Decoding the Oil Value Chart: A Journey By means of Volatility and Geopolitics

Associated Articles: Decoding the Oil Value Chart: A Journey By means of Volatility and Geopolitics

Introduction

With enthusiasm, let’s navigate by the intriguing matter associated to Decoding the Oil Value Chart: A Journey By means of Volatility and Geopolitics. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Oil Value Chart: A Journey By means of Volatility and Geopolitics

The value of oil, a seemingly easy commodity, is a posh tapestry woven from threads of worldwide provide and demand, geopolitical tensions, financial forecasts, and speculative buying and selling. Understanding the fluctuations depicted in an oil value chart requires greater than only a look; it calls for a deep dive into the multifaceted components that affect this significant world market. This text will discover the historic developments, key drivers, and implications of oil value actions, providing a complete evaluation of what the chart really reveals.

Historic Context: A Rollercoaster Trip

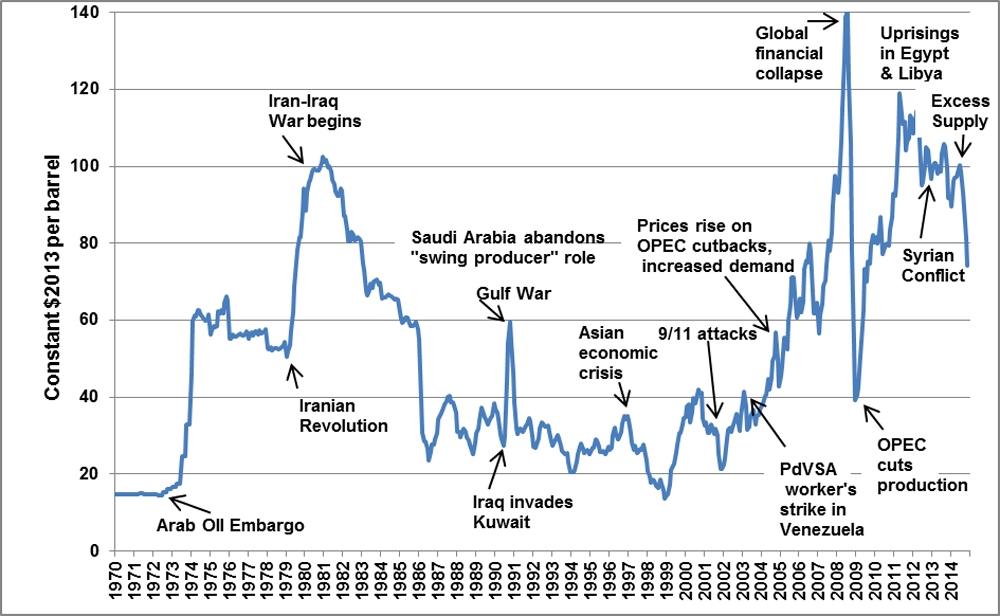

An extended-term view of the oil value chart reveals a narrative of dramatic swings. For many years, costs remained comparatively secure, punctuated by occasional spikes associated to particular occasions just like the Yom Kippur Warfare in 1973 or the Iranian Revolution in 1979. These occasions highlighted the inherent vulnerability of the worldwide oil provide to geopolitical instability. The value remained comparatively low within the Eighties and Nineties, with durations of oversupply main to cost wars.

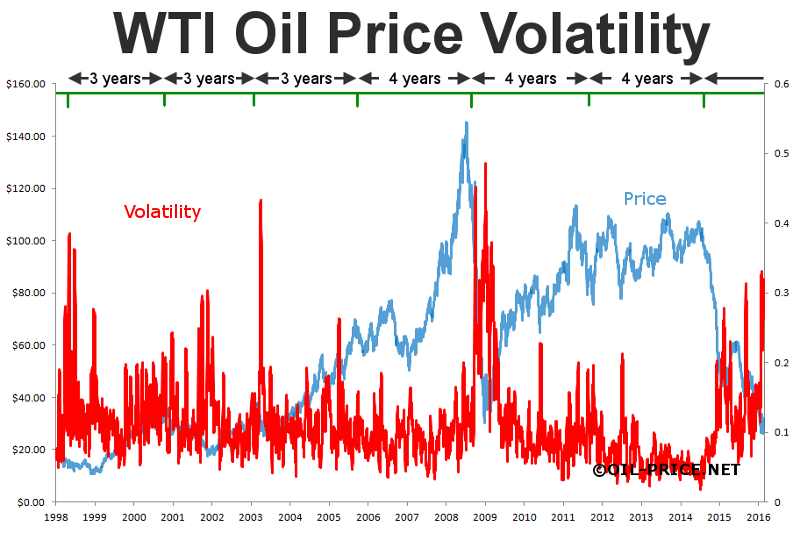

Nonetheless, the early twenty first century witnessed a major shift. Fast financial development, significantly in rising markets like China and India, fueled a surge in world vitality demand. This, coupled with manufacturing constraints and geopolitical uncertainties in key oil-producing areas, led to a sustained interval of value will increase culminating in document highs above $147 per barrel in 2008. The next world monetary disaster prompted a dramatic value collapse, underscoring the interconnectedness of oil markets with broader financial situations.

The next years noticed a interval of relative stability, adopted by one other important value downturn in 2014-2016, largely pushed by a provide glut ensuing from elevated US shale oil manufacturing. The chart throughout this era illustrates a protracted interval of low costs, impacting oil-producing nations and vitality firms considerably. The next restoration was gradual, punctuated by occasional spikes as a result of components like OPEC manufacturing cuts and geopolitical occasions.

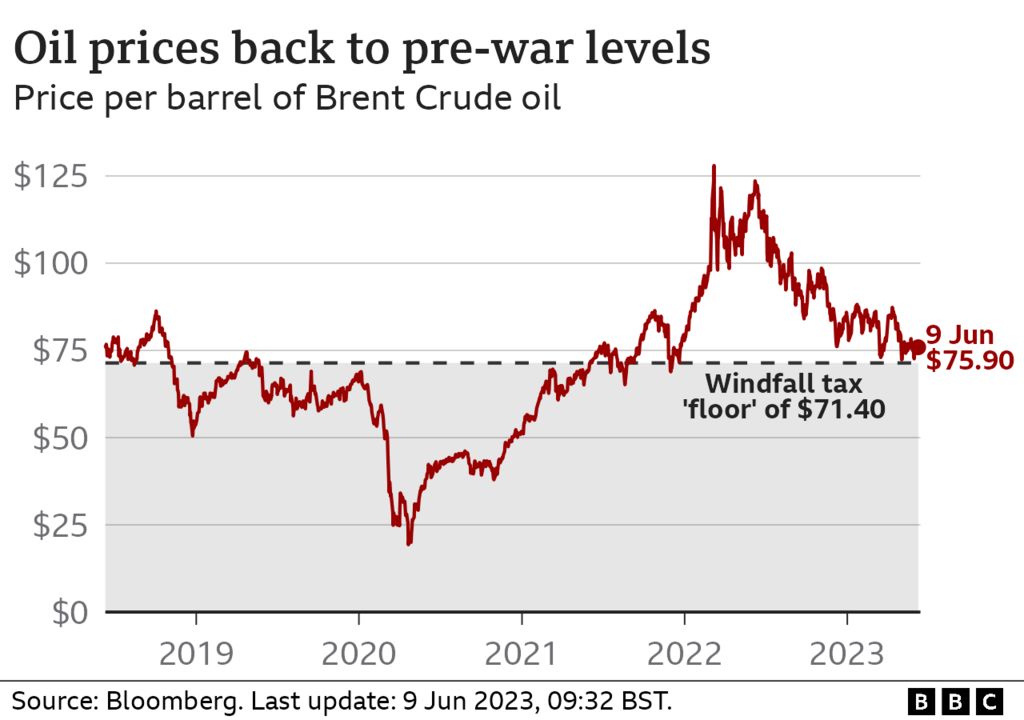

The COVID-19 pandemic in 2020 marked one other unprecedented occasion. Lockdowns and decreased financial exercise led to an unprecedented collapse in oil demand, leading to adverse oil costs for a short interval – a phenomenon by no means seen earlier than. This highlighted the intense sensitivity of oil costs to sudden and drastic modifications in world financial exercise. The next restoration, nevertheless, has been remarkably swift, pushed by a rebound in demand and provide constraints. The latest geopolitical instability stemming from the battle in Ukraine has additional exacerbated value volatility, pushing costs to ranges not seen because the 2008 disaster.

Key Drivers of Oil Value Fluctuations:

The oil value chart is a mirrored image of the interaction of quite a few components, making its interpretation difficult. A few of the most vital drivers embrace:

-

OPEC and Different Producers: The Group of the Petroleum Exporting Nations (OPEC) performs a vital function in influencing world oil provide. By means of manufacturing quotas and agreements, OPEC can considerably influence oil costs. The actions of different main oil-producing nations, resembling Russia and america, additionally play a vital function. The chart usually displays durations of cooperation and battle amongst these producers.

-

International Demand: International financial development is a main driver of oil demand. Sturdy financial development in main economies sometimes interprets into larger oil consumption and costs. Recessions or financial slowdowns, alternatively, result in decreased demand and decrease costs. The chart clearly displays the correlation between financial cycles and oil value actions.

-

Geopolitical Instability: Political instability in oil-producing areas can considerably disrupt provide and result in value spikes. Wars, sanctions, and political upheavals can all influence oil manufacturing and transportation, creating uncertainty and driving costs larger. The chart usually reveals sharp will increase following important geopolitical occasions.

-

US Greenback Alternate Fee: Oil is priced in US {dollars}. A stronger US greenback makes oil costlier for patrons utilizing different currencies, doubtlessly decreasing demand and placing downward strain on costs. Conversely, a weaker greenback can increase demand and costs. The connection between the greenback and oil costs is commonly seen within the chart.

-

Hypothesis and Buying and selling: The oil market is very vulnerable to speculative buying and selling. Buyers’ expectations about future value actions can considerably affect present costs. This speculative factor provides one other layer of complexity to decoding the chart, as short-term value fluctuations might be pushed by market sentiment moderately than basic components.

-

Technological Developments: Technological breakthroughs in oil extraction, resembling hydraulic fracturing ("fracking"), can considerably influence provide and costs. The shale oil revolution in america, for instance, initially led to a surge in manufacturing and decrease costs, as evident within the chart.

-

Stock Ranges: International oil inventories play a vital function in figuring out costs. Excessive stock ranges typically point out a surplus of oil, placing downward strain on costs. Low stock ranges, alternatively, can sign a possible provide scarcity and result in value will increase. The chart usually displays modifications in stock ranges, though this data is commonly circuitously seen.

Decoding the Chart: Past the Numbers

Analyzing an oil value chart requires extra than simply observing value actions. It includes understanding the context and the interaction of the components talked about above. For instance, a pointy value improve is perhaps attributed to a mix of geopolitical tensions and unexpectedly robust financial development. A gradual decline might replicate a mix of elevated manufacturing and weaker financial exercise.

Trying on the chart together with different financial indicators, resembling GDP development charges, inflation figures, and US greenback change charges, can present a extra complete understanding of value actions. Analyzing information occasions and geopolitical developments alongside the chart can assist establish the particular components driving value modifications.

Implications of Oil Value Actions:

Oil value fluctuations have far-reaching implications for the worldwide economic system. Excessive oil costs can improve inflation, impacting shopper spending and financial development. They will additionally profit oil-producing international locations however hurt oil-importing nations. Low oil costs can increase financial exercise however hurt oil firms and oil-producing economies.

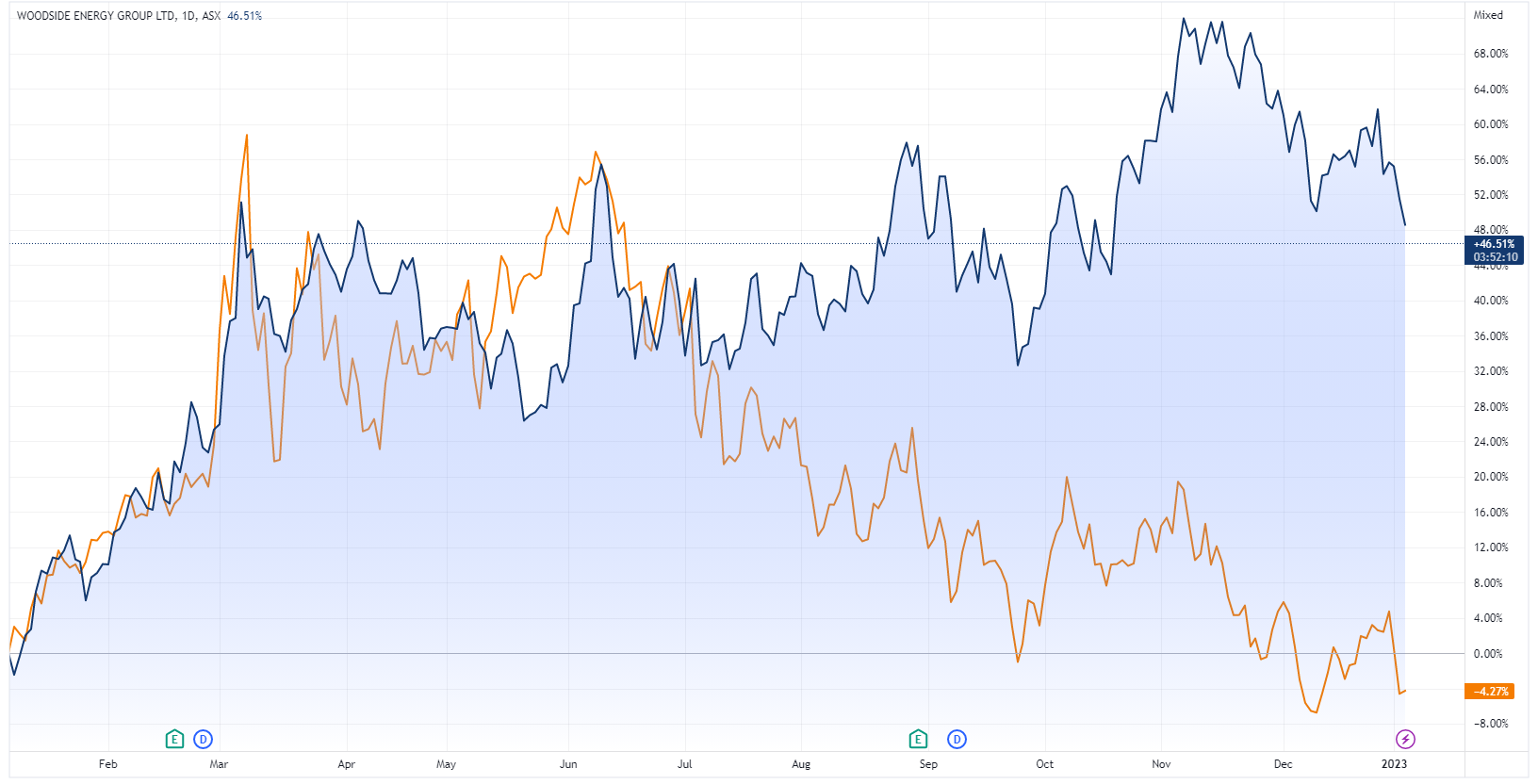

The influence on numerous sectors can also be important. Transportation, manufacturing, and agriculture are all closely reliant on oil, and value modifications can have an effect on their prices and profitability. The vitality sector itself is straight affected by oil value volatility, with profitability and funding selections closely influenced by value developments.

Conclusion:

The oil value chart is a dynamic illustration of a posh and interconnected world market. Understanding its fluctuations requires a complete understanding of the varied components at play, from geopolitical occasions to financial cycles and technological developments. By rigorously analyzing the chart together with different financial and political information, one can acquire a deeper appreciation for the forces that form this significant commodity market and its profound influence on the worldwide economic system. The way forward for oil costs stays unsure, however by understanding the historic context and the important thing drivers, we are able to higher navigate the volatility and anticipate potential future developments. The chart, due to this fact, serves not solely as a document of previous occasions but in addition as a worthwhile device for forecasting and understanding the long run path of this important world useful resource.

Closure

Thus, we hope this text has supplied worthwhile insights into Decoding the Oil Value Chart: A Journey By means of Volatility and Geopolitics. We hope you discover this text informative and useful. See you in our subsequent article!