Mastering the TradingView Dwell Chart: A Deep Dive into Options and Methods

Associated Articles: Mastering the TradingView Dwell Chart: A Deep Dive into Options and Methods

Introduction

With nice pleasure, we’ll discover the intriguing matter associated to Mastering the TradingView Dwell Chart: A Deep Dive into Options and Methods. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Mastering the TradingView Dwell Chart: A Deep Dive into Options and Methods

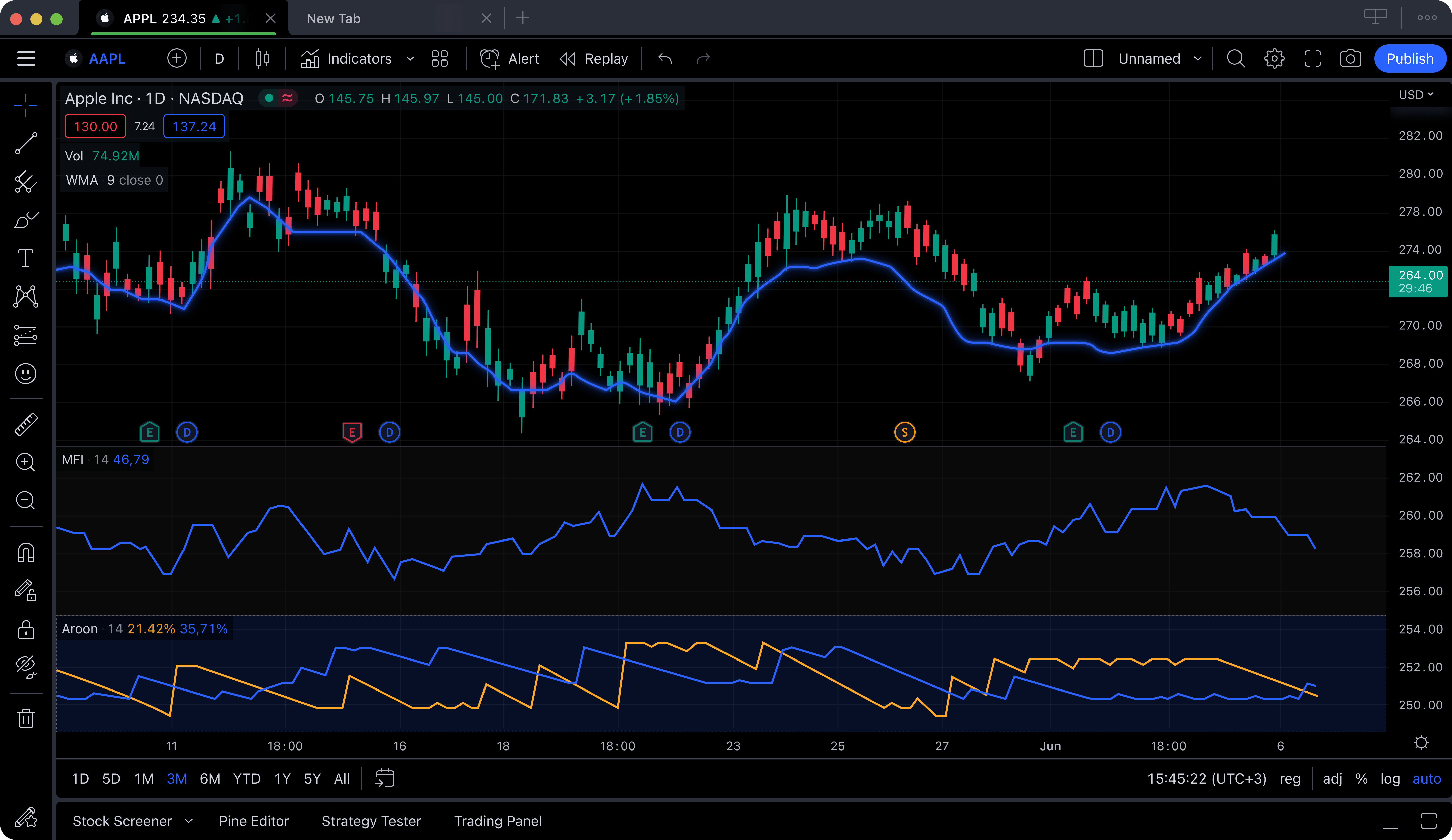

TradingView has quickly turn into the go-to platform for thousands and thousands of merchants worldwide, largely as a result of its highly effective and versatile reside charting capabilities. This text delves deep into the options and functionalities of the TradingView reside chart, exploring its strengths, limitations, and leverage its instruments for efficient buying and selling methods. We’ll cowl all the pieces from fundamental navigation to superior methods, offering a complete information for each newbies and skilled merchants.

Understanding the Core: Chart Sorts and Indicators

The muse of any profitable buying and selling technique on TradingView lies in understanding its numerous chart varieties and the power to overlay quite a few technical indicators. The platform gives a complete choice, together with:

-

Candle Charts: The preferred alternative, showcasing open, excessive, low, and shut costs for a selected interval (e.g., 1-minute, 5-minute, each day). The visible illustration of worth motion makes it straightforward to establish traits, patterns, and potential reversal factors.

-

Line Charts: A less complicated illustration displaying solely the closing worth for every interval. Best for figuring out general traits however lacks the detailed worth info supplied by candlestick charts.

-

Bar Charts: Much like candlestick charts, however as an alternative of candlesticks, they use vertical bars to characterize worth ranges. They provide a barely completely different visible perspective on worth motion.

-

Heikin Ashi Charts: These easy out worth fluctuations, making traits simpler to establish. They are often notably helpful for lowering the influence of noise and specializing in the general path of the market.

Past chart varieties, TradingView boasts an enormous library of technical indicators. These mathematical calculations are overlaid on the chart to supply insights into worth momentum, development energy, assist/resistance ranges, and potential purchase/promote alerts. Some standard examples embrace:

-

Transferring Averages (MA): Calculate the common worth over a selected interval, smoothing out worth fluctuations and highlighting traits. Frequent varieties embrace Easy Transferring Common (SMA), Exponential Transferring Common (EMA), and Weighted Transferring Common (WMA).

-

Relative Power Index (RSI): Measures the magnitude of current worth modifications to guage overbought or oversold circumstances. It is typically used to establish potential reversal factors.

-

MACD (Transferring Common Convergence Divergence): Compares two transferring averages to generate purchase/promote alerts based mostly on crossovers and divergence from worth motion.

-

Bollinger Bands: Plot normal deviations round a transferring common, indicating volatility and potential overbought/oversold circumstances.

-

Fibonacci Retracements and Extensions: Based mostly on the Fibonacci sequence, these instruments assist establish potential assist and resistance ranges based mostly on historic worth actions.

Navigating the TradingView Interface: A Sensible Information

The TradingView interface, whereas initially daunting, is remarkably intuitive when you grasp its key parts. Here is a breakdown of important elements:

-

Chart Space: The central focus, displaying the chosen chart kind, indicators, and drawing instruments.

-

Toolbar: Supplies entry to chart varieties, drawing instruments, indicators, timeframes, and different important features.

-

Indicator Panel: Lists all utilized indicators, permitting for personalization and removing.

-

Drawing Instruments: A big selection of instruments for drawing trendlines, Fibonacci retracements, assist/resistance ranges, and different annotations straight on the chart.

-

Timeframe Selector: Permits fast switching between completely different timeframes (e.g., 1-minute, 5-minute, hourly, each day, weekly). That is essential for analyzing worth motion throughout numerous time scales.

-

Market Watchlist: Permits you to observe a number of property concurrently, monitoring worth modifications in real-time.

Superior Methods and Methods:

TradingView’s energy really shines while you mix its options to develop refined buying and selling methods. Listed here are some superior methods:

-

A number of Timeframe Evaluation: Analyzing the identical asset throughout completely different timeframes (e.g., evaluating a each day chart with a 5-minute chart) offers a extra complete understanding of the present market context. This enables for figuring out higher-probability setups.

-

Backtesting Methods: Whereas TradingView would not provide totally automated backtesting, you possibly can manually take a look at your methods by observing historic worth motion and evaluating the potential outcomes of your buying and selling plan.

-

Alert Creation: Arrange customized alerts based mostly on worth motion, indicator alerts, or different circumstances. These alerts can notify you of potential buying and selling alternatives, making certain you do not miss necessary market actions.

-

Script Improvement (Pine Script): For superior customers, TradingView’s Pine Script permits you to create customized indicators and methods. This offers unparalleled flexibility and the power to tailor your evaluation to your particular wants.

-

Combining Indicators: Efficient methods typically contain combining a number of indicators to verify alerts and cut back false entries. For instance, combining RSI with MACD can present stronger purchase/promote alerts.

Limitations and Concerns:

Whereas TradingView is a robust device, it is important to concentrate on its limitations:

-

Information Accuracy: Whereas typically dependable, the accuracy of the info will depend on the info supplier. It is essential to decide on a good information supplier to attenuate errors.

-

Over-Evaluation Paralysis: The abundance of indicators and instruments can result in over-analysis and doubtlessly poor decision-making. Deal with a restricted set of instruments and develop a transparent buying and selling plan.

-

No Direct Buying and selling: TradingView is primarily a charting and evaluation platform. You will want to make use of a separate brokerage account to execute trades.

-

Subscription Prices: Whereas a free model is offered, accessing superior options and eradicating limitations requires a paid subscription.

Conclusion:

The TradingView reside chart is a robust device for merchants of all ranges. By mastering its options, understanding its limitations, and creating a well-defined buying and selling technique, you possibly can considerably improve your buying and selling efficiency. From fundamental candlestick evaluation to superior script growth, the platform gives a complete ecosystem for analyzing markets and making knowledgeable buying and selling choices. Nonetheless, do not forget that profitable buying and selling requires self-discipline, danger administration, and steady studying. TradingView is a worthwhile asset in your arsenal, but it surely’s not a magic bullet for assured earnings. Use it properly, and it’ll considerably enhance your probabilities of success within the dynamic world of buying and selling.

Closure

Thus, we hope this text has supplied worthwhile insights into Mastering the TradingView Dwell Chart: A Deep Dive into Options and Methods. We hope you discover this text informative and helpful. See you in our subsequent article!