Decoding the W Sample Chart: A Complete Information to its Formation, Interpretation, and Buying and selling Implications

Associated Articles: Decoding the W Sample Chart: A Complete Information to its Formation, Interpretation, and Buying and selling Implications

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Decoding the W Sample Chart: A Complete Information to its Formation, Interpretation, and Buying and selling Implications. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Decoding the W Sample Chart: A Complete Information to its Formation, Interpretation, and Buying and selling Implications

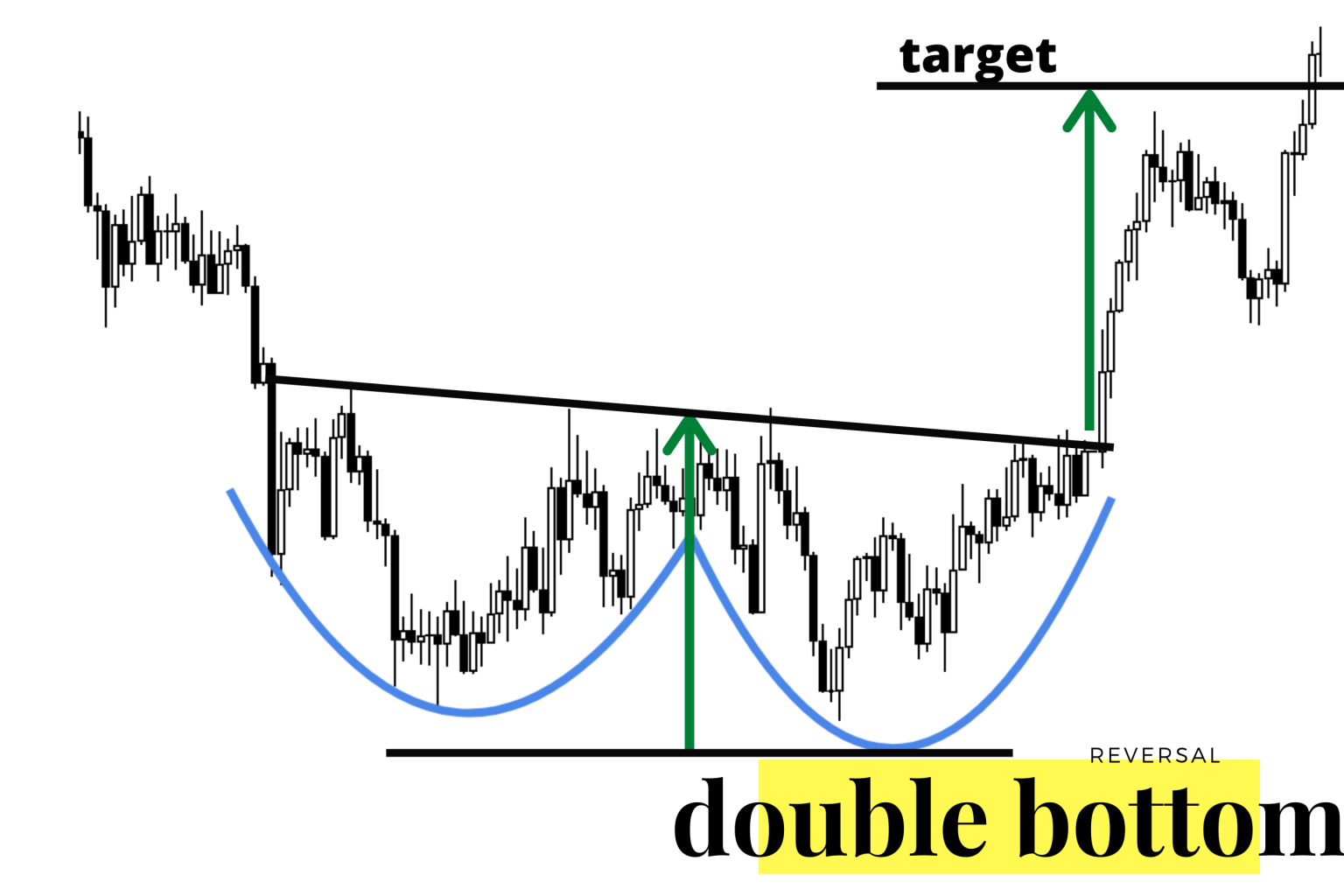

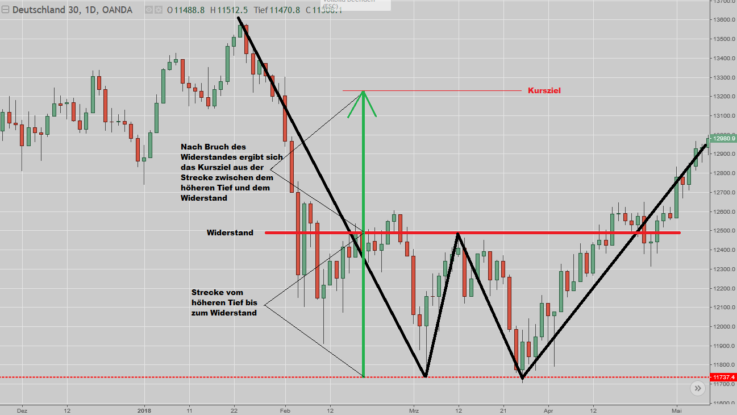

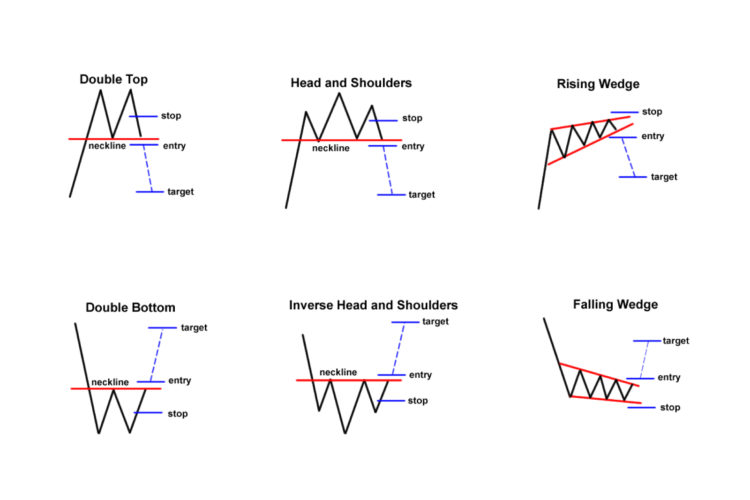

The W sample, often known as a double backside, is a well known chart sample in technical evaluation that alerts a possible bullish reversal. Its distinctive form, resembling the letter "W," signifies a interval of worth decline adopted by a rebound, suggesting a shift in market sentiment from bearish to bullish. Whereas seemingly easy, understanding the nuances of the W sample—its formation, affirmation, and danger administration—is essential for profitable buying and selling. This text delves deep into the W sample, exploring its traits, interpretation methods, and sensible functions in several market contexts.

Formation of the W Sample:

The W sample is characterised by two distinct troughs (lows) related by a rally, forming the "W" form. Let’s break down the important thing parts:

-

First Trough (Low 1): This marks the preliminary vital worth decline. It represents a degree the place promoting strain has overwhelmed shopping for strain, driving the value to a low. The depth and period of this decline are vital components in figuring out the sample’s potential power.

-

Rally (B): Following the primary trough, a worth rally ensues. This upward motion is pushed by consumers stepping in, doubtlessly as a result of oversold circumstances, optimistic information, or a change in market sentiment. The rally does not essentially want to succeed in the earlier excessive; a major bounce is ample.

-

Second Trough (Low 2): After the rally, the value retraces, forming the second trough (Low 2). Ideally, this second trough needs to be comparatively shut in worth to the primary trough (Low 1), inside an affordable vary (usually 5-10%, relying on the timeframe and volatility of the asset). This affirmation of assist at an identical worth degree reinforces the potential reversal.

-

Neckline (Resistance): The road connecting the very best factors of the 2 rallies (between Low 1 and Low 2) types the neckline. This neckline acts as an important resistance degree. A breakout above the neckline confirms the sample and alerts a possible bullish continuation.

-

Proper Shoulder (C): The worth rally after the second trough types the precise shoulder of the "W". This rally ought to ideally surpass the neckline, confirming the bullish breakout.

Figuring out a Legitimate W Sample:

Not each "W"-shaped worth motion constitutes a sound W sample. A number of components contribute to validating the sample’s reliability:

-

Quantity Affirmation: A lower in quantity through the formation of the 2 troughs suggests weakening promoting strain, whereas a rise in quantity through the breakout above the neckline confirms the bullish reversal. This quantity evaluation strengthens the sample’s predictive energy.

-

Timeframe Consistency: The sample’s reliability is dependent upon the timeframe thought of. A W sample shaped on a every day chart carries extra weight than one shaped on a 5-minute chart. The timeframe ought to align with the dealer’s buying and selling technique and danger tolerance.

-

Neckline Breakout: A decisive breakout above the neckline is crucial for confirming the sample. A weak or false breakout usually results in disappointment and potential losses. The breakout ought to ideally be accompanied by elevated quantity.

-

Symmetry: Whereas not strictly needed, a symmetrical W sample, the place the 2 troughs are roughly equal in depth, is mostly thought of stronger and extra dependable.

-

Assist and Resistance Ranges: The sample’s formation ought to ideally coincide with current assist and resistance ranges. The presence of those ranges reinforces the sample’s significance and potential for worth reversal.

Buying and selling Methods with the W Sample:

As soon as a confirmed W sample is recognized, a number of buying and selling methods may be employed:

-

Breakout Technique: The commonest technique includes shopping for the asset as soon as the value decisively breaks above the neckline. The stop-loss order needs to be positioned beneath the second trough (Low 2) to restrict potential losses. The revenue goal may be set based mostly on the sample’s peak (the space between the neckline and the second trough).

-

Pullback Technique: A extra conservative method includes ready for a slight pullback after the neckline breakout. This pullback gives a greater entry level with decrease danger, but it surely additionally will increase the possibility of lacking out on the preliminary worth surge.

-

Mixture Technique: Combining each breakout and pullback methods can optimize risk-reward ratios. A portion of the buying and selling capital may be deployed on the breakout, whereas the remaining portion may be deployed on a possible pullback.

Threat Administration and Concerns:

Buying and selling the W sample, like every technical evaluation sample, includes inherent dangers. Efficient danger administration is essential:

-

Cease-Loss Orders: All the time use stop-loss orders to restrict potential losses. Putting the stop-loss beneath the second trough (Low 2) is a standard apply.

-

Place Sizing: By no means danger greater than a small share of your buying and selling capital on a single commerce. Applicable place sizing helps handle danger and stop vital losses.

-

False Breakouts: Pay attention to the opportunity of false breakouts. A weak breakout above the neckline would possibly result in a worth reversal, leading to losses. Affirmation by way of quantity and different technical indicators is essential.

-

Market Context: Contemplate the general market context earlier than buying and selling the W sample. A bullish W sample in a bearish market won’t be dependable. Basic evaluation can present helpful insights into the market’s total course.

Limitations of the W Sample:

Whereas the W sample could be a useful gizmo, it is essential to acknowledge its limitations:

-

Subjectivity: Figuring out the exact factors of the troughs and the neckline may be subjective, resulting in variations in interpretation.

-

False Indicators: The sample can generate false alerts, particularly in unstable markets. Affirmation by way of different technical indicators and elementary evaluation is essential.

-

Not a Assure: The W sample does not assure a worth reversal. It merely suggests a possible change in market sentiment.

Conclusion:

The W sample, or double backside, is a helpful instrument in a dealer’s arsenal. Its capacity to sign potential bullish reversals may be extremely worthwhile when used accurately. Nevertheless, profitable buying and selling with the W sample requires a deep understanding of its formation, affirmation standards, and danger administration methods. Combining the W sample with different technical indicators and elementary evaluation enhances its predictive energy and reduces the chance of false alerts. Keep in mind that no technical sample ensures success, and prudent danger administration is paramount to sustainable buying and selling profitability. Steady studying and adaptation are important for mastering the artwork of figuring out and buying and selling the W sample successfully.

Closure

Thus, we hope this text has supplied helpful insights into Decoding the W Sample Chart: A Complete Information to its Formation, Interpretation, and Buying and selling Implications. We hope you discover this text informative and useful. See you in our subsequent article!