Mastering the QuickBooks Chart of Accounts: A Complete PDF Information

Associated Articles: Mastering the QuickBooks Chart of Accounts: A Complete PDF Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Mastering the QuickBooks Chart of Accounts: A Complete PDF Information. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Mastering the QuickBooks Chart of Accounts: A Complete PDF Information

The Chart of Accounts in QuickBooks is the spine of your monetary record-keeping. It is a meticulously organized checklist of each account your corporation makes use of to trace revenue, bills, property, liabilities, and fairness. Understanding and successfully managing your Chart of Accounts is essential for correct monetary reporting, environment friendly tax preparation, and knowledgeable enterprise decision-making. This complete information will delve into the intricacies of the QuickBooks Chart of Accounts, offering a sensible understanding that will help you maximize its potential. Whereas a downloadable PDF is not potential inside this text-based format, the knowledge offered right here could be readily used to create your personal detailed PDF information.

I. Understanding the Fundamentals: What’s a Chart of Accounts?

Consider your Chart of Accounts as an in depth monetary roadmap for your corporation. Every account represents a selected class for monitoring monetary transactions. These accounts are categorized in response to a standardized accounting framework, usually following the widely accepted accounting ideas (GAAP) or comparable frameworks. The chart organizes these accounts in a hierarchical construction, making it straightforward to categorize and analyze your monetary information.

Key Account Varieties:

- Property: These signify what your corporation owns, comparable to money, accounts receivable (cash owed to you), stock, gear, and property.

- Liabilities: These signify what your corporation owes to others, together with accounts payable (cash you owe to suppliers), loans, and bank card balances.

- Fairness: This represents the homeowners’ stake within the enterprise. It is the distinction between property and liabilities.

- Income: This tracks revenue generated from your corporation actions, comparable to gross sales, service charges, and curiosity revenue.

- Bills: These signify the prices incurred in operating your corporation, together with salaries, lease, utilities, advertising and marketing, and provides.

II. Establishing Your QuickBooks Chart of Accounts: A Step-by-Step Information

Establishing your Chart of Accounts in QuickBooks is a important first step in utilizing the software program successfully. Whereas QuickBooks supplies default accounts, customizing it to replicate your particular enterprise wants is important. Here is a step-by-step information:

-

Select the Proper QuickBooks Model: Choose the QuickBooks model that most accurately fits your corporation dimension and wishes (e.g., QuickBooks Self-Employed, QuickBooks On-line, QuickBooks Desktop).

-

Perceive Your Enterprise Construction: Your corporation construction (sole proprietorship, partnership, LLC, company) will affect the particular accounts you want.

-

Determine Your Key Revenue and Expense Classes: Record all of the methods your corporation generates income and incurs bills. Be as particular as potential. For instance, as an alternative of a common "Advertising" expense, think about separate accounts for "On-line Promoting," "Print Promoting," and "Commerce Exhibits."

-

Create Detailed Account Names: Use clear and concise account names that precisely replicate the character of the transaction. Consistency is essential for correct reporting.

-

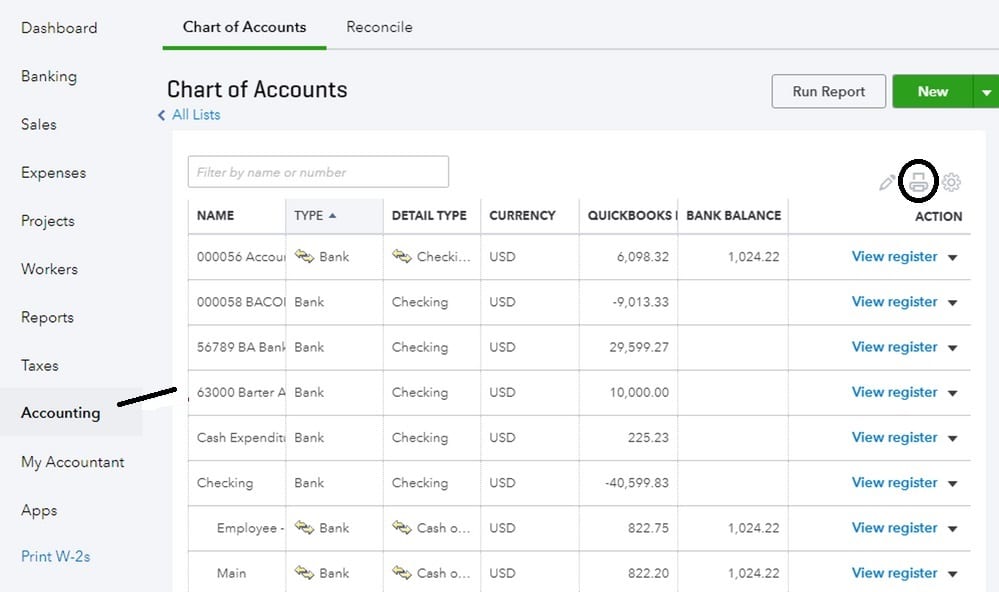

Assign Account Numbers: QuickBooks routinely assigns account numbers, however you possibly can customise them for higher group. A well-structured numbering system can facilitate straightforward looking and reporting. Think about using a hierarchical system (e.g., 1000-1999 for Property, 2000-2999 for Liabilities).

-

Choose Account Varieties: Fastidiously choose the suitable account kind (asset, legal responsibility, fairness, income, expense) for every account.

-

Frequently Evaluate and Replace: Your corporation will evolve, so repeatedly overview your Chart of Accounts so as to add new accounts as wanted and get rid of out of date ones.

III. Superior Chart of Accounts Administration in QuickBooks

Upon getting your primary Chart of Accounts arrange, you possibly can leverage superior options in QuickBooks to reinforce its performance:

-

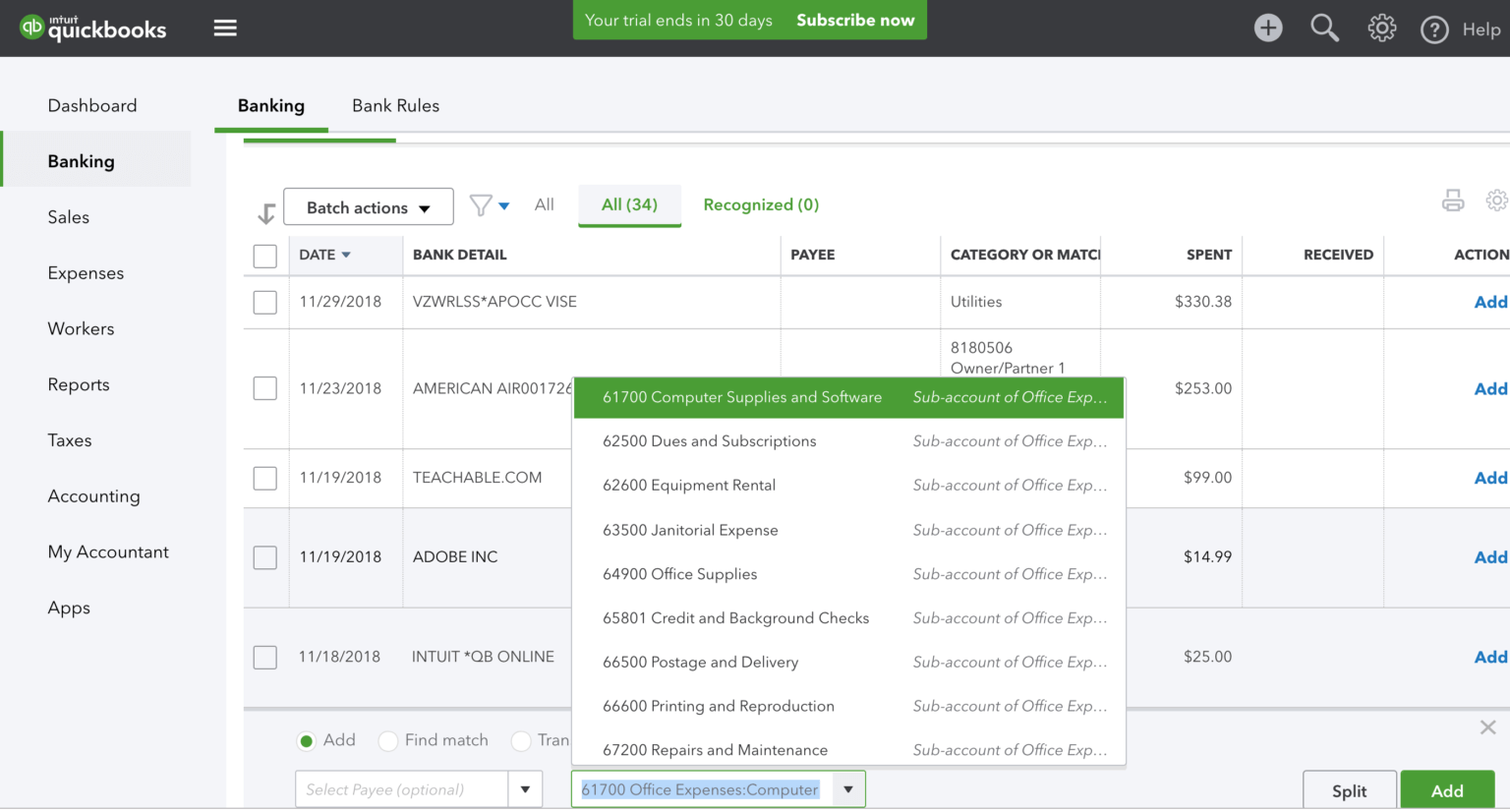

Subaccounts: Create subaccounts inside foremost accounts for extra granular element. For instance, you possibly can have a "Advertising" account with subaccounts for "On-line Promoting," "Print Promoting," and "Commerce Exhibits." This permits for extra detailed evaluation of your spending.

-

Customized Fields: Add customized fields to accounts to trace further info, comparable to undertaking codes, division codes, or buyer IDs. This helps in categorizing transactions for extra focused reporting.

-

Account Numbers and Buildings: Make the most of a constant and logical account numbering system to make sure straightforward identification and retrieval of knowledge.

-

Import and Export: QuickBooks lets you import and export your Chart of Accounts, making it straightforward emigrate information between completely different QuickBooks variations or share it with accountants.

-

Reconciliation: Frequently reconcile your financial institution accounts together with your QuickBooks Chart of Accounts to make sure accuracy and establish any discrepancies.

IV. Greatest Practices for Chart of Accounts Administration

-

Maintain it Easy, But Complete: Keep away from extreme complexity. Purpose for a steadiness between detailed categorization and manageable simplicity.

-

Keep Consistency: Use constant terminology and account names all through your Chart of Accounts.

-

Frequently Evaluate and Replace: As your corporation grows and modifications, your Chart of Accounts must adapt. Common opinions guarantee accuracy and relevance.

-

Doc Your Chart of Accounts: Create an in depth doc explaining the aim and construction of every account. That is invaluable for coaching new staff and for reference throughout audits.

-

Search Skilled Recommendation: For those who’re not sure about organising or managing your Chart of Accounts, seek the advice of with an accountant or QuickBooks skilled.

V. Troubleshooting Widespread Chart of Accounts Points

-

Duplicate Accounts: Keep away from creating duplicate accounts. This results in inaccurate reporting and confusion.

-

Incorrect Account Varieties: Make sure you’ve assigned the proper account kind to every account. Misclassifying accounts can result in vital errors in monetary statements.

-

Inconsistent Naming Conventions: Keep constant naming conventions all through your Chart of Accounts. Inconsistent naming makes looking and reporting harder.

-

Lacking Accounts: Guarantee you’ve got accounts for all of your revenue and expense classes. Lacking accounts can result in incomplete monetary reporting.

-

Out of date Accounts: Frequently overview and take away out of date accounts to keep up a clear and environment friendly Chart of Accounts.

VI. The Significance of a Properly-Managed Chart of Accounts

A well-managed Chart of Accounts isn’t just a requirement for correct bookkeeping; it is a highly effective instrument for enterprise administration. It lets you:

- Observe monetary efficiency: Acquire insights into your profitability, bills, and money move.

- Make knowledgeable enterprise choices: Use your monetary information to make strategic choices about pricing, advertising and marketing, and funding.

- Put together correct tax returns: Guarantee compliance with tax laws and keep away from penalties.

- Enhance effectivity: Streamline your accounting processes and scale back the time spent on bookkeeping.

- Facilitate audits: Present auditors with a transparent and arranged report of your monetary transactions.

By fastidiously planning and managing your QuickBooks Chart of Accounts, you will lay a stable basis for correct monetary reporting, knowledgeable decision-making, and the long-term success of your corporation. Keep in mind that this can be a dynamic instrument that ought to evolve alongside your corporation. Common overview and updates are key to sustaining its effectiveness and making certain the accuracy of your monetary info. Contemplate this information a place to begin; additional analysis {and professional} session can assist you refine your Chart of Accounts to completely fit your particular enterprise wants.

Closure

Thus, we hope this text has offered precious insights into Mastering the QuickBooks Chart of Accounts: A Complete PDF Information. We respect your consideration to our article. See you in our subsequent article!