Decoding the US GDP Pie Chart: A Sector-by-Sector Evaluation of the American Economic system

Associated Articles: Decoding the US GDP Pie Chart: A Sector-by-Sector Evaluation of the American Economic system

Introduction

With enthusiasm, let’s navigate via the intriguing subject associated to Decoding the US GDP Pie Chart: A Sector-by-Sector Evaluation of the American Economic system. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Decoding the US GDP Pie Chart: A Sector-by-Sector Evaluation of the American Economic system

The USA boasts the world’s largest financial system, a posh tapestry woven from the contributions of numerous industries. Understanding the construction of this financial system is essential for policymakers, buyers, and residents alike. A visible illustration usually employed as an instance this construction is the Gross Home Product (GDP) by business pie chart. This chart divides the overall GDP – the financial worth of all completed items and companies produced inside a rustic’s borders in a particular time interval – into its constituent sectors, offering a snapshot of the relative significance of every. This text will delve into an in depth evaluation of a typical US GDP by business pie chart, exploring the key sectors, their historic developments, and the implications for the general financial well being of the nation.

The Main Gamers: Dissecting the Pie Slices

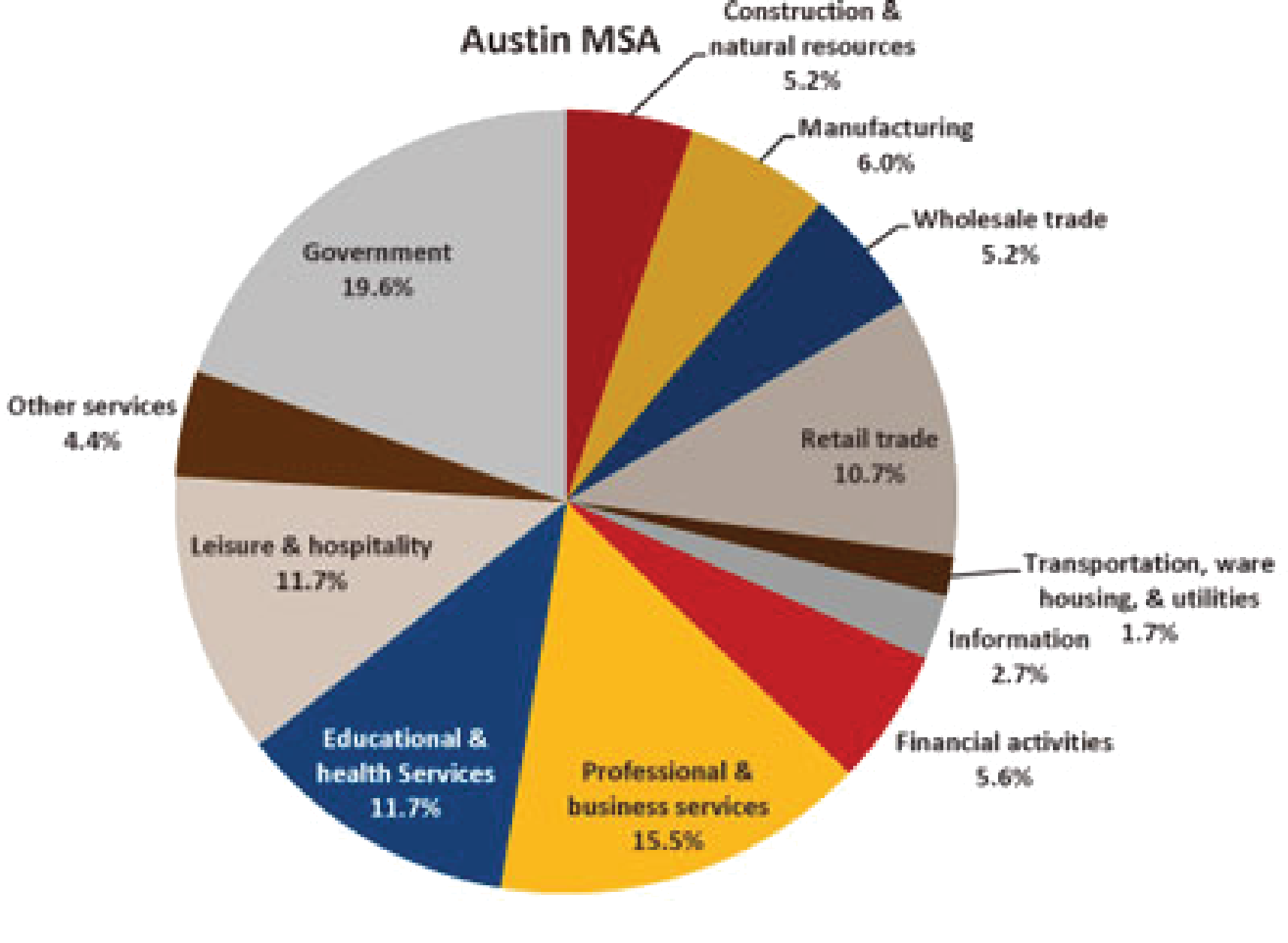

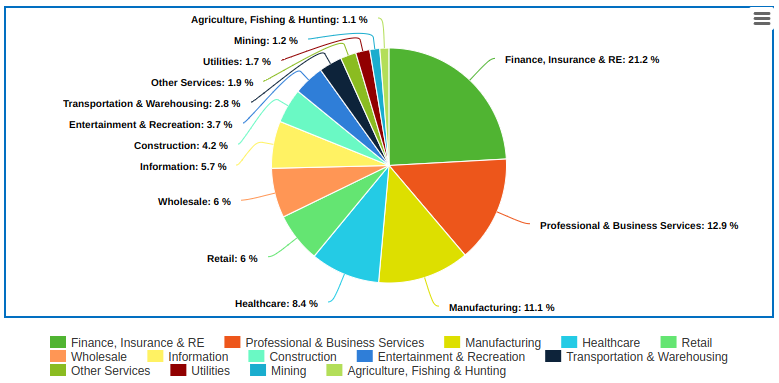

A typical US GDP by business pie chart reveals a couple of dominant sectors, every taking part in a definite and very important position within the nation’s financial engine. These sectors are usually categorized utilizing the North American Business Classification System (NAICS), a standardized system for classifying enterprise institutions. Whereas the precise percentages fluctuate 12 months to 12 months, the next sectors persistently characterize important parts of the pie:

-

Companies: That is invariably the biggest slice of the pie, usually accounting for over 70% of US GDP. This broad class encompasses an unlimited array of actions, together with healthcare, finance, training, retail, transportation, {and professional} companies (like regulation and consulting). The dominance of companies displays the shift in direction of a knowledge-based financial system, the place intangible items and companies are more and more essential drivers of financial development. Additional breakdown inside this sector can reveal essential particulars – for instance, the relative measurement of the healthcare sector highlights its important contribution and potential vulnerabilities.

-

Manufacturing: Whereas not as dominant as companies, manufacturing stays an important element of the US financial system, usually representing round 10-15% of GDP. This sector consists of the manufacturing of sturdy and non-durable items, starting from cars and equipment to meals and clothes. The manufacturing sector’s efficiency is a key indicator of the nation’s industrial power and competitiveness within the international market. Fluctuations on this sector usually mirror adjustments in client demand, technological developments, and international commerce dynamics.

-

Wholesale and Retail Commerce: This sector usually contributes round 10-15% of GDP, reflecting the essential position of distribution in getting items and companies to shoppers. Wholesale commerce entails the majority sale of products to retailers, whereas retail commerce encompasses the direct sale of products to shoppers. The well being of this sector is a powerful indicator of client confidence and spending habits. E-commerce’s development has considerably impacted this sector, resulting in each alternatives and challenges for conventional brick-and-mortar companies.

-

Development: This sector contributes a smaller, however nonetheless important, portion of GDP, usually round 4-6%. Development exercise displays funding in infrastructure, residential housing, and business buildings. Fluctuations on this sector are sometimes linked to rates of interest, credit score availability, and general financial confidence. A strong development sector is essential for sustained financial development and job creation.

-

Agriculture: Whereas comparatively small in comparison with different sectors, agriculture stays an essential a part of the US financial system, often contributing round 1-2% of GDP. This sector’s contribution extends past the direct manufacturing of meals and fiber; it additionally consists of associated industries reminiscent of meals processing and agricultural expertise. The sector’s efficiency is closely influenced by climate patterns, international commodity costs, and technological developments.

-

Authorities: Authorities spending, at each the federal, state, and native ranges, constitutes a good portion of GDP, usually round 15-20%. This consists of spending on protection, training, healthcare, infrastructure, and social welfare packages. The scale and composition of presidency spending can considerably affect the general financial system, affecting combination demand and useful resource allocation.

Decoding the Developments: Historic Context and Future Projections

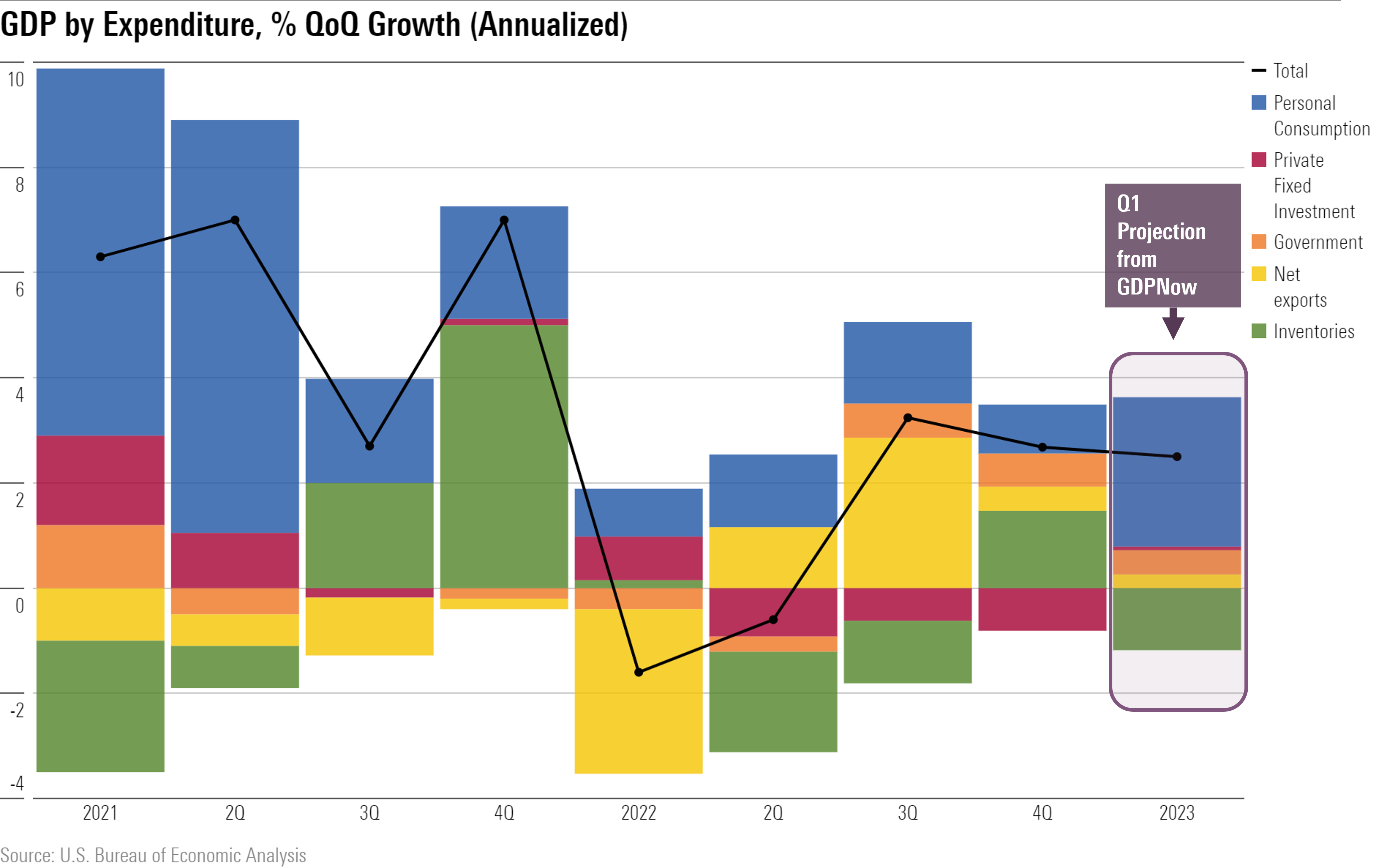

Analyzing the historic evolution of the US GDP by business pie chart reveals important shifts within the relative significance of various sectors. The dramatic rise of the companies sector over the previous few a long time displays the technological developments and the growing demand for knowledge-based companies. Conversely, the relative decline of producing, whereas nonetheless important, highlights the challenges confronted by the US in sustaining its international manufacturing competitiveness.

Inspecting the developments inside particular person sectors is equally essential. For instance, the expansion of the healthcare sector displays the getting older inhabitants and rising healthcare prices, whereas the rise of e-commerce has reshaped the retail commerce panorama. Analyzing these developments helps to establish rising financial alternatives and potential vulnerabilities.

Future projections for the US GDP by business pie chart usually contain contemplating varied elements, together with technological developments, demographic adjustments, international financial situations, and authorities insurance policies. The continued development of the companies sector is extensively anticipated, significantly in areas reminiscent of expertise, healthcare, and finance. Nonetheless, the way forward for manufacturing stays a subject of ongoing debate, with discussions centered round reshoring, automation, and the event of superior manufacturing applied sciences.

Coverage Implications and Financial Forecasting

The GDP by business pie chart supplies invaluable insights for policymakers in shaping financial methods. Understanding the relative power and weaknesses of various sectors permits for focused interventions to advertise development, create jobs, and tackle financial imbalances. For instance, insurance policies geared toward boosting manufacturing competitiveness or investing in infrastructure can have a major affect on the general financial system.

Economists use the GDP by business pie chart, alongside different financial indicators, to forecast future financial development and stability. Analyzing the developments inside every sector helps to foretell potential bottlenecks, dangers, and alternatives. This info is essential for companies in making funding selections and for people in planning their monetary futures.

Conclusion:

The US GDP by business pie chart provides a robust visible illustration of the nation’s financial construction. By fastidiously analyzing the relative measurement and historic developments of every sector, we achieve a deeper understanding of the complexities of the American financial system. This understanding is vital for policymakers, companies, and people alike in navigating the challenges and alternatives of the ever-evolving international financial panorama. The chart’s dynamic nature underscores the necessity for steady monitoring and evaluation to adapt to the shifting financial tides and guarantee sustainable and inclusive development for the longer term. Additional analysis into particular sectors and their interdependencies can present even larger insights into the intricate workings of the US financial system.

Closure

Thus, we hope this text has offered precious insights into Decoding the US GDP Pie Chart: A Sector-by-Sector Evaluation of the American Economic system. We hope you discover this text informative and helpful. See you in our subsequent article!