Decoding the Quicken 30-12 months Mortgage Price Chart: A Complete Information

Associated Articles: Decoding the Quicken 30-12 months Mortgage Price Chart: A Complete Information

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Decoding the Quicken 30-12 months Mortgage Price Chart: A Complete Information. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Decoding the Quicken 30-12 months Mortgage Price Chart: A Complete Information

The dream of homeownership typically hinges on securing a good mortgage price. For a lot of, a 30-year fixed-rate mortgage represents essentially the most attainable path, providing predictable month-to-month funds over an prolonged interval. Understanding the intricacies of mortgage charges, significantly as introduced on platforms like Quicken Loans’ price charts, is essential for making knowledgeable monetary selections. This text delves into the Quicken 30-year mortgage price chart, exploring its parts, find out how to interpret the info, and the components influencing the charges displayed. We can even talk about the restrictions of relying solely on on-line price charts and the significance of customized pre-qualification.

Understanding the Quicken Mortgage Price Chart

Quicken Loans, a distinguished mortgage lender, offers on-line instruments and sources, together with a price chart showcasing present mortgage charges. Whereas the particular format and information introduced might change periodically, the core components typically stay constant. A typical chart will show:

- Mortgage Time period: Primarily specializing in 30-year fixed-rate mortgages, although shorter-term choices may be included.

- Curiosity Price: That is the annual proportion price (APR) charged on the mortgage. It is essential to distinguish between the rate of interest and the APR, because the latter consists of extra charges and prices related to the mortgage.

- Mortgage Sort: The chart might categorize charges primarily based on mortgage sort, resembling conforming loans (assembly Fannie Mae and Freddie Mac pointers) and jumbo loans (exceeding conforming mortgage limits).

- Credit score Rating Ranges: Charges are sometimes segmented primarily based on borrower credit score scores, reflecting the lender’s evaluation of threat. Larger credit score scores typically correlate with decrease rates of interest.

- Down Fee Proportion: The required down fee considerably impacts the speed provided. Bigger down funds sometimes end in decrease charges.

- Factors: "Factors" signify pay as you go curiosity, paid upfront to scale back the rate of interest. The chart may present price changes primarily based on the variety of factors bought.

- Date and Time: It is important to notice the date and time the charges had been final up to date, as charges are extremely dynamic and fluctuate consistently.

Deciphering the Information: A Sensible Instance

We could say a pattern Quicken 30-year mortgage price chart:

| Credit score Rating | Down Fee | Factors | APR (30-12 months Fastened) |

|---|---|---|---|

| 760+ | 20% | 0 | 6.5% |

| 760+ | 20% | 1 | 6.25% |

| 700-759 | 20% | 0 | 6.75% |

| 700-759 | 10% | 0 | 7.0% |

| 660-699 | 20% | 0 | 7.25% |

This simplified chart illustrates how numerous components affect the APR. A borrower with a credit score rating above 760 and a 20% down fee may safe a 6.5% APR with zero factors. Nevertheless, by paying one level upfront, they will scale back their price to six.25%. Conversely, a borrower with a credit score rating between 700 and 759 and a ten% down fee faces the next APR of seven.0%.

Components Influencing Quicken 30-12 months Mortgage Charges

A number of macroeconomic and microeconomic components work together to find out the charges displayed on Quicken’s chart:

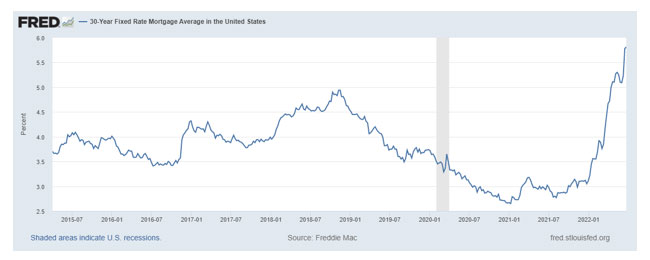

- Federal Reserve Coverage: The Federal Reserve’s actions, significantly its goal federal funds price, considerably affect total rates of interest. Larger federal funds charges sometimes result in increased mortgage charges.

- Inflation: Excessive inflation erodes buying energy and infrequently prompts the Federal Reserve to lift rates of interest to curb inflation, consequently impacting mortgage charges.

- Financial Development: Sturdy financial development can result in elevated demand for mortgages, probably driving up charges. Conversely, financial slowdowns can depress charges.

- Investor Sentiment: Investor confidence within the housing market and the general financial system impacts mortgage-backed securities (MBS) markets, influencing the price of funds for lenders and subsequently affecting mortgage charges.

- Credit score Danger: Lenders assess the creditworthiness of debtors, factoring in credit score scores, debt-to-income ratios, and different monetary components. Larger-risk debtors are assigned increased charges.

- Mortgage Sort and Options: Totally different mortgage sorts (e.g., conforming vs. jumbo) and options (e.g., adjustable-rate mortgages vs. fixed-rate mortgages) carry various ranges of threat, leading to completely different charges.

- Competitors: The extent of competitors amongst mortgage lenders additionally performs a job. Elevated competitors can result in extra favorable charges for debtors.

Limitations of On-line Price Charts:

Whereas Quicken’s price chart offers a basic overview of prevailing charges, it is essential to acknowledge its limitations:

- Common Estimates: The charges displayed are estimates and never assured approvals. Your precise price will rely in your particular monetary profile and the lender’s evaluation.

- Lack of Personalization: On-line charts lack the personalization of a pre-qualification or mortgage software course of. They do not account for particular person circumstances, resembling particular mortgage phrases, charges, or property traits.

- Dynamic Charges: Charges change consistently all through the day, so the data on the chart could also be outdated shortly.

- Excluding Further Prices: The chart often shows the APR, but it surely may not embody all closing prices, which might considerably impression the general value of the mortgage.

The Significance of Pre-qualification:

Relying solely on a web based price chart to make home-buying selections is unwise. As a substitute, potential homebuyers ought to endure a pre-qualification course of with a lender like Quicken Loans. Pre-qualification includes offering primary monetary data to find out your eligibility for a mortgage and obtain a customized price quote. This course of offers a a lot clearer image of your borrowing energy and the charges you are prone to obtain.

Navigating the Quicken Price Chart and Past:

The Quicken 30-year mortgage price chart serves as a helpful place to begin for understanding prevailing mortgage charges. Nevertheless, it is merely a snapshot of a fancy and dynamic market. To make knowledgeable selections, potential homebuyers ought to:

- Monitor Price Tendencies: Usually examine the chart and different sources to trace price fluctuations.

- Perceive Your Monetary Profile: Assess your credit score rating, debt-to-income ratio, and financial savings to find out your borrowing capability.

- Store Round: Examine charges from a number of lenders, not simply counting on a single supply.

- Search Skilled Recommendation: Seek the advice of with a monetary advisor or mortgage dealer for customized steerage.

- Learn the Superb Print: Rigorously overview all mortgage paperwork and perceive the phrases and situations earlier than committing to a mortgage.

In conclusion, the Quicken 30-year mortgage price chart is a helpful device for gaining a basic understanding of the present mortgage market. Nevertheless, it should not be the only foundation for making vital monetary selections. A complete method involving pre-qualification, comparability procuring, {and professional} recommendation is crucial for securing the very best mortgage phrases and attaining your homeownership objectives. Do not forget that the data introduced right here is for academic functions solely and shouldn’t be thought-about monetary recommendation. All the time seek the advice of with a certified skilled earlier than making any monetary selections.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the Quicken 30-12 months Mortgage Price Chart: A Complete Information. We respect your consideration to our article. See you in our subsequent article!