Decoding the W Sample Chart: A Complete Information for Merchants

Associated Articles: Decoding the W Sample Chart: A Complete Information for Merchants

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the W Sample Chart: A Complete Information for Merchants. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Decoding the W Sample Chart: A Complete Information for Merchants

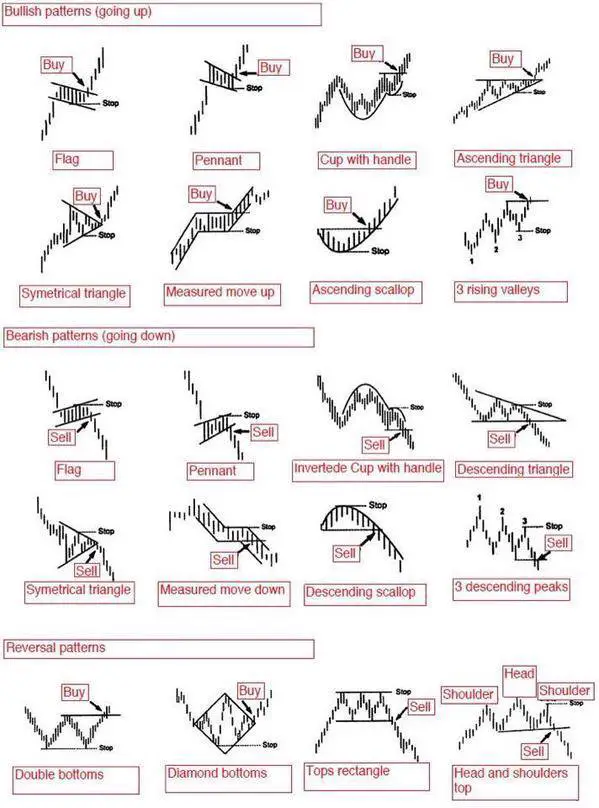

The W sample, a robust chart formation in technical evaluation, signifies a possible reversal in a prevailing pattern. Recognizing and understanding this sample may be essential for merchants looking for to capitalize on market shifts. In contrast to less complicated formations, the W sample, often known as a double backside, requires a eager eye for element and an intensive understanding of its traits to keep away from false indicators. This text will delve into the intricacies of the W sample, protecting its identification, affirmation methods, danger administration, and sensible functions.

Understanding the Formation:

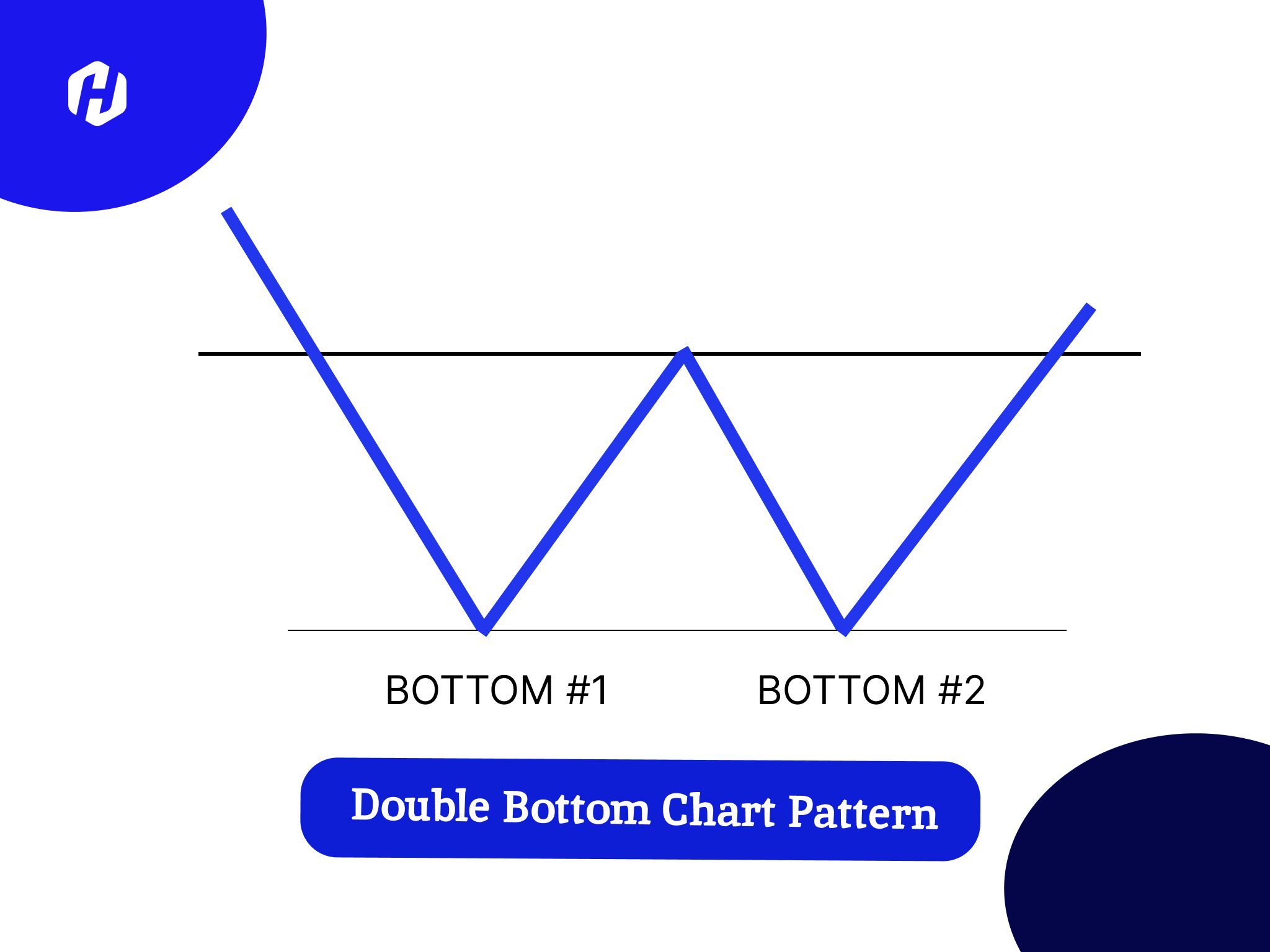

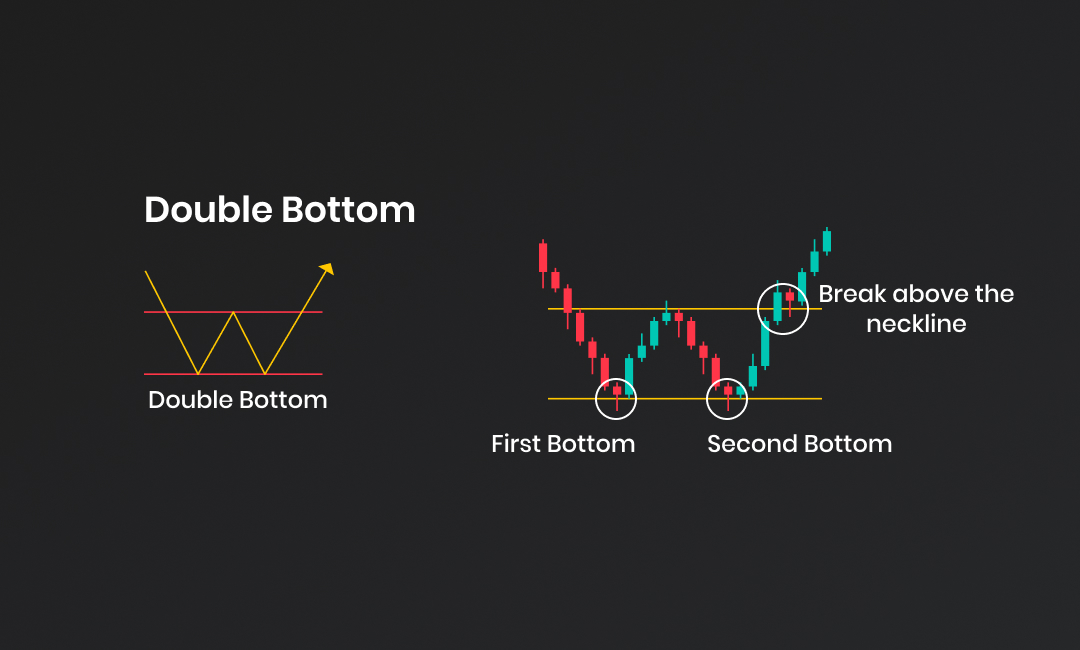

The W sample is characterised by two distinct troughs (lows) separated by an intervening peak (excessive). The sample’s title derives from its resemblance to the letter "W" on a worth chart. The 2 troughs ideally must be roughly equal in worth, though minor discrepancies are acceptable. The intervening peak, sometimes called the "reversal level," represents a short lived restoration earlier than the value resumes its downward trajectory. The general construction suggests a interval of promoting strain adopted by a short lived bounce, after which a renewed wave of promoting.

Key Traits of a Legitimate W Sample:

A number of components contribute to the validity and reliability of a W sample:

-

Neckline: An important component is the neckline, a horizontal or barely sloping line connecting the 2 troughs. A break above this neckline confirms the sample and indicators a possible bullish reversal. The power of the breakout above the neckline is commonly indicative of the potential worth motion.

-

Quantity: Quantity evaluation performs a major position in confirming the W sample. Ideally, quantity must be comparatively low in the course of the formation of the 2 troughs, indicating a scarcity of conviction within the promoting strain. Conversely, a surge in quantity accompanying the breakout above the neckline signifies sturdy shopping for strain and enhances the validity of the reversal sign.

-

Depth of the Troughs: The depth of the troughs influences the potential magnitude of the value motion after the breakout. Deeper troughs typically counsel a stronger reversal sign and a larger potential worth appreciation.

-

Symmetry: Whereas not strictly obligatory, a symmetrical sample, the place the 2 troughs are practically equal in worth and the 2 slopes are comparatively related, will increase the reliability of the sign.

-

Timeframe: The timeframe wherein the W sample kinds is essential. A W sample forming on a every day chart, as an illustration, signifies a longer-term reversal, whereas a sample on a 5-minute chart might sign a shorter-term alternative.

Affirmation Methods:

Figuring out a possible W sample is barely step one. Affirmation is crucial to scale back the chance of false indicators. A number of methods may be employed to reinforce confidence within the commerce:

-

Breakout above the Neckline: As talked about earlier, a transparent and decisive breakout above the neckline, ideally with elevated quantity, supplies sturdy affirmation.

-

Shifting Common Crossover: A bullish crossover of a short-term shifting common (e.g., 50-period) above a longer-term shifting common (e.g., 200-period) can strengthen the bullish sign.

-

RSI Divergence: A bullish divergence happens when the value makes a decrease low, however the RSI (Relative Energy Index) kinds the next low. This means weakening promoting strain and potential bullish momentum.

-

MACD Crossover: A bullish crossover of the MACD (Shifting Common Convergence Divergence) line above its sign line can even corroborate the bullish reversal.

-

Assist and Resistance Ranges: The neckline itself typically acts as a help degree after the breakout. Observing how the value interacts with different help and resistance ranges can present additional affirmation.

Threat Administration Concerns:

Buying and selling the W sample, like some other buying and selling technique, includes danger. Correct danger administration is crucial to guard capital and keep away from vital losses:

-

Cease-Loss Order: A stop-loss order must be positioned under the bottom trough of the W sample. This limits potential losses if the breakout fails. The location of the stop-loss order ought to contemplate the volatility of the asset being traded.

-

Place Sizing: By no means danger greater than a small share of your buying and selling capital on a single commerce. Place sizing must be decided based mostly in your danger tolerance and the potential reward-to-risk ratio.

-

Trailing Cease-Loss: As soon as the commerce is worthwhile, think about using a trailing stop-loss order to lock in income and defend towards potential reversals.

-

Cash Administration: Adhere to a strict cash administration plan, whatever the buying and selling technique employed. This includes setting real looking revenue targets and adhering to pre-determined danger limits.

Sensible Functions and Examples:

The W sample may be utilized to varied asset lessons, together with shares, foreign exchange, commodities, and cryptocurrencies. Nevertheless, the reliability of the sample can differ relying available on the market circumstances and the particular asset being traded. As an illustration, in extremely unstable markets, the sample could also be much less dependable.

Instance State of affairs:

Think about a inventory buying and selling at $50. The worth declines to $45, then rallies to $48, and subsequently drops once more to $45 earlier than breaking decisively above $48 (the neckline). This kinds a transparent W sample. A dealer might enter a protracted place above $48 with a stop-loss order positioned under $45. The goal worth might be decided based mostly on the sample’s depth and the general market pattern.

Limitations and False Alerts:

It is essential to acknowledge that the W sample, like every technical indicator, just isn’t foolproof. False indicators can happen, resulting in losses. Some components that may contribute to false indicators embody:

-

Inadequate Quantity: A breakout above the neckline with out vital quantity enhance could also be a false sign.

-

Lack of Affirmation: Absence of affirmation from different technical indicators or worth motion can counsel a weak sign.

-

Market Manipulation: In manipulated markets, the sample could also be artificially created to lure merchants into false trades.

-

Poor Sample Formation: Patterns that lack symmetry or have considerably unequal troughs are much less dependable.

Conclusion:

The W sample is a helpful device in a dealer’s arsenal, providing potential insights into market reversals. Nevertheless, it is essential to make use of it at the side of different technical indicators and basic evaluation to enhance accuracy and decrease danger. Understanding the important thing traits, affirmation methods, and danger administration ideas is paramount to efficiently buying and selling the W sample. Bear in mind, self-discipline, endurance, and an intensive understanding of market dynamics are important for constant success in buying and selling. By no means rely solely on a single indicator; at all times make use of a holistic strategy to buying and selling that includes varied instruments and methods. Repeatedly refine your understanding of chart patterns and adapt your methods as market circumstances evolve.

Closure

Thus, we hope this text has offered helpful insights into Decoding the W Sample Chart: A Complete Information for Merchants. We admire your consideration to our article. See you in our subsequent article!