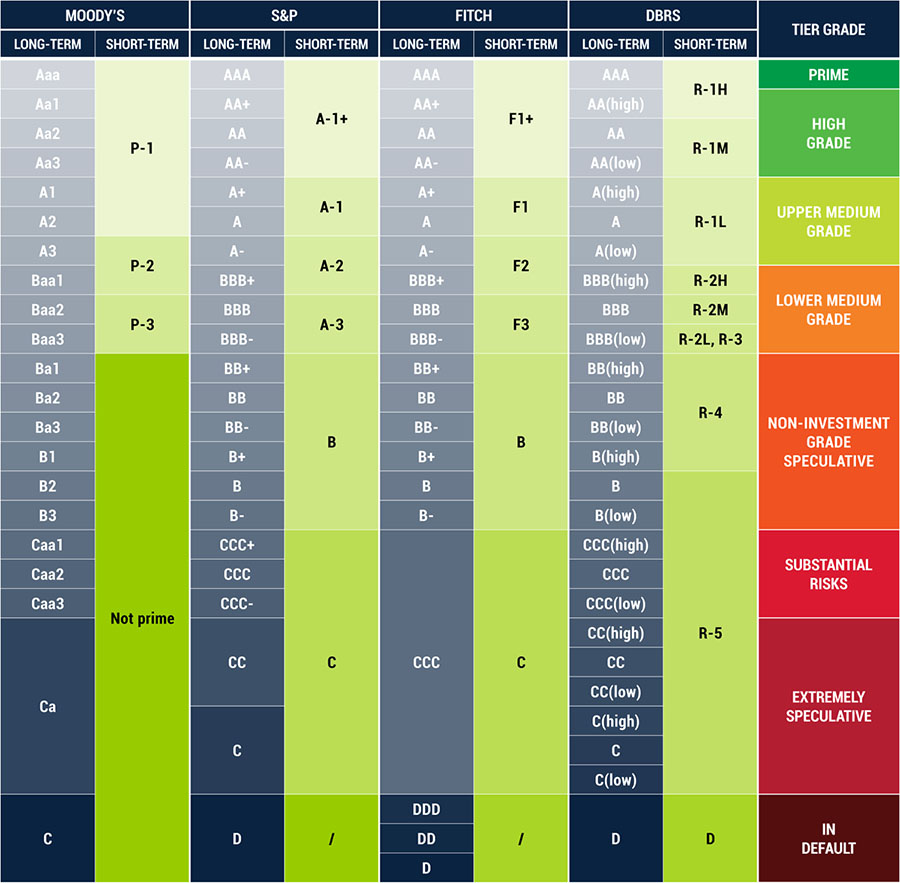

Main Credit score Score Businesses and Scoring Methods:

A number of credit score bureaus function in most international locations, every using its personal scoring mannequin. Probably the most outstanding in the USA are:

- Equifax: Makes use of a scoring mannequin starting from 280 to 850.

- Experian: Additionally makes use of a scoring mannequin starting from 280 to 850.

- TransUnion: Equally, employs a scoring mannequin starting from 280 to 850.

Whereas the scoring ranges are related, the precise algorithms utilized by every company differ barely, resulting in potential variations in your rating throughout these bureaus. This is the reason it is important to observe your credit score experiences from all three companies.

Different international locations have their very own credit score bureaus and scoring programs, usually tailor-made to their particular monetary landscapes. For instance, Canada makes use of a unique scoring system than the US, and the identical applies to international locations in Europe and Asia. It is essential to know the precise scoring system related to your location.

Credit score Score Chart Interpretation:

Understanding a credit standing chart requires familiarity with the rating ranges and their related meanings. Whereas the precise cutoffs may range barely relying on the lender and the precise scoring mannequin, a basic interpretation is as follows:

| Credit score Rating Vary | Credit score Score Class | Interpretation | Mortgage Approval Probability | Curiosity Charges |

|---|---|---|---|---|

| 800-850 | Glorious | Distinctive credit score historical past, minimal danger to lenders. | Very Excessive | Very Low |

| 740-799 | Very Good | Sturdy credit score historical past, low danger to lenders. | Very Excessive | Low |

| 670-739 | Good | Good credit score historical past, reasonable danger to lenders. | Excessive | Reasonable |

| 580-669 | Truthful | Some credit score historical past points, increased danger to lenders. | Reasonable | Excessive |

| Under 580 | Poor | Important credit score issues, excessive danger to lenders. | Low | Very Excessive, doubtlessly denied |

Elements Influencing Credit score Scores:

A number of key elements contribute to your credit score rating. Understanding these parts is essential for enhancing your credit standing:

-

Cost Historical past (35%): That is probably the most vital issue. Constant on-time funds exhibit your reliability as a borrower. Late or missed funds severely affect your rating.

-

Quantities Owed (30%): This refers to your credit score utilization ratio – the quantity of credit score you are utilizing in comparison with your complete obtainable credit score. Protecting your credit score utilization low (ideally beneath 30%) is essential for a superb rating. Excessive utilization suggests you are closely reliant on credit score.

-

Size of Credit score Historical past (15%): An extended credit score historical past, demonstrating constant accountable borrowing over time, typically leads to a greater rating. Opening and shutting accounts regularly can negatively affect this issue.

-

New Credit score (10%): Making use of for a number of credit score accounts inside a brief interval can sign elevated danger to lenders. It is advisable to restrict new credit score purposes.

-

Credit score Combine (10%): Having a mixture of completely different credit score accounts (e.g., bank cards, installment loans) can positively affect your rating, demonstrating your skill to handle numerous credit score merchandise responsibly. Nonetheless, this issue has the least affect in your total rating.

Deciphering Credit score Score Charts: Sensible Examples

Credit standing charts usually visualize the distribution of credit score scores inside a inhabitants or throughout particular demographics. As an example, a chart may present the proportion of people falling inside every credit score rating vary (e.g., wonderful, good, honest, poor). Analyzing such charts permits for comparisons and insights into credit score well being traits.

Instance 1: Nationwide Credit score Rating Distribution Chart

A chart depicting the nationwide distribution of credit score scores may reveal that a good portion of the inhabitants falls throughout the "good" credit score rating vary, whereas a smaller share has "wonderful" scores, and a regarding quantity have "poor" scores. This information may inform policymakers concerning the want for monetary literacy applications or spotlight areas for enchancment in shopper credit score practices.

Instance 2: Credit score Rating Distribution by Age Group

A chart evaluating credit score rating distributions throughout completely different age teams may illustrate that youthful people are inclined to have decrease common scores than older people, doubtlessly attributable to shorter credit score histories. This might point out a necessity for focused monetary schooling initiatives for youthful generations.

Instance 3: Credit score Rating Distribution by Revenue Degree

A chart evaluating credit score rating distributions throughout completely different revenue ranges may present a correlation between increased revenue and higher credit score scores, though this is not all the time a assured relationship. This information may spotlight potential disparities in entry to monetary sources and the necessity for equitable lending practices.

Enhancing Your Credit score Rating:

Enhancing your credit score rating is a gradual course of requiring constant effort. Listed here are some key methods:

-

Pay Payments on Time: That is the one most necessary step. Arrange computerized funds to keep away from late funds.

-

Maintain Credit score Utilization Low: Keep away from maxing out your bank cards. Intention to maintain your credit score utilization beneath 30%.

-

Preserve a Wholesome Credit score Combine: Take into account having a mixture of bank cards and installment loans, however keep away from opening too many new accounts directly.

-

Monitor Your Credit score Reviews Usually: Verify your credit score experiences from all three main bureaus for errors and inconsistencies. Dispute any inaccuracies promptly.

-

Keep away from Closing Previous Accounts: An extended credit score historical past is helpful. Maintain older accounts open, even for those who’re not actively utilizing them.

Conclusion:

Credit score scores are a important element of your monetary well-being. Understanding the which means of credit standing charts and the elements that affect your rating empowers you to make knowledgeable monetary choices, negotiate higher mortgage phrases, and construct a powerful monetary future. By actively monitoring your credit score experiences and using accountable credit score administration practices, you possibly can considerably enhance your creditworthiness and unlock a wider vary of monetary alternatives. Keep in mind to seek the advice of with a monetary advisor for personalised steerage on enhancing your credit score rating and managing your funds successfully.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Numbers: A Complete Information to Credit score Score Which means and Charts. We thanks for taking the time to learn this text. See you in our subsequent article!