Decoding the QQQ Chart: A Two-Decade Journey By way of Tech’s Triumphs and Tribulations

Associated Articles: Decoding the QQQ Chart: A Two-Decade Journey By way of Tech’s Triumphs and Tribulations

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the QQQ Chart: A Two-Decade Journey By way of Tech’s Triumphs and Tribulations. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the QQQ Chart: A Two-Decade Journey By way of Tech’s Triumphs and Tribulations

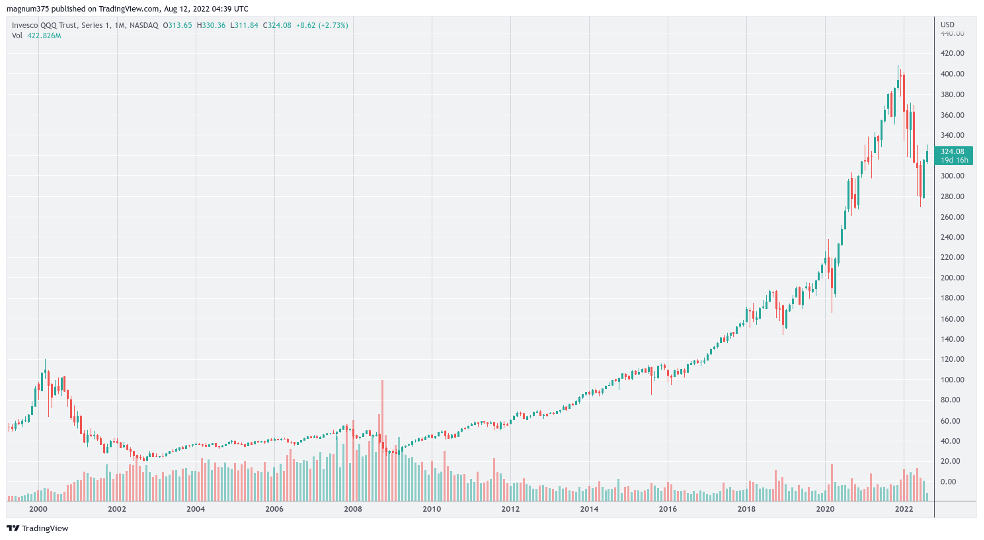

The Invesco QQQ Belief (QQQ) has turn into synonymous with the Nasdaq-100 index, providing buyers a handy and liquid strategy to acquire publicity to the efficiency of a few of the world’s most progressive and influential know-how firms. Its chart, a tapestry woven from years of market fluctuations, displays not solely the evolution of the tech sector but in addition broader financial developments and investor sentiment. This text delves into the historic efficiency of QQQ, analyzing key durations of progress, correction, and the components which have formed its trajectory.

The Early Years (2000-2009): Dot-com Bust and Restoration

QQQ’s inception coincided with the tail finish of the dot-com increase and the next bust. Launched in March 1999, the ETF initially benefited from the lingering euphoria surrounding tech shares. Nonetheless, the dramatic implosion of the tech bubble in 2000 dealt a big blow, sending QQQ plummeting from its peak. The chart from this era vividly illustrates the volatility, with sharp declines interspersed with durations of tentative restoration. The bursting of the bubble highlighted the inherent dangers related to investing closely in a sector as inclined to speedy technological change and investor sentiment as know-how. This period serves as a stark reminder of the significance of diversification and threat administration, even inside a seemingly high-growth sector.

A number of key components contributed to QQQ’s downturn throughout this era:

- Overvaluation: Many tech firms had been considerably overvalued in the course of the dot-com increase, resulting in unsustainable value will increase and a subsequent crash.

- Rate of interest hikes: The Federal Reserve’s rate of interest will increase aimed toward combating inflation additional dampened investor enthusiasm and fueled the decline.

- Lack of profitability: Many dot-com firms lacked a transparent path to profitability, making them susceptible to market corrections.

The interval following the dot-com bust noticed a protracted interval of consolidation and restoration. QQQ steadily regained a few of its misplaced floor, albeit slowly, because the tech sector started to stabilize and refocus on sustainable enterprise fashions. This era underscores the resilience of the tech sector and its capability to adapt and innovate within the face of adversity. Analyzing the chart from this period highlights the significance of long-term investing and the power to climate short-term market fluctuations.

The Rise of the Tech Giants (2010-2019): A Decade of Development

The 2010s witnessed a outstanding resurgence for QQQ, mirroring the outstanding progress of tech giants like Apple, Microsoft, Amazon, Google (Alphabet), and Fb (Meta). The chart throughout this era shows a predominantly upward pattern, punctuated by occasional corrections. A number of components fueled this sustained progress:

- Cellular revolution: The proliferation of smartphones and cell purposes created huge new markets and alternatives for tech firms.

- Cloud computing: The shift in the direction of cloud-based providers reworked the best way companies operated and spurred important progress for firms like Amazon Net Companies (AWS).

- Social media: The rise of social media platforms like Fb created fully new avenues for promoting and communication, producing substantial income streams.

- Massive information and AI: The growing significance of knowledge evaluation and synthetic intelligence fueled innovation and funding in associated applied sciences.

This decade showcased the ability of technological disruption and the potential for exponential progress inside the tech sector. The QQQ chart throughout this era serves as a testomony to the long-term worth creation potential of investing in main know-how firms. Nonetheless, it additionally reveals the significance of recognizing and managing threat, as even in periods of sustained progress, market corrections can happen.

Navigating Volatility (2020-Current): Pandemic, Inflation, and Geopolitical Uncertainty

The interval from 2020 onwards has been characterised by unprecedented volatility, pushed by a confluence of things:

- COVID-19 pandemic: The pandemic initially triggered a pointy market downturn, however the subsequent shift in the direction of distant work and e-commerce boosted the efficiency of many tech firms. The QQQ chart displays this preliminary drop adopted by a speedy restoration and subsequent progress.

- Inflation and rate of interest hikes: Rising inflation and subsequent rate of interest hikes by the Federal Reserve created a difficult atmosphere for progress shares, resulting in a big correction in QQQ’s value. This era highlights the sensitivity of progress shares to modifications in financial coverage.

- Geopolitical uncertainty: The continued warfare in Ukraine and growing geopolitical tensions added additional uncertainty to the market, impacting investor sentiment and contributing to market volatility.

- Provide chain disruptions: International provide chain disruptions exacerbated inflationary pressures and impacted the efficiency of sure tech firms.

This latest interval underscores the significance of adaptability and resilience in navigating unexpected occasions. The QQQ chart demonstrates how even seemingly strong sectors might be impacted by macroeconomic components and international occasions. Analyzing the chart from this era requires a nuanced understanding of the interaction between technological innovation, macroeconomic situations, and geopolitical dangers.

Analyzing the QQQ Chart: Key Takeaways

A complete evaluation of the QQQ chart over the previous 20 years reveals a number of key takeaways for buyers:

- Lengthy-term progress potential: Regardless of durations of great volatility, QQQ has demonstrated substantial long-term progress potential, reflecting the enduring energy of technological innovation.

- Danger administration: Investing in QQQ, whereas providing important upside, entails inherent dangers. Understanding these dangers and implementing acceptable threat administration methods is essential.

- Market cycles: The QQQ chart highlights the cyclical nature of the market, with durations of progress adopted by corrections. Recognizing these cycles and adjusting funding methods accordingly is important for long-term success.

- Macroeconomic components: Macroeconomic situations, similar to inflation and rates of interest, considerably impression the efficiency of QQQ. Staying knowledgeable about these components is significant for making knowledgeable funding selections.

- Diversification: Whereas QQQ affords publicity to a diversified basket of tech shares, diversification throughout completely different asset lessons stays essential for mitigating threat.

In conclusion, the QQQ chart affords an interesting and insightful case examine within the dynamics of the know-how sector and the broader market. By rigorously analyzing its historic efficiency and understanding the underlying components which have formed its trajectory, buyers can acquire precious insights into navigating the complexities of the market and making knowledgeable funding selections. Nonetheless, it is essential to do not forget that previous efficiency is just not indicative of future outcomes, and the way forward for QQQ, like every funding, stays inherently unsure. Steady monitoring, adaptation, and a well-defined funding technique are paramount for achievement on this dynamic market.

![[学术报告]Alireza Behnejad - Two Decade Journey Of An Archineer Through](https://structure.tongji.edu.cn/__local/B/92/90/7E896757AA23D0FEED54768CE4A_339507CE_1A386F.jpg)

Closure

Thus, we hope this text has supplied precious insights into Decoding the QQQ Chart: A Two-Decade Journey By way of Tech’s Triumphs and Tribulations. We respect your consideration to our article. See you in our subsequent article!