Decoding the USD/INR OTC Stay Chart: A Deep Dive into India’s Foreign exchange Market

Associated Articles: Decoding the USD/INR OTC Stay Chart: A Deep Dive into India’s Foreign exchange Market

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the USD/INR OTC Stay Chart: A Deep Dive into India’s Foreign exchange Market. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the USD/INR OTC Stay Chart: A Deep Dive into India’s Foreign exchange Market

The USD/INR trade charge, an important indicator of India’s financial well being and world standing, is continually in flux. Whereas the official trade charge, printed by the Reserve Financial institution of India (RBI), offers a snapshot of the market, a richer understanding comes from observing the Over-The-Counter (OTC) market. This text delves into the intricacies of the USD/INR OTC stay chart, explaining its parts, influencing components, and the implications for companies, buyers, and the Indian economic system.

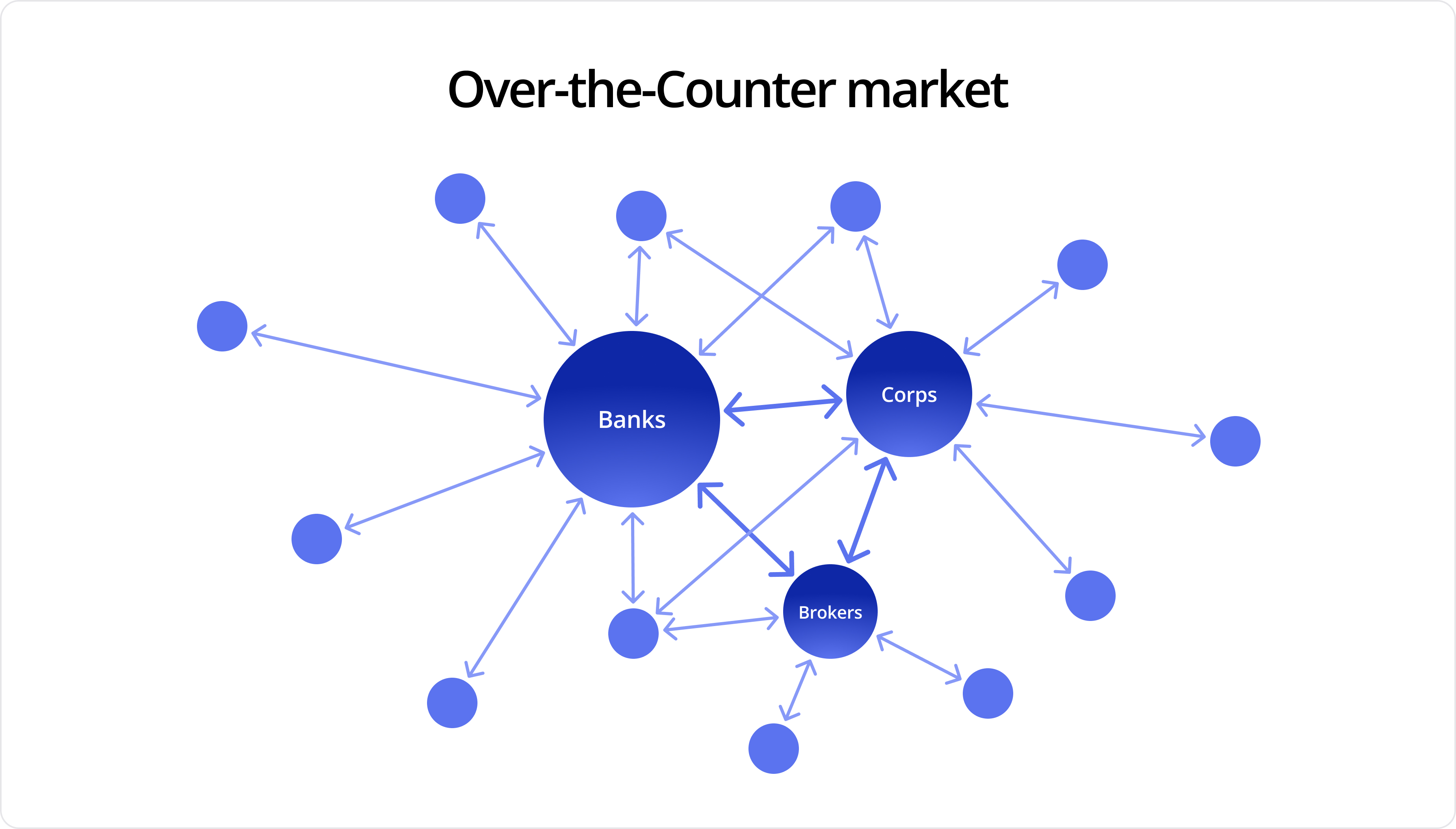

Understanding the OTC Market:

In contrast to exchange-traded markets with centralized platforms, the OTC market operates by a community of banks, monetary establishments, and brokers. These entities negotiate forex trades instantly, providing better flexibility and liquidity, significantly for bigger transactions. The USD/INR OTC stay chart displays this decentralized buying and selling, offering a real-time illustration of the prevailing bid and ask costs. This contrasts with the official charge, which regularly lags behind the dynamic OTC market.

Deciphering the USD/INR OTC Stay Chart:

A typical USD/INR OTC stay chart shows the next key info:

- Bid Worth: The value at which a purchaser is prepared to buy USD in trade for INR.

- Ask Worth: The value at which a vendor is prepared to promote USD in trade for INR.

- Unfold: The distinction between the bid and ask worth, representing the revenue margin for the middleman. A wider unfold signifies decrease liquidity.

- Chart Sort: The chart could be introduced in numerous codecs, together with candlestick, line, and bar charts, every providing distinctive views on worth actions over time.

- Timeframes: The chart can show knowledge starting from intraday (minutes, hours) to longer intervals (days, weeks, months, years), permitting for evaluation of short-term volatility and long-term developments.

- Technical Indicators: Merchants usually overlay technical indicators like transferring averages, RSI (Relative Power Index), MACD (Shifting Common Convergence Divergence), and Bollinger Bands to establish potential buying and selling alternatives primarily based on historic worth patterns.

- Quantity: The amount of USD/INR trades executed at particular worth factors offers perception into market sentiment and the energy of worth actions. Excessive quantity usually accompanies vital worth adjustments.

Components Influencing the USD/INR OTC Stay Chart:

The USD/INR trade charge is a posh interaction of varied macroeconomic and geopolitical components. Understanding these influences is essential for deciphering the stay chart and making knowledgeable choices.

- International Financial Circumstances: International financial progress, recessionary fears, and shifts in investor sentiment considerably impression the worth of the USD. A powerful USD usually places downward stress on the INR.

- US Financial Coverage: The Federal Reserve’s actions, significantly rate of interest choices, have a direct impression on the USD’s worth. Rate of interest hikes often strengthen the USD, whereas charge cuts weaken it.

- Indian Financial Efficiency: India’s GDP progress, inflation charge, present account deficit, and international funding inflows considerably affect the INR’s worth. Sturdy financial fundamentals usually help a stronger INR.

- Inflation Differentials: The distinction in inflation charges between the US and India influences the trade charge. Greater inflation in India in comparison with the US tends to weaken the INR.

- Geopolitical Occasions: International political instability, commerce wars, and sanctions can create uncertainty within the international trade market, resulting in volatility within the USD/INR charge.

- Authorities Insurance policies: RBI’s interventions within the foreign exchange market, adjustments in import-export insurance policies, and financial insurance policies all impression the USD/INR trade charge.

- Hypothesis and Market Sentiment: Market hypothesis and the general sentiment in direction of the Indian economic system considerably affect short-term fluctuations within the USD/INR charge.

Implications for Companies and Buyers:

The USD/INR OTC stay chart holds vital implications for companies and buyers:

- Importers and Exporters: Fluctuations within the trade charge instantly impression the profitability of importers and exporters. A stronger USD makes imports costlier and exports cheaper, whereas a weaker USD has the other impact. Hedging methods are sometimes employed to mitigate dangers related to trade charge volatility.

- Overseas Funding: The trade charge impacts the returns on international investments in India. A weaker INR will increase the returns for international buyers when changing again to their residence forex.

- Portfolio Managers: Funding managers fastidiously monitor the USD/INR charge to optimize their portfolio allocation and handle forex threat.

- Multinational Companies: Multinational firms working in India must handle their forex publicity successfully to keep away from vital losses attributable to trade charge fluctuations.

Dangers and Challenges:

Whereas the OTC market gives better flexibility, it additionally presents sure dangers:

- Liquidity Threat: Whereas usually liquid, the OTC market can expertise intervals of lowered liquidity, significantly throughout occasions of serious market turmoil. This will make it tough to execute trades at desired costs.

- Counterparty Threat: The OTC market depends on the creditworthiness of counterparties. The danger of default by a buying and selling companion is a big concern.

- Transparency: In comparison with exchange-traded markets, the OTC market is much less clear, making it tough to trace all transactions and establish potential manipulation.

- Regulatory Oversight: Whereas regulated, the OTC market is topic to various ranges of regulatory oversight throughout totally different jurisdictions, probably creating inconsistencies and challenges.

Conclusion:

The USD/INR OTC stay chart offers a dynamic view of India’s international trade market, providing priceless insights into the interaction of world and home financial forces. Understanding the components that affect the trade charge, together with the inherent dangers and challenges related to the OTC market, is essential for companies, buyers, and policymakers alike. By fastidiously analyzing the chart and contemplating the broader financial context, stakeholders could make knowledgeable choices to mitigate dangers and capitalize on alternatives introduced by the ever-changing USD/INR trade charge. Steady monitoring of the chart, mixed with a complete understanding of macroeconomic indicators and geopolitical occasions, is important for navigating the complexities of India’s foreign exchange market. The knowledge supplied on this chart must be used together with skilled monetary recommendation, as it isn’t an alternative choice to professional steerage in making funding or enterprise choices.

Closure

Thus, we hope this text has supplied priceless insights into Decoding the USD/INR OTC Stay Chart: A Deep Dive into India’s Foreign exchange Market. We thanks for taking the time to learn this text. See you in our subsequent article!