Mastering TradingView Charts: A Complete Information for Merchants of All Ranges

Associated Articles: Mastering TradingView Charts: A Complete Information for Merchants of All Ranges

Introduction

With enthusiasm, let’s navigate by means of the intriguing matter associated to Mastering TradingView Charts: A Complete Information for Merchants of All Ranges. Let’s weave attention-grabbing info and provide recent views to the readers.

Desk of Content material

Mastering TradingView Charts: A Complete Information for Merchants of All Ranges

TradingView has quickly turn into the go-to platform for tens of millions of merchants worldwide, providing a robust suite of charting instruments, technical evaluation indicators, and a vibrant neighborhood. Its intuitive interface, mixed with its in depth performance, makes it appropriate for each inexperienced persons taking their first steps available in the market and seasoned professionals searching for superior analytical capabilities. This text will delve into the important thing options of TradingView charts, exploring find out how to successfully make the most of them for numerous buying and selling methods and evaluation strategies.

Understanding the TradingView Chart Interface:

The core of TradingView is its customizable charting system. Upon logging in, you are offered with a clear, but highly effective interface. Let’s break down the important elements:

-

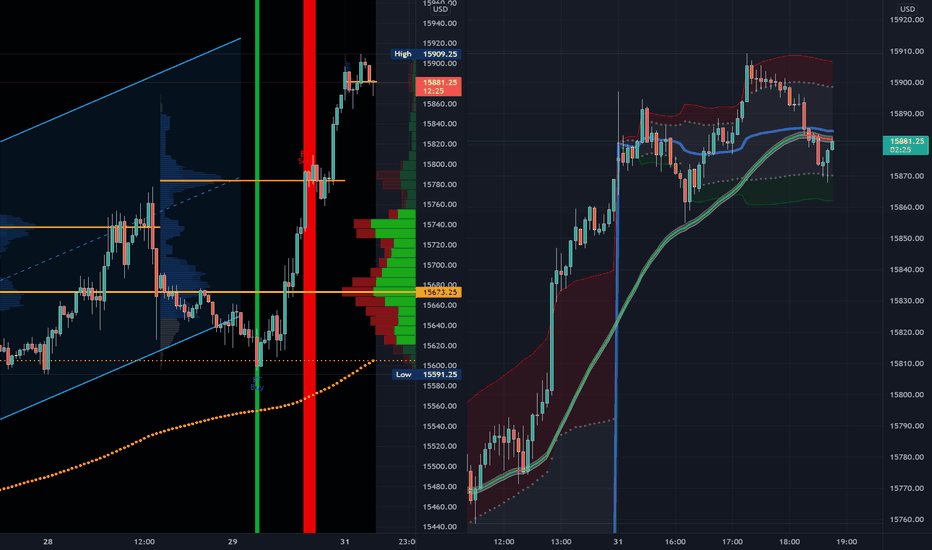

Chart Space: That is the central focus, displaying the value motion of your chosen asset (shares, foreign exchange, cryptocurrencies, futures, and so forth.) over a particular time-frame. You’ll be able to modify the timeframe from intraday (1-minute, 5-minute, and so forth.) to day by day, weekly, and even month-to-month charts, relying in your buying and selling horizon.

-

Toolbars: Positioned on the prime and alongside the perimeters, these toolbars present entry to an unlimited array of instruments. You may discover choices so as to add indicators, draw drawing instruments (development strains, Fibonacci retracements, and so forth.), change chart varieties (candlestick, bar, line), and modify chart settings (colours, kinds, quantity).

-

Indicator Library: TradingView boasts an intensive library of technical indicators, starting from traditional oscillators like RSI and MACD to extra superior indicators just like the Superior Oscillator and Supertrend. These indicators assist merchants establish potential entry and exit factors, momentum shifts, and general market developments.

-

Drawing Instruments: That is arguably one in all TradingView’s strongest options. You should use quite a lot of instruments to visually symbolize patterns, assist and resistance ranges, and potential worth targets. These instruments embrace development strains, Fibonacci instruments, Gann strains, and plenty of extra. The power to annotate charts with notes and labels additional enhances the analytical course of.

-

Pine Editor: For superior customers, the Pine Editor lets you create and customise your individual indicators and techniques utilizing a proprietary scripting language. This opens up a world of prospects for growing distinctive buying and selling instruments tailor-made to particular person wants and preferences.

Chart Sorts and Timeframes:

TradingView provides a number of chart varieties, every with its personal strengths and weaknesses:

-

Candlestick Charts: The preferred alternative, candlestick charts visually symbolize the open, excessive, low, and shut (OHLC) costs of an asset over a particular interval. The physique of the candlestick signifies the value vary between the open and shut, whereas the wicks (shadows) present the excessive and low costs. Candlestick patterns present helpful insights into market sentiment and potential worth actions.

-

Bar Charts: Much like candlestick charts, bar charts show the OHLC information, however in a less complicated, much less visually detailed format. They’re helpful for rapidly figuring out worth fluctuations.

-

Line Charts: Line charts join the closing costs of an asset over time, offering a clean illustration of worth developments. They’re much less detailed than candlestick or bar charts however are helpful for figuring out long-term developments.

Selecting the suitable timeframe is essential. Brief-term timeframes (e.g., 1-minute, 5-minute) are appropriate for scalping and day buying and selling, whereas longer timeframes (e.g., day by day, weekly, month-to-month) are higher suited to swing buying and selling and long-term investing. Many merchants make the most of a number of timeframes concurrently to substantiate indicators and acquire a extra complete perspective.

Using Technical Indicators Successfully:

TradingView’s indicator library is a treasure trove of analytical instruments. Nonetheless, it is essential to grasp that indicators will not be predictive instruments; they’re lagging indicators that mirror previous worth motion. Over-reliance on any single indicator can result in inaccurate buying and selling selections.

Some generally used indicators embrace:

-

Shifting Averages (MA): These clean out worth fluctuations and assist establish developments. Widespread varieties embrace Easy Shifting Common (SMA), Exponential Shifting Common (EMA), and Weighted Shifting Common (WMA).

-

Relative Energy Index (RSI): An oscillator that measures the magnitude of current worth modifications to judge overbought and oversold circumstances.

-

Shifting Common Convergence Divergence (MACD): One other oscillator that identifies momentum modifications and potential development reversals.

-

Bollinger Bands: These bands measure volatility and may help establish potential breakouts or reversals.

Efficient indicator utilization entails combining a number of indicators to substantiate indicators and filter out false indicators. Backtesting methods utilizing historic information can be important to evaluate the effectiveness of various indicator combos.

Mastering Drawing Instruments for Technical Evaluation:

TradingView’s drawing instruments are invaluable for figuring out assist and resistance ranges, development strains, and potential worth targets. Some generally used instruments embrace:

-

Pattern Strains: These strains join important highs or lows to establish the general route of a development.

-

Assist and Resistance Ranges: Horizontal strains drawn at worth ranges the place the value has beforehand bounced or damaged by means of.

-

Fibonacci Retracements: These instruments use Fibonacci ratios to establish potential assist and resistance ranges inside a development.

-

Fibonacci Extensions: These instruments venture potential worth targets primarily based on Fibonacci ratios.

-

Gann Strains: These strains are primarily based on Gann’s theories of market cycles and angles.

Mastering drawing instruments requires follow and expertise. Understanding find out how to precisely establish assist and resistance ranges and interpret chart patterns is essential for profitable buying and selling.

The TradingView Group and Social Options:

TradingView’s neighborhood facet is a big benefit. Merchants can share their concepts, methods, and chart setups by means of private and non-private charts, fostering collaboration and studying. The platform additionally permits customers to observe different merchants, analyze their methods, and be taught from their experiences. This social facet may be invaluable for each inexperienced persons and skilled merchants.

Backtesting and Technique Optimization:

TradingView provides restricted backtesting capabilities, primarily by means of its Pine Editor. Whereas not as complete as devoted backtesting platforms, it permits customers to check their methods on historic information to judge their efficiency earlier than risking actual capital. Nonetheless, it is essential to do not forget that previous efficiency just isn’t indicative of future outcomes.

Conclusion:

TradingView charts present a complete and highly effective platform for technical evaluation and buying and selling. By mastering the assorted options, together with chart varieties, indicators, drawing instruments, and neighborhood assets, merchants of all ranges can considerably improve their buying and selling methods and enhance their decision-making course of. Nonetheless, do not forget that profitable buying and selling requires steady studying, self-discipline, and danger administration. TradingView is a helpful instrument, but it surely’s just one element of a profitable buying and selling strategy. All the time conduct thorough analysis, handle your danger successfully, and by no means make investments greater than you’ll be able to afford to lose.

Closure

Thus, we hope this text has supplied helpful insights into Mastering TradingView Charts: A Complete Information for Merchants of All Ranges. We thanks for taking the time to learn this text. See you in our subsequent article!