Mastering TradingView Charts inside Zerodha: A Complete Information

Associated Articles: Mastering TradingView Charts inside Zerodha: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Mastering TradingView Charts inside Zerodha: A Complete Information. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

Mastering TradingView Charts inside Zerodha: A Complete Information

Zerodha, a well-liked Indian brokerage, would not natively combine with TradingView, a number one charting platform. Nevertheless, the facility and adaptability of TradingView’s charting instruments are extremely wanted by many Zerodha customers. This text will information you thru the method of successfully using TradingView alongside your Zerodha account, maximizing your buying and selling technique improvement and execution. We’ll cowl every thing from fundamental setup to superior strategies, making certain you possibly can leverage one of the best of each platforms.

I. Bridging the Hole: Linking TradingView and Zerodha

Since there is not any direct integration, the connection between TradingView and Zerodha is oblique. You will use TradingView primarily for evaluation and chart research, whereas executing trades by means of your Zerodha Kite or Console terminal. This implies you will must manually enter orders primarily based in your TradingView evaluation. This might sound cumbersome initially, however with observe, it turns into a streamlined workflow.

II. Establishing TradingView for Zerodha Utilization:

-

Account Creation: If you happen to do not have already got one, create a TradingView account. Select a plan that fits your wants; the free plan presents ample options for many merchants.

-

Image Choice: TradingView helps an enormous vary of devices. Make sure you’re utilizing the proper symbols on your Zerodha holdings. Zerodha sometimes makes use of NSE: image format (e.g., NSE:RELIANCE). Double-check the image accuracy to keep away from errors.

-

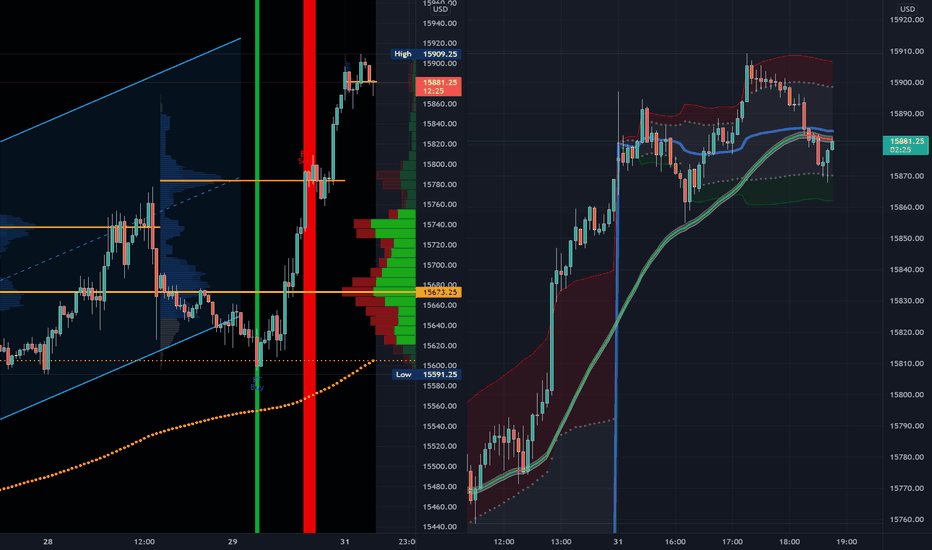

Chart Choice: TradingView gives quite a few chart varieties (candlestick, bar, line, Heikin-Ashi, and so on.). Choose the chart kind that most accurately fits your buying and selling type and evaluation wants. Candlestick charts are the commonest alternative for technical evaluation.

-

Indicator Integration: TradingView’s library of technical indicators is in depth. Discover and add indicators related to your technique. Begin with just a few key indicators and steadily add extra as you change into extra accustomed to the platform. Widespread selections embrace shifting averages (SMA, EMA), RSI, MACD, Bollinger Bands, and quantity indicators.

-

Drawing Instruments: Make the most of TradingView’s drawing instruments (pattern strains, Fibonacci retracements, assist/resistance ranges, and so on.) to determine potential commerce setups. These instruments assist visualize worth motion and ensure your buying and selling hypotheses.

-

Pine Script (Optionally available): For superior customers, TradingView’s Pine Script lets you create customized indicators and methods. This requires programming information however presents unparalleled customization.

III. Environment friendly Workflow: TradingView Evaluation & Zerodha Execution

The important thing to profitable utilization lies in a well-defined workflow:

-

Market Evaluation on TradingView: Start by analyzing the charts on TradingView. Establish potential entry and exit factors primarily based in your chosen indicators and drawing instruments. Word down key ranges (assist, resistance, stop-loss, goal).

-

Order Placement in Zerodha: As soon as you’ve got recognized a buying and selling alternative, swap to your Zerodha Kite or Console terminal. Manually enter the order particulars (purchase/promote, amount, worth, order kind – market or restrict). Make sure the order particulars exactly match your evaluation on TradingView.

-

Order Kind Choice: Select the suitable order kind in Zerodha primarily based in your technique. Market orders execute instantly at one of the best accessible worth, whereas restrict orders execute solely at your specified worth or higher. Cease-loss orders mechanically exit a place if the value reaches a predefined stage, minimizing potential losses.

-

Place Monitoring: Monitor your positions in Zerodha. You need to use TradingView to trace worth motion and assess the efficiency of your trades. Keep in mind to regulate your stop-loss or take-profit ranges as wanted primarily based on altering market situations.

-

Document Maintaining: Keep an in depth buying and selling journal, noting your TradingView evaluation, order particulars (entry worth, exit worth, revenue/loss), and any related market occasions. This helps monitor your efficiency and refine your buying and selling technique over time.

IV. Superior Strategies and Ideas:

-

Alert Creation: TradingView lets you set alerts primarily based on worth motion or indicator indicators. These alerts can notify you when a possible buying and selling alternative arises, permitting you to react shortly. Nevertheless, keep in mind that alerts are solely notifications and require handbook order placement in Zerodha.

-

A number of Timeframe Evaluation: Analyze charts throughout a number of timeframes (e.g., 1-minute, 5-minute, 15-minute, every day, weekly) to get a complete view of the market. This helps determine larger chance trades by confirming indicators throughout completely different timeframes.

-

Backtesting (with warning): Whereas TradingView presents backtesting capabilities, deal with the outcomes with warning. Backtesting would not completely replicate real-market situations, and previous efficiency shouldn’t be indicative of future outcomes. Use backtesting to refine your technique, however at all times validate it with dwell buying and selling.

-

Technique Optimization: Constantly evaluate and optimize your buying and selling technique primarily based in your efficiency. Analyze your buying and selling journal to determine areas for enchancment and adapt your method as wanted.

-

Threat Administration: Implement sturdy danger administration strategies. By no means danger greater than you possibly can afford to lose on any single commerce. Use stop-loss orders to restrict potential losses and handle your place dimension appropriately.

V. Troubleshooting Widespread Points:

-

Image Discrepancies: Make sure you’re utilizing the proper symbols in each TradingView and Zerodha. Incorrect symbols can result in inaccurate evaluation and order placement errors.

-

Delayed Information: TradingView’s knowledge might generally lag barely behind real-time market knowledge. Be conscious of this delay when making buying and selling selections.

-

Order Execution Errors: Double-check your order particulars in Zerodha earlier than submitting them. Errors in amount, worth, or order kind can lead to unintended penalties.

-

Platform Points: Occasional glitches can happen on both TradingView or Zerodha. If you happen to encounter points, verify the respective platform’s standing pages or contact their assist groups.

VI. Conclusion:

Utilizing TradingView with Zerodha requires a handbook course of, however the advantages of TradingView’s superior charting and evaluation capabilities considerably outweigh the inconvenience. By following the steps outlined on this information and adopting a disciplined workflow, you possibly can successfully mix the strengths of each platforms to reinforce your buying and selling technique and enhance your total buying and selling efficiency. Do not forget that profitable buying and selling requires constant studying, adaptation, and rigorous danger administration, whatever the instruments you employ. All the time prioritize accountable buying and selling practices and steady enchancment.

Closure

Thus, we hope this text has offered beneficial insights into Mastering TradingView Charts inside Zerodha: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!