Decoding the Entire Life Insurance coverage Charges Chart: A Complete Information

Associated Articles: Decoding the Entire Life Insurance coverage Charges Chart: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Decoding the Entire Life Insurance coverage Charges Chart: A Complete Information. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Decoding the Entire Life Insurance coverage Charges Chart: A Complete Information

Entire life insurance coverage, a cornerstone of everlasting life insurance coverage, affords lifelong protection and a money worth element that grows tax-deferred. Understanding its value, nevertheless, requires navigating the complexities of complete life insurance coverage charges charts. This text delves into the intricacies of those charts, explaining the elements influencing charges, how you can interpret them, and what to think about earlier than buying a coverage.

Understanding the Constructing Blocks of Entire Life Insurance coverage Charges

Earlier than diving into the charts themselves, it is essential to know the basic elements that decide your complete life insurance coverage premiums:

-

Age: That is arguably essentially the most vital issue. Youthful candidates typically qualify for decrease charges as a result of they’ve a statistically longer life expectancy. The older you’re while you apply, the upper your premium shall be. Charges sometimes improve considerably with every age bracket.

-

Well being: Your well being standing performs a significant function. Candidates with pre-existing situations, equivalent to coronary heart illness, diabetes, or most cancers, will doubtless face increased premiums and even be denied protection altogether. Underwriters rigorously evaluation medical historical past, together with present medicines, household historical past, and way of life selections (smoking, alcohol consumption).

-

Gender: Historically, girls have loved decrease charges than males resulting from statistically increased life expectations. Nonetheless, this hole is narrowing, and a few insurers are transferring in the direction of gender-neutral pricing.

-

Dying Profit: The quantity of protection you select immediately impacts your premium. The next dying profit necessitates a better premium to compensate for the elevated danger the insurer assumes.

-

Coverage Sort: Whereas we’re specializing in complete life insurance coverage, there are variations inside this class. Variations in money worth accumulation charges and the kinds of riders (further advantages) chosen can have an effect on premiums. A coverage with extra riders or a better money worth progress price will typically command a better premium.

-

Insurer: Totally different insurance coverage corporations have totally different underwriting tips and danger assessments. Their monetary energy and working prices additionally affect their pricing methods. Evaluating quotes from a number of insurers is important to securing essentially the most aggressive charges.

Deciphering the Entire Life Insurance coverage Charges Chart

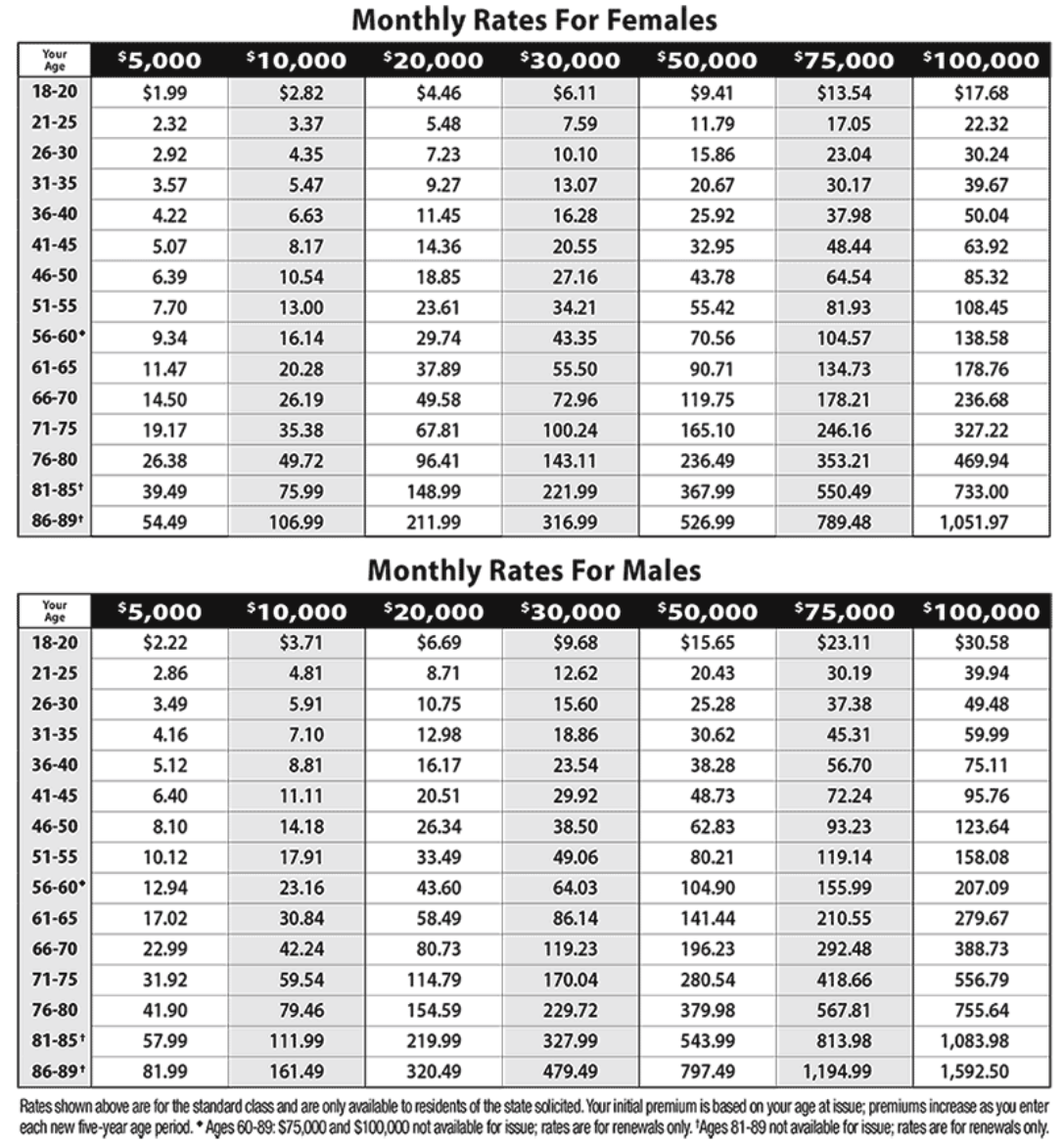

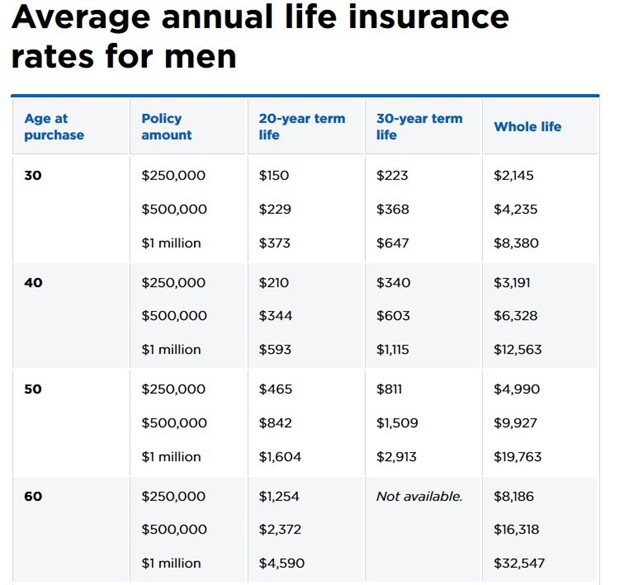

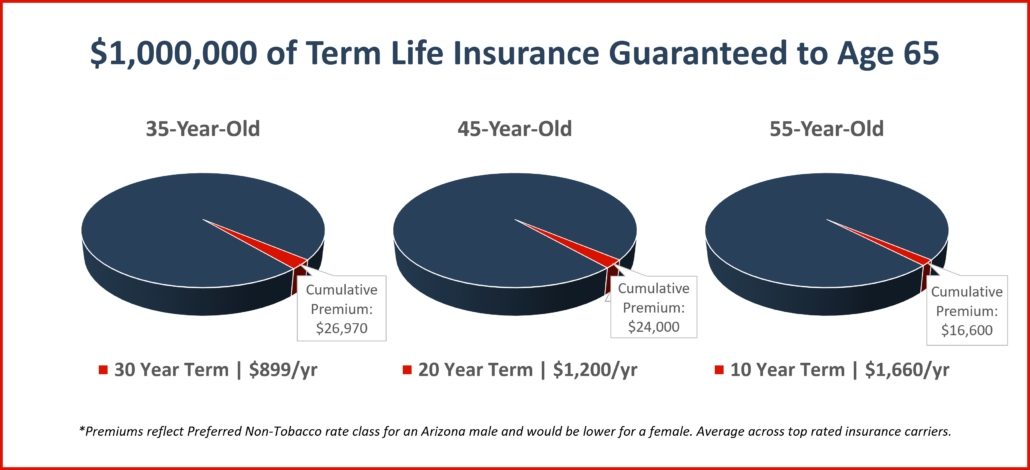

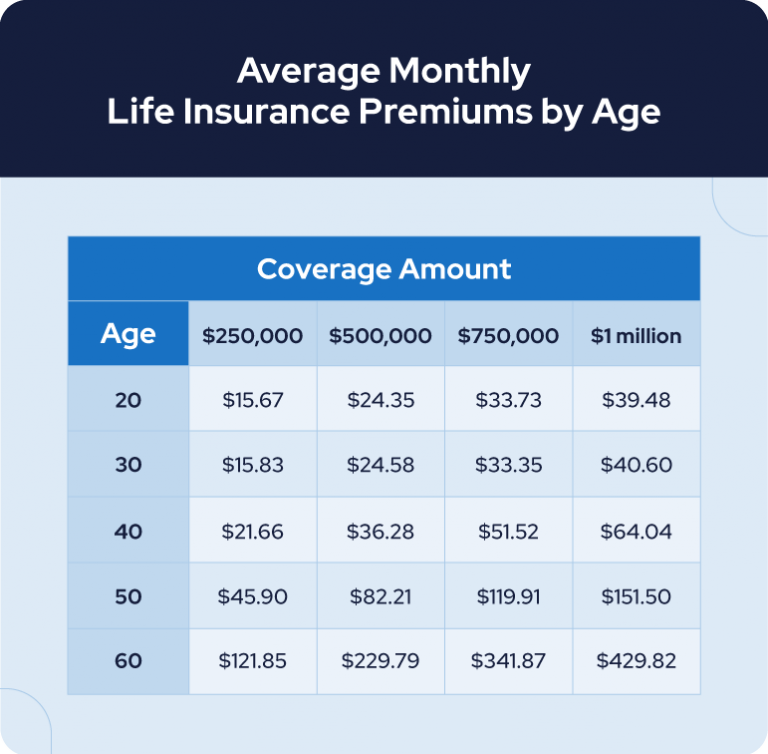

Entire life insurance coverage price charts sometimes current premiums based mostly on age, gender (in lots of instances), and the specified dying profit. They may seem as tables or graphs, displaying the annual premium for a given quantity of protection at totally different ages. This is what to search for:

-

Age Bands: The chart shall be organized into age brackets, normally in increments of 5 years (e.g., 25-30, 30-35, and many others.). Every bracket could have a corresponding premium.

-

Dying Profit Ranges: The chart will present premiums for varied dying profit quantities (e.g., $100,000, $250,000, $500,000, and many others.). Premiums improve proportionally with the dying profit.

-

Premium Sort: The chart ought to specify whether or not the premium is annual, semi-annual, quarterly, or month-to-month. Extra frequent funds typically lead to barely increased total prices resulting from administrative charges.

-

Assumptions: It is essential to know the underlying assumptions of the chart. These would possibly embrace the assumed rate of interest used to calculate the money worth progress, the mortality tables used to evaluate danger, and any further charges or costs included within the premium.

-

Non-guaranteed components: Whereas the premium displayed is likely to be initially stage, complete life insurance policies usually have non-guaranteed components. Which means whereas the preliminary premium is mounted, the insurer could regulate features like money worth progress or dividend funds based mostly on funding efficiency. This info is essential and ought to be clearly acknowledged.

Instance of a Hypothetical Entire Life Insurance coverage Charges Chart

(Be aware: It is a simplified instance and doesn’t mirror precise charges from any particular insurer.)

| Age Vary | $100,000 Dying Profit | $250,000 Dying Profit | $500,000 Dying Profit |

|---|---|---|---|

| 25-30 | $500/12 months | $1250/12 months | $2500/12 months |

| 30-35 | $600/12 months | $1500/12 months | $3000/12 months |

| 35-40 | $750/12 months | $1875/12 months | $3750/12 months |

| 40-45 | $1000/12 months | $2500/12 months | $5000/12 months |

| 45-50 | $1400/12 months | $3500/12 months | $7000/12 months |

This simplified chart illustrates how premiums improve with each age and the dying profit quantity. Actual-world charts are considerably extra detailed and should embrace further elements.

Past the Chart: Essential Issues

Whereas price charts present a precious overview, a number of different elements require cautious consideration:

-

Money Worth Development: The chart may not explicitly present the projected money worth progress. It is a crucial side of complete life insurance coverage, because it permits you to borrow in opposition to the coverage or withdraw funds. Perceive the projected progress price and any related charges.

-

Dividends: Some complete life insurance policies pay dividends, that are a return of a portion of the insurer’s earnings. These dividends aren’t assured and might range 12 months to 12 months. The chart could not mirror dividend funds.

-

Riders: Take into account the fee and advantages of including riders, equivalent to unintended dying advantages, long-term care riders, or incapacity earnings riders. These can improve the coverage however will improve the premium.

-

Charges and Costs: Concentrate on any further charges, equivalent to give up costs (penalties for withdrawing from the coverage early), administrative charges, or mortality and expense costs. These can considerably affect the general value.

-

Monetary Power of the Insurer: Select a financially secure insurer with a excessive ranking from unbiased ranking businesses like A.M. Finest, Moody’s, and Normal & Poor’s. This ensures the insurer will be capable of pay out claims when wanted.

Conclusion:

Entire life insurance coverage price charts present a snapshot of premium prices, however they aren’t your entire image. Completely understanding the elements influencing charges, decoding the chart precisely, and contemplating the broader monetary implications are important earlier than making a buying choice. Seek the advice of with a professional monetary advisor to debate your particular person wants and decide if complete life insurance coverage is the appropriate selection for you, and that will help you navigate the complexities of evaluating insurance policies and understanding the nuances of price charts from totally different insurers. Keep in mind to match quotes from a number of insurers to search out essentially the most aggressive charges that align together with your particular circumstances and monetary targets. Do not solely depend on the chart; search skilled steering to make an knowledgeable choice about your long-term monetary safety.

Closure

Thus, we hope this text has supplied precious insights into Decoding the Entire Life Insurance coverage Charges Chart: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!