Mastering the Chart of Accounts in Tally ERP: A Complete Information

Associated Articles: Mastering the Chart of Accounts in Tally ERP: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Mastering the Chart of Accounts in Tally ERP: A Complete Information. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Mastering the Chart of Accounts in Tally ERP: A Complete Information

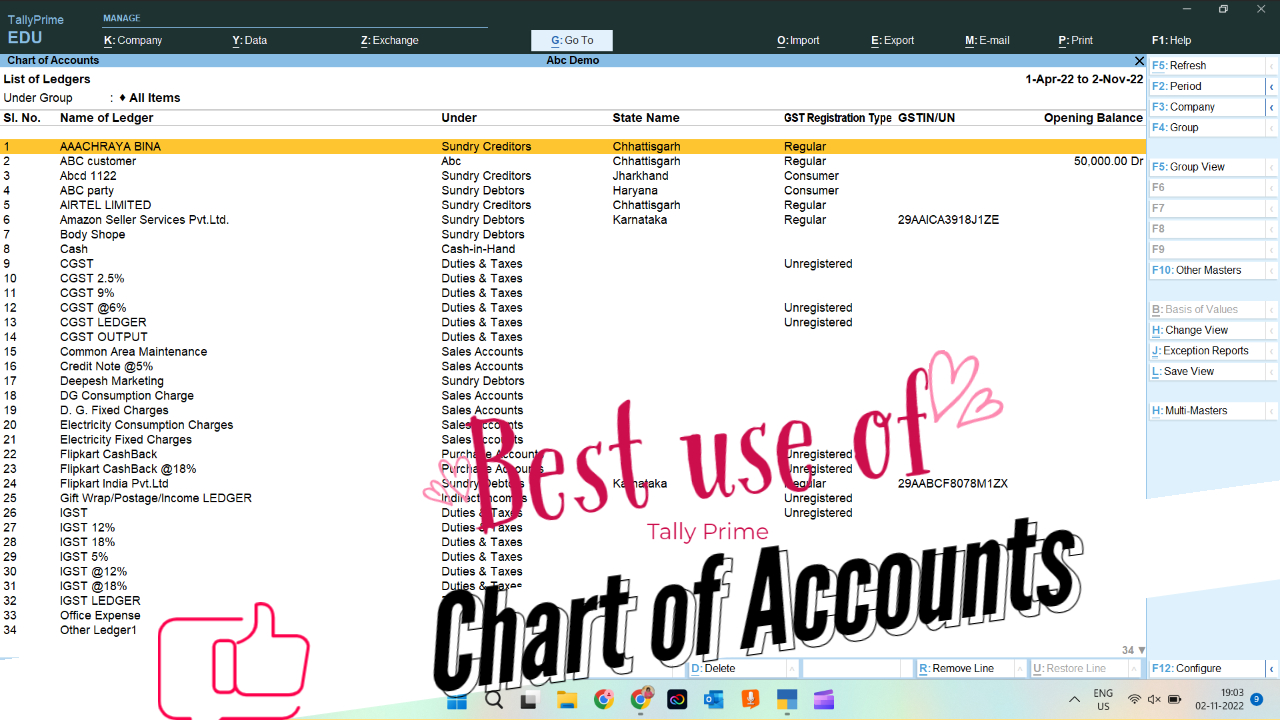

Tally ERP9, a extensively used accounting software program in India and past, depends closely on its Chart of Accounts (COA) for correct and environment friendly monetary administration. The COA acts because the spine of your accounting system, offering a structured framework for classifying all of your monetary transactions. Understanding and successfully managing your COA in Tally ERP9 is essential for producing significant monetary reviews and sustaining the integrity of your monetary knowledge. This text will delve deep into the intricacies of the Tally ERP9 Chart of Accounts, overlaying its creation, upkeep, and strategic significance.

What’s a Chart of Accounts?

In easy phrases, a Chart of Accounts is a complete record of all of the accounts utilized by a enterprise to report its monetary transactions. Every account represents a selected aspect of the enterprise’s monetary actions, comparable to belongings, liabilities, fairness, revenues, and bills. The COA organizes these accounts in a hierarchical construction, permitting for detailed monitoring and reporting. In Tally ERP9, this construction is meticulously designed to make sure compliance with numerous accounting requirements and to facilitate environment friendly knowledge administration.

Making a Chart of Accounts in Tally ERP9:

Making a well-structured COA in Tally ERP9 is the primary and most vital step in establishing your accounting system. The method includes defining numerous account varieties and assigning them particular ledger names and attributes. Here is a breakdown of the steps concerned:

-

Understanding Account Teams: Earlier than creating particular person accounts, it’s essential outline account teams. These teams categorize accounts based mostly on their nature (e.g., Property, Liabilities, Fairness, Revenue, Bills). Tally ERP9 gives pre-defined account teams, however you may customise them to fit your particular enterprise wants. Correctly structuring your account teams is important for correct monetary reporting. As an example, you would possibly create sub-groups inside "Bills" comparable to "Salaries," "Hire," and "Utilities," enabling granular evaluation of expenditure.

-

Creating Ledgers: Ledgers are particular person accounts inside the account teams. Every ledger represents a selected merchandise in your monetary data, comparable to "Money in Hand," "Accounts Receivable," "Gross sales," or "Hire Expense." When making a ledger, you specify its identify, group, and different related attributes like opening stability, and whether or not it is a debit or credit score stability account. Correct ledger creation is important for sustaining a clear and arranged COA. Detailed ledger descriptions are beneficial for higher understanding and simple identification.

-

Defining Account Attributes: Tally ERP9 lets you assign numerous attributes to your ledgers. These attributes improve the performance and reporting capabilities of the system. Some key attributes embrace:

- Opening Stability: The beginning stability of the account originally of the accounting interval.

- Credit score/Debit Stability: Signifies whether or not the account usually has a credit score or debit stability.

- Set-off: Permits you to robotically set off balances between sure accounts.

- Curiosity Calculation: Permits computerized curiosity calculations for accounts like loans and advances.

- Price Centres and Price Classes: For allocating prices to particular departments or initiatives.

-

Utilizing Pre-defined Account Teams and Ledgers: Tally ERP9 gives a spread of pre-defined account teams and ledgers to simplify the setup course of. You should utilize these as a place to begin and customise them to suit your enterprise’s distinctive necessities. Leveraging pre-defined choices saves time and ensures consistency with commonplace accounting practices.

-

Sustaining the Chart of Accounts: The COA will not be a static entity. As your corporation grows and evolves, you would possibly want so as to add new accounts, modify present ones, and even delete accounts which might be now not related. Commonly reviewing and updating your COA is essential for sustaining its accuracy and relevance. This contains including new price facilities, updating ledger descriptions, and guaranteeing correct categorization of accounts.

Significance of a Effectively-Structured Chart of Accounts:

A well-structured COA gives a number of crucial benefits:

-

Correct Monetary Reporting: A correctly designed COA ensures that every one transactions are precisely labeled, resulting in dependable and significant monetary reviews. This enables for higher decision-making based mostly on correct monetary knowledge.

-

Improved Monetary Management: An in depth COA gives higher management over your funds by permitting you to trace bills and revenues intimately. This allows well timed identification of potential monetary points and permits for proactive corrective measures.

-

Enhanced Compliance: A well-structured COA ensures compliance with related accounting requirements and rules. That is particularly necessary for companies that have to submit monetary statements to regulatory our bodies.

-

Environment friendly Information Evaluation: A correctly organized COA facilitates environment friendly knowledge evaluation. You’ll be able to simply generate reviews on particular facets of your corporation’s monetary efficiency, comparable to profitability by product line or division.

-

Streamlined Auditing: A well-maintained COA simplifies the auditing course of by offering a transparent and arranged view of your monetary transactions. This reduces the effort and time required for audits.

Widespread Errors to Keep away from:

-

Inadequate planning: Failing to plan your COA completely earlier than implementation can result in inconsistencies and inaccuracies in your monetary knowledge.

-

Ignoring account teams: Neglecting to make use of account teams successfully could make your COA tough to handle and analyze.

-

Inconsistent naming conventions: Utilizing inconsistent naming conventions to your accounts can create confusion and errors.

-

Lack of standard upkeep: Failing to commonly replace and keep your COA can result in outdated and inaccurate info.

-

Overlooking price facilities and value classes: Not utilizing price facilities and value classes can restrict your means to investigate your corporation’s efficiency by division or venture.

Superior Options and Concerns:

Tally ERP9 gives superior options to additional improve the performance of your COA:

-

A number of Corporations: Handle the COA for a number of corporations inside a single Tally set up.

-

Person-Outlined Fields: Add customized fields to your ledgers to seize further info related to your corporation.

-

Integration with different modules: The COA integrates seamlessly with different modules in Tally ERP9, comparable to stock and payroll, offering a holistic view of your corporation operations.

-

Reporting and Evaluation: Tally ERP9 gives a variety of reviews and evaluation instruments to extract significant insights out of your monetary knowledge based mostly in your COA construction.

Conclusion:

The Chart of Accounts in Tally ERP9 is a elementary aspect of your accounting system. By understanding its construction, mastering its creation, and diligently sustaining it, you may considerably enhance the accuracy, effectivity, and effectiveness of your monetary administration. Investing the effort and time to create a well-structured and meticulously maintained COA will reap important rewards by way of improved monetary management, correct reporting, and knowledgeable decision-making. Common evaluation and adaptation of your COA to mirror the evolving wants of your corporation are essential for long-term success. Bear in mind to seek the advice of with an accounting skilled in the event you want help in designing and implementing your Chart of Accounts to make sure compliance and optimum performance inside Tally ERP9.

Closure

Thus, we hope this text has supplied helpful insights into Mastering the Chart of Accounts in Tally ERP: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!