Mastering the Chart of Accounts in QuickBooks: A Complete Information with Examples

Associated Articles: Mastering the Chart of Accounts in QuickBooks: A Complete Information with Examples

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Mastering the Chart of Accounts in QuickBooks: A Complete Information with Examples. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Mastering the Chart of Accounts in QuickBooks: A Complete Information with Examples

QuickBooks, a well-liked accounting software program, depends closely on its Chart of Accounts (COA) to categorize and observe monetary transactions. A well-structured COA is the inspiration of correct monetary reporting and environment friendly bookkeeping. This text gives a complete overview of the QuickBooks Chart of Accounts, together with detailed examples and finest practices that can assist you maximize its potential.

What’s a Chart of Accounts?

The Chart of Accounts is a listing of all of the accounts utilized by a enterprise to report its monetary transactions. Every account represents a particular class of belongings, liabilities, fairness, income, or bills. Consider it as an in depth organizational system on your firm’s funds, permitting you to trace all the things from money available to gross sales income to mortgage funds. In QuickBooks, this method is essential for producing monetary statements like steadiness sheets, earnings statements, and money circulate statements.

Understanding Account Varieties in QuickBooks

QuickBooks categorizes accounts into 5 fundamental sorts:

-

Property: These signify what your corporation owns. Examples embrace:

- Money: Money available, checking accounts, financial savings accounts.

- Accounts Receivable: Cash owed to your corporation by clients.

- Stock: Items held on the market.

- Pay as you go Bills: Bills paid prematurely (e.g., insurance coverage, hire).

- Fastened Property: Lengthy-term belongings like gear and buildings.

-

Liabilities: These signify what your corporation owes to others. Examples embrace:

- Accounts Payable: Cash owed to suppliers and distributors.

- Loans Payable: Cash owed on loans.

- Salaries Payable: Wages owed to workers.

- Taxes Payable: Taxes owed to authorities businesses.

-

Fairness: This represents the proprietor’s funding within the enterprise and the collected income or losses. For sole proprietorships and partnerships, that is typically represented by a single Proprietor’s Fairness account. For companies, it consists of accounts like Retained Earnings and Widespread Inventory.

-

Income: This represents the earnings generated from the enterprise’s operations. Examples embrace:

- Gross sales: Income from the sale of products or companies.

- Service Income: Income from offering companies.

- Curiosity Revenue: Income from curiosity earned on investments.

-

Bills: These signify the prices incurred in operating the enterprise. Examples embrace:

- Price of Items Bought (COGS): The direct prices related to producing items offered.

- Hire Expense: Hire paid for workplace house.

- Salaries Expense: Wages paid to workers.

- Utilities Expense: Prices related to electrical energy, water, and fuel.

- Advertising Expense: Prices related to promoting and promotion.

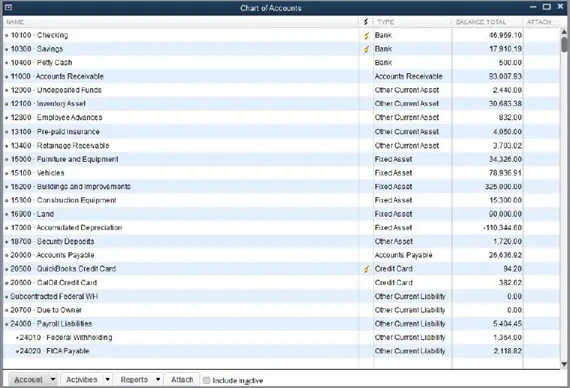

Instance Chart of Accounts for a Small Retail Enterprise (QuickBooks On-line)

Let’s contemplate a small retail enterprise promoting handcrafted jewellery. This is an instance of a simplified Chart of Accounts they could use in QuickBooks On-line:

| Account Identify | Account Kind | Account Quantity | Description |

|---|---|---|---|

| Money | Asset | 1000 | Money available and in checking account |

| Accounts Receivable | Asset | 1010 | Cash owed by clients |

| Stock | Asset | 1020 | Uncooked supplies and completed jewellery |

| Pay as you go Insurance coverage | Asset | 1030 | Insurance coverage paid prematurely |

| Tools | Asset | 1040 | Jewellery making instruments and gear |

| Accounts Payable | Legal responsibility | 2000 | Cash owed to suppliers |

| Gross sales Tax Payable | Legal responsibility | 2010 | Gross sales tax collected however not but remitted |

| Loans Payable | Legal responsibility | 2020 | Cash owed on enterprise mortgage |

| Proprietor’s Fairness | Fairness | 3000 | Proprietor’s funding and retained earnings |

| Gross sales Income | Income | 4000 | Income from jewellery gross sales |

| Price of Items Bought (COGS) | Expense | 5000 | Direct prices of manufacturing jewellery (supplies) |

| Hire Expense | Expense | 5010 | Hire for studio house |

| Utilities Expense | Expense | 5020 | Electrical energy, water, and fuel prices |

| Advertising Expense | Expense | 5030 | Prices related to promoting and promotion |

| Salaries Expense | Expense | 5040 | Wages paid to workers (if relevant) |

| Insurance coverage Expense | Expense | 5050 | Insurance coverage expense |

| Provides Expense | Expense | 5060 | Price of packaging supplies, and many others. |

Detailed Account Examples and Issues:

-

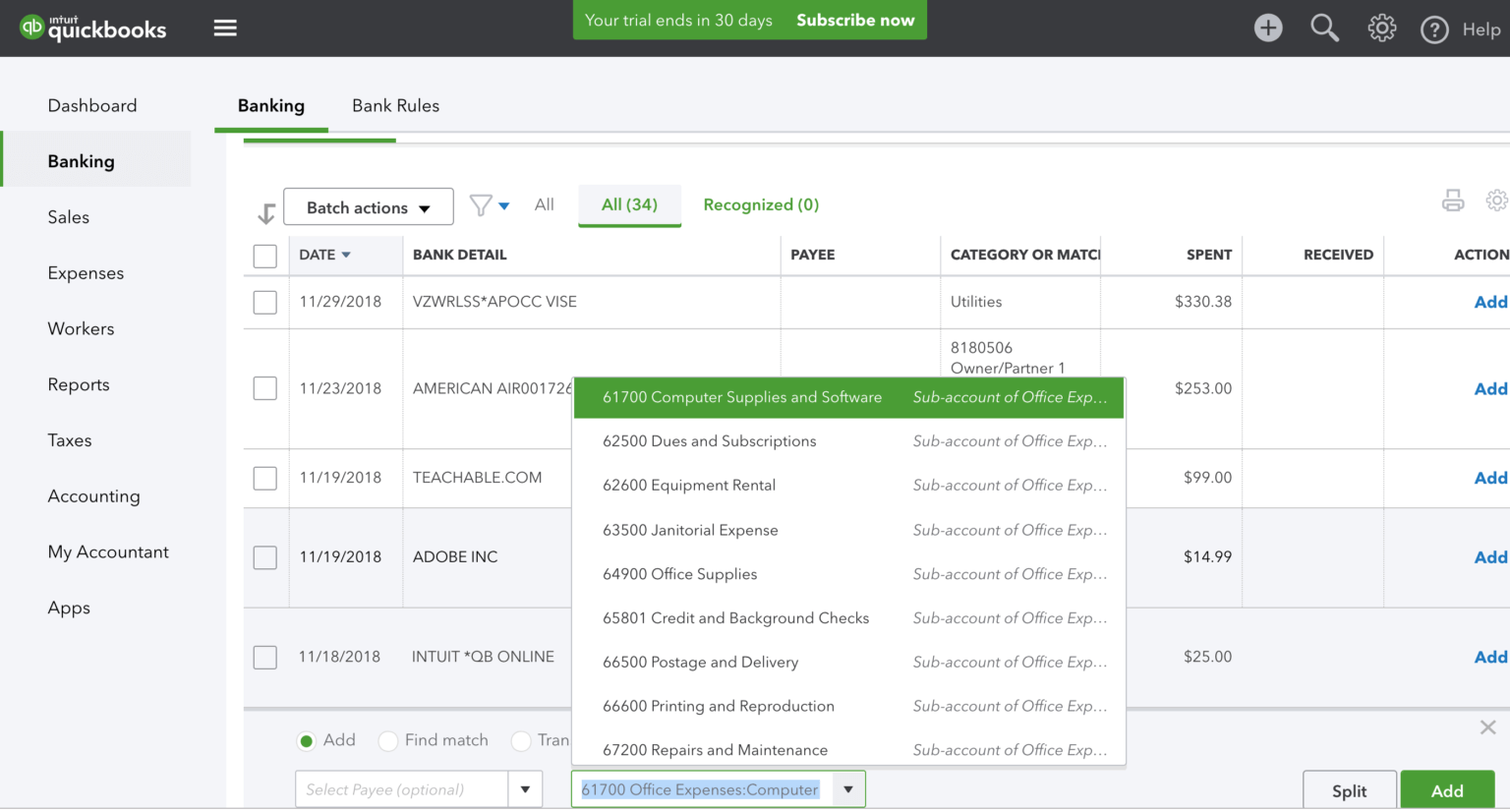

Subaccounts: For bigger companies, it is useful to make use of subaccounts inside main classes. For instance, below "Advertising Expense," you may need subaccounts for "On-line Promoting," "Print Promoting," and "Commerce Exhibits." This gives extra granular element in your monetary reviews.

-

Particular Income Accounts: As a substitute of a single "Gross sales Income" account, you could possibly create separate accounts for various product traces or companies. This enables for extra detailed gross sales evaluation. For instance, "Gross sales Income – Earrings," "Gross sales Income – Necklaces," "Gross sales Income – Bracelets."

-

Monitoring Stock: For companies with important stock, utilizing QuickBooks’ stock monitoring options is essential. This entails organising stock gadgets with related prices and monitoring their motion.

-

Expense Categorization: Detailed expense categorization is vital for efficient budgeting and value management. The extra particular your expense accounts, the higher you possibly can perceive the place your cash goes.

-

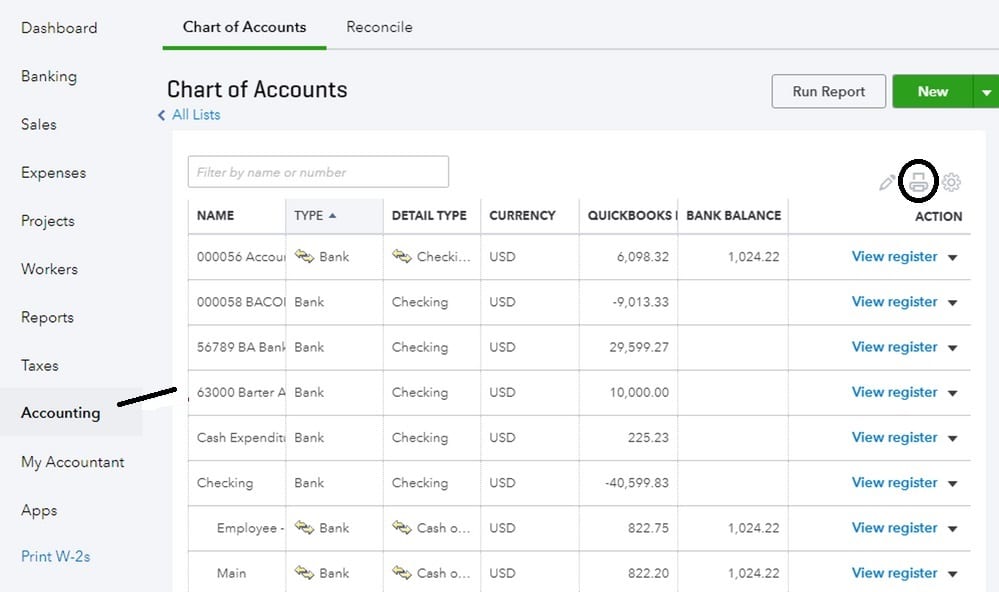

Chart of Accounts Numbering System: Utilizing a constant numbering system (e.g., 1000-1999 for Property, 2000-2999 for Liabilities) makes it simpler to navigate and keep your COA.

Greatest Practices for Managing Your Chart of Accounts:

-

Plan Forward: Earlier than organising your Chart of Accounts, take time to think about your corporation’s particular wants and anticipated transactions.

-

Maintain it Easy (Initially): Begin with a primary COA and add extra accounts as your corporation grows and its wants evolve.

-

Consistency is Key: As soon as you have established your COA, follow it constantly to make sure correct monetary reporting.

-

Common Evaluation: Periodically overview your COA to make sure it stays related and environment friendly. Take away pointless accounts and add new ones as wanted.

-

Use QuickBooks’ Constructed-in Options: Make the most of QuickBooks’ options for creating and managing your COA, together with the flexibility to import and export COA knowledge.

-

Seek the advice of with an Accountant: In case you’re not sure about methods to construction your COA, seek the advice of with a certified accountant for steering. They may also help you create a COA that meets your particular enterprise wants and complies with accounting requirements.

Conclusion:

The Chart of Accounts is the spine of your monetary administration system in QuickBooks. A well-designed and meticulously maintained COA is crucial for correct monetary reporting, knowledgeable decision-making, and the general success of your corporation. By understanding the completely different account sorts, using subaccounts successfully, and following finest practices, you possibly can leverage the ability of QuickBooks’ COA to realize worthwhile insights into your organization’s monetary efficiency. Keep in mind to recurrently overview and replace your COA to replicate the evolving wants of your rising enterprise. This proactive method will guarantee your monetary knowledge stays correct, dependable, and available for knowledgeable decision-making.

Closure

Thus, we hope this text has offered worthwhile insights into Mastering the Chart of Accounts in QuickBooks: A Complete Information with Examples. We hope you discover this text informative and useful. See you in our subsequent article!