Decoding the Reliance Jio Share Worth Chart: A Complete Evaluation

Associated Articles: Decoding the Reliance Jio Share Worth Chart: A Complete Evaluation

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Decoding the Reliance Jio Share Worth Chart: A Complete Evaluation. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the Reliance Jio Share Worth Chart: A Complete Evaluation

Reliance Jio Infocomm Restricted (JIO), a subsidiary of Reliance Industries, has quickly turn into a dominant pressure within the Indian telecom sector. Its disruptive entry and aggressive pricing methods have reshaped the panorama, resulting in vital market share beneficial properties. Understanding the trajectory of its share value, nevertheless, requires a deeper dive than simply trying on the every day fluctuations. This text will analyze the Reliance Jio share value chart, exploring its historic efficiency, key influencing elements, and potential future tendencies, offering insights for each traders and market fanatics.

Historic Efficiency: A Rollercoaster Trip with Upward Momentum

Jio’s preliminary public providing (IPO) in 2021 noticed a major surge in investor curiosity, reflecting the corporate’s spectacular progress and market dominance. Nevertheless, the share value hasn’t been a straight line upwards. Analyzing the chart reveals distinct phases:

-

Preliminary Surge and Consolidation: The post-IPO interval witnessed a speedy rise adopted by a interval of consolidation. That is typical for newly listed corporations because the market absorbs the preliminary pleasure and assesses the corporate’s long-term prospects. The consolidation section allowed the inventory to construct a robust base earlier than embarking on its subsequent leg of progress. This section noticed fluctuations influenced by broader market tendencies and sector-specific information.

-

Progress Pushed by 5G Rollout and Digital Companies: The following surge within the share value was largely pushed by Jio’s aggressive 5G rollout throughout India. This enlargement, coupled with the corporate’s foray into numerous digital providers past telecommunications, similar to JioMart and Jio Platforms, fueled investor confidence. The chart throughout this era exhibits a comparatively steep upward development, punctuated by periodic corrections reflecting profit-booking and market volatility.

-

Macroeconomic Components and World Uncertainty: The Jio share value, like different shares, hasn’t been resistant to macroeconomic headwinds. World uncertainties, inflation considerations, and rate of interest hikes have impacted investor sentiment, resulting in intervals of value correction. The chart throughout these occasions displays elevated volatility, with sharp dips adopted by gradual recoveries.

-

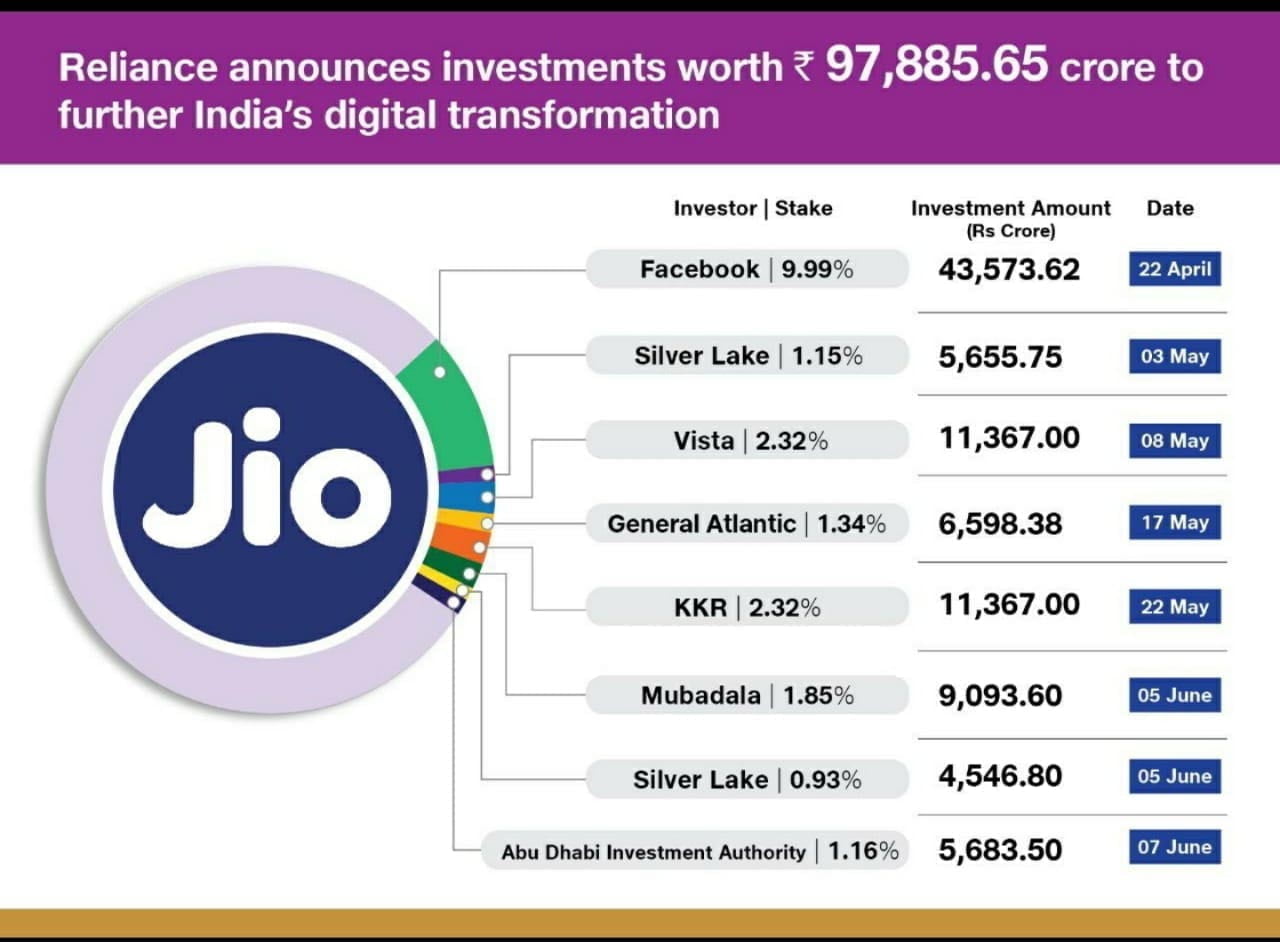

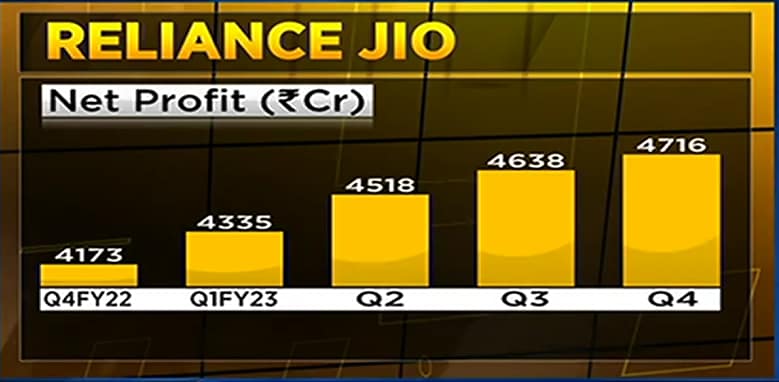

Quarterly Earnings and Bulletins: Analyzing the chart along side Reliance Jio’s quarterly earnings studies gives beneficial insights. Stronger-than-expected earnings typically resulted in optimistic value actions, whereas disappointing outcomes led to corrections. Equally, vital bulletins, similar to partnerships, new product launches, and strategic investments, have had a noticeable influence on the share value.

Key Components Influencing the Share Worth:

A number of elements have considerably influenced the Reliance Jio share value chart:

-

Subscriber Base Progress: Jio’s huge subscriber base progress has been a main driver of its share value. Constant addition of recent subscribers, particularly within the high-value pay as you go section, demonstrates the corporate’s market attraction and potential for future income progress. The chart typically exhibits optimistic correlation between subscriber progress bulletins and value will increase.

-

ARPU (Common Income Per Consumer): A rise in ARPU signifies larger income era from present subscribers. This can be a essential metric for profitability and is intently watched by traders. A rising ARPU development typically interprets right into a optimistic influence on the share value.

-

5G Rollout and Infrastructure Investments: Jio’s aggressive 5G community deployment has been a significant catalyst for its share value progress. The enlargement of its 5G infrastructure showcases its dedication to technological development and future-proofing its community. Vital investments on this space, whereas initially impacting profitability, have been considered positively by traders in the long run.

-

Digital Companies Diversification: Jio’s enlargement past telecom providers, into areas like e-commerce (JioMart), digital funds, and leisure, has diversified its income streams and diminished reliance on a single sector. This diversification technique has typically been perceived favorably by the market.

-

Aggressive Panorama: The aggressive dynamics throughout the Indian telecom sector additionally influence Jio’s share value. Intense competitors from different gamers can have an effect on market share and pricing methods, doubtlessly impacting profitability and investor sentiment. The chart typically displays the influence of aggressive actions and regulatory modifications.

-

General Market Sentiment and World Financial Circumstances: Broader market tendencies and world financial situations considerably affect the share value. Durations of market optimism typically result in larger valuations, whereas bearish sentiment can set off value corrections.

Analyzing the Chart: Technical Indicators and Patterns

A complete evaluation of the Reliance Jio share value chart requires incorporating technical indicators and figuring out potential chart patterns. Instruments like shifting averages, relative energy index (RSI), and MACD can present insights into potential value tendencies and momentum. Figuring out patterns like head and shoulders, double tops/bottoms, and flags might help predict future value actions. Nevertheless, it is essential to do not forget that technical evaluation shouldn’t be foolproof and needs to be used along side elementary evaluation.

Future Outlook and Potential Traits:

Predicting future share value actions is inherently difficult. Nevertheless, a number of elements counsel a optimistic outlook for Reliance Jio:

- Continued 5G Enlargement: The continuing 5G rollout is prone to drive additional subscriber progress and ARPU will increase.

- Progress of Digital Companies: Jio’s digital providers are poised for vital progress, contributing to income diversification.

- Authorities Initiatives: Authorities initiatives selling digitalization in India are prone to profit Jio’s operations.

- Technological Improvements: Jio’s dedication to technological innovation may give it a aggressive edge.

Nevertheless, potential challenges embrace:

- Intense Competitors: The aggressive panorama stays difficult, requiring steady innovation and environment friendly operations.

- Regulatory Modifications: Modifications in authorities rules can influence the telecom business and Jio’s profitability.

- Financial Slowdown: A possible financial slowdown may have an effect on client spending and influence subscriber progress.

Conclusion:

The Reliance Jio share value chart displays a journey of speedy progress, punctuated by intervals of consolidation and correction. Understanding the historic efficiency, key influencing elements, and potential future tendencies requires a holistic strategy, combining elementary and technical evaluation. Whereas the long run is unsure, Jio’s robust fundamentals, aggressive progress methods, and diversified choices place it favorably for continued progress in the long run. Buyers ought to fastidiously assess their danger tolerance and funding horizon earlier than making any choices primarily based on the evaluation of the share value chart. Common monitoring of the corporate’s efficiency, monetary studies, and business tendencies is essential for making knowledgeable funding selections. This text gives a framework for understanding the complexities of the Jio share value chart; nevertheless, it is important to conduct thorough analysis and search skilled recommendation earlier than making any funding choices.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the Reliance Jio Share Worth Chart: A Complete Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!