Decoding the W Sample: A Complete Information to Chart Sample Evaluation

Associated Articles: Decoding the W Sample: A Complete Information to Chart Sample Evaluation

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Decoding the W Sample: A Complete Information to Chart Sample Evaluation. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Decoding the W Sample: A Complete Information to Chart Sample Evaluation

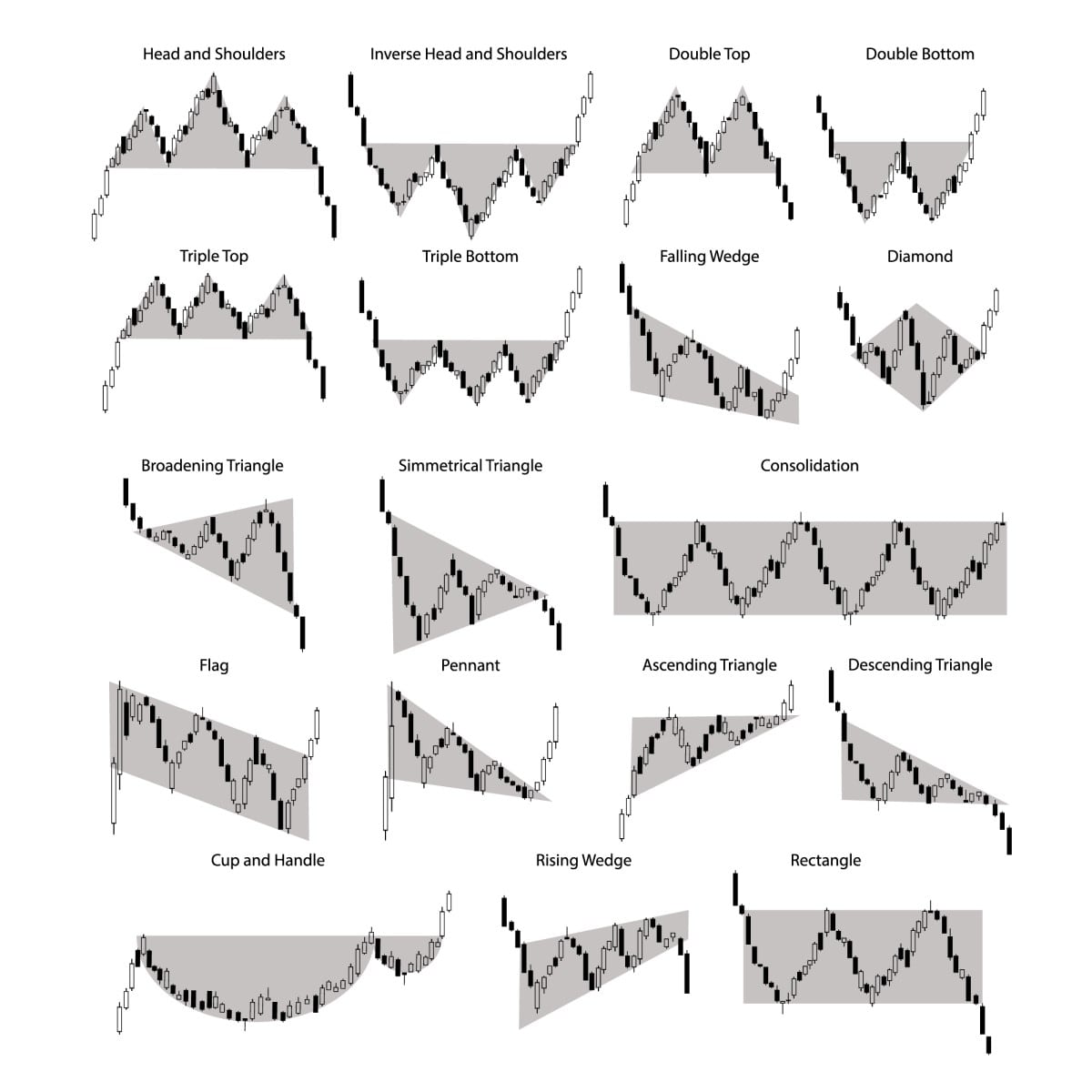

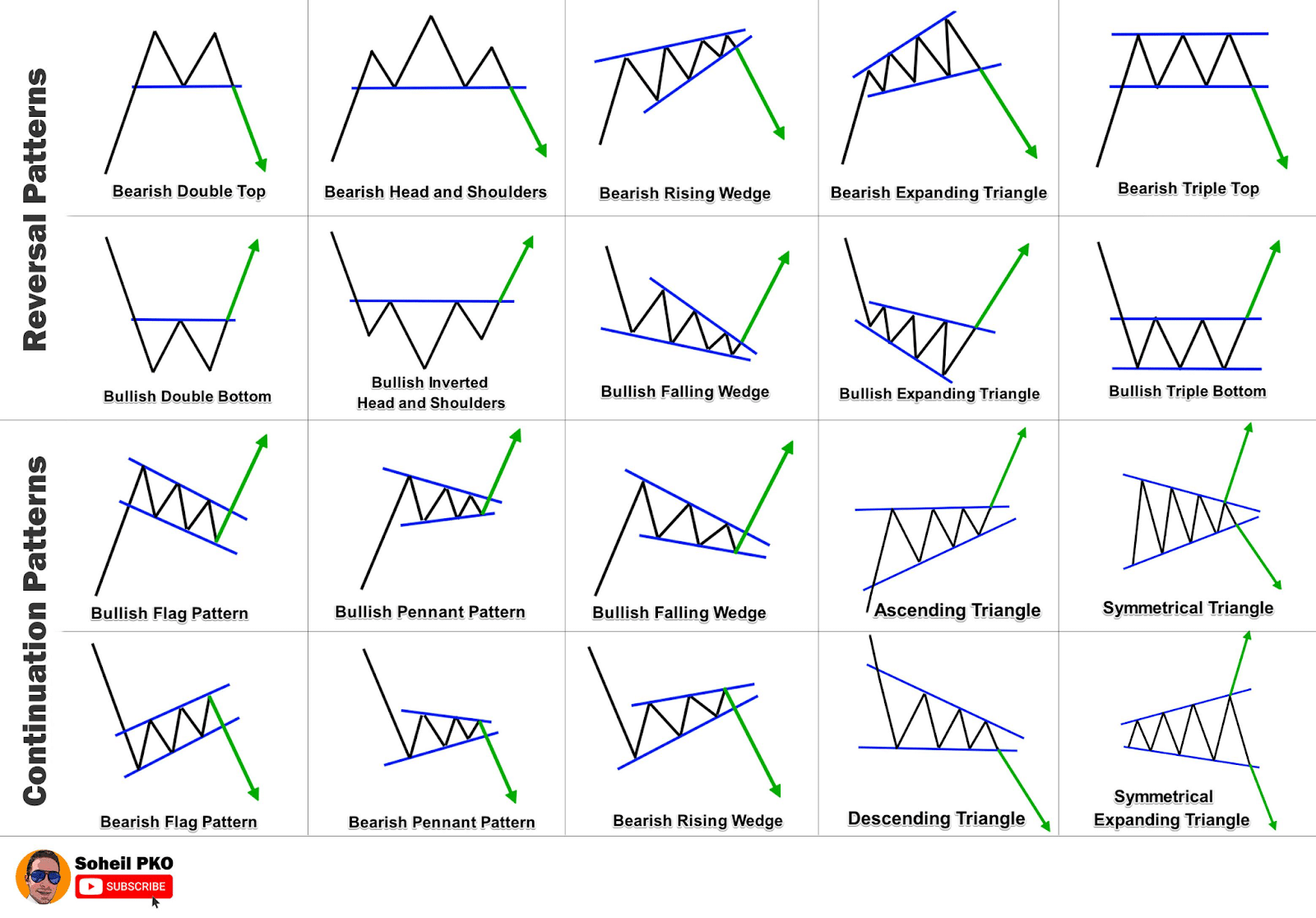

Chart patterns are visible representations of value actions in monetary markets, providing precious insights into potential future value motion. Among the many varied patterns merchants make the most of, the "W" sample, often known as a double backside or typically a "M" sample (its inverse), stands out for its potential to sign important value reversals. Whereas not as extensively mentioned as head and shoulders or triangles, understanding the W sample can considerably improve a dealer’s skill to establish worthwhile buying and selling alternatives. This text delves into the intricacies of the W sample, exploring its formation, identification, affirmation, and buying and selling methods.

Understanding the Formation of the W Sample:

The W sample is a reversal sample characterised by two distinct troughs (lows) separated by a rally (intermediate excessive). The sample visually resembles the letter "W," therefore its title. The formation signifies a possible shift in market sentiment from bearish to bullish. Let’s break down the elements:

-

First Trough (Left Backside): This marks the preliminary important low in value. It represents a interval of bearish strain, doubtlessly pushed by detrimental information, sell-offs, or total market weak spot. The amount related to this trough is essential; excessive quantity confirms the power of the promoting strain.

-

Rally (Intermediate Excessive): Following the primary trough, the value rallies, forming the next excessive. This rally is a short lived reversal, typically pushed by short-covering, cut price searching, or optimistic information. The amount throughout this rally can be essential; average quantity suggests a wholesome restoration, whereas excessively excessive quantity may point out a possible false breakout.

-

Second Trough (Proper Backside): That is the second important low, ideally near the extent of the primary trough. The value retraces a portion of the rally, earlier than discovering assist and bouncing again. Much like the primary trough, the quantity is essential; a decrease quantity in comparison with the primary trough might point out weakening promoting strain, enhancing the bullish potential.

-

Neckline (Resistance): The road connecting the 2 peaks (highs) of the rally kinds the neckline. A breakout above the neckline confirms the sample and alerts a possible upward pattern.

Key Traits of a Legitimate W Sample:

Not each "W"-shaped value motion constitutes a legitimate buying and selling sample. A number of traits assist distinguish a real W sample from random value fluctuations:

-

Symmetry: Whereas good symmetry is uncommon, the 2 troughs ought to be comparatively shut in value. Important discrepancies weaken the sample’s predictive energy.

-

Quantity: The amount ought to be comparatively excessive through the formation of the 2 troughs and comparatively decrease through the rally, indicating a shift in market sentiment. Excessive quantity on the breakout above the neckline additional confirms the sample.

-

Timeframe: The time it takes to type a W sample can range relying on the asset and timeframe. It might vary from days to weeks and even months.

-

Clear Help and Resistance Ranges: The sample ought to clearly present assist ranges on the troughs and resistance ranges on the peaks.

-

Affirmation: A profitable breakout above the neckline with elevated quantity supplies robust affirmation of the sample’s validity. Different indicators, comparable to transferring averages or RSI, may also be used to verify the bullish reversal.

Differentiating the W Sample from Different Patterns:

It is essential to distinguish the W sample from different related patterns to keep away from false alerts. These embody:

-

Double High (M Sample): The inverse of the W sample, forming a "M" form. This means a bearish reversal.

-

Head and Shoulders Sample: A extra complicated reversal sample with three distinct peaks, resembling a head and two shoulders.

-

Rounding Backside: A gradual U-shaped reversal sample.

Cautious commentary of the sample’s traits, quantity, and affirmation alerts is important to keep away from misinterpretations.

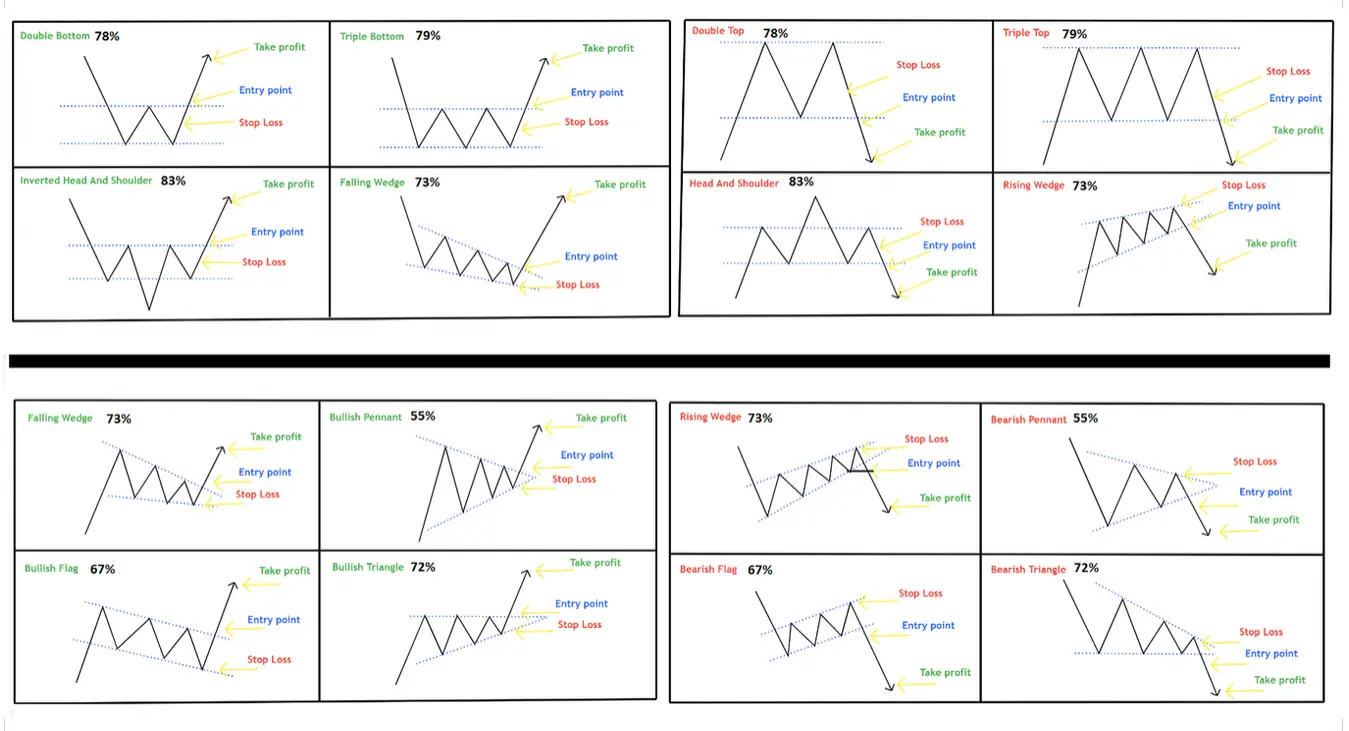

Buying and selling Methods Based mostly on the W Sample:

As soon as a confirmed W sample is recognized, a number of buying and selling methods might be employed:

-

Breakout Technique: This includes shopping for the asset as soon as it breaks above the neckline with elevated quantity. The stop-loss order ought to be positioned beneath the second trough. The take-profit goal might be set based mostly on the sample’s top, measured from the neckline to the bottom trough.

-

Pullback Technique: A extra conservative strategy includes ready for a slight pullback after the neckline breakout earlier than getting into a protracted place. This reduces the chance of getting into at a neighborhood excessive.

-

Affirmation with Indicators: Combining the W sample with technical indicators like RSI, MACD, or transferring averages can present additional affirmation and enhance the accuracy of buying and selling alerts. For instance, a bullish divergence between the value and RSI can strengthen the bullish sign.

Danger Administration and Issues:

As with all buying and selling technique, threat administration is paramount when buying and selling the W sample:

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses. Inserting the stop-loss beneath the second trough is a typical apply.

-

Place Sizing: Keep away from over-leveraging and handle place measurement appropriately to mitigate threat.

-

False Breakouts: Concentrate on the opportunity of false breakouts, the place the value briefly breaks above the neckline earlier than reversing. Affirmation from different indicators will help reduce this threat.

-

Market Context: At all times take into account the broader market context and total pattern earlier than getting into a commerce. A bullish W sample in a powerful bearish market may not be dependable.

Conclusion:

The W sample is a strong chart sample that may sign potential value reversals. By understanding its formation, traits, and affirmation alerts, merchants can considerably enhance their skill to establish worthwhile buying and selling alternatives. Nevertheless, it is essential to do not forget that no chart sample ensures success. Combining sample recognition with sound threat administration and an intensive understanding of market dynamics is important for constant profitability. Diligent apply, backtesting, and steady studying are very important for mastering the artwork of chart sample evaluation and successfully using the W sample in your buying and selling technique. Bear in mind to at all times conduct thorough analysis and take into account consulting with a monetary advisor earlier than making any funding choices.

Closure

Thus, we hope this text has supplied precious insights into Decoding the W Sample: A Complete Information to Chart Sample Evaluation. We recognize your consideration to our article. See you in our subsequent article!