Decoding the Silver Value Chart: A Journey By means of Two A long time of Volatility and Worth

Associated Articles: Decoding the Silver Value Chart: A Journey By means of Two A long time of Volatility and Worth

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Silver Value Chart: A Journey By means of Two A long time of Volatility and Worth. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Decoding the Silver Value Chart: A Journey By means of Two A long time of Volatility and Worth

Silver, a lustrous steel prized for its magnificence and industrial versatility, has captivated traders and merchants for hundreds of years. Its value, nevertheless, is something however static, fluctuating wildly in response to a fancy interaction of financial, geopolitical, and market forces. Understanding the world silver value chart requires deciphering these influences and recognizing the patterns that emerge over time. This text delves into the intricacies of silver pricing, analyzing its historic efficiency, key drivers of value volatility, and potential future tendencies.

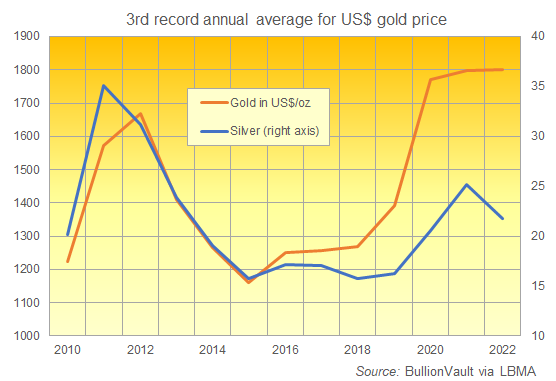

A Historic Perspective: The Silver Value Chart Since 2000

The silver value chart because the 12 months 2000 reveals a narrative of serious ups and downs, marked by durations of dramatic progress and sharp corrections. The early 2000s noticed comparatively subdued value motion, with silver buying and selling inside a comparatively slim vary. Nevertheless, the start of the twenty first century witnessed a rising consciousness of the steel’s industrial functions, particularly in electronics and photo voltaic vitality. This, coupled with growing funding demand, fueled a gradual upward development.

The interval between 2008 and 2011 witnessed an unprecedented surge in silver costs. This dramatic rise was primarily attributed to a number of elements:

- The World Monetary Disaster: The 2008 monetary disaster fueled a flight to security, pushing traders in the direction of treasured metals as a hedge towards financial uncertainty. Silver, perceived as a comparatively undervalued asset in comparison with gold, benefited considerably.

- Elevated Industrial Demand: The burgeoning demand for silver in electronics, significantly in quickly creating economies like China and India, additional bolstered costs. The rising renewable vitality sector, reliant on silver for photo voltaic panels, additionally contributed to this demand.

- Funding Hypothesis: A good portion of the worth enhance was pushed by speculative funding, with traders piling into silver ETFs and futures contracts, making a self-reinforcing cycle of value appreciation.

Nevertheless, this spectacular rally was short-lived. Following the height in 2011, silver costs skilled a pointy and extended correction, falling considerably from their highs. This downturn was influenced by a number of elements:

- Revenue-Taking: As costs soared, many traders took earnings, resulting in a wave of promoting strain.

- Diminished Speculative Curiosity: The extreme speculative exercise that fueled the earlier value surge subsided, leaving the market extra susceptible to cost corrections.

- Financial Restoration: As the worldwide economic system started to recuperate from the monetary disaster, the safe-haven demand for silver diminished.

The next years noticed silver costs fluctuating inside a broader vary, influenced by varied financial and geopolitical occasions. The interval after 2015 witnessed a gradual restoration, interspersed with durations of volatility. This volatility typically mirrors broader market tendencies, reacting to elements similar to rate of interest adjustments, inflation issues, and world financial progress.

Key Drivers of Silver Value Volatility:

The silver value chart is influenced by a fancy internet of interconnected elements. Understanding these drivers is essential for deciphering value actions and formulating efficient buying and selling methods. Among the most vital elements embrace:

- Industrial Demand: Silver’s industrial functions are a serious driver of its value. Any vital adjustments within the demand for electronics, photo voltaic panels, or different silver-intensive industries can have a considerable affect on costs. Technological developments and the expansion of rising economies are key determinants of this demand.

- Funding Demand: Silver can also be thought-about a treasured steel and a retailer of worth, making it enticing to traders searching for diversification and a hedge towards inflation. Investor sentiment, influenced by macroeconomic circumstances and market sentiment, performs an important position in value fluctuations. Trade-traded funds (ETFs) monitoring silver costs additionally contribute considerably to funding demand.

- Geopolitical Components: Geopolitical instability and uncertainty can affect silver costs. Occasions similar to wars, political upheavals, and commerce disputes can set off safe-haven shopping for, pushing silver costs greater.

- Foreign money Fluctuations: The US greenback is the first forex utilized in treasured steel buying and selling. A weakening greenback usually results in greater costs for silver (and different commodities) because it turns into cheaper for traders holding different currencies to purchase.

- Provide and Demand Dynamics: Like several commodity, the interaction of provide and demand essentially influences silver costs. Surprising disruptions to silver mining, processing, or transportation can result in value will increase, whereas elevated manufacturing can exert downward strain.

- Inflation: Silver is commonly thought-about an inflation hedge. In periods of excessive inflation, traders are inclined to flock to treasured metals as a retailer of worth, driving up costs.

Analyzing the Silver Value Chart: Strategies and Indicators

Analyzing the silver value chart requires a mixture of technical and elementary evaluation. Technical evaluation includes finding out value charts and figuring out patterns to foretell future value actions. Frequent technical indicators utilized in silver buying and selling embrace:

- Transferring Averages: These assist establish tendencies and potential assist and resistance ranges.

- Relative Power Index (RSI): This indicator measures the momentum of value adjustments and can assist establish overbought or oversold circumstances.

- MACD (Transferring Common Convergence Divergence): This indicator helps establish adjustments in momentum and potential development reversals.

Basic evaluation includes analyzing the underlying financial and geopolitical elements that affect silver costs. This consists of analyzing industrial demand, funding sentiment, forex fluctuations, and geopolitical occasions.

Future Outlook for Silver Costs:

Predicting future silver costs is inherently difficult as a result of quite a few interconnected elements influencing its worth. Nevertheless, a number of elements counsel potential future tendencies:

- Continued Development in Renewable Vitality: The growing adoption of renewable vitality applied sciences, significantly solar energy, will doubtless proceed to drive demand for silver.

- Technological Developments: New technological functions for silver might emerge, additional boosting demand.

- Inflationary Pressures: Persistent inflationary pressures might enhance the attraction of silver as an inflation hedge, supporting value appreciation.

- Geopolitical Dangers: Ongoing geopolitical uncertainties might gasoline safe-haven demand for silver.

Nevertheless, potential headwinds additionally exist:

- Financial Slowdown: A worldwide financial slowdown might scale back industrial demand for silver.

- Elevated Silver Provide: Elevated mining manufacturing might exert downward strain on costs.

- Adjustments in Investor Sentiment: A shift in investor sentiment away from treasured metals might result in decrease costs.

Conclusion:

The world silver value chart is a dynamic reflection of complicated market forces. Understanding these forces, using efficient analytical strategies, and staying knowledgeable about related financial and geopolitical occasions are essential for navigating the volatility of the silver market. Whereas predicting the longer term with certainty is not possible, analyzing historic knowledge, understanding the important thing drivers, and contemplating potential future tendencies can assist traders and merchants make knowledgeable selections and handle their threat successfully. The journey by means of the silver value chart is a steady technique of studying, adaptation, and cautious statement, rewarding those that strategy it with diligence and a eager eye for element.

Closure

Thus, we hope this text has offered precious insights into Decoding the Silver Value Chart: A Journey By means of Two A long time of Volatility and Worth. We thanks for taking the time to learn this text. See you in our subsequent article!