Decoding the W Sample: A Complete Information to Chart Buying and selling

Associated Articles: Decoding the W Sample: A Complete Information to Chart Buying and selling

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the W Sample: A Complete Information to Chart Buying and selling. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the W Sample: A Complete Information to Chart Buying and selling

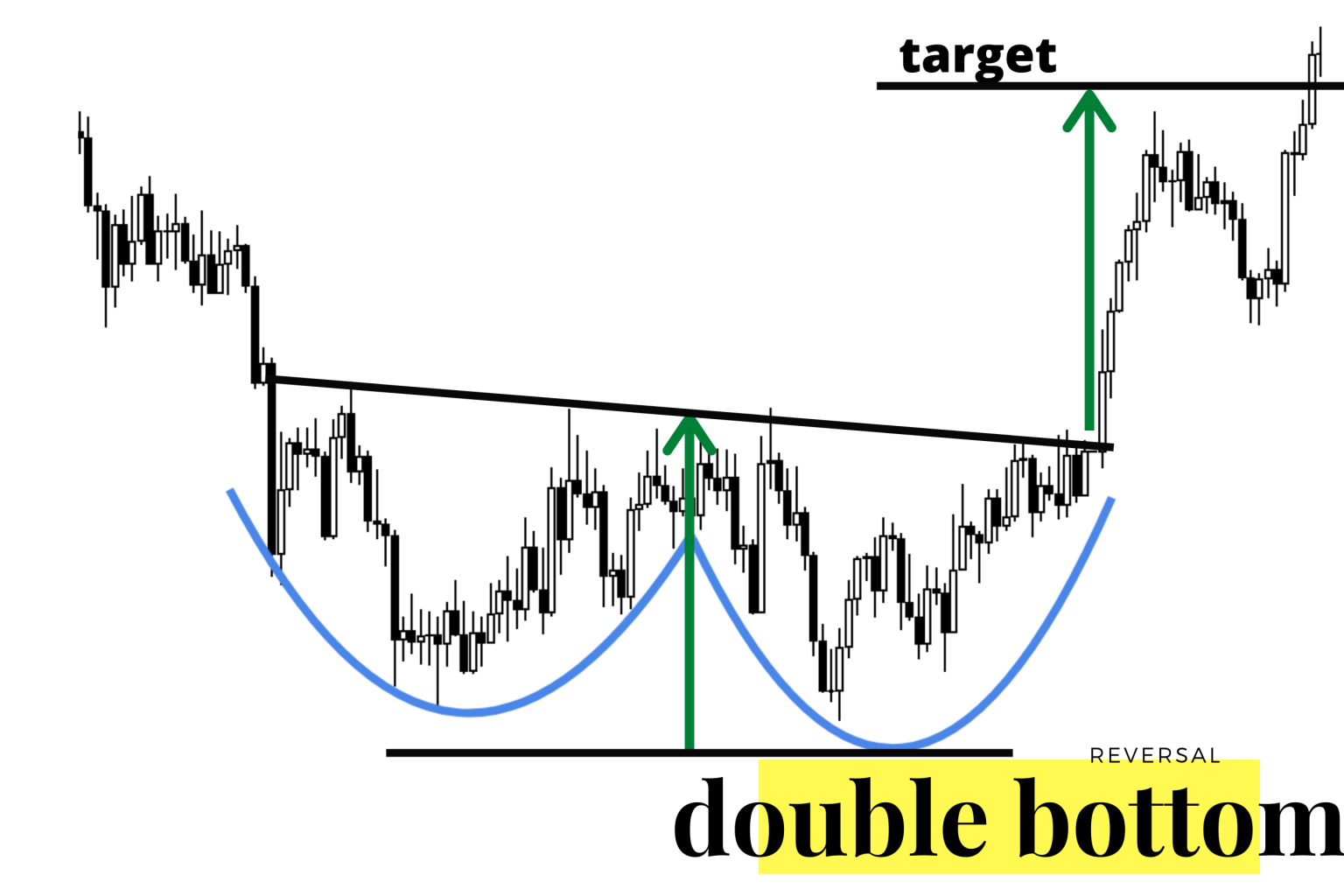

The world of technical evaluation is wealthy with patterns, every whispering potential buying and selling alternatives. Amongst these, the W sample, also referred to as the double backside, stands out for its reliability and clear sign technology. Whereas not foolproof, understanding the formation, affirmation, and danger administration facets of the W sample can considerably improve a dealer’s success fee. This text delves deep into the intricacies of W sample chart buying and selling, equipping you with the data to establish, interpret, and capitalize on this highly effective reversal sample.

Understanding the W Sample Formation:

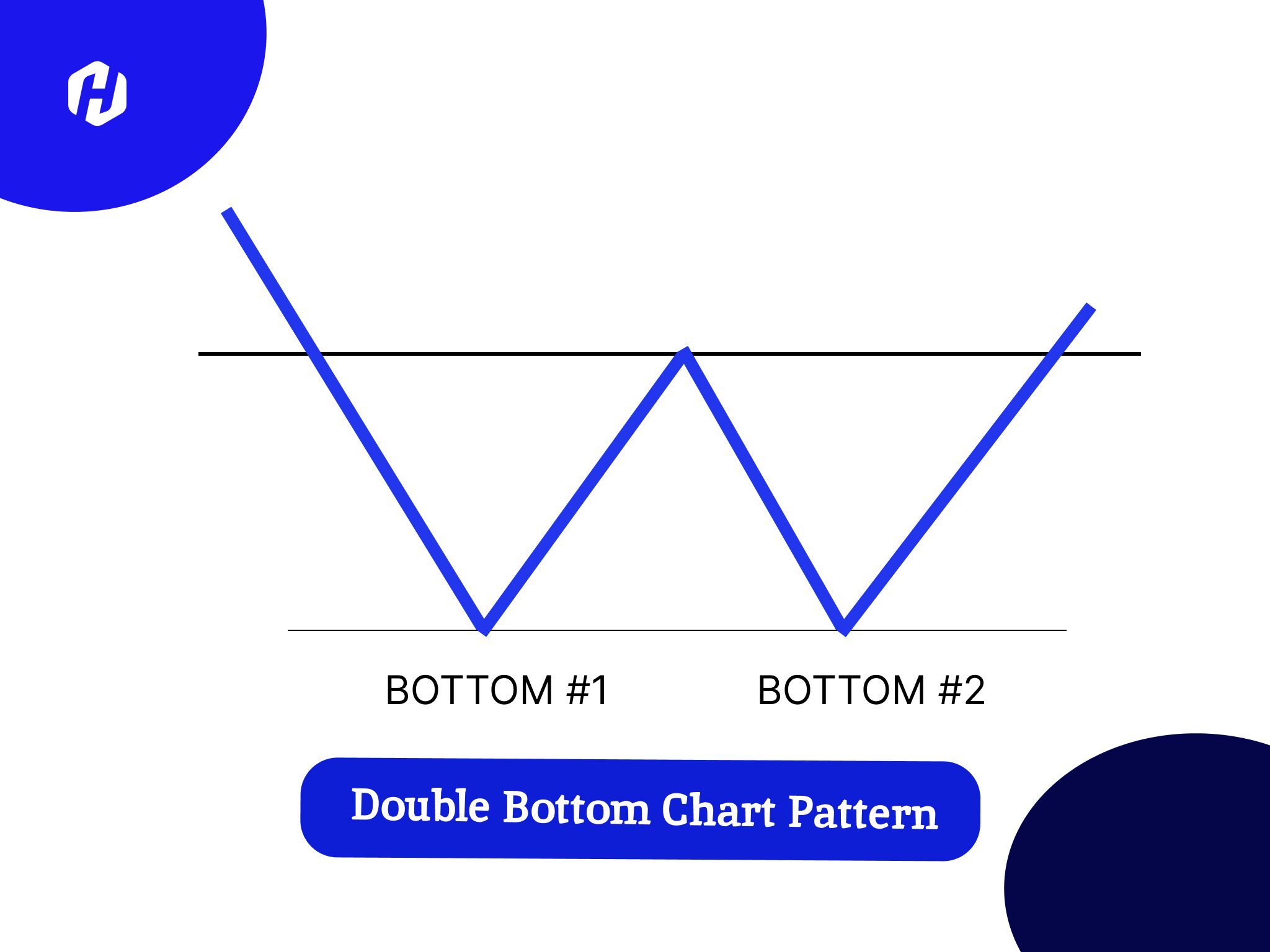

The W sample is a bullish reversal sample, that means it indicators a possible shift from a downtrend to an uptrend. Its title derives from its visible resemblance to the letter "W" on a value chart. The formation consists of two distinct troughs (lows) related by the next intervening peak (excessive). Let’s break down the parts:

-

First Trough (Left Shoulder): This marks the preliminary low level within the downtrend. The worth experiences vital promoting strain, resulting in a decline. This trough represents a possible space of help.

-

Intervening Peak (Head): After the primary trough, the value rallies, forming a peak. This rally is usually short-lived and represents a brief reversal of the downtrend. The worth does not attain earlier highs, suggesting waning promoting strain.

-

Second Trough (Proper Shoulder): Following the intervening peak, the value retraces, forming a second trough. Ideally, this second trough must be roughly on the similar stage as the primary trough, confirming the sample’s energy. This second trough demonstrates a retest of the help stage established by the primary trough.

-

Neckline: A vital component of the W sample is the neckline. This can be a trendline connecting the 2 peaks (the pinnacle and the precise shoulder’s peak). The neckline acts as a resistance stage. A decisive break above the neckline confirms the sample and triggers a bullish sign.

Figuring out a Legitimate W Sample:

Not each dip resembling a "W" is a legitimate buying and selling sign. A number of components decide the validity and energy of a W sample:

-

Symmetry: The best W sample displays symmetry between the 2 troughs. Whereas good symmetry is uncommon, a comparatively shut resemblance in depth between the 2 troughs enhances the sample’s reliability.

-

Quantity Affirmation: Quantity performs a essential function in confirming the W sample. Ideally, quantity must be comparatively excessive through the preliminary downtrend, lower through the intervening peak, and enhance once more as the value breaks above the neckline. This signifies rising shopping for strain.

-

Time Body: The timeframe thought of for the sample formation issues. A W sample shaped on a day by day chart holds extra significance than one shaped on a 5-minute chart. The longer the timeframe, the extra vital the potential value motion.

-

Neckline Break: The decisive break above the neckline is probably the most essential affirmation sign. A powerful and sustained break above the neckline, accompanied by elevated quantity, strengthens the bullish sign. A weak or false break can result in losses.

-

Contextual Evaluation: It is important to think about the broader market context. Is the general market trending upwards? Are there any vital information occasions or financial indicators which may affect the value motion? Contextual evaluation enhances the accuracy of the prediction.

Buying and selling Methods with the W Sample:

As soon as a legitimate W sample is recognized and confirmed, a number of buying and selling methods may be employed:

-

Breakout Buying and selling: This includes getting into a protracted place as soon as the value decisively breaks above the neckline. A stop-loss order must be positioned beneath the second trough to restrict potential losses. The take-profit order may be set based mostly on the sample’s top (the gap between the neckline and the intervening peak).

-

Pullback Buying and selling: Some merchants desire to attend for a slight pullback after the neckline break earlier than getting into a protracted place. This technique reduces the chance of getting into at a excessive value. Nevertheless, it additionally carries the chance of lacking a good portion of the upward motion.

-

Trailing Cease-Loss: Utilizing a trailing stop-loss order permits merchants to lock in income whereas minimizing potential losses. The stop-loss order is adjusted upwards as the value will increase, making certain that a good portion of the revenue is preserved even when the value retraces.

Threat Administration in W Sample Buying and selling:

Threat administration is paramount in any buying and selling technique, and the W sample is not any exception. Listed below are some essential danger administration issues:

-

Cease-Loss Orders: At all times use stop-loss orders to restrict potential losses. Place the stop-loss order beneath the second trough.

-

Place Sizing: By no means danger extra capital than you possibly can afford to lose. Decide the suitable place dimension based mostly in your danger tolerance and account stability.

-

Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout completely different belongings and buying and selling methods to cut back total danger.

-

False Breakouts: Pay attention to the potential of false breakouts. A false breakout happens when the value briefly breaks above the neckline however then reverses route. This could result in vital losses if not correctly managed. Search for affirmation indicators, akin to elevated quantity and sustained value motion above the neckline, earlier than getting into a commerce.

Superior Issues:

-

Measuring the Potential Revenue: The space between the neckline and the intervening peak can be utilized as a possible goal for the value motion after a breakout. This can be a easy projection methodology, nevertheless it’s essential to do not forget that market situations can considerably have an effect on the precise value motion.

-

Combining with different indicators: Utilizing the W sample at the side of different technical indicators, akin to shifting averages, RSI, or MACD, can improve the accuracy of the buying and selling indicators. For instance, a bullish divergence between the value and the RSI can affirm the bullish sign of the W sample.

-

Figuring out Inverted W Patterns (M Patterns): The inverted W sample, or double high (M sample), is a bearish reversal sample. Understanding this sample is equally vital for brief promoting alternatives.

Conclusion:

The W sample is a robust software for figuring out potential reversal factors available in the market. Nevertheless, it is essential to know the sample’s formation, affirmation indicators, and danger administration methods. By combining technical evaluation with sound danger administration practices and an intensive understanding of market context, merchants can considerably enhance their probabilities of success when using the W sample of their buying and selling methods. Keep in mind that no buying and selling technique is foolproof, and steady studying and adaptation are essential for long-term success within the dynamic world of economic markets. At all times follow accountable buying and selling and think about searching for skilled monetary recommendation earlier than making any funding choices.

Closure

Thus, we hope this text has supplied invaluable insights into Decoding the W Sample: A Complete Information to Chart Buying and selling. We admire your consideration to our article. See you in our subsequent article!