Mastering TradingView Charts: A Complete Tutorial

Associated Articles: Mastering TradingView Charts: A Complete Tutorial

Introduction

With enthusiasm, let’s navigate by way of the intriguing subject associated to Mastering TradingView Charts: A Complete Tutorial. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

Mastering TradingView Charts: A Complete Tutorial

TradingView has turn into the go-to platform for tens of millions of merchants and buyers worldwide, primarily attributable to its highly effective and versatile charting capabilities. This complete tutorial will information you thru the intricacies of TradingView charts, from the fundamentals to superior strategies, empowering you to research markets and make knowledgeable buying and selling choices.

I. Understanding the TradingView Chart Interface:

Earlier than diving into particular chart sorts and indicators, it is essential to familiarize your self with the TradingView interface. The format might sound overwhelming initially, however with observe, it turns into intuitive. The core parts embrace:

-

Chart Space: That is the central house displaying the value chart itself. You possibly can zoom out and in, pan throughout timeframes, and add numerous indicators and drawings.

-

Toolbar: Situated on the prime, the toolbar supplies fast entry to important capabilities like altering chart sorts, including indicators, drawing instruments, and managing your format.

-

Indicator Panel: This panel, normally on the left, lists all obtainable indicators, permitting you to look, filter, and add them to your chart.

-

Drawing Instruments Panel: Just like the indicator panel, this panel supplies entry to varied drawing instruments for technical evaluation, akin to pattern strains, Fibonacci retracements, and help/resistance ranges.

-

Properties Panel: This panel, normally positioned on the best, lets you customise the looks and settings of your chosen indicators, drawings, and the chart itself.

-

Timeframe Selector: This lets you swap between completely different timeframes, from intraday (1-minute, 5-minute, and so on.) to day by day, weekly, and month-to-month charts.

-

Image Search: Use this to rapidly search and add completely different belongings (shares, cryptocurrencies, foreign exchange pairs, and so on.) to your chart.

II. Chart Varieties:

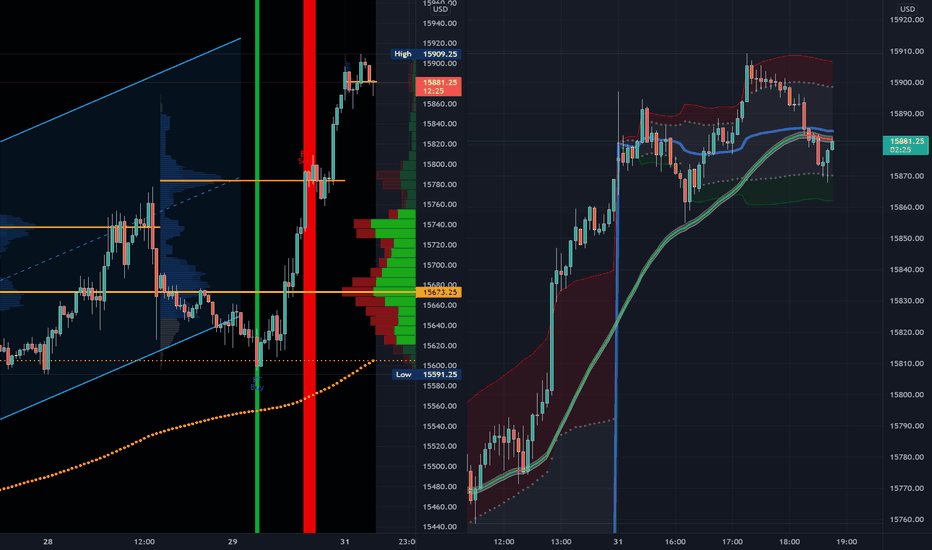

TradingView provides a number of chart sorts, every offering a novel perspective on value motion:

-

Candlestick Chart: The most well-liked chart kind, displaying value knowledge for a particular interval as candles. The physique of the candle represents the value vary between the open and shut, whereas the wicks symbolize the excessive and low costs. Inexperienced candles sometimes point out an upward pattern, whereas pink candles point out a downward pattern.

-

Bar Chart: Just like candlestick charts, however as a substitute of candles, it makes use of vertical bars to symbolize value knowledge. Every bar represents the open, excessive, low, and shut costs for a particular interval.

-

Line Chart: A easy chart kind connecting the closing costs of every interval with a line. It is helpful for visualizing long-term tendencies and smoothing out value fluctuations.

-

Heikin Ashi Chart: A modified candlestick chart designed to clean out value fluctuations and make tendencies simpler to determine. It makes use of a weighted common of the open, excessive, low, and shut costs to create every candle.

-

Space Chart: This chart kind fills the world between the value line and the x-axis, making it simpler to visualise value ranges and quantity.

III. Including and Utilizing Indicators:

TradingView’s in depth library of indicators is a key characteristic. This is how you can add and use them successfully:

-

Seek for Indicators: Use the search bar within the indicator panel to search out particular indicators (e.g., RSI, MACD, Bollinger Bands).

-

Add Indicators: Click on on the indicator so as to add it to your chart. The indicator will seem on the chart, and its settings shall be obtainable within the Properties panel.

-

Customise Settings: Regulate parameters like intervals, lengths, and colours to optimize the indicator’s efficiency in your particular buying and selling technique.

-

Decoding Indicators: Every indicator supplies distinctive indicators. Learn to interpret these indicators accurately to keep away from misinterpretations. Understanding the strengths and limitations of every indicator is essential. For instance, the RSI (Relative Power Index) measures momentum, whereas the MACD (Shifting Common Convergence Divergence) identifies modifications in momentum. Bollinger Bands present value volatility.

IV. Using Drawing Instruments:

Drawing instruments are important for technical evaluation. TradingView provides a variety, together with:

-

Pattern Traces: Join important value factors to determine help and resistance ranges, in addition to total tendencies.

-

Fibonacci Retracements: Used to determine potential help and resistance ranges primarily based on Fibonacci ratios.

-

Horizontal Traces: Draw horizontal strains to focus on help and resistance ranges.

-

Vertical Traces: Mark important occasions or value cut-off dates.

-

Channels: Draw parallel strains to determine value ranges and potential breakouts.

-

Rectangles: Spotlight particular value areas or patterns.

-

Elliott Wave: For these aware of Elliott Wave Principle, this software helps to determine wave constructions.

V. Superior Methods:

-

A number of Timeframe Evaluation: Analyzing the identical asset throughout completely different timeframes (e.g., evaluating a day by day chart with a 1-hour chart) can present a extra complete understanding of the market.

-

Combining Indicators: Utilizing a number of indicators collectively can present a extra sturdy buying and selling sign. Nonetheless, keep away from indicator overload; deal with a number of key indicators that complement one another.

-

Backtesting: TradingView lets you backtest your buying and selling methods utilizing historic knowledge. This helps to guage the efficiency of your methods earlier than risking actual capital. Nonetheless, keep in mind that previous efficiency is just not indicative of future outcomes.

-

Alert Creation: Arrange alerts to inform you of particular value actions or indicator crossovers. This may be essential for well timed commerce execution.

-

Pine Scripting: For superior customers, TradingView provides Pine Script, a programming language permitting you to create customized indicators and methods. This opens up a world of prospects for tailoring your evaluation to your particular wants.

VI. Ideas for Efficient Chart Use:

-

Hold it Easy: Keep away from cluttering your chart with too many indicators and drawings. Deal with a number of key indicators and instruments that present essentially the most related info.

-

Context is Key: Contemplate the broader market context when decoding chart patterns and indicator indicators. Financial information, geopolitical occasions, and total market sentiment can considerably affect value actions.

-

Apply Repeatedly: The extra you utilize TradingView, the extra snug you will turn into with its options and capabilities. Experiment with completely different chart sorts, indicators, and drawing instruments to search out what works finest in your buying and selling fashion.

-

Threat Administration: All the time use acceptable threat administration strategies, no matter your charting expertise. By no means threat extra capital than you possibly can afford to lose.

-

Steady Studying: The monetary markets are consistently evolving. Keep up to date on new indicators, methods, and strategies to reinforce your buying and selling expertise.

VII. Conclusion:

TradingView’s charting capabilities supply a strong software for technical evaluation. By mastering the interface, understanding completely different chart sorts and indicators, and using drawing instruments successfully, you possibly can considerably enhance your skill to research markets and make knowledgeable buying and selling choices. Nonetheless, keep in mind that charting is only one piece of the puzzle. Profitable buying and selling requires a holistic strategy that features threat administration, elementary evaluation, and a deep understanding of the markets. This tutorial serves as a basis; steady studying and observe are important for mastering TradingView and attaining your buying and selling targets. Bear in mind to at all times commerce responsibly and inside your threat tolerance.

Closure

Thus, we hope this text has offered invaluable insights into Mastering TradingView Charts: A Complete Tutorial. We respect your consideration to our article. See you in our subsequent article!