Decoding the PCR Ratio: Financial institution Nifty’s Intraday Pulse and its Stay Chart Implications

Associated Articles: Decoding the PCR Ratio: Financial institution Nifty’s Intraday Pulse and its Stay Chart Implications

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the PCR Ratio: Financial institution Nifty’s Intraday Pulse and its Stay Chart Implications. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Decoding the PCR Ratio: Financial institution Nifty’s Intraday Pulse and its Stay Chart Implications

The Put-Name Ratio (PCR) is a extensively used indicator in choices buying and selling, providing insights into market sentiment and potential worth course. For Financial institution Nifty, a extremely unstable and liquid index, understanding the PCR and its implications on the stay chart is essential for each short-term and long-term buying and selling methods. This text delves deep into the Financial institution Nifty PCR ratio, exploring its calculation, interpretation, and sensible utility at the side of stay chart evaluation.

Understanding the PCR Ratio:

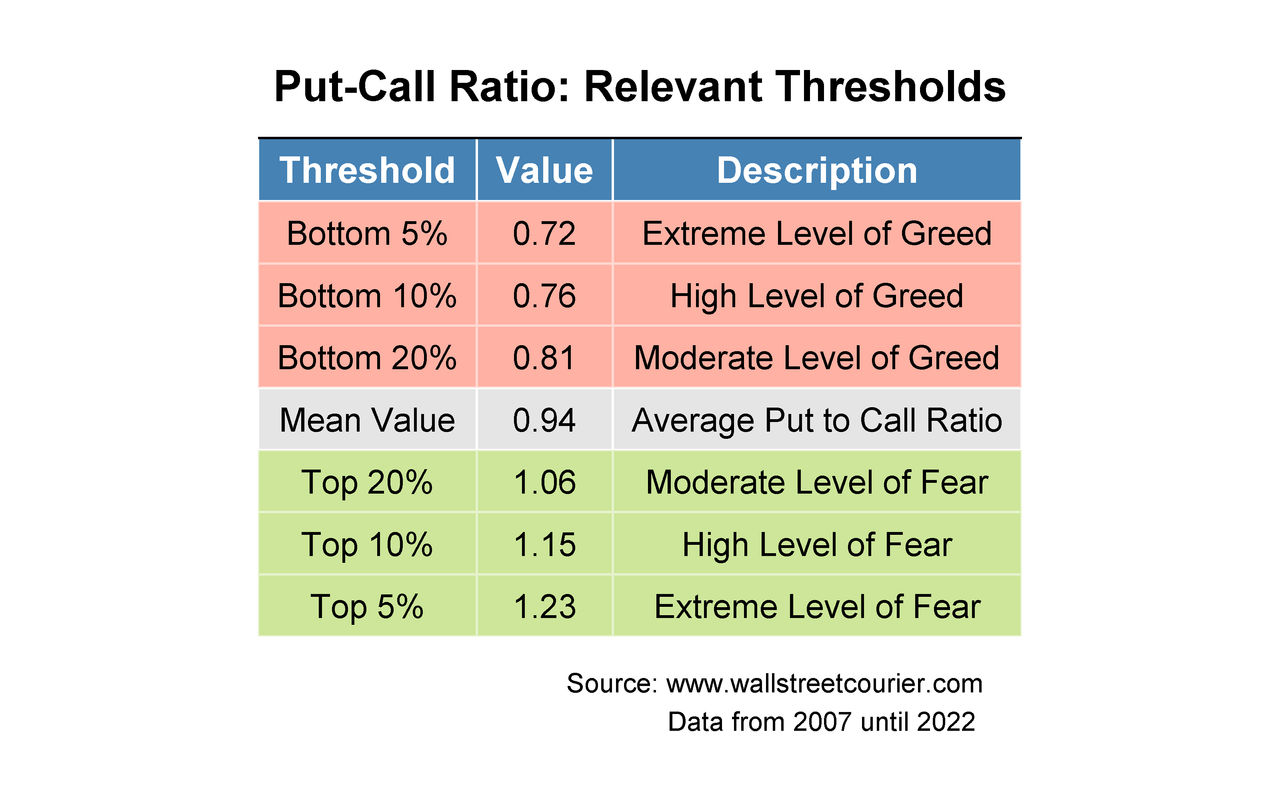

The PCR ratio is calculated by dividing the full variety of put choices traded by the full variety of name choices traded for a selected underlying asset, on this case, Financial institution Nifty. A PCR worth above 1 suggests the next quantity of put choices traded in comparison with name choices, indicating a bearish sentiment, whereas a worth under 1 suggests the alternative – a bullish sentiment pushed by larger name choice buying and selling quantity. Nonetheless, it is essential to grasp that the PCR just isn’t a standalone predictor of worth motion however relatively a sentiment indicator that needs to be used at the side of different technical and basic evaluation instruments.

Information Sources for Financial institution Nifty PCR:

Actual-time knowledge for Financial institution Nifty’s PCR is available by means of numerous sources, together with:

- Brokerage Platforms: Most on-line brokerage platforms present real-time market knowledge, together with the PCR for Financial institution Nifty choices. These platforms typically supply customizable charts and permit for simple integration with different technical indicators.

- Monetary Web sites: A number of monetary web sites devoted to market knowledge supply stay updates on the PCR, alongside different related info akin to choice chain knowledge, worth charts, and information.

- Devoted Information Suppliers: Specialised monetary knowledge suppliers supply complete market knowledge packages, together with detailed historic and real-time PCR knowledge for numerous indices, together with Financial institution Nifty. These suppliers typically cater to skilled merchants and establishments.

Decoding the Financial institution Nifty PCR Stay Chart:

Analyzing the Financial institution Nifty PCR stay chart entails greater than merely observing the numerical worth. The chart’s tendencies and patterns are equally, if no more, essential. Here is a breakdown of key facets to contemplate:

- Pattern Evaluation: A constantly rising PCR above 1 suggests rising bearish sentiment, probably indicating a weakening market. Conversely, a constantly falling PCR under 1 signifies rising bullishness. Nonetheless, it is important to notice that these tendencies needs to be noticed inside a selected timeframe, akin to every day, weekly, or month-to-month, to keep away from misinterpretations primarily based on short-term fluctuations.

- Help and Resistance Ranges: Like another technical indicator, the PCR can exhibit help and resistance ranges. These ranges signify worth factors the place the PCR has traditionally reversed its development. Figuring out these ranges can present merchants with potential entry and exit factors.

- Divergence: A divergence happens when the PCR’s development contradicts the value development of Financial institution Nifty. For instance, a rising PCR whereas Financial institution Nifty is making larger highs suggests a weakening bullish momentum and potential for a reversal. Conversely, a falling PCR whereas Financial institution Nifty is making decrease lows signifies weakening bearish momentum and a possible bullish reversal.

- Excessive Values: Extraordinarily excessive PCR values (considerably above 1) may sign an oversold situation, suggesting potential shopping for alternatives. Conversely, extraordinarily low PCR values (considerably under 1) may point out an overbought situation, hinting at potential promoting alternatives. Nonetheless, it is essential to do not forget that these excessive values should not ensures of a worth reversal and needs to be thought-about at the side of different indicators.

- Quantity Affirmation: The PCR ought to ideally be analyzed at the side of buying and selling quantity. A excessive PCR worth accompanied by excessive quantity strengthens the bearish sign, whereas a low PCR with excessive quantity strengthens the bullish sign. Low quantity readings may point out weak sentiment and fewer dependable PCR alerts.

Integrating PCR with Stay Chart Evaluation:

The Financial institution Nifty PCR is best when built-in with different technical evaluation instruments utilized in stay chart buying and selling. Listed here are some examples:

- Candlestick Patterns: Combining PCR evaluation with candlestick patterns (e.g., hammer, engulfing, doji) can present extra dependable buying and selling alerts. A bearish candlestick sample showing at a excessive PCR worth strengthens the bearish sign.

- Shifting Averages: The interplay between the PCR and transferring averages (e.g., 20-day, 50-day) might help establish potential development adjustments. A crossing of transferring averages coupled with a major change within the PCR can present a powerful buying and selling sign.

- Help and Resistance Ranges: Combining PCR evaluation with help and resistance ranges recognized on the Financial institution Nifty worth chart might help pinpoint potential entry and exit factors. A excessive PCR at a resistance degree may point out a possible bearish reversal.

- RSI and MACD: Utilizing the PCR at the side of different momentum oscillators just like the Relative Energy Index (RSI) and Shifting Common Convergence Divergence (MACD) can present a extra complete view of market sentiment and momentum.

Limitations of the PCR Ratio:

Whereas the PCR is a beneficial software, it is important to acknowledge its limitations:

- Not a Predictive Indicator: The PCR just isn’t a crystal ball; it does not predict future worth actions with certainty. It displays market sentiment, which might change quickly.

- Inclined to Manipulation: Giant institutional merchants can affect the PCR by means of aggressive choice shopping for or promoting.

- Timeframe Dependency: The interpretation of the PCR varies relying on the timeframe thought-about (every day, weekly, month-to-month).

- Context is Essential: The PCR ought to at all times be interpreted throughout the broader market context, contemplating information occasions, financial knowledge, and total market sentiment.

Conclusion:

The Financial institution Nifty PCR ratio, when used successfully with different technical indicators and stay chart evaluation, supplies beneficial insights into market sentiment and potential worth course. Nonetheless, it is essential to do not forget that the PCR just isn’t a foolproof predictor, and merchants ought to at all times use it at the side of different evaluation instruments and handle their danger successfully. Thorough understanding of its calculation, interpretation, and limitations is important for profitable utility in stay buying and selling methods. Steady monitoring of the stay chart and adapting to altering market situations are essential for maximizing the advantages of this highly effective indicator. Bear in mind to at all times follow accountable buying and selling and seek the advice of with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has offered beneficial insights into Decoding the PCR Ratio: Financial institution Nifty’s Intraday Pulse and its Stay Chart Implications. We thanks for taking the time to learn this text. See you in our subsequent article!