Deconstructing the Apple Inventory Chart: A Journey By way of Innovation, Hype, and Market Forces

Associated Articles: Deconstructing the Apple Inventory Chart: A Journey By way of Innovation, Hype, and Market Forces

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Deconstructing the Apple Inventory Chart: A Journey By way of Innovation, Hype, and Market Forces. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Deconstructing the Apple Inventory Chart: A Journey By way of Innovation, Hype, and Market Forces

Apple Inc. (AAPL), a reputation synonymous with technological innovation and client need, boasts a inventory chart that is as charming as its merchandise. Tracing its trajectory from a comparatively modest begin to its present standing as a trillion-dollar behemoth, the AAPL chart gives an interesting case research in market dynamics, investor sentiment, and the interaction between technological developments and monetary efficiency. This in-depth evaluation will delve into key durations, important occasions, and underlying components which have formed the Apple inventory chart, offering insights for each seasoned buyers and people new to the world of inventory market evaluation.

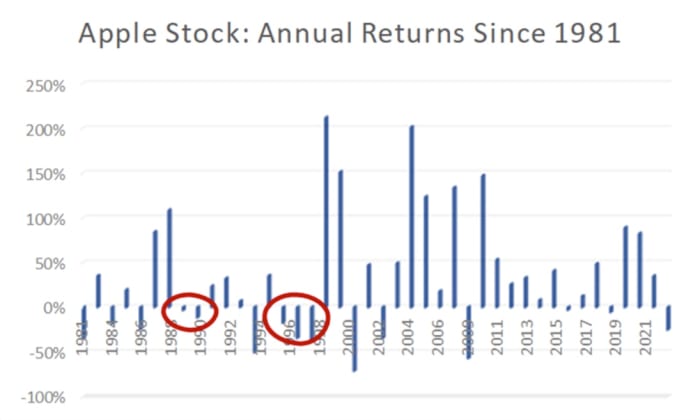

The Early Years: Humble Beginnings and Gradual Ascent (1980-2000)

Apple’s preliminary public providing (IPO) in 1980 priced its shares at $22. The early years mirrored the unstable nature of a younger firm navigating the burgeoning private laptop market. The chart reveals durations of great development interspersed with durations of stagnation and even decline, mirroring the corporate’s inside struggles and the broader financial panorama. The late Eighties and early Nineteen Nineties noticed a interval of relative underperformance, punctuated by management modifications and intense competitors from trade giants like IBM and Microsoft. This era highlights a vital lesson: even revolutionary firms face challenges, and their inventory efficiency would not at all times mirror rapid success. The chart throughout this period reveals a characteristically uneven sample, with restricted sustained upward momentum. Analyzing this era requires understanding the constraints of early expertise, the altering market dynamics, and the inner challenges Apple confronted in sustaining its aggressive edge.

The Jobs Return and the iPod Period: A Resurgence of Development (2000-2010)

The return of Steve Jobs in 1997 marked a turning level. The chart displays a dramatic shift in trajectory following his appointment. The introduction of the iMac in 1998, a visually beautiful and user-friendly laptop, signaled a renewed deal with design and consumer expertise. Nonetheless, the actual catalyst for explosive development got here with the launch of the iPod in 2001. This era is characterised by a sustained upward pattern on the chart, reflecting the immense recognition of the iPod and its contribution to Apple’s burgeoning market capitalization. The chart demonstrates a transparent correlation between product innovation and inventory value appreciation. This period additionally showcases the facility of brand name constructing and the creation of a loyal buyer base, which interprets straight into sustained investor confidence and better inventory valuations. Analyzing this era necessitates contemplating the affect of disruptive expertise, the facility of efficient advertising, and the function of a visionary chief in driving firm development.

The iPhone Revolution and Past: Exponential Development and Market Dominance (2010-Current)

The launch of the iPhone in 2007 is arguably the one most vital occasion in Apple’s historical past, and its affect is vividly depicted on the inventory chart. The following years witnessed an nearly parabolic rise within the inventory value, reflecting the exceptional success of the iPhone and its ecosystem of apps and companies. The chart reveals a interval of sustained, exponential development, punctuated by periodic corrections however finally sustaining a robust upward trajectory. The introduction of the iPad, Apple Watch, and AirPods additional fueled this development, solidifying Apple’s place as a dominant participant within the client electronics market. Analyzing this era requires understanding the community impact of the Apple ecosystem, the facility of app retailer income, and the corporate’s skill to persistently innovate and seize market share. The chart additionally reveals the affect of investor sentiment, with durations of elevated volatility reflecting market uncertainty and hypothesis surrounding Apple’s future product releases and market positioning.

Key Elements Influencing the Apple Inventory Chart:

A number of components have persistently influenced the value of Apple inventory:

-

Product Innovation: The launch of groundbreaking merchandise just like the iPod, iPhone, iPad, and Apple Watch has persistently pushed important inventory value appreciation. Innovation stays a core driver of Apple’s success and a key issue to contemplate when analyzing the chart.

-

Market Sentiment: Investor confidence and general market circumstances considerably affect Apple’s inventory value. Durations of financial uncertainty or broader market downturns typically result in non permanent dips within the inventory value, even for firms as sturdy as Apple.

-

Competitors: The aggressive panorama, together with rivals like Samsung, Google, and Microsoft, influences Apple’s market share and finally its inventory value. Analyzing the aggressive dynamics throughout the tech trade is essential to understanding fluctuations within the AAPL chart.

-

Financial Elements: Macroeconomic circumstances, similar to rates of interest, inflation, and international financial development, affect investor habits and may affect the inventory’s efficiency.

-

Monetary Efficiency: Apple’s earnings experiences and monetary statements straight affect investor sentiment and the inventory value. Robust earnings usually result in upward strain on the inventory value, whereas disappointing outcomes can set off declines.

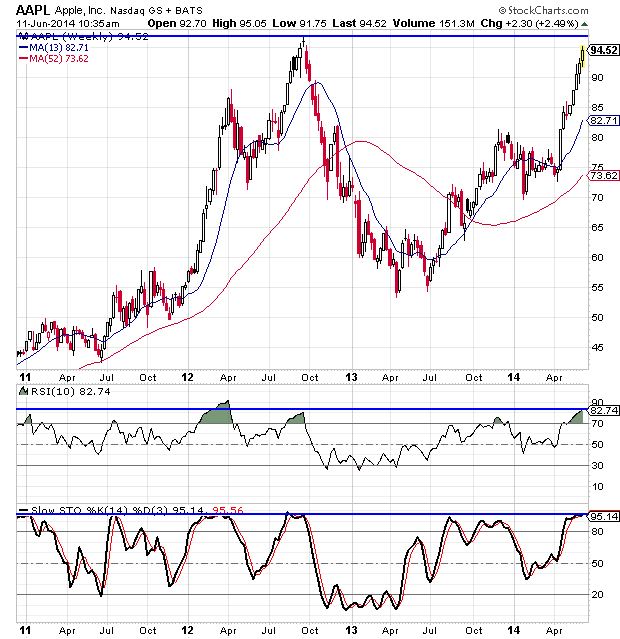

Technical Evaluation of the Apple Inventory Chart:

Technical evaluation of the AAPL chart entails figuring out patterns, tendencies, and assist/resistance ranges to foretell future value actions. This entails learning indicators similar to transferring averages, relative energy index (RSI), and quantity to gauge momentum and potential turning factors. Skilled buyers use these strategies to establish potential entry and exit factors, aiming to capitalize on value fluctuations. Nonetheless, it is essential to do not forget that technical evaluation will not be foolproof and must be used along side basic evaluation.

Elementary Evaluation of the Apple Inventory Chart:

Elementary evaluation focuses on evaluating the intrinsic worth of Apple’s inventory based mostly on its monetary efficiency, aggressive place, and future development prospects. This entails inspecting components like income development, profitability, debt ranges, and market share. Traders utilizing basic evaluation intention to establish shares which can be undervalued relative to their intrinsic worth. Evaluating the inventory value to its basic worth helps decide whether or not the inventory is overbought or oversold.

Conclusion:

The Apple inventory chart is a wealthy tapestry woven from threads of innovation, market forces, and investor sentiment. Analyzing its trajectory reveals useful classes concerning the interaction between technological developments, enterprise technique, and monetary efficiency. Whereas previous efficiency will not be indicative of future outcomes, learning the AAPL chart supplies invaluable insights into the dynamics of a extremely profitable firm and the components that drive inventory value actions within the expertise sector. Understanding each the technical and basic points of the chart empowers buyers to make knowledgeable selections and navigate the complexities of the inventory market. The journey of Apple’s inventory, from its humble beginnings to its present dominance, continues to unfold, providing a compelling narrative for buyers and market analysts alike. The way forward for the AAPL chart stays unwritten, a testomony to the ever-evolving nature of the expertise trade and the unpredictable forces that form the inventory market.

Closure

Thus, we hope this text has supplied useful insights into Deconstructing the Apple Inventory Chart: A Journey By way of Innovation, Hype, and Market Forces. We recognize your consideration to our article. See you in our subsequent article!