Decoding the Trump Media Inventory Value Chart: A Rollercoaster Journey of Hype, Hope, and Actuality

Associated Articles: Decoding the Trump Media Inventory Value Chart: A Rollercoaster Journey of Hype, Hope, and Actuality

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Decoding the Trump Media Inventory Value Chart: A Rollercoaster Journey of Hype, Hope, and Actuality. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Trump Media Inventory Value Chart: A Rollercoaster Journey of Hype, Hope, and Actuality

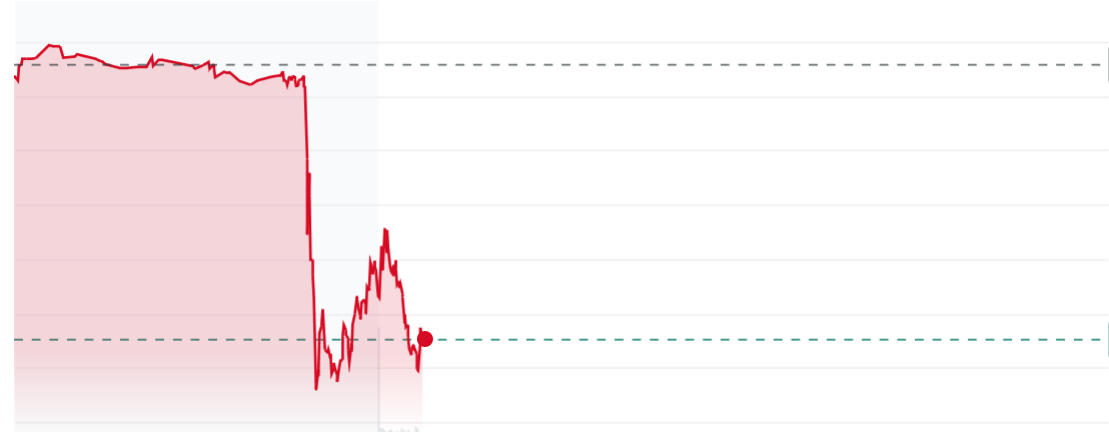

Donald Trump’s foray into the media panorama with the creation of Fact Social and its father or mother firm, Trump Media & Know-how Group (TMTG), has been something however predictable. The inventory value chart of TMTG, whereas technically pre-merger and largely primarily based on hypothesis and projections, displays a turbulent journey marked by intense hype, dashed expectations, and the continued battle to navigate a fancy and aggressive market. Analyzing this chart requires understanding the interaction of a number of elements, starting from the inherent volatility of pre-merger SPACs to the unpredictable nature of the previous president’s affect and the broader media panorama.

The Pre-Merger Hypothesis: A Wild Journey Earlier than the Bell

Earlier than the precise merger with Digital World Acquisition Corp. (DWAC), the inventory value chart of DWAC, the particular goal acquisition firm (SPAC) meant to take TMTG public, was a spectacle in itself. The preliminary surge was pushed by the sheer novelty of a Trump-branded media platform and the fervent loyalty of his base. This part exemplifies the ability of personality-driven funding, the place hypothesis far outweighed basic evaluation. The chart exhibits a dramatic upward trajectory fueled by media consideration, social media buzz, and the promise of a conservative various to established tech giants. This era noticed excessive volatility, with important every day swings reflecting the ebb and circulate of reports and hypothesis surrounding the merger, regulatory hurdles, and Trump’s personal pronouncements.

The chart doubtless displayed a number of key options throughout this pre-merger part:

- Fast Ascents and Sharp Declines: Information cycles, each constructive and unfavorable, instantly impacted the inventory value. Constructive information, similar to progress on the merger or Trump’s pronouncements supporting the enterprise, would result in sharp will increase. Conversely, unfavorable information, together with regulatory investigations or criticism of the platform, brought on steep declines.

- Excessive Buying and selling Quantity: The excessive stage of curiosity, fueled by each supporters and detractors, resulted in considerably larger buying and selling quantity in comparison with typical SPACs.

- Lack of Elementary Worth: As a pre-merger SPAC, the inventory value held little to no intrinsic worth primarily based on firm earnings or belongings. The value was nearly totally speculative, reflecting the market’s evaluation of the potential future worth of TMTG.

Put up-Merger Actuality: Navigating the Challenges of the Media Panorama

The post-merger interval presents a distinct image. Whereas the preliminary euphoria may need endured for a short time, the fact of constructing a profitable media firm in a extremely aggressive market rapidly set in. The chart doubtless reveals a major divergence from the pre-merger hype, reflecting the challenges confronted by TMTG. These challenges embrace:

- Competitors: Fact Social faces stiff competitors from established social media platforms like Fb, Twitter (now X), and others. Attracting and retaining customers on this crowded market requires a compelling product and efficient advertising and marketing, which has confirmed tough for Fact Social.

- Technical Points and Consumer Expertise: Stories of technical glitches, sluggish loading instances, and a much less user-friendly interface in comparison with rivals have hindered consumer progress and satisfaction. This negatively impacted the inventory value, reflecting investor considerations in regards to the platform’s viability.

- Regulatory Scrutiny: TMTG has confronted regulatory scrutiny concerning its merger course of and compliance with securities legal guidelines. These investigations, and the uncertainty they create, have undoubtedly weighed on the inventory value.

- Monetary Efficiency: The corporate’s monetary efficiency, significantly its income technology and profitability, is probably going a key issue influencing the inventory value. With out substantial income streams, the long-term sustainability of the corporate is questionable, resulting in investor apprehension.

- Trump’s Affect (Each Constructive and Detrimental): Whereas Trump’s title initially attracted traders, his continued involvement and pronouncements have been a double-edged sword. Constructive statements supporting the platform can result in short-term boosts, however controversies and authorized battles could cause important drops.

Analyzing the Chart’s Patterns: Figuring out Key Developments and Turning Factors

An in depth evaluation of the TMTG inventory value chart would contain figuring out key traits and turning factors:

- Assist and Resistance Ranges: The chart would doubtless present distinct help and resistance ranges, representing value factors the place the inventory value has traditionally struggled to interrupt via. These ranges present insights into investor sentiment and potential future value actions.

- Shifting Averages: Utilizing transferring averages (e.g., 50-day, 200-day) will help determine traits and potential reversals. A break above a key transferring common may sign a bullish pattern, whereas a break under might point out a bearish pattern.

- Quantity Evaluation: Analyzing buying and selling quantity alongside value actions can present invaluable context. Excessive quantity throughout value will increase suggests robust shopping for strain, whereas excessive quantity throughout value decreases signifies robust promoting strain.

- Correlation with Information Occasions: Mapping important information occasions (e.g., regulatory bulletins, Trump’s statements, platform updates) to cost actions can reveal the affect of particular occasions on investor sentiment.

The Way forward for TMTG: Hypothesis and Uncertainty

Predicting the longer term trajectory of the TMTG inventory value is inherently speculative. The corporate’s success hinges on a number of elements, together with its means to beat technical challenges, appeal to and retain customers, generate income, and navigate regulatory hurdles. The continued affect of Donald Trump, each constructive and unfavorable, may also play a major position.

The chart’s future will doubtless rely on:

- Fact Social’s Consumer Progress and Engagement: Important progress in lively customers and elevated engagement could be a constructive signal, probably driving up the inventory value.

- Income Technology: The corporate’s means to generate substantial income via promoting, subscriptions, or different means is essential for long-term viability.

- Regulatory Outcomes: The result of ongoing regulatory investigations will considerably affect investor confidence and the inventory value.

- Diversification: TMTG’s future success may rely on its means to diversify past Fact Social and develop different income streams.

Conclusion: A Cautionary Story for Buyers

The TMTG inventory value chart serves as a cautionary story in regards to the dangers related to investing in corporations closely reliant on character, hypothesis, and pre-merger SPACs. Whereas the preliminary hype may need attracted traders, the long-term success of TMTG stays unsure. A radical understanding of the corporate’s fundamentals, the aggressive panorama, and the inherent dangers is essential for any potential investor. The chart, whereas unstable and unpredictable, gives a invaluable case research within the complexities of the media business and the challenges of constructing a profitable enterprise in a quickly evolving digital setting. Buyers ought to proceed with warning and conduct thorough due diligence earlier than contemplating any funding in TMTG.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the Trump Media Inventory Value Chart: A Rollercoaster Journey of Hype, Hope, and Actuality. We thanks for taking the time to learn this text. See you in our subsequent article!