Mastering Your QuickBooks Chart of Accounts: A Complete Information

Associated Articles: Mastering Your QuickBooks Chart of Accounts: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Mastering Your QuickBooks Chart of Accounts: A Complete Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Mastering Your QuickBooks Chart of Accounts: A Complete Information

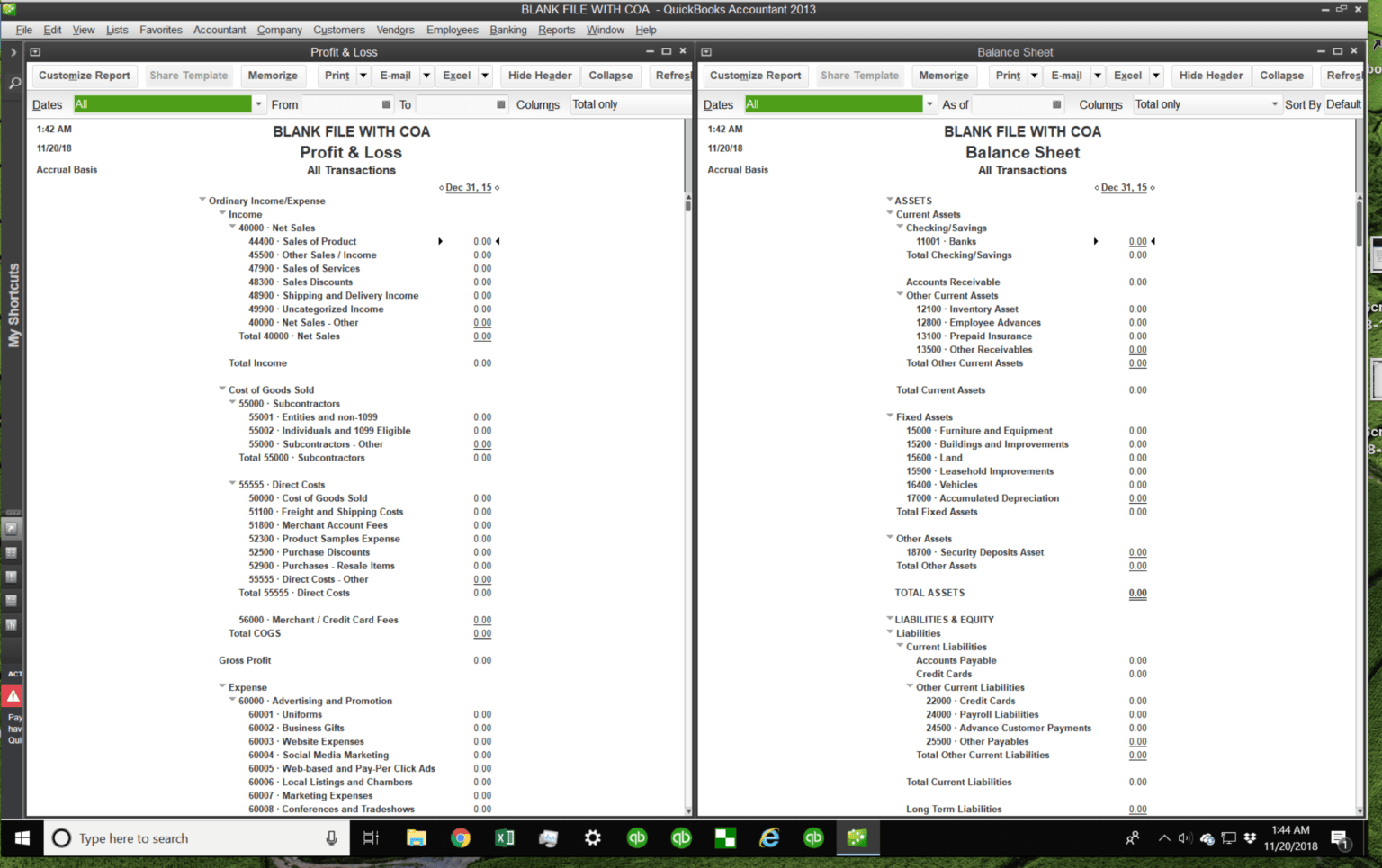

The QuickBooks Chart of Accounts is the spine of your monetary system. It is a meticulously organized checklist of all of your firm’s accounts, categorized to trace revenue, bills, property, liabilities, and fairness. A well-structured chart of accounts is essential for correct monetary reporting, environment friendly tax preparation, and knowledgeable enterprise decision-making. This text delves into the intricacies of QuickBooks Chart of Accounts, offering a complete information for each freshmen and skilled customers.

Understanding the Fundamentals: What’s a Chart of Accounts?

Consider your Chart of Accounts as an in depth ledger for what you are promoting. Every account represents a selected side of your funds. For instance, you might need accounts for "Money," "Accounts Receivable," "Gross sales Income," "Lease Expense," and "Mortgage Payable." Each transaction you document in QuickBooks is linked to a number of accounts on this chart, making certain that each one monetary exercise is correctly categorized and tracked.

The Chart of Accounts follows the rules of double-entry bookkeeping, which means each transaction impacts at the least two accounts. As an illustration, once you obtain cost for a service, you’d debit (improve) your "Money" account and credit score (improve) your "Gross sales Income" account. This ensures that the accounting equation (Property = Liabilities + Fairness) all the time stays balanced.

Key Account Varieties in Your QuickBooks Chart of Accounts:

QuickBooks organizes accounts into a number of key classes:

-

Property: These symbolize what what you are promoting owns. Examples embrace:

- Present Property: Money, Accounts Receivable (cash owed to you), Stock, Pay as you go Bills. These are property anticipated to be transformed to money inside a 12 months.

- Mounted Property: Property, Plant, and Gear (PP&E) like buildings, automobiles, and equipment. These are long-term property utilized in enterprise operations.

- Different Property: Investments, intangible property (patents, copyrights).

-

Liabilities: These symbolize what what you are promoting owes to others. Examples embrace:

- Present Liabilities: Accounts Payable (cash you owe to suppliers), Brief-term Loans, Salaries Payable. These are money owed due inside a 12 months.

- Lengthy-term Liabilities: Lengthy-term Loans, Mortgages. These are money owed due past a 12 months.

-

Fairness: This represents the proprietor’s stake within the enterprise. For sole proprietorships and partnerships, that is usually the proprietor’s capital account. For companies, it contains retained earnings and customary inventory.

-

Income: This represents revenue generated from what you are promoting actions. Examples embrace:

- Gross sales Income

- Service Income

- Curiosity Earnings

- Rental Earnings

-

Bills: These symbolize prices incurred in working what you are promoting. Examples embrace:

- Value of Items Offered (COGS)

- Lease Expense

- Salaries Expense

- Utilities Expense

- Advertising Expense

Setting Up Your QuickBooks Chart of Accounts:

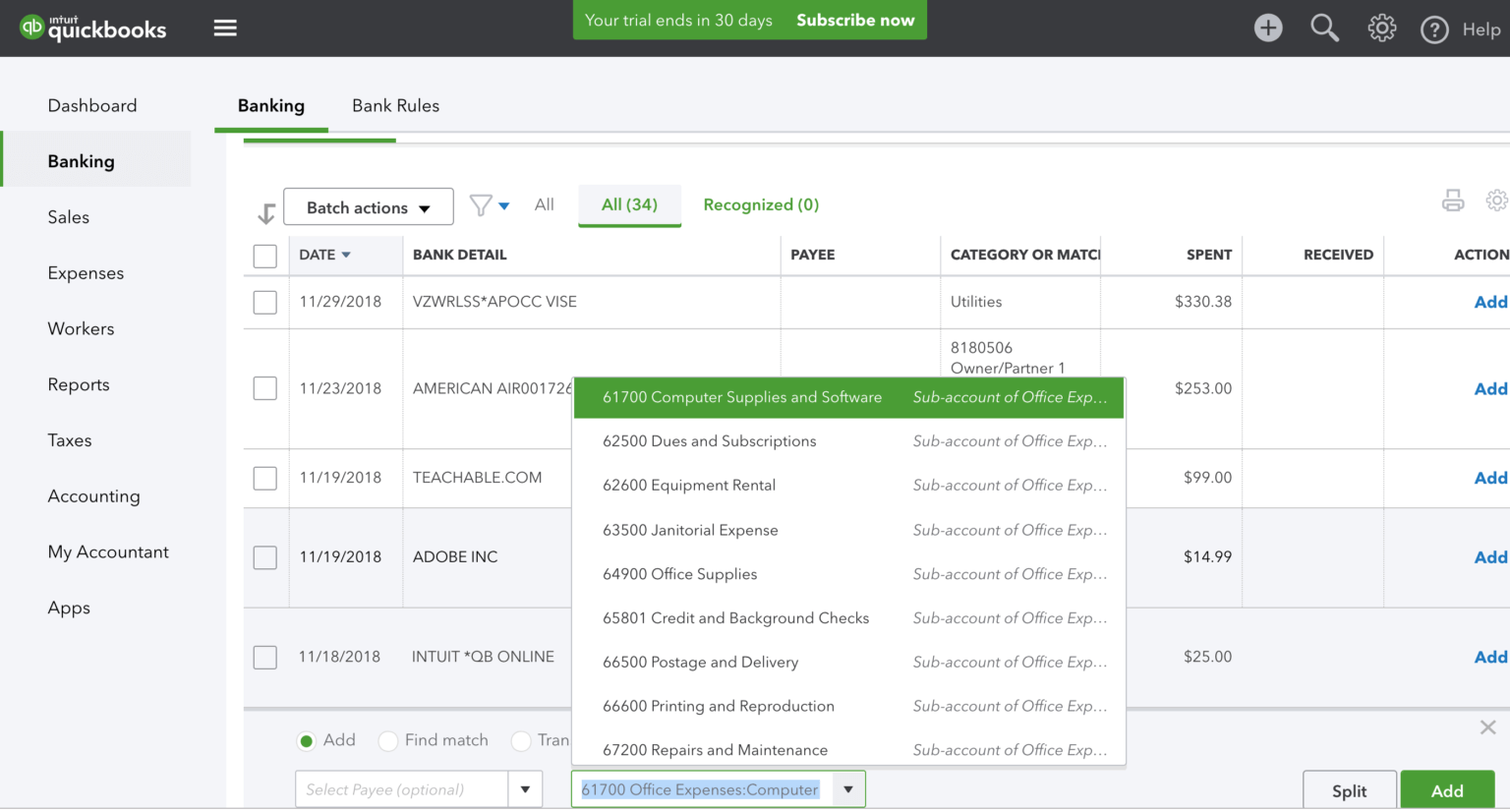

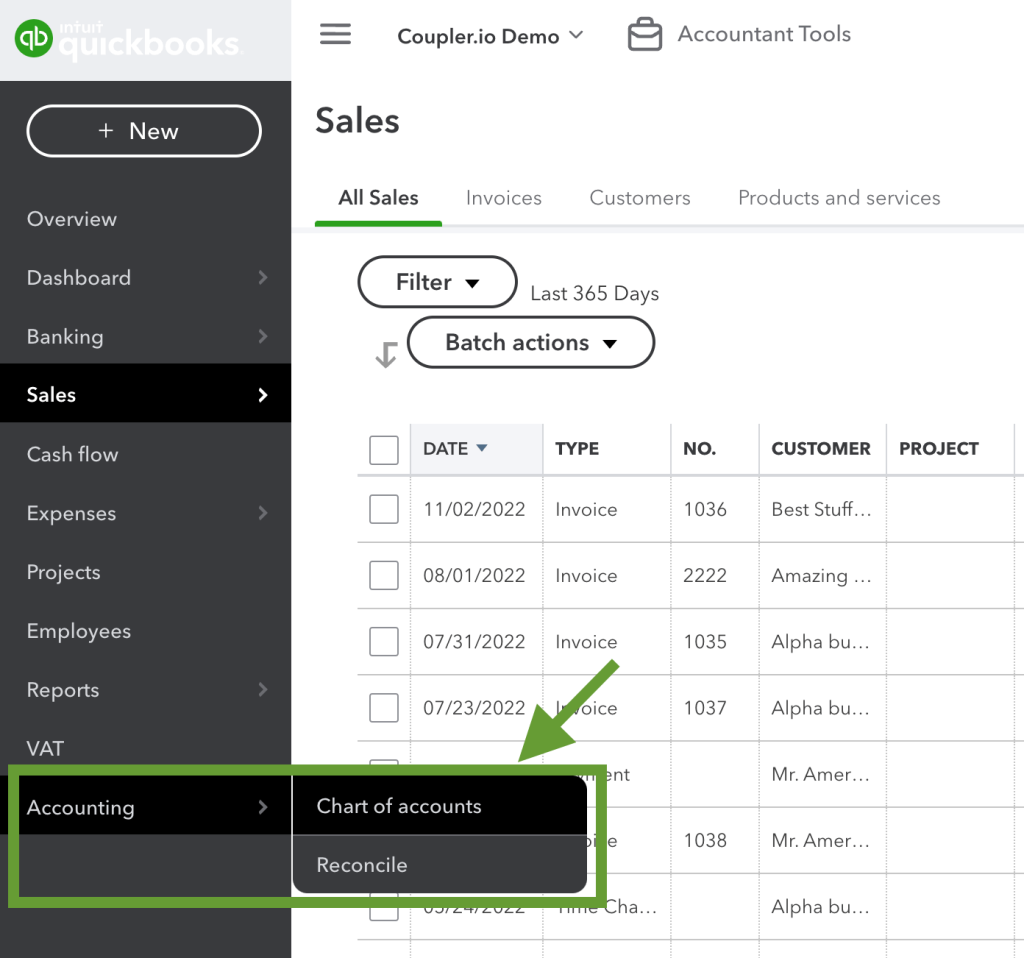

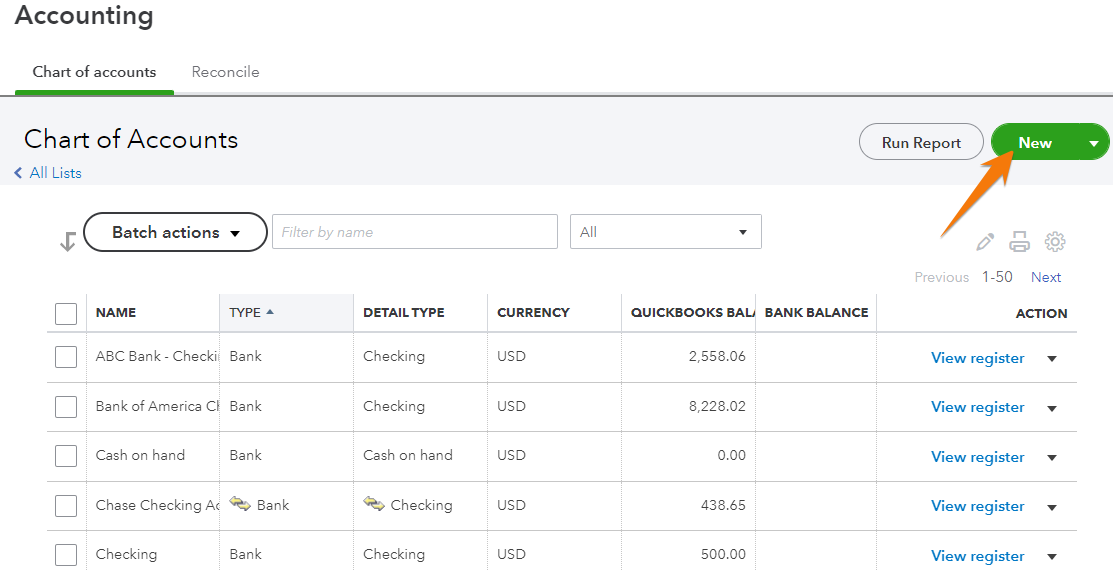

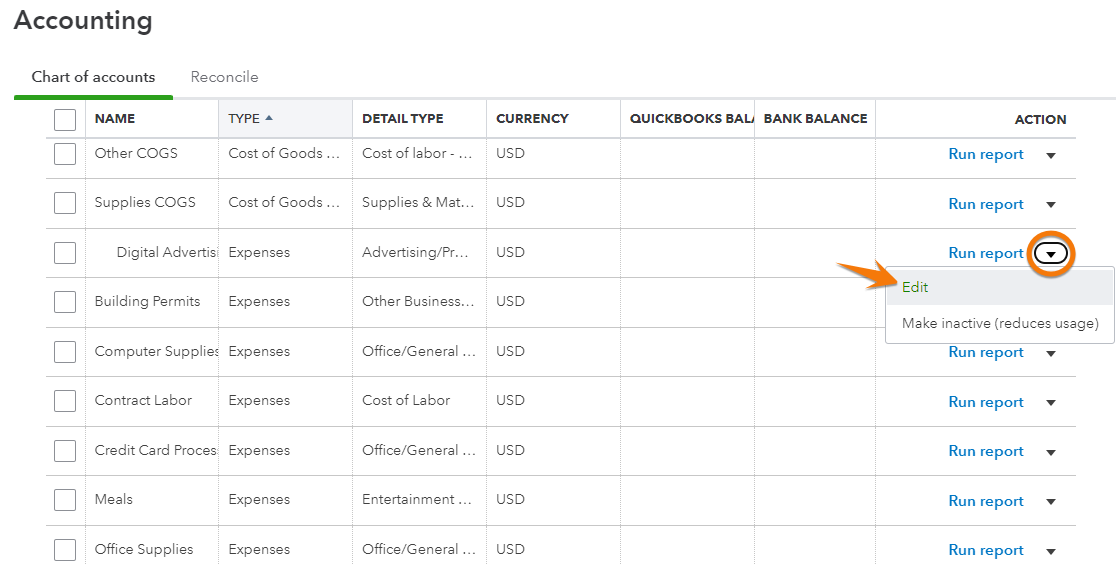

Establishing your Chart of Accounts in QuickBooks is a vital preliminary step. Whereas QuickBooks provides default account templates, customizing it to your particular enterprise wants is important for correct monetary reporting. Here is a step-by-step information:

-

Select the Proper Chart of Accounts Template: QuickBooks gives industry-specific templates that may be a great place to begin. Nonetheless, you may seemingly have to customise it additional.

-

Add New Accounts: If what you are promoting requires accounts not included within the template, you may want so as to add them. Be exact and descriptive in your account naming. For instance, as a substitute of "Advertising," use "On-line Advertising" or "Print Advertising" for higher monitoring.

-

Use a Constant Chart of Accounts Construction: Preserve a logical construction utilizing sub-accounts to categorize bills and revenues additional. This enables for detailed monetary evaluation. For instance, beneath "Advertising Expense," you might need sub-accounts for "Promoting," "Public Relations," and "Commerce Exhibits."

-

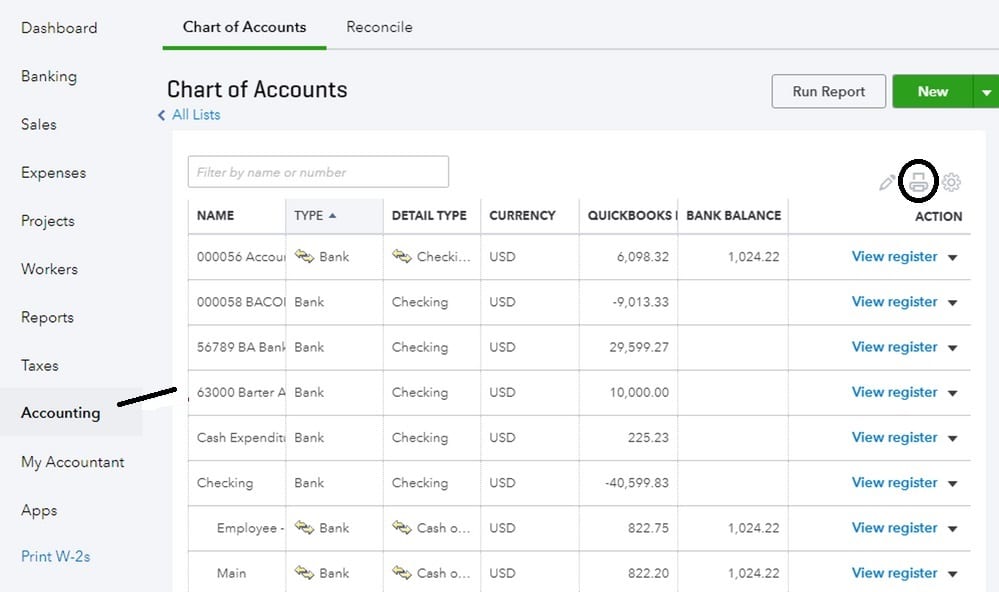

Account Numbers: Assign distinctive account numbers to every account. This facilitates simpler group and reporting. A typical methodology is to make use of a hierarchical system, the place the primary digit represents the account sort (e.g., 1 for property, 2 for liabilities), and subsequent digits present additional categorization.

-

Common Overview and Upkeep: Your enterprise will evolve, so usually overview and replace your Chart of Accounts to mirror modifications in your operations. This ensures your monetary knowledge stays correct and related.

Finest Practices for a Sturdy Chart of Accounts:

-

Maintain it Easy however Complete: Keep away from extreme element, however guarantee you’ve gotten enough accounts to trace all important elements of what you are promoting.

-

Use Descriptive Account Names: Clear and concise names will make it simpler to grasp your monetary stories.

-

Preserve Consistency: Use the identical account names and constructions all through your accounting course of.

-

Often Reconcile Your Accounts: Evaluate your QuickBooks knowledge to your financial institution statements and different monetary information to make sure accuracy.

-

Think about using a Advisor: For those who’re uncertain about organising your Chart of Accounts, take into account in search of recommendation from an accountant or QuickBooks marketing consultant.

The Significance of a Effectively-Structured Chart of Accounts:

A well-maintained Chart of Accounts provides quite a few advantages:

-

Correct Monetary Reporting: Supplies the muse for producing correct and dependable monetary statements, together with revenue statements, stability sheets, and money stream statements.

-

Improved Determination-Making: Detailed monetary knowledge permits for higher knowledgeable enterprise choices relating to pricing, budgeting, and funding.

-

Environment friendly Tax Preparation: Correctly categorized transactions simplify tax preparation and scale back the danger of errors.

-

Streamlined Auditing: A well-organized Chart of Accounts facilitates audits and ensures compliance with accounting requirements.

-

Enhanced Enterprise Administration: Supplies priceless insights into what you are promoting’s monetary well being and efficiency.

Conclusion:

The QuickBooks Chart of Accounts is a crucial element of your monetary administration system. By understanding its construction, implementing finest practices, and usually sustaining it, you possibly can guarantee correct monetary reporting, knowledgeable decision-making, and general enterprise success. Do not underestimate the significance of investing effort and time in creating and sustaining a sturdy and well-organized Chart of Accounts. It is an funding that may pay dividends in the long term. Keep in mind, when you’re unsure about any side of organising or managing your Chart of Accounts, in search of skilled recommendation is all the time a clever alternative.

Closure

Thus, we hope this text has offered priceless insights into Mastering Your QuickBooks Chart of Accounts: A Complete Information. We respect your consideration to our article. See you in our subsequent article!