Decoding the TDS Chart for FY 23-24: A Complete Information

Associated Articles: Decoding the TDS Chart for FY 23-24: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Decoding the TDS Chart for FY 23-24: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the TDS Chart for FY 23-24: A Complete Information

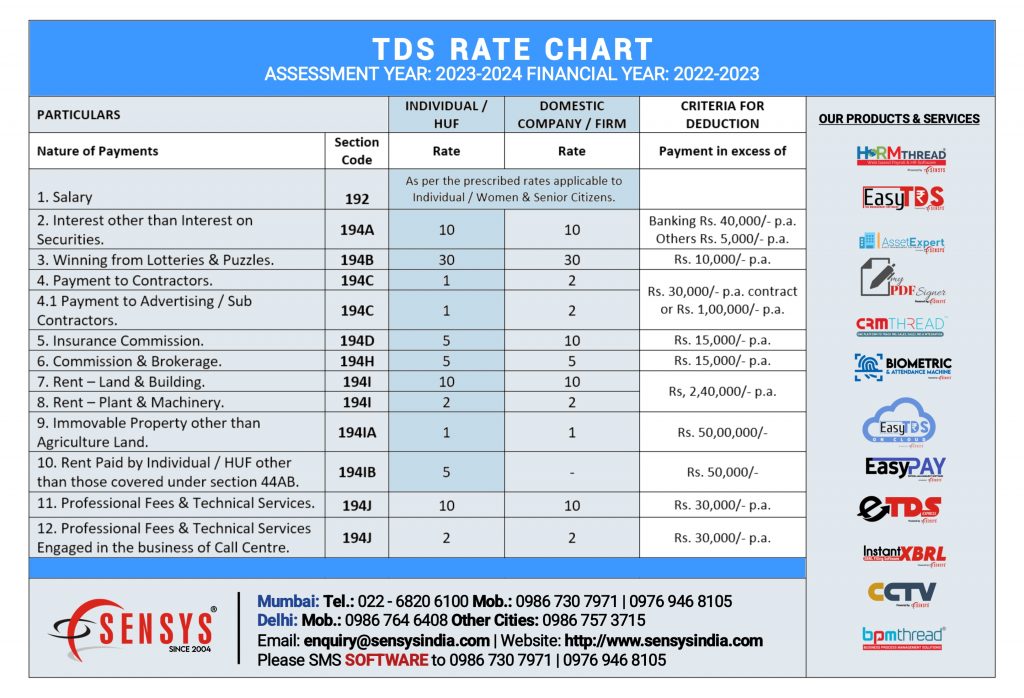

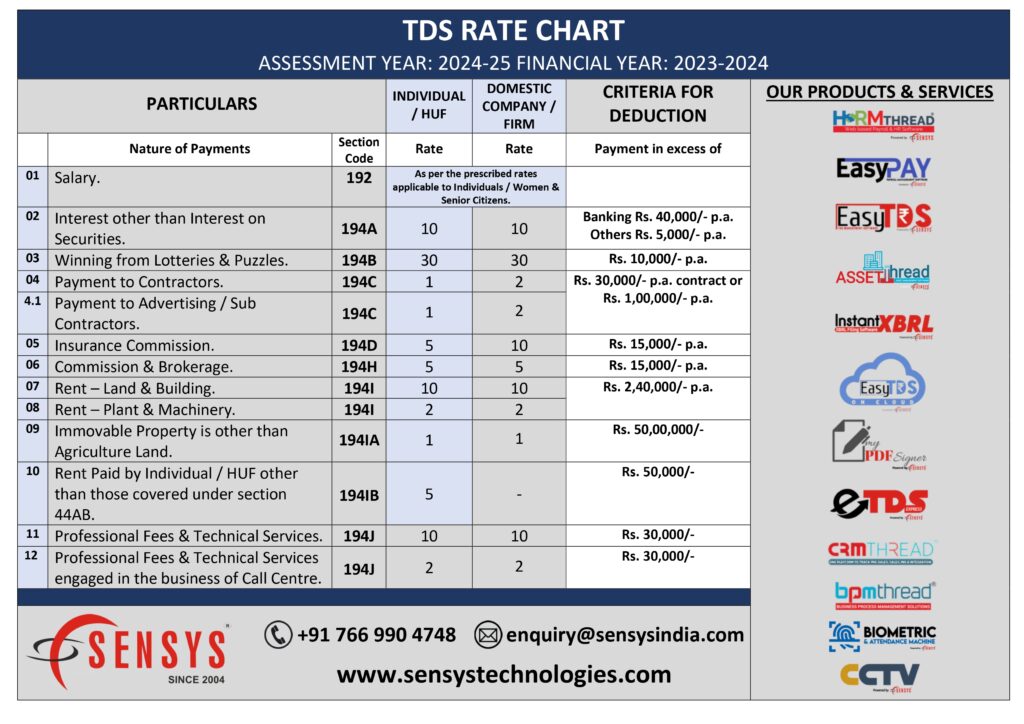

The Tax Deducted at Supply (TDS) chart for the monetary yr 2023-24 (FY 23-24) performs a vital position in India’s tax assortment system. Understanding its intricacies is important for each companies and people to make sure compliance and keep away from penalties. This text offers a complete overview of the TDS chart for FY 23-24, explaining its key elements, implications, and the way it impacts completely different stakeholders.

What’s TDS?

TDS is a mechanism employed by the Indian authorities to gather tax on the supply of earnings. As a substitute of ready for taxpayers to file their returns and pay taxes, the federal government mandates that sure payers deduct tax on the time of creating funds to the payee. This deducted tax is then remitted to the federal government on behalf of the payee. This pre-emptive tax assortment streamlines the tax administration course of, improves compliance, and ensures a gentle stream of income for the federal government.

The Significance of the TDS Chart

The TDS chart serves as a reference information outlining the relevant tax charges for varied earnings classes. It specifies the share of tax to be deducted based mostly on the character of cost and the payee’s standing (particular person, agency, firm, and many others.). Modifications in tax charges, exemptions, and thresholds are mirrored within the up to date chart every monetary yr. Correct adherence to the TDS chart is essential for avoiding penalties and authorized issues.

Key Parts of the FY 23-24 TDS Chart

The FY 23-24 TDS chart encompasses a variety of earnings classes, every with its personal particular tax charges. These classes embody:

-

Salaries: TDS on salaries is deducted by employers from their staff’ salaries based mostly on the worker’s tax slab and different deductions claimed. The chart outlines the relevant tax charges for various earnings brackets. The brand new tax regime launched lately additionally influences the TDS calculation for salaries.

-

Curiosity on Securities: Curiosity earnings from varied securities like fastened deposits, bonds, and debentures is topic to TDS. The chart specifies the TDS charges relevant to various kinds of securities and the curiosity thresholds that set off TDS deduction.

-

Lease: Lease funds exceeding a specified threshold are topic to TDS. The owner’s PAN particulars are required for TDS deduction. The chart signifies the relevant TDS charges based mostly on the annual hire obtained.

-

Skilled Charges: Funds made to professionals like medical doctors, legal professionals, consultants, and designers are topic to TDS in the event that they exceed a sure threshold. The chart outlines the relevant TDS charges based mostly on the character of the skilled companies.

-

Contract Funds: Funds made to contractors for varied companies are additionally topic to TDS. The chart specifies the TDS charges based mostly on the character of the contract and the quantity paid.

-

Fee Funds: Fee funds to brokers, brokers, and different intermediaries are topic to TDS in the event that they exceed a selected threshold. The chart outlines the relevant TDS charges for fee earnings.

-

Funds to Non-Residents: Funds made to non-residents are topic to TDS at larger charges, as specified within the chart. This caters to the tax treaty preparations India has with varied international locations.

Understanding the Tax Slabs and Charges:

The TDS chart incorporates the earnings tax slabs and charges prevalent throughout FY 23-24. These slabs are essential in figuring out the relevant TDS share. For people, the tax regime alternative (outdated or new) considerably impacts the TDS calculation. The chart clearly outlines the relevant tax charges for every slab underneath each regimes, permitting for correct TDS deduction.

Impression of the New Tax Regime:

The introduction of the brand new tax regime has considerably altered the TDS panorama. The brand new regime affords less complicated tax slabs with decrease charges however with fewer exemptions. The TDS chart displays this variation, offering separate TDS charges for taxpayers choosing the brand new regime. Payers are required to determine the taxpayer’s alternative of regime earlier than deducting TDS.

Compliance and Penalties:

Correct adherence to the TDS chart is paramount. Failure to deduct TDS on the prescribed charges or failure to remit the deducted TDS to the federal government inside the stipulated timeframe may end up in important penalties. These penalties can embody curiosity prices, late charges, and even authorized motion. Companies and people are suggested to keep up meticulous information of TDS deductions and remittances.

Quarterly TDS Returns:

The TDS deducted is required to be remitted to the federal government on a quarterly foundation. Particular due dates are prescribed for every quarter. The TDS returns are filed electronically by the federal government’s on-line portal. Correct and well timed submitting of TDS returns is essential for avoiding penalties.

Reconciliation and TDS Certificates:

After deducting TDS, the payer is obligated to problem a TDS certificates (Kind 16 for salaries, Kind 16B for different funds) to the payee. This certificates serves as proof of TDS deduction and is important for the payee to assert credit score for the deducted tax whereas submitting their earnings tax return. Reconciliation of TDS deducted and remitted is essential to make sure accuracy and forestall discrepancies.

Challenges and Issues:

Navigating the TDS chart could be advanced, notably for companies coping with quite a few transactions and various cost sorts. Staying up to date with the newest amendments and clarifications issued by the tax authorities is important. In search of skilled recommendation from tax consultants can considerably simplify the method and decrease the chance of non-compliance.

Conclusion:

The TDS chart for FY 23-24 is an important doc for anybody concerned in monetary transactions in India. Understanding its intricacies is essential for guaranteeing compliance, avoiding penalties, and sustaining a wholesome monetary standing. Whereas the complexities concerned might sound daunting, correct understanding and adherence to the rules outlined within the chart can streamline the TDS course of and contribute to a extra environment friendly tax system. Common updates on adjustments and clarifications from the tax authorities, coupled with skilled help the place needed, are important for navigating this crucial side of Indian tax legislation. Keep in mind, proactive compliance is at all times the perfect strategy to managing TDS obligations.

-compressed.jpg)

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the TDS Chart for FY 23-24: A Complete Information. We hope you discover this text informative and helpful. See you in our subsequent article!