Decoding the V-Backside Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the V-Backside Chart Sample: A Complete Information for Merchants

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the V-Backside Chart Sample: A Complete Information for Merchants. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the V-Backside Chart Sample: A Complete Information for Merchants

The world of technical evaluation is wealthy with chart patterns, every providing a novel perspective on potential value actions. Amongst these, the V-bottom sample stands out as a visually placing and doubtlessly profitable reversal sign. This text delves deep into the intricacies of the V-bottom sample, exploring its formation, identification, affirmation, buying and selling methods, and limitations. Understanding this sample can considerably improve a dealer’s capability to determine potential shopping for alternatives in downtrending markets.

Understanding the V-Backside Sample:

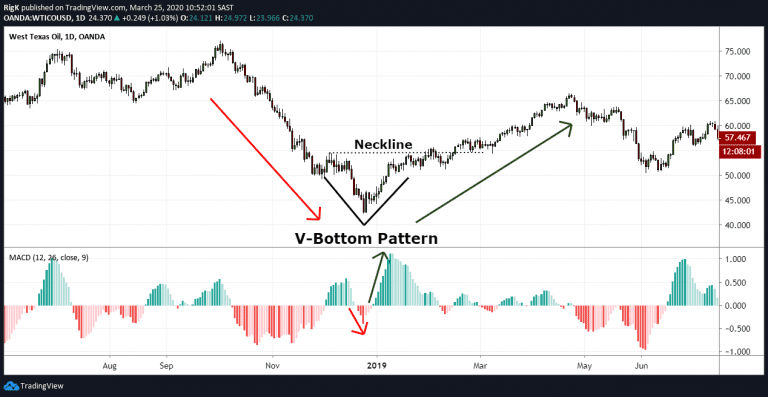

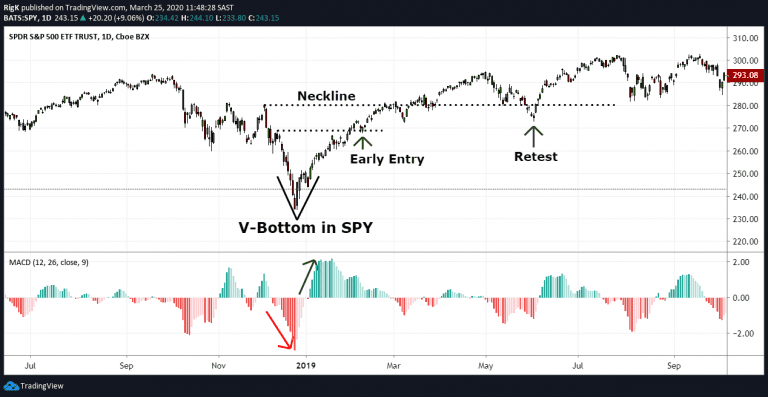

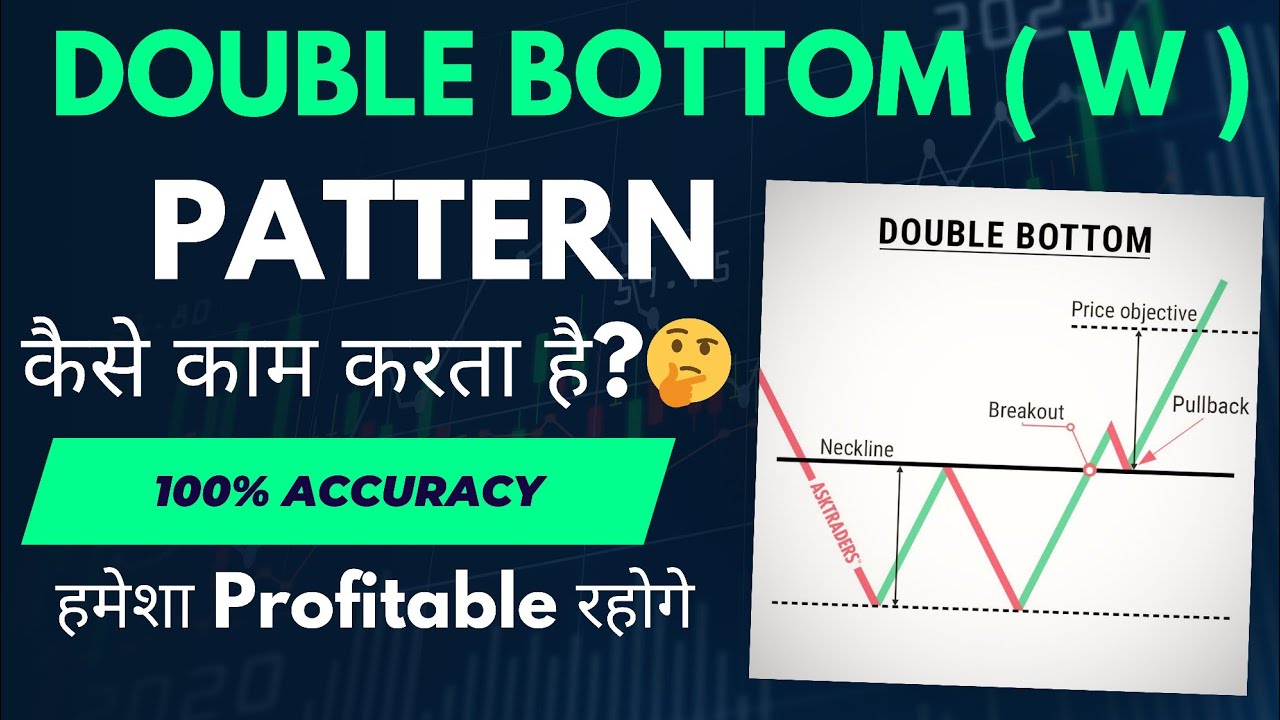

The V-bottom sample, as its identify suggests, resembles the letter "V" on a value chart. It is characterised by a pointy, swift decline in value, adopted by an equally abrupt and decisive reversal. In contrast to the extra gradual U-bottom sample, the V-bottom signifies a fast change in market sentiment, typically pushed by important information occasions, sudden catalysts, or a sudden shift in investor psychology. The sample’s steepness is a key distinguishing function, highlighting the depth of the promoting stress adopted by the equally robust shopping for stress that fuels the reversal.

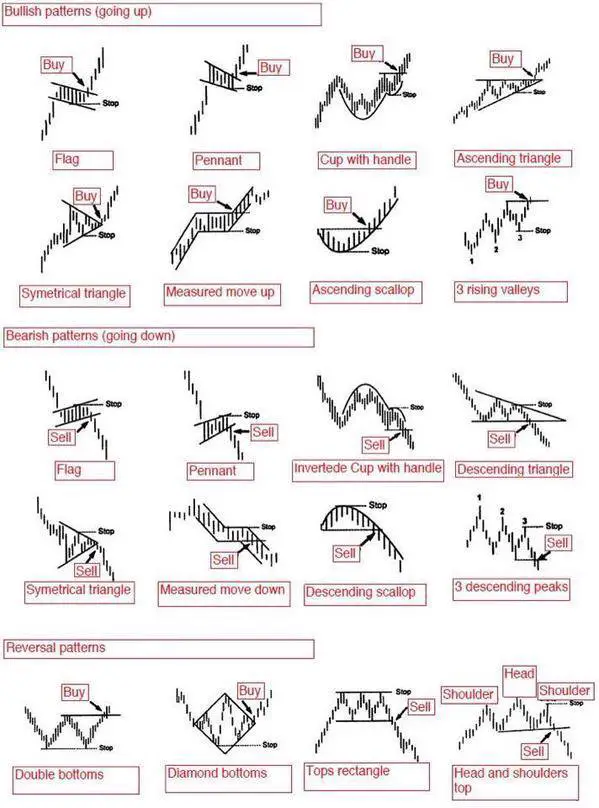

Key Traits of a V-Backside:

- Sharp Decline: The sample begins with a big and comparatively fast value drop, typically fueled by damaging information, panic promoting, or technical elements. This decline varieties the left-hand aspect of the "V."

- Reversal Level: The bottom level of the "V" represents the market backside. That is the essential level of the sample, signaling the potential finish of the downtrend. The pace and decisiveness of the reversal are essential for figuring out a real V-bottom.

- Sharp Ascent: After the reversal level, the worth swiftly strikes upwards, forming the right-hand aspect of the "V." This upward motion is pushed by renewed shopping for stress, typically fueled by discount looking, short-covering, or constructive information.

- Symmetry (Non-compulsory however Most well-liked): Whereas not strictly necessary, a symmetrical V-bottom, the place the decline and ascent are roughly equal when it comes to each pace and magnitude, strengthens the sample’s reliability. Nevertheless, asymmetrical V-bottoms, the place the ascent is steeper or shallower than the decline, are additionally potential.

- Restricted Consolidation: In contrast to U-bottom patterns which often exhibit a interval of consolidation on the backside, V-bottoms are characterised by minimal sideways buying and selling on the reversal level. The value motion is swift and decisive.

Figuring out a V-Backside Sample:

Figuring out a V-bottom requires cautious commentary of value motion and quantity. Here is a step-by-step information:

- Spot the Downtrend: First, determine a transparent and established downtrend. That is essential as a result of V-bottoms are reversal patterns; they point out the potential finish of a downtrend.

- Search for the Sharp Decline: Observe the sharp and comparatively fast decline in value. This decline ought to be extra pronounced than typical fluctuations throughout the downtrend.

- Establish the Reversal Level: The bottom level of the "V" is essential. This level marks the potential finish of the promoting stress and the start of shopping for stress.

- Observe the Sharp Ascent: A powerful and decisive upward motion following the reversal level confirms the potential for a V-bottom. This ascent ought to be comparatively fast and important.

- Analyze Quantity: Quantity evaluation can present worthwhile affirmation. Excessive quantity through the decline and growing quantity through the ascent usually strengthens the sample’s validity. Low quantity through the reversal might point out a weak sign.

- Take into account the Context: All the time think about the broader market context. Is the general market trending up or down? Are there any important information occasions or financial indicators that would affect the worth motion?

Affirmation of the V-Backside Sample:

Whereas the visible formation of a V-bottom is suggestive, affirmation is essential earlier than getting into a commerce. A number of indicators and strategies might help verify the validity of the sample:

- Shifting Averages: A bullish crossover of short-term shifting averages (e.g., 50-day MA) over long-term shifting averages (e.g., 200-day MA) can verify the upward development.

- Relative Energy Index (RSI): An RSI studying beneath 30 through the decline, adopted by a rebound above 50, suggests oversold situations and potential bullish momentum.

- MACD (Shifting Common Convergence Divergence): A bullish MACD crossover (the MACD line crossing above the sign line) can verify the upward development.

- Assist and Resistance Ranges: The reversal level ought to ideally be examined as a brand new help stage. The following value motion ought to bounce off this help, additional confirming the sample.

- Quantity Affirmation: Growing quantity through the upward transfer offers robust affirmation of the shopping for stress.

Buying and selling Methods for V-Backside Patterns:

The perfect entry level for an extended place in a V-bottom sample is after the affirmation of the reversal. Listed below are some frequent buying and selling methods:

- Breakout Technique: Anticipate a decisive break above the neckline (the horizontal line connecting the 2 troughs of the "V"). This signifies a affirmation of the upward development.

- Pullback Technique: Anticipate a slight pullback to the neckline or a not too long ago established help stage after the breakout. This offers a doubtlessly higher entry level with diminished threat.

- Cease-Loss Order: All the time use a stop-loss order to restrict potential losses. Place the stop-loss beneath the reversal level or barely beneath the latest low.

- Revenue Goal: Decide a revenue goal primarily based on the sample’s depth. A standard strategy is to set the revenue goal equal to the depth of the "V." Alternatively, merchants can use Fibonacci retracement ranges or different technical indicators to find out revenue targets.

Limitations of the V-Backside Sample:

Whereas the V-bottom sample could be a highly effective indicator, it isn’t foolproof. A number of limitations ought to be thought-about:

- False Breakouts: The value might break above the neckline however then fail to maintain the upward momentum, resulting in a false breakout.

- Market Volatility: V-bottoms typically happen in risky markets, growing the chance of whipsaws and sudden value actions.

- Subjectivity: Figuring out the exact reversal level and the sample’s boundaries may be subjective, resulting in differing interpretations amongst merchants.

- Affirmation Significance: Relying solely on the visible formation of the V-bottom with out affirmation from different indicators may be dangerous.

Conclusion:

The V-bottom chart sample represents a doubtlessly profitable reversal sign, indicating a shift from a downtrend to an uptrend. Nevertheless, profitable buying and selling utilizing this sample requires a radical understanding of its traits, cautious identification, strong affirmation, and a well-defined buying and selling technique. Merchants ought to at all times incorporate threat administration strategies, similar to stop-loss orders, and think about the broader market context earlier than getting into any trades primarily based on this sample. By combining the visible evaluation of the V-bottom with different technical indicators and sound threat administration practices, merchants can considerably enhance their possibilities of capitalizing on the potential alternatives introduced by this dynamic chart sample. Do not forget that previous efficiency isn’t indicative of future outcomes, and thorough due diligence is essential earlier than implementing any buying and selling technique.

Closure

Thus, we hope this text has offered worthwhile insights into Decoding the V-Backside Chart Sample: A Complete Information for Merchants. We respect your consideration to our article. See you in our subsequent article!