In Chart or On Chart: Navigating the Nuances of Technical Evaluation

Associated Articles: In Chart or On Chart: Navigating the Nuances of Technical Evaluation

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to In Chart or On Chart: Navigating the Nuances of Technical Evaluation. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

In Chart or On Chart: Navigating the Nuances of Technical Evaluation

Technical evaluation, the artwork and science of predicting future value actions primarily based on previous market knowledge, depends closely on charts. Nonetheless, a seemingly easy phrase – "in chart" or "on chart" – can subtly alter the which means and interpretation of buying and selling methods and indicators. Understanding this distinction is essential for any severe technical analyst or dealer. This text delves into the nuances of those phrases, exploring their implications for numerous charting methods and providing sensible examples to make clear their utilization.

Understanding the Context: Chart as a Illustration

Earlier than diving into the precise meanings, it is important to grasp {that a} chart itself is a illustration of market exercise. It is a visible distillation of value actions over time, usually incorporating quantity, open curiosity, or different related knowledge. The phrases "in chart" and "on chart" due to this fact confer with the connection between a particular ingredient or phenomenon and this visible illustration.

"On Chart": A Floor-Stage Interpretation

When one thing is described as being "on chart," it typically refers to its direct visible presence on the value chart itself. This might embody:

-

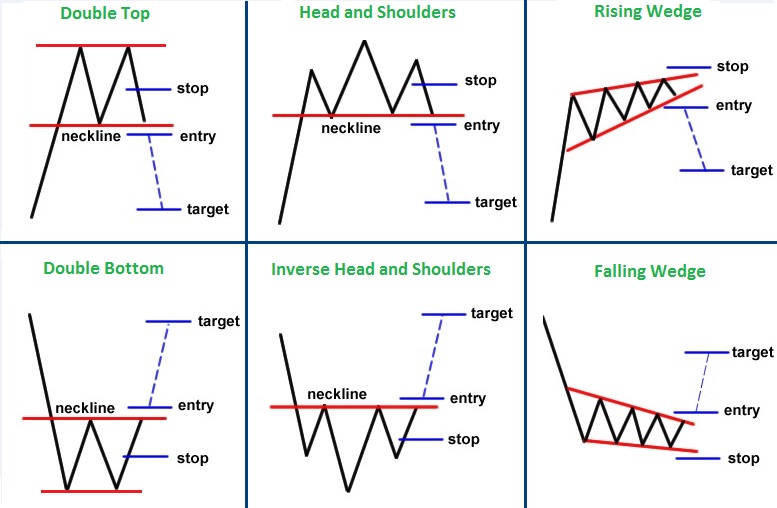

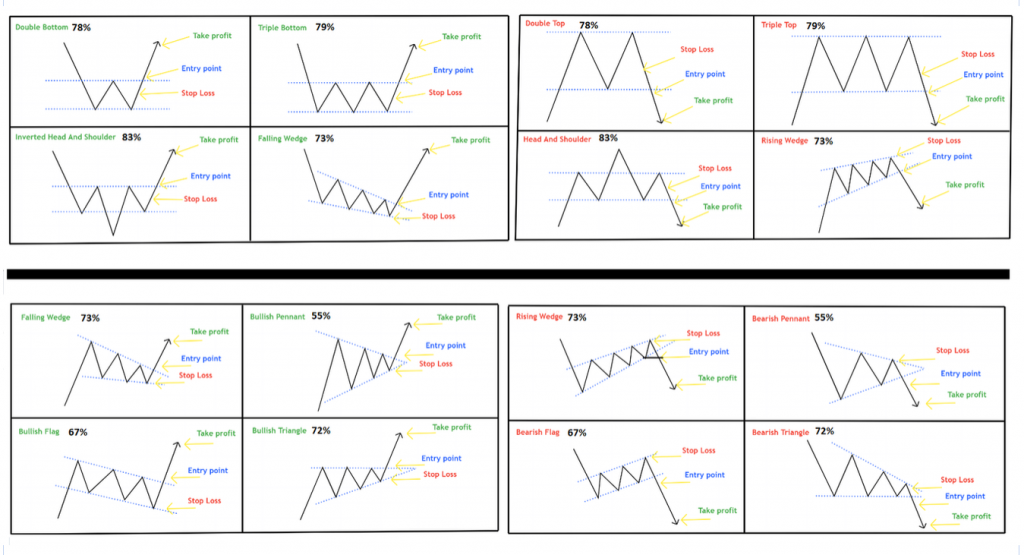

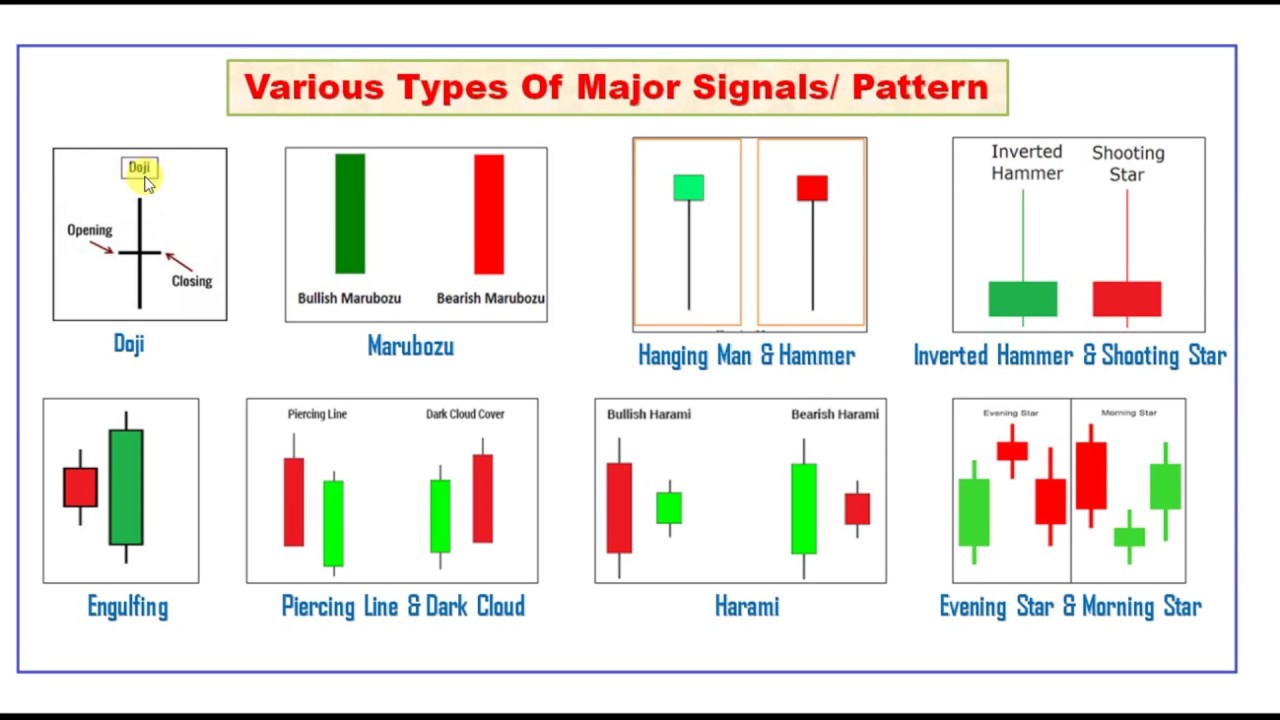

Worth Motion: Probably the most elementary facet "on chart" is the value motion itself – the candlestick patterns, bars, or traces depicting the value fluctuations. Analyzing value motion "on chart" entails straight observing formations like head and shoulders, double tops/bottoms, flags, pennants, and different patterns to foretell future value actions.

-

Technical Indicators: Many technical indicators are plotted straight "on chart," overlaying the value knowledge. Examples embody shifting averages (easy, exponential, weighted), Relative Power Index (RSI), MACD, Bollinger Bands, and Stochastic Oscillator. Deciphering these indicators "on chart" entails observing their relationship to the value motion, figuring out potential purchase/promote indicators primarily based on crossovers, divergences, or different patterns.

-

Help and Resistance Ranges: These essential ranges, usually drawn straight "on chart," characterize value areas the place consumers or sellers have traditionally exerted vital affect. Figuring out these ranges "on chart" is a elementary facet of value motion evaluation, serving to merchants anticipate potential value reversals or breakouts.

-

Trendlines: Trendlines, drawn "on chart" to attach a sequence of swing highs or swing lows, visually characterize the prevailing development. Breaks of trendlines usually sign vital shifts in market momentum, offering invaluable buying and selling indicators.

-

Fibonacci Retracements and Extensions: These instruments, plotted "on chart," are primarily based on the Fibonacci sequence and are used to establish potential help and resistance ranges, in addition to value targets for future actions.

The important thing attribute of parts "on chart" is their rapid visible accessibility. They’re straight observable throughout the confines of the value chart’s graphical illustration.

"In Chart": A Deeper, Contextual Interpretation

"In chart" signifies a extra nuanced relationship, implying a deeper contextual evaluation relatively than simply visible presence. It usually refers to:

-

Inside Market Dynamics: "In chart" evaluation usually entails inspecting the interior relationships between completely different parts throughout the chart. This contains analyzing the interaction between value motion and indicators, figuring out divergences (the place value and an indicator transfer in reverse instructions), or observing the connection between quantity and value modifications.

-

Hidden Patterns and Buildings: Some patterns and constructions may not be instantly apparent "on chart" however turn into obvious by means of deeper evaluation. For instance, figuring out refined modifications in quantity profile or recognizing advanced harmonic patterns requires a extra in-depth "in chart" examination.

-

Affirmation of Indicators: "In chart" evaluation is usually used to substantiate indicators generated by indicators or value motion. For instance, a bearish crossover on the MACD could be thought-about extra vital if it is accompanied by a bearish candlestick sample and declining quantity, all noticed "in chart."

-

Contextual Interpretation of Indicators: Understanding the historic context of indicator readings is essential for correct interpretation. An RSI studying of 70 could be thought-about overbought in a typically trending market, however much less vital in a sideways vary. This contextual understanding is a side of "in chart" evaluation.

-

Market Regime Evaluation: Figuring out the prevailing market regime (e.g., trending, ranging, consolidating) is an important facet of "in chart" evaluation. This understanding influences the number of acceptable buying and selling methods and indicators. A method efficient in a trending market could be ineffective in a range-bound market, and recognizing this "in chart" is essential.

Sensible Examples: Illustrating the Distinction

Let’s illustrate the distinction with sensible examples:

State of affairs 1: Transferring Common Crossover

-

On Chart: A dealer observes a 50-day shifting common crossing above a 200-day shifting common on the chart. This can be a clear visible ingredient "on chart."

-

In Chart: The dealer additional analyzes this crossover, contemplating the quantity accompanying the crossover, the general market development, and the historic efficiency of this indicator in related market situations. This deeper evaluation is "in chart."

State of affairs 2: Head and Shoulders Sample

-

On Chart: A dealer identifies a head and shoulders sample visually on the value chart. This sample is straight "on chart."

-

In Chart: The dealer then analyzes the quantity throughout the formation of the sample, checks for affirmation from different indicators (like RSI or MACD), and considers the broader market context earlier than making a buying and selling choice. That is an "in chart" evaluation.

State of affairs 3: Quantity Evaluation

-

On Chart: A dealer observes excessive quantity throughout a value breakout. That is visually "on chart."

-

In Chart: The dealer analyzes the quantity profile throughout completely different value ranges, figuring out areas of great accumulation or distribution. This contextual quantity evaluation is "in chart."

Conclusion: A Synergistic Method

Whereas "on chart" and "in chart" evaluation may appear distinct, they’re, in actuality, complementary approaches. Efficient technical evaluation requires a synergistic mixture of each. Observing the visible parts "on chart" supplies the preliminary basis, whereas the deeper "in chart" evaluation provides context, affirmation, and a extra nuanced understanding of market dynamics. Ignoring both facet can result in incomplete evaluation and doubtlessly flawed buying and selling selections. By mastering each "on chart" and "in chart" methods, merchants can considerably improve their skill to interpret market knowledge and make knowledgeable buying and selling selections. The profitable dealer is the one who can seamlessly combine visible remark with contextual understanding to navigate the complexities of the monetary markets.

:max_bytes(150000):strip_icc()/dotdash_INV_Final_Line_Chart_Jan_2021-01-d2dc4eb9a59c43468e48c03e15501ebe.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-01-c68c49b8f38741a6b909ecc71e41f6eb.jpg)

Closure

Thus, we hope this text has offered invaluable insights into In Chart or On Chart: Navigating the Nuances of Technical Evaluation. We thanks for taking the time to learn this text. See you in our subsequent article!