Mastering the thinkorswim Chart: A Complete Information to Setup and Customization

Associated Articles: Mastering the thinkorswim Chart: A Complete Information to Setup and Customization

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Mastering the thinkorswim Chart: A Complete Information to Setup and Customization. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

Mastering the thinkorswim Chart: A Complete Information to Setup and Customization

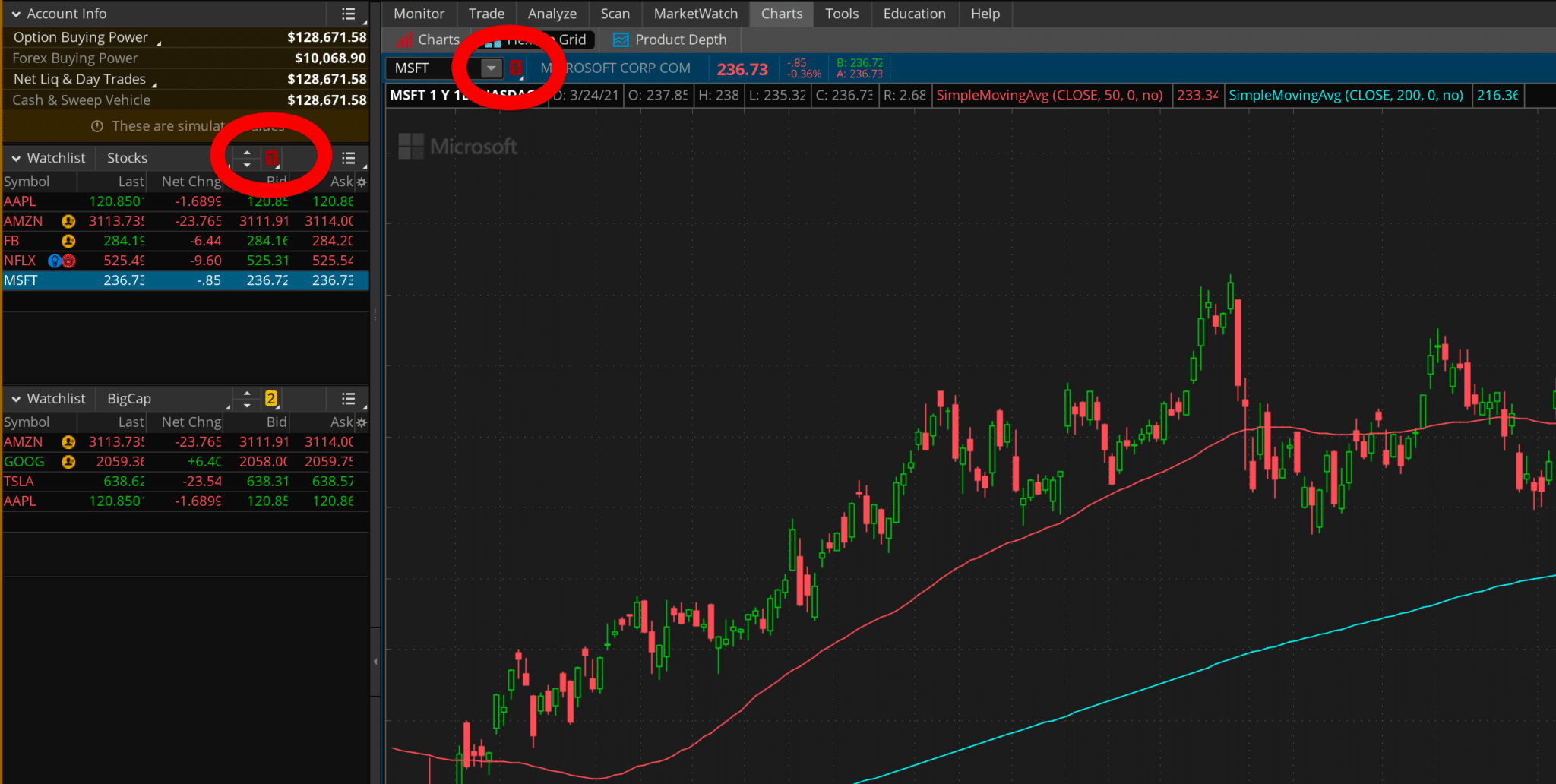

thinkorswim, TD Ameritrade’s highly effective buying and selling platform, affords a extremely customizable charting expertise. Whereas initially daunting, mastering its charting capabilities unlocks important benefits for merchants of all ranges. This complete information dives deep into establishing and customizing your thinkorswim charts, protecting all the pieces from fundamental configurations to superior strategies.

I. Understanding the thinkorswim Charting Interface:

Earlier than diving into customization, let’s familiarize ourselves with the core elements:

-

Chart Space: The principle space displaying the value information. You possibly can alter the timeframe (from intraday to yearly), chart sort (candlestick, bar, line), and overlay quite a few indicators.

-

Toolbars: A number of toolbars present fast entry to charting instruments, drawing instruments, research, and extra. These will be custom-made to show solely the instruments you ceaselessly use.

-

Examine Window: Situated beneath the chart space, this shows the values of technical indicators you’ve got added to your chart.

-

Watchlist: Simply monitor your favourite property and their worth actions. You possibly can drag and drop symbols instantly onto the chart out of your watchlist.

-

Order Entry Window: Conveniently place trades instantly from the chart interface.

-

Evaluation Window: Presents superior evaluation instruments, together with backtesting and technique optimization.

II. Primary Chart Setup: Selecting Your Preferences:

-

Chart Kind: Choose the chart sort finest suited to your buying and selling model:

-

Candlestick Charts: Visually symbolize worth motion over a particular interval, exhibiting open, excessive, low, and shutting costs. Ultimate for figuring out patterns and traits.

-

Bar Charts: Much like candlestick charts, however use vertical bars as a substitute of candles. They are often much less visually cluttered.

-

Line Charts: Easy charts connecting closing costs, appropriate for long-term pattern evaluation.

-

-

Timeframe: Select the suitable timeframe primarily based in your buying and selling technique:

-

Intraday: 1-minute, 5-minute, 15-minute, 30-minute, 1-hour, and so on., appropriate for short-term buying and selling.

-

Every day: Exhibits every day worth motion.

-

Weekly: Exhibits weekly worth motion.

-

Month-to-month: Exhibits month-to-month worth motion.

-

-

Image Choice: Choose the asset you wish to chart (shares, choices, futures, foreign exchange, and so on.).

-

Knowledge Supply: Make sure you’re utilizing a dependable information supply for correct worth data.

III. Including and Customizing Technical Indicators:

thinkorswim boasts an unlimited library of technical indicators. Including them is simple:

-

Entry the Research Menu: Find the "Research" menu (often a button or icon).

-

Search or Browse: Seek for a particular indicator by title or flick through classes (oscillators, pattern indicators, quantity indicators, and so on.).

-

Add the Indicator: Choose the indicator and click on "Add." It would seem in your chart.

-

Customise the Indicator: Most indicators supply customization choices:

-

Parameters: Alter settings like durations, averages, and thresholds to fine-tune the indicator’s sensitivity.

-

Coloration: Change the colour of the indicator strains for higher visible readability.

-

Model: Modify the road model (stable, dashed, dotted) and thickness.

-

Show: Select the place the indicator is displayed (on the primary chart or in a separate research window).

-

Instance Indicator Mixtures:

-

Pattern Identification: Mix a transferring common (e.g., 20-period EMA) with a relative energy index (RSI) to establish potential pattern reversals.

-

Momentum Affirmation: Use the MACD (Transferring Common Convergence Divergence) together with the stochastic oscillator to verify momentum shifts.

-

Volatility Measurement: Mix Bollinger Bands with Common True Vary (ATR) to gauge market volatility and potential breakouts.

IV. Using Drawing Instruments for Technical Evaluation:

thinkorswim gives a variety of drawing instruments for figuring out patterns and help/resistance ranges:

-

Trendlines: Draw strains connecting important worth highs or lows to establish traits.

-

Horizontal Traces: Mark help and resistance ranges.

-

Fibonacci Retracements: Establish potential worth reversal factors primarily based on Fibonacci ratios.

-

Gann Traces: Primarily based on Gann’s theories of market cycles.

-

Rectangles, Channels, and different shapes: Spotlight worth consolidation areas or potential breakout zones.

V. Superior Chart Customization:

-

A number of Timeframes: View a number of timeframes concurrently on a single chart to realize a broader perspective.

-

A number of Charts: Open a number of charts to investigate completely different property or the identical asset with completely different indicators.

-

Customizing Toolbars: Add or take away instruments from the toolbars to streamline your workflow.

-

Templates: Save your most well-liked chart setups as templates for fast entry.

-

Alerting: Arrange worth alerts primarily based on particular circumstances (e.g., worth crossing a transferring common, RSI reaching an overbought/oversold degree).

-

Backtesting: Use the thinkorswim platform to backtest your buying and selling methods utilizing historic information.

-

DOM (Depth of Market): Combine the DOM to view market depth and order move.

VI. Optimizing Your Chart for Your Buying and selling Model:

The important thing to profitable chart setup is tailoring it to your particular buying and selling model and wishes. Contemplate these elements:

-

Buying and selling Technique: Select indicators and drawing instruments that align along with your technique.

-

Time Horizon: Choose acceptable timeframes primarily based in your buying and selling horizon (short-term, swing, long-term).

-

Danger Tolerance: Use indicators and instruments that assist you to handle threat successfully.

-

Visible Preferences: Customise the chart’s look to make it simple to learn and interpret.

VII. Troubleshooting Frequent Points:

-

Sluggish Chart Efficiency: Shut pointless charts and indicators to enhance efficiency. Contemplate decreasing the info decision.

-

Indicator Errors: Test the indicator’s parameters and make sure you’re utilizing the proper information supply.

-

Chart Freezing: Restart the thinkorswim platform or your pc.

-

Knowledge Discrepancies: Confirm that you simply’re utilizing a dependable information supply and that your information feed is up-to-date.

VIII. Conclusion:

Mastering thinkorswim’s charting capabilities is an ongoing course of. Experiment with completely different settings, indicators, and drawing instruments to seek out the configuration that most accurately fits your wants. Keep in mind that the very best chart setup is one which means that you can successfully analyze market information and make knowledgeable buying and selling selections. By dedicating time to studying and customizing your thinkorswim charts, you possibly can considerably improve your buying and selling efficiency and achieve a aggressive edge out there. Steady studying and adaptation are essential to stay efficient within the dynamic world of buying and selling. Often discover new indicators, strategies, and options provided by thinkorswim to remain forward of the curve.

Closure

Thus, we hope this text has supplied priceless insights into Mastering the thinkorswim Chart: A Complete Information to Setup and Customization. We respect your consideration to our article. See you in our subsequent article!