Decoding the V-Formed Chart Sample: A Complete Information for Merchants

Associated Articles: Decoding the V-Formed Chart Sample: A Complete Information for Merchants

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the V-Formed Chart Sample: A Complete Information for Merchants. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Decoding the V-Formed Chart Sample: A Complete Information for Merchants

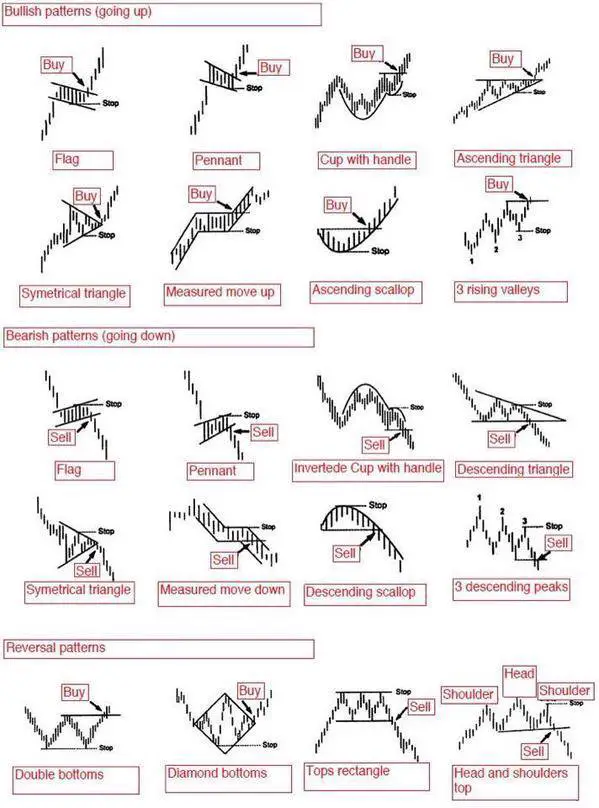

The world of technical evaluation is replete with chart patterns, every whispering potential insights into future worth actions. Amongst these, the V-shaped sample stands out for its dramatic visible illustration and the often-swift, highly effective worth reversals it suggests. Whereas not as widespread as different patterns like head and shoulders or triangles, understanding the V-shape’s traits, implications, and limitations is essential for any dealer aiming to reinforce their analytical expertise. This complete information delves into the intricacies of the V-shaped chart sample, exploring its formation, interpretation, affirmation strategies, threat administration methods, and real-world examples.

Understanding the V-Formed Sample:

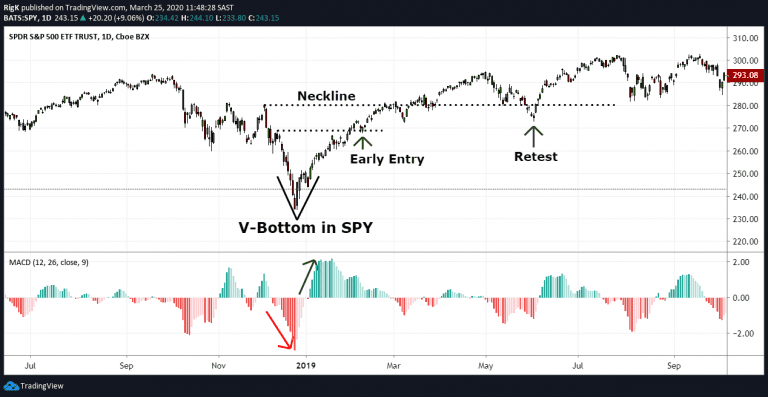

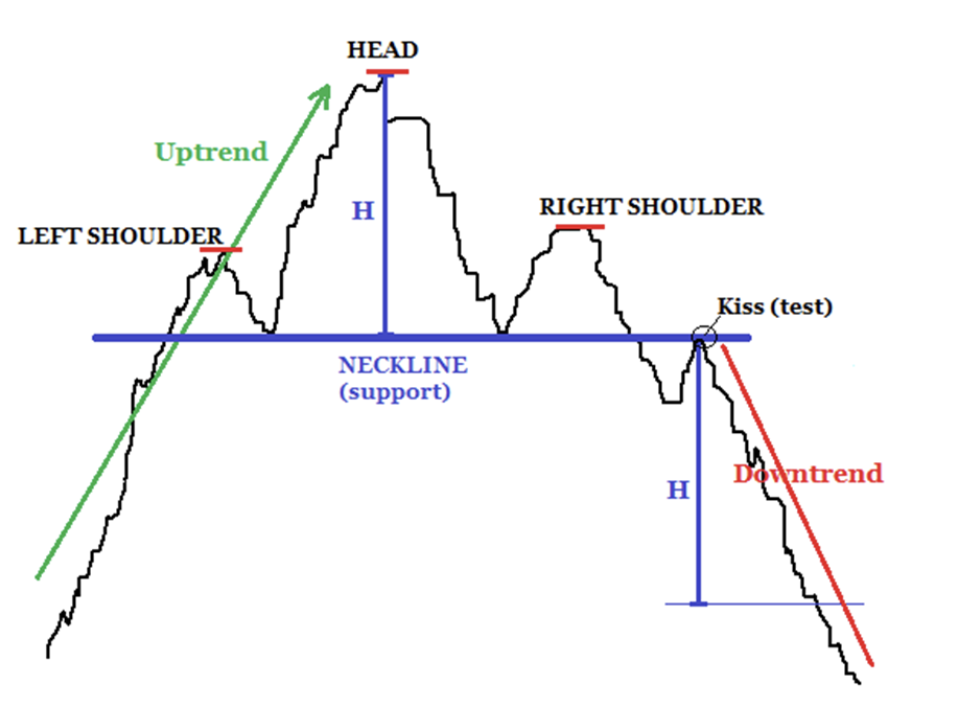

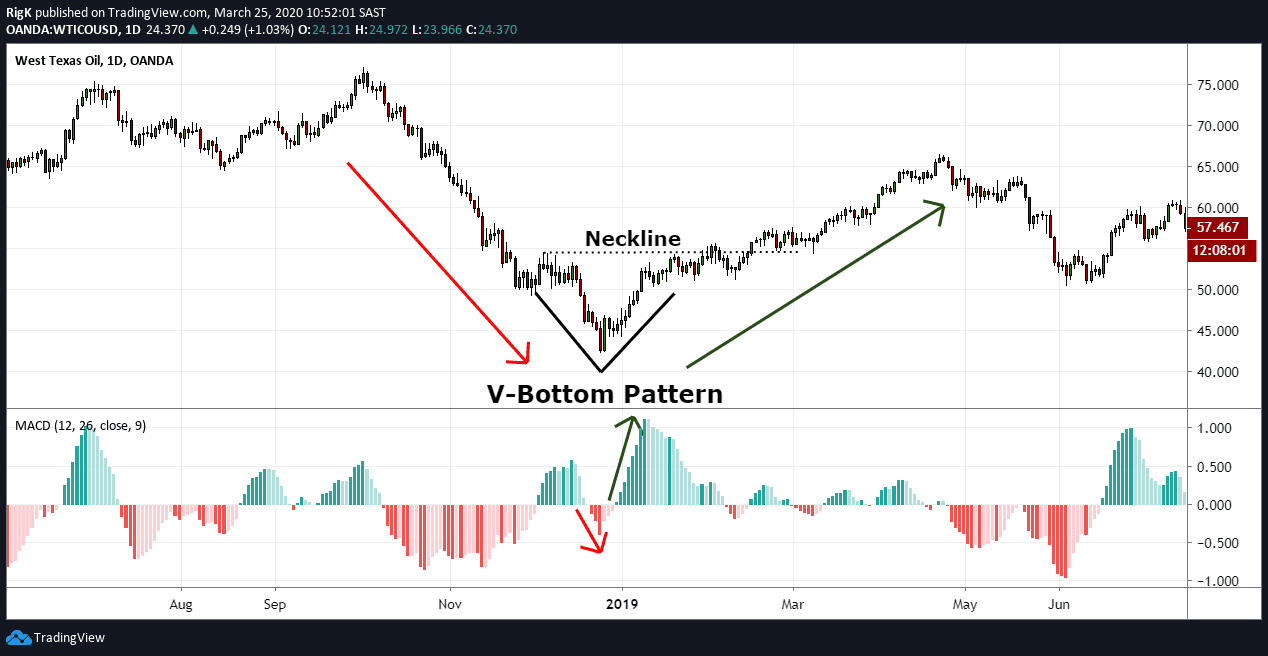

The V-shaped sample, as its title suggests, resembles the letter "V" on a worth chart. It is characterised by a pointy, fast decline adopted by an equally sharp and fast restoration. The decline part is often characterised by panic promoting, driving the worth down aggressively. That is then adopted by a swift reversal, usually triggered by shopping for strain, leading to a equally steep ascent again to, or past, earlier ranges. The "V" is created by the connection of the trough (lowest level) of the decline and the height (highest level) of the next restoration.

Key Traits of a V-Formed Reversal:

- Sharp Decline: The preliminary downward leg is characterised by a steep, nearly vertical drop in worth. This signifies a powerful bearish sentiment and infrequently happens quickly.

- Outlined Trough: A transparent, well-defined low level marks the underside of the "V". That is essential for figuring out the sample.

- Sharp Restoration: The restoration leg mirrors the decline, showcasing a fast and important worth improve. This means a shift in market sentiment in direction of bullishness.

- Symmetry (Optionally available however Most well-liked): Whereas not all the time completely symmetrical, a well-defined V-shape ideally displays an identical diploma of steepness in each the decline and restoration phases. Asymmetry can point out weaker reversal potential.

- Quick Length: V-shaped patterns usually kind over a comparatively brief interval, starting from a couple of days to a couple weeks. Longer-term formations are much less widespread and infrequently characterize a distinct sample altogether.

Formation and Interpretation:

The formation of a V-shaped sample usually displays a sudden shift in market sentiment. This shift might be triggered by numerous components, together with:

- Surprising optimistic information: A shock announcement, equivalent to a optimistic earnings report, profitable product launch, or regulatory approval, can quickly reverse bearish sentiment.

- Quick squeeze: A fast improve in shopping for strain can drive brief sellers to cowl their positions, resulting in a pointy worth improve.

- Technical components: Reaching a key help stage, a bullish candlestick sample forming on the trough, or a major improve in buying and selling quantity can contribute to the reversal.

- Market manipulation: Whereas much less widespread, manipulation can even contribute to the formation of V-shaped patterns.

Decoding a V-shaped sample requires cautious consideration of the context. Whereas the sample suggests a possible reversal, it is essential to search for affirmation indicators earlier than getting into a commerce. A standalone V-shape with out supporting proof is dangerous.

Affirmation Strategies:

A number of strategies might help verify the validity and potential of a V-shaped sample:

- Quantity Evaluation: Elevated quantity through the restoration part confirms shopping for strain and strengthens the reversal sign. Conversely, low quantity through the restoration raises issues concerning the sustainability of the uptrend.

- Technical Indicators: RSI (Relative Energy Index), MACD (Transferring Common Convergence Divergence), and Stochastic Oscillator can be utilized to determine oversold situations on the trough and ensure the bullish momentum through the restoration. Divergence between worth and these indicators can even present precious insights.

- Assist and Resistance Ranges: The sample’s formation and subsequent break above resistance ranges verify the energy of the reversal.

- Candlestick Patterns: Bullish candlestick patterns, equivalent to hammer or bullish engulfing patterns, on the trough additional reinforce the reversal sign.

- Transferring Averages: A break above a key transferring common, such because the 20-day or 50-day transferring common, can verify the upward development.

Threat Administration and Buying and selling Methods:

Buying and selling V-shaped patterns includes inherent dangers, given their swift and infrequently risky worth actions. Efficient threat administration is paramount:

- Cease-Loss Orders: Inserting a stop-loss order beneath the trough of the "V" is essential to restrict potential losses if the reversal fails.

- Place Sizing: Keep away from over-leveraging. Begin with smaller place sizes to handle threat successfully.

- Trailing Cease-Loss: As the worth rises, think about using a trailing stop-loss order to guard income and lock in good points.

- Affirmation is Key: By no means enter a commerce solely primarily based on the V-shape sample. All the time anticipate affirmation indicators from quantity, technical indicators, and different components.

- Take into account the Context: Analyze the broader market situations and the precise asset’s fundamentals earlier than getting into a commerce.

Limitations of the V-Formed Sample:

Whereas promising, the V-shaped sample is not foolproof. A number of limitations want consideration:

- False Breakouts: The sample can typically result in false breakouts, the place the worth briefly breaks above the resistance stage earlier than reversing downwards.

- Lack of Predictability: The period and magnitude of the worth restoration are unpredictable.

- Rarer Prevalence: In comparison with different patterns, V-shaped patterns are much less frequent, making alternatives much less plentiful.

- Susceptibility to Manipulation: As talked about earlier, the sample might be prone to market manipulation, making it essential to investigate the context rigorously.

Actual-World Examples:

Analyzing historic charts of assorted property can reveal situations of V-shaped patterns. Nonetheless, it is essential to keep in mind that previous efficiency is just not indicative of future outcomes. Finding out these examples must be performed along with a broader understanding of market dynamics and technical evaluation rules. Figuring out real-world examples requires meticulous chart evaluation and consideration of the encircling market context. It is extremely beneficial to make use of respected charting platforms with historic knowledge to conduct such evaluation.

Conclusion:

The V-shaped chart sample represents a strong visible indicator of potential worth reversals. Its sharp declines and recoveries usually sign dramatic shifts in market sentiment. Nonetheless, merchants should train warning and make use of sturdy threat administration methods. Relying solely on the V-shape is dangerous. Affirmation by quantity evaluation, technical indicators, and different components is essential earlier than getting into any commerce. By combining the understanding of this sample with a broader technical and basic evaluation strategy, merchants can considerably enhance their decision-making course of and doubtlessly capitalize on the alternatives offered by this distinctive chart formation. Keep in mind that steady studying and disciplined buying and selling are key to success within the dynamic world of economic markets.

Closure

Thus, we hope this text has supplied precious insights into Decoding the V-Formed Chart Sample: A Complete Information for Merchants. We thanks for taking the time to learn this text. See you in our subsequent article!