Decoding the NVIDIA Inventory Reside Chart: A Deep Dive into the Semiconductor Big’s Efficiency

Associated Articles: Decoding the NVIDIA Inventory Reside Chart: A Deep Dive into the Semiconductor Big’s Efficiency

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the NVIDIA Inventory Reside Chart: A Deep Dive into the Semiconductor Big’s Efficiency. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the NVIDIA Inventory Reside Chart: A Deep Dive into the Semiconductor Big’s Efficiency

NVIDIA (NVDA), a reputation synonymous with high-performance graphics processing models (GPUs) and synthetic intelligence (AI), has develop into a Wall Avenue darling. Its inventory value has skilled dramatic swings, reflecting the risky nature of the expertise sector and the corporate’s pioneering function in rising applied sciences. Understanding the NVIDIA inventory reside chart requires extra than simply glancing on the fluctuating numbers; it necessitates a complete understanding of the components driving its efficiency. This text will delve into the intricacies of deciphering the NVDA reside chart, analyzing the important thing indicators, influencing components, and potential implications for buyers.

Navigating the NVIDIA Inventory Reside Chart: Key Metrics and Indicators

A typical NVIDIA inventory reside chart shows quite a lot of knowledge factors, every providing a distinct perspective on the inventory’s efficiency. These embody:

-

Worth: Probably the most fast info displayed is the present market value of NVDA. That is the worth at which consumers and sellers are presently agreeing to commerce the inventory. Fluctuations on this value are the core of the chart’s exercise.

-

Quantity: The amount signifies the variety of shares traded throughout a selected interval (e.g., minute, hour, day). Excessive quantity typically suggests robust investor curiosity, both bullish (shopping for) or bearish (promoting). Conversely, low quantity would possibly point out an absence of conviction available in the market.

-

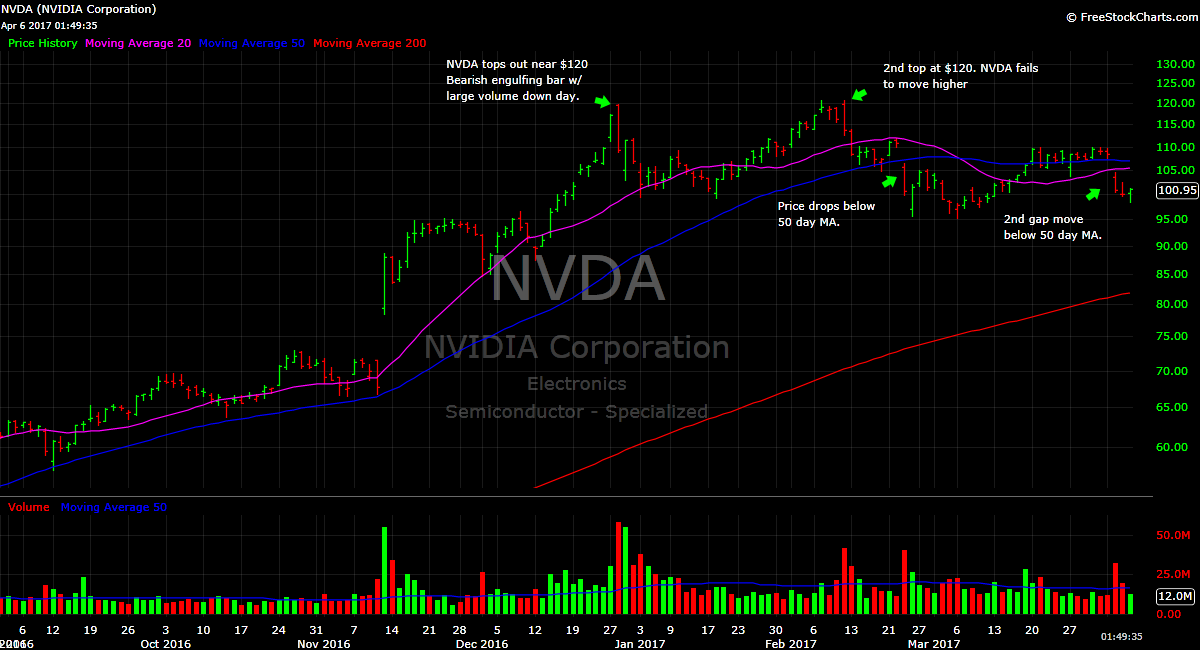

Transferring Averages: Transferring averages (e.g., 50-day, 200-day) clean out value fluctuations, offering a clearer image of the general pattern. Crossovers between completely different shifting averages (e.g., the 50-day shifting common crossing above the 200-day shifting common) are sometimes interpreted as bullish indicators, and vice-versa.

-

Relative Energy Index (RSI): The RSI is a momentum indicator that measures the magnitude of latest value modifications to judge overbought or oversold situations. Readings above 70 are typically thought of overbought, suggesting a possible value correction, whereas readings under 30 recommend an oversold situation, probably signaling a value rebound.

-

Candlestick Charts: These charts present a visible illustration of value motion over a given interval, incorporating open, excessive, low, and shutting costs. The form and shade of the candlesticks can point out bullish or bearish sentiment.

-

Bollinger Bands: These bands plot normal deviations round a shifting common, indicating value volatility. Costs bouncing off the higher band would possibly recommend an overbought situation, whereas costs touching the decrease band would possibly point out an oversold situation.

Components Influencing the NVIDIA Inventory Reside Chart

The NVIDIA inventory reside chart is influenced by a posh interaction of things, each inner and exterior to the corporate. Understanding these components is essential for deciphering the chart’s actions:

-

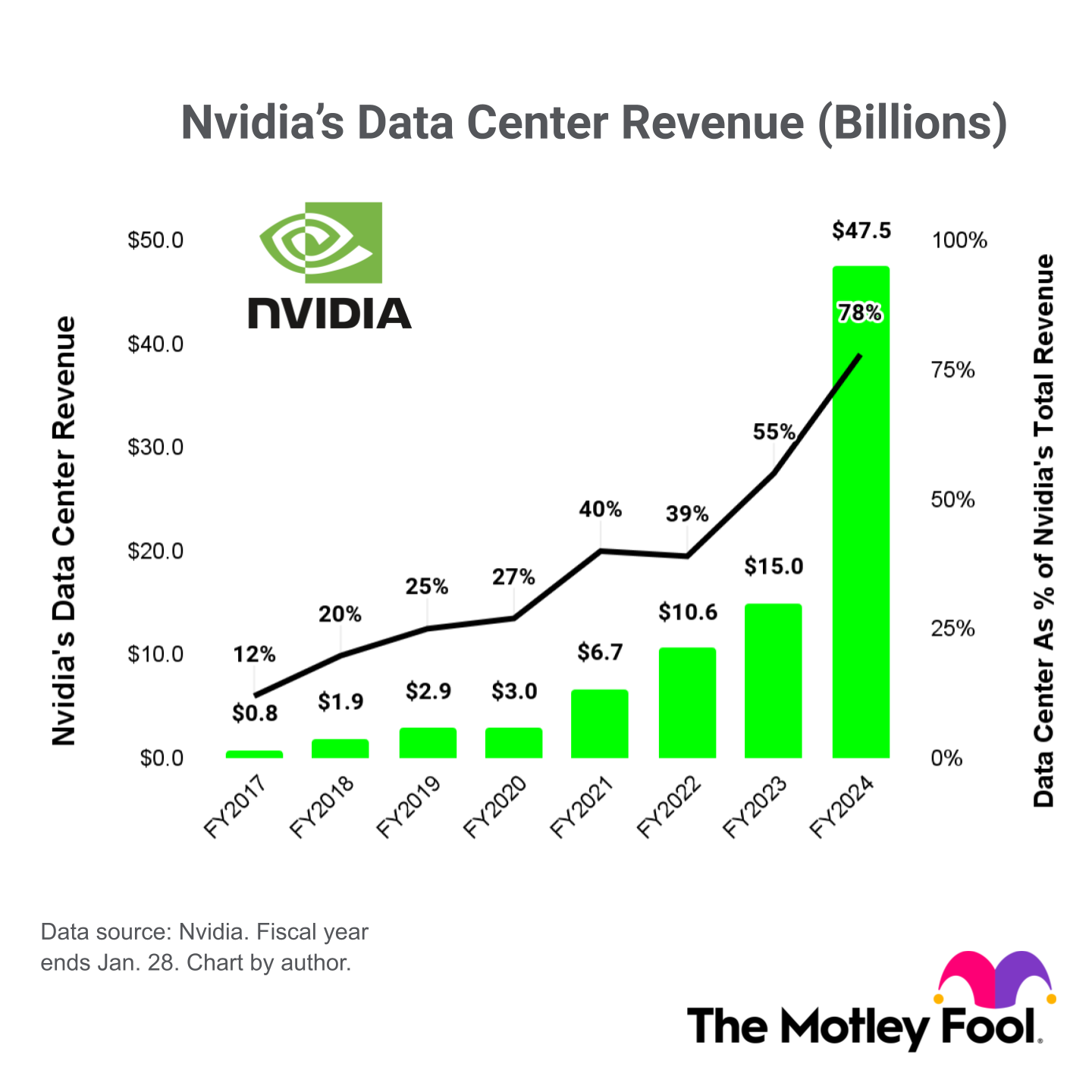

Monetary Efficiency: NVIDIA’s quarterly and annual earnings stories are pivotal. Robust income progress, significantly in key segments like knowledge facilities and gaming, sometimes results in constructive inventory value actions. Conversely, disappointing outcomes can set off vital sell-offs.

-

Technological Developments: As a expertise firm, NVIDIA’s innovation pipeline is paramount. Bulletins of recent GPUs, AI chips, or software program platforms can considerably influence investor sentiment and the inventory value. Profitable product launches and market adoption drive constructive momentum.

-

Trade Traits: The semiconductor business is cyclical and inclined to international financial situations. Components like provide chain disruptions, geopolitical instability, and macroeconomic tendencies (inflation, rates of interest) can affect demand for NVIDIA’s merchandise and consequently, its inventory value.

-

Competitors: NVIDIA faces competitors from AMD, Intel, and different gamers within the GPU and AI chip markets. Aggressive pressures, new product launches from rivals, and market share shifts can influence NVDA’s efficiency.

-

Regulatory Surroundings: Authorities laws, commerce insurance policies, and antitrust scrutiny can affect NVIDIA’s operations and profitability. Any vital regulatory modifications can create uncertainty and have an effect on the inventory value.

-

Investor Sentiment: Market sentiment, pushed by information, analyst scores, and total market tendencies, performs an important function. Optimistic information and robust analyst suggestions typically enhance the inventory value, whereas unfavourable information and downgrades can result in declines.

-

Cryptocurrency Market: Whereas much less dominant than in earlier years, the cryptocurrency market nonetheless impacts NVIDIA’s GPU gross sales. A surge in cryptocurrency mining exercise can enhance demand for NVIDIA’s GPUs, whereas a downturn can negatively influence gross sales.

Decoding the NVIDIA Inventory Reside Chart: A Cautious Method

Whereas the NVIDIA inventory reside chart supplies useful insights, it is important to method its interpretation with warning. No single indicator or issue completely predicts future value actions. As an alternative, a holistic method is critical, contemplating a spread of indicators and components.

For instance, a sudden spike in value is perhaps attributed to constructive information, however it may be on account of short-term speculative buying and selling. Equally, a decline in value would possibly replicate real issues concerning the firm’s prospects or just a brief market correction.

Moreover, previous efficiency will not be indicative of future outcomes. Whereas analyzing historic value knowledge might be informative, it is essential to keep in mind that market situations and the corporate’s circumstances can change dramatically over time.

Methods for Using the NVIDIA Inventory Reside Chart Successfully

To leverage the NVIDIA inventory reside chart successfully, buyers can make use of a number of methods:

-

Technical Evaluation: Using technical indicators like shifting averages, RSI, and Bollinger Bands may also help determine potential assist and resistance ranges, in addition to potential pattern reversals.

-

Basic Evaluation: Thorough analysis into NVIDIA’s monetary statements, aggressive panorama, and technological developments supplies a deeper understanding of the corporate’s intrinsic worth.

-

Diversification: Investing in a diversified portfolio mitigates threat. Relying solely on NVIDIA inventory can expose buyers to vital volatility.

-

Lengthy-Time period Perspective: The expertise sector is liable to short-term fluctuations. A protracted-term funding method permits buyers to trip out momentary market corrections and profit from the corporate’s long-term progress potential.

-

Threat Administration: Implementing stop-loss orders can restrict potential losses if the inventory value strikes in opposition to the investor’s place.

Conclusion:

The NVIDIA inventory reside chart is a dynamic software that displays the corporate’s efficiency and the broader market atmosphere. By understanding the important thing metrics, influencing components, and using sound funding methods, buyers can acquire useful insights into NVDA’s potential and make knowledgeable choices. Nevertheless, it is essential to keep in mind that the inventory market is inherently unpredictable, and even essentially the most thorough evaluation can’t assure success. A balanced method, combining technical and basic evaluation with a long-term perspective and efficient threat administration, is important for navigating the complexities of investing in NVIDIA and different expertise shares. Steady monitoring of the reside chart, coupled with a deep understanding of the corporate and the broader market context, stays very important for profitable funding on this dynamic sector.

Closure

Thus, we hope this text has supplied useful insights into Decoding the NVIDIA Inventory Reside Chart: A Deep Dive into the Semiconductor Big’s Efficiency. We hope you discover this text informative and useful. See you in our subsequent article!