Decoding the Silver Commodity Worth Stay Chart: A Complete Information

Associated Articles: Decoding the Silver Commodity Worth Stay Chart: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the Silver Commodity Worth Stay Chart: A Complete Information. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the Silver Commodity Worth Stay Chart: A Complete Information

Silver, a lustrous white metallic prized for its conductive properties and aesthetic attraction, has captivated buyers and industrial customers for millennia. Its worth, nonetheless, is much from static, fluctuating always primarily based on a posh interaction of financial components, market sentiment, and international occasions. Understanding the silver commodity worth stay chart is essential for anybody concerned within the silver market, whether or not as a dealer, investor, or industrial client. This text supplies a complete overview of the silver worth chart, its influencing components, and how one can interpret its actions.

Understanding the Silver Worth Stay Chart:

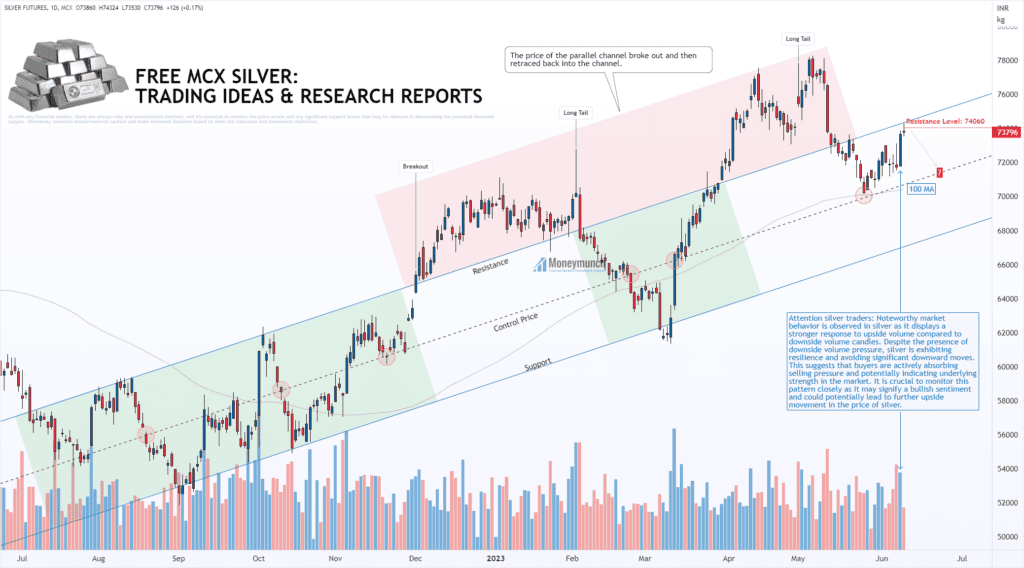

A silver worth stay chart shows the real-time worth of silver, usually expressed in US {dollars} per troy ounce (USD/oz). Most charts current the worth knowledge graphically, utilizing line graphs, candlestick charts, or bar charts. These charts often span varied timeframes, starting from intraday (minutes, hours) to each day, weekly, month-to-month, and even yearly views. Key components to search for on a typical silver worth stay chart embody:

- Worth Axis (Y-axis): Reveals the worth of silver in USD/oz.

- Time Axis (X-axis): Represents the time interval coated by the chart (e.g., minutes, hours, days, months).

- Worth Candlesticks (or traces/bars): Illustrate the opening, closing, excessive, and low costs of silver throughout a particular time interval. The candlestick’s physique reveals the worth vary between the open and shut, whereas the "wicks" (or shadows) lengthen to the excessive and low costs.

- Shifting Averages: These are traces that easy out worth fluctuations, serving to to determine traits. Frequent shifting averages embody 50-day, 100-day, and 200-day averages.

- Technical Indicators: Varied technical indicators, resembling Relative Power Index (RSI), Shifting Common Convergence Divergence (MACD), and Bollinger Bands, are sometimes overlaid on the chart to supply further insights into worth momentum, potential reversals, and volatility.

- Quantity: This knowledge represents the quantity of silver traded throughout a particular interval. Excessive quantity typically accompanies important worth actions.

Elements Influencing Silver Costs:

The value of silver is influenced by a large number of things, making it a unstable commodity. These components may be broadly categorized as:

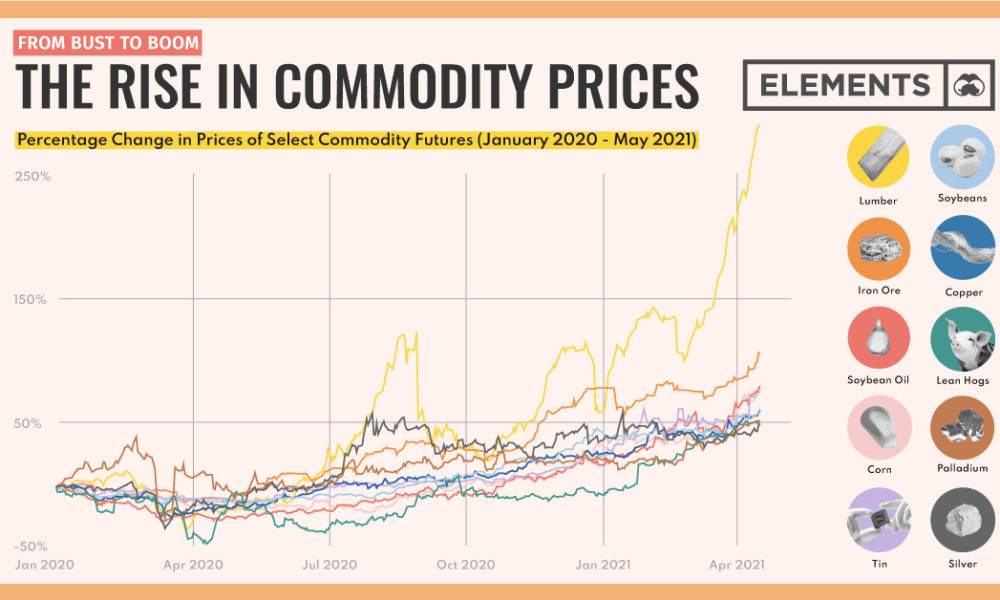

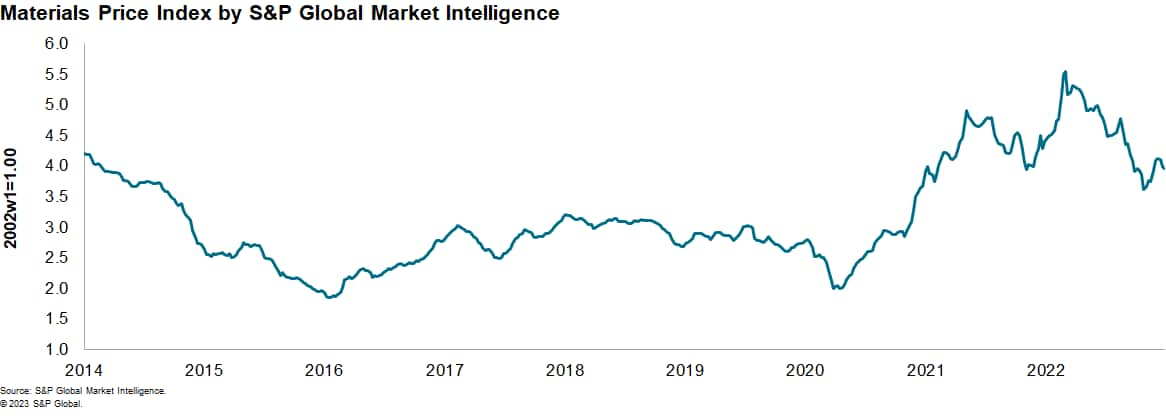

1. Industrial Demand: Silver’s distinctive electrical conductivity makes it indispensable in varied industries, together with electronics, photo voltaic vitality, automotive, and healthcare. Sturdy demand from these sectors usually pushes silver costs greater. Technological developments and the expansion of renewable vitality are significantly important drivers of business demand. A slowdown in these industries can conversely suppress silver costs.

2. Funding Demand: Silver is taken into account a valuable metallic and a protected haven asset, that means buyers typically flip to it throughout occasions of financial uncertainty or inflation. Alternate-traded funds (ETFs) backed by bodily silver, together with silver cash and bars, contribute considerably to funding demand. Investor sentiment performs an important function; optimistic sentiment drives up demand, whereas adverse sentiment can result in promoting strain.

3. Hypothesis: Speculators, who guess on future worth actions, can considerably affect silver costs. Their actions can amplify each upward and downward worth traits, typically resulting in short-term volatility. Information occasions, geopolitical developments, and even social media traits can set off speculative shopping for or promoting.

4. Foreign money Fluctuations: The US greenback is the first forex used for silver buying and selling. A weakening greenback usually makes silver extra enticing to worldwide consumers, driving up demand and costs. Conversely, a strengthening greenback can depress silver costs.

5. Mining Provide: The provision of silver is basically decided by mining manufacturing. Elements resembling mining prices, technological developments in extraction, and geopolitical occasions affecting mining operations can affect the general provide and consequently impression costs. Surprising disruptions to mining operations, resembling strikes or pure disasters, can result in worth spikes.

6. Authorities Insurance policies and Laws: Authorities insurance policies referring to mining, taxation, and environmental laws can have an effect on the price of silver manufacturing and the general market dynamics. Adjustments in these insurance policies can affect each provide and demand, impacting silver costs.

7. Inflation: Silver, like different valuable metals, is usually seen as a hedge in opposition to inflation. During times of excessive inflation, buyers are inclined to flock to silver as a retailer of worth, growing demand and pushing costs greater.

8. Substitutes and Competitors: The supply of substitute supplies in varied purposes can have an effect on silver demand. Technological improvements resulting in the event of other supplies with related properties can doubtlessly cut back silver’s industrial demand, influencing its worth.

Decoding the Silver Worth Stay Chart:

Analyzing a silver worth stay chart entails combining technical evaluation with an understanding of the basic components mentioned above. Technical evaluation focuses on figuring out patterns and traits within the worth chart utilizing instruments like shifting averages, indicators, and candlestick patterns. Elementary evaluation entails assessing the underlying financial and market forces that affect silver costs.

Technical Evaluation Methods:

- Pattern Identification: Figuring out the general development (uptrend, downtrend, or sideways) is essential. Shifting averages may help decide the prevailing development.

- Assist and Resistance Ranges: These are worth ranges the place the worth has traditionally struggled to interrupt by means of. Assist ranges characterize potential shopping for alternatives, whereas resistance ranges point out potential promoting strain.

- Candlestick Patterns: Sure candlestick patterns can sign potential worth reversals or continuations of current traits.

- Technical Indicators: Indicators like RSI and MACD present insights into worth momentum and potential overbought or oversold circumstances.

Elementary Evaluation Methods:

- Monitoring Industrial Demand: Staying knowledgeable concerning the progress prospects of industries that closely depend on silver is important.

- Monitoring Funding Flows: Monitoring ETF holdings and investor sentiment can present insights into funding demand.

- Analyzing Foreign money Actions: Understanding the power or weak point of the US greenback relative to different currencies is essential.

- Assessing Geopolitical Dangers: Monitoring geopolitical occasions that might have an effect on silver mining or international financial stability is vital.

Conclusion:

The silver commodity worth stay chart gives a dynamic view of this multifaceted market. Mastering the artwork of decoding this chart requires a mixture of technical and elementary evaluation, coupled with a deep understanding of the components influencing silver costs. By diligently following market traits, financial indicators, and geopolitical occasions, buyers and merchants could make extra knowledgeable selections when navigating the unstable world of silver buying and selling. Keep in mind, nonetheless, that no evaluation can assure future worth actions, and danger administration is paramount in any commodity buying and selling technique. All the time conduct thorough analysis and think about looking for skilled recommendation earlier than making any funding selections.

Closure

Thus, we hope this text has offered helpful insights into Decoding the Silver Commodity Worth Stay Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!