Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates

Associated Articles: Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates

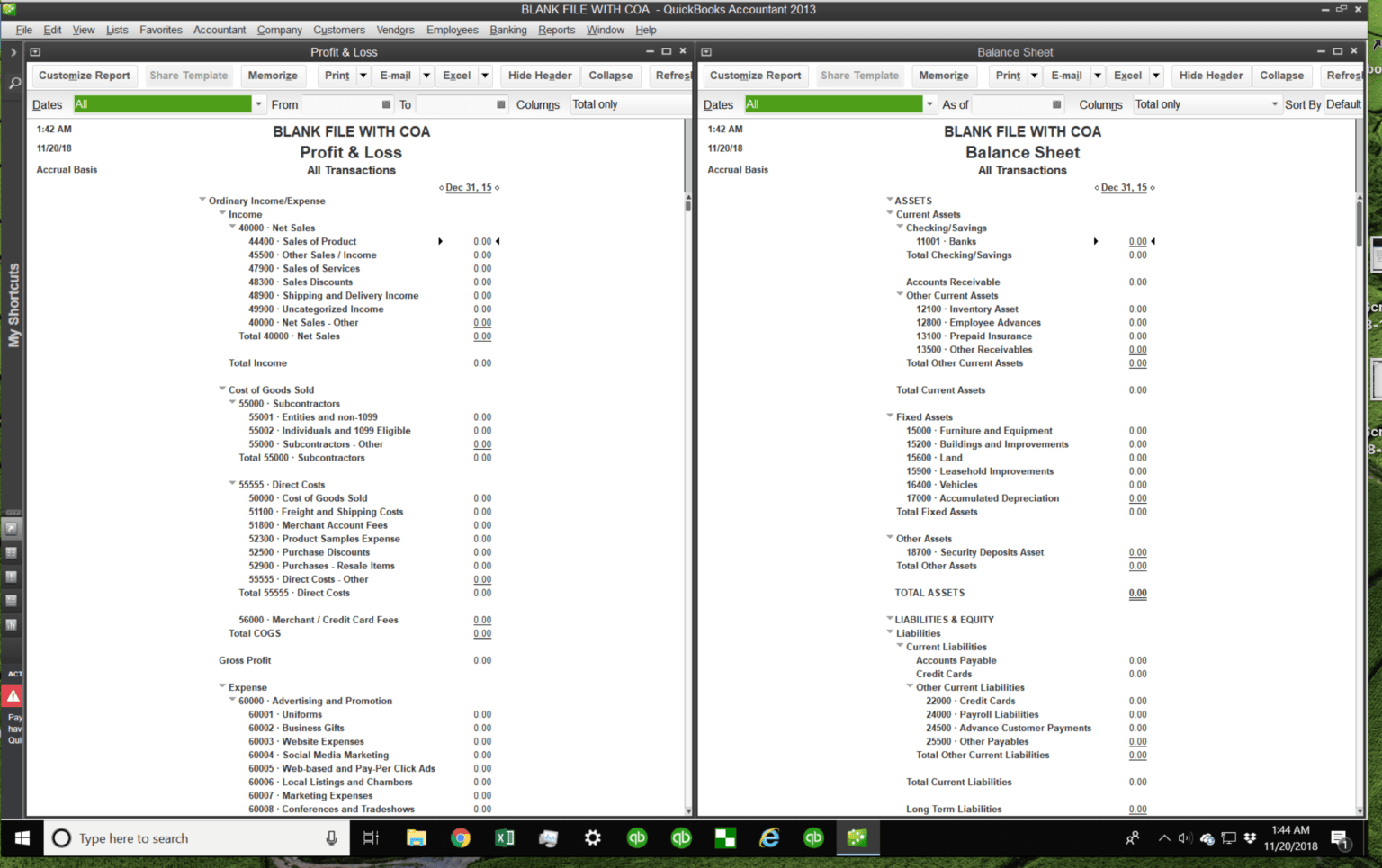

QuickBooks, a number one accounting software program, depends closely on its Chart of Accounts (COA) to prepare and categorize all monetary transactions. A well-structured COA is the spine of correct monetary reporting, environment friendly bookkeeping, and knowledgeable enterprise choices. This text offers a complete information to QuickBooks Chart of Accounts templates, exploring their significance, differing kinds, learn how to create and customise them, and finest practices for optimum monetary administration.

Understanding the Chart of Accounts in QuickBooks

The Chart of Accounts is basically an inventory of all of the accounts used to file monetary transactions inside your small business. Every account represents a selected facet of your funds, similar to belongings, liabilities, fairness, income, and bills. Consider it as an in depth organizational system to your firm’s cash – the place it comes from, the place it goes, and what it is used for.

QuickBooks gives a number of methods to handle your COA:

- Pre-built Templates: QuickBooks offers numerous pre-designed templates catering to totally different enterprise sorts (e.g., sole proprietorship, partnership, company). These templates supply a place to begin, offering a primary construction you’ll be able to customise.

- Customized Creation: You may have full management to construct a COA from scratch, tailor-made exactly to your particular enterprise wants and accounting strategies.

- Import/Export: You possibly can import a COA from one other accounting system or export your current COA for backup or switch.

Why Select a QuickBooks Chart of Accounts Template?

Utilizing a template gives a number of benefits:

- Time Financial savings: Beginning with a pre-built construction considerably reduces the time spent establishing your COA. You do not have to create every account individually.

- Consistency: Templates guarantee consistency in account naming and categorization, resulting in extra correct monetary reporting.

- Greatest Practices: Templates usually incorporate {industry} finest practices, guaranteeing your COA adheres to accounting requirements.

- Simple Customization: Whereas templates present a basis, they’re simply customizable to suit your distinctive enterprise wants. You possibly can add, delete, or modify accounts as required.

Forms of QuickBooks Chart of Accounts Templates

QuickBooks does not explicitly label its templates as such, however the numerous industry-specific beginning factors successfully act as templates. The hot button is selecting the one that the majority carefully aligns with your small business construction and {industry}. Think about these frequent sorts:

- Sole Proprietorship: This template consists of accounts related to a enterprise owned and operated by a single particular person. It usually simplifies the fairness part, specializing in the proprietor’s capital account.

- Partnership: This template caters to companies with a number of homeowners. It options separate capital accounts for every associate and displays the revenue and loss sharing agreements.

- Company (S Corp & C Corp): These templates are extra advanced, reflecting the company construction with accounts for retained earnings, inventory, and different corporate-specific transactions.

- Non-profit: This template consists of accounts particular to non-profit organizations, similar to contributions, grants, and program bills.

- Service-Based mostly Companies: This template emphasizes income and expense accounts associated to service provision, similar to consulting charges, labor prices, and advertising and marketing bills.

- Retail Companies: This template incorporates accounts related to stock administration, value of products bought, gross sales tax, and different retail-specific transactions.

Creating and Customizing Your QuickBooks Chart of Accounts

Whereas QuickBooks offers a primary construction, customizing it’s essential for correct monetary reporting. This is a step-by-step information:

- Select a Template (or Begin from Scratch): Choose the template that most accurately fits your small business kind. If none completely match, begin from scratch.

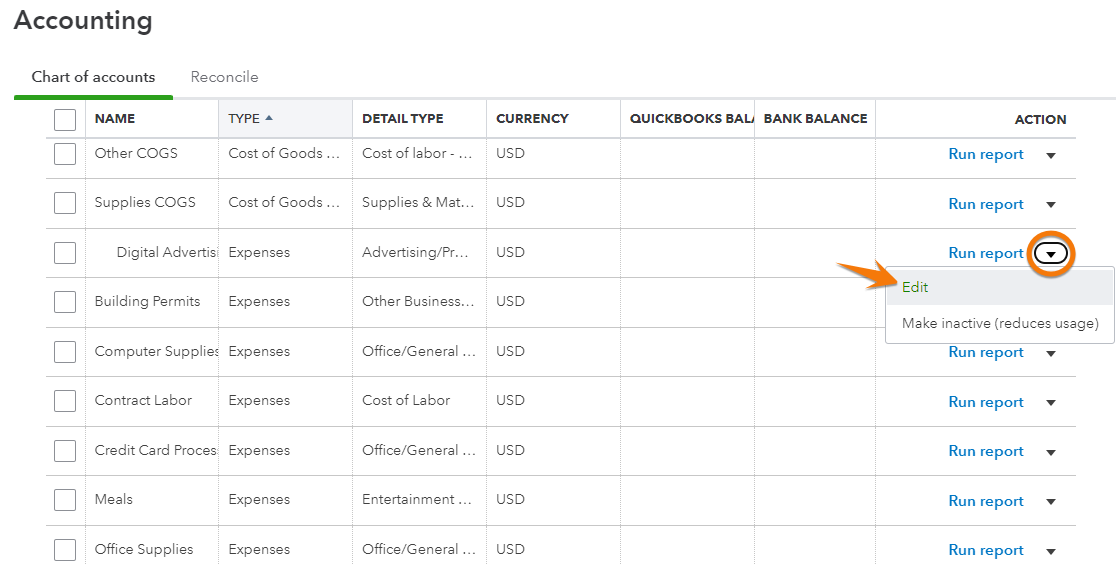

- Overview Current Accounts: Fastidiously look at the pre-existing accounts. Perceive their goal and guarantee they align along with your accounting wants.

- Add New Accounts: Add accounts as wanted. Use descriptive names that clearly point out the account’s goal. For instance, as a substitute of "Expense," use "Advertising Bills" or "Workplace Provides."

- Categorize Accounts: Assign every account to the right class (asset, legal responsibility, fairness, income, expense). That is essential for producing correct monetary reviews.

- Outline Account Numbers: QuickBooks makes use of account numbers for group. Think about using a constant numbering system (e.g., chart of accounts numbering system) to make sure straightforward identification and reporting.

- Specify Account Sorts: Totally different account sorts (e.g., earnings, expense, asset) have particular capabilities inside QuickBooks. Select the right kind for every account.

- Set Up Subaccounts: For detailed monitoring, create subaccounts below most important accounts. As an illustration, below "Advertising Bills," you might need subaccounts for "Promoting," "Social Media," and "Public Relations."

- Common Overview and Updates: Your small business evolves, so usually overview and replace your COA to replicate modifications in your operations and monetary actions. Add new accounts for brand new services or products, and take away out of date ones.

Greatest Practices for Chart of Accounts Administration

- Use a Constant Numbering System: A well-structured numbering system facilitates straightforward identification and reporting.

- Descriptive Account Names: Use clear and concise account names to keep away from confusion.

- Frequently Reconcile Your Accounts: Common reconciliation ensures accuracy and identifies potential discrepancies.

- Preserve a Detailed Account Description: Embrace an in depth description for every account to supply context and make clear its goal.

- Hold it Easy: Keep away from extreme complexity. A streamlined COA is simpler to handle and perceive.

- Keep Compliant: Guarantee your COA complies with related accounting requirements and laws.

- Again Up Your COA Frequently: Common backups defend your knowledge towards loss or corruption.

Troubleshooting Frequent COA Points

- Duplicate Account Names: Guarantee all account names are distinctive to keep away from confusion and errors.

- Incorrect Account Categorization: Correct categorization is crucial for correct monetary reporting. Double-check all account classifications.

- Lacking Accounts: Establish and add any lacking accounts to make sure full monetary monitoring.

- Inconsistent Numbering: Preserve a constant numbering system for environment friendly group and reporting.

Conclusion

A well-designed and maintained Chart of Accounts is prime to profitable monetary administration in QuickBooks. By understanding the totally different templates obtainable, making a personalized COA, and adhering to finest practices, companies can guarantee correct monetary reporting, streamline their bookkeeping processes, and make knowledgeable choices based mostly on dependable monetary knowledge. Keep in mind, investing time in establishing a sturdy COA is an funding within the long-term well being and success of your small business. Common overview and updates are key to making sure its continued effectiveness. Do not hesitate to hunt skilled accounting recommendation for those who want help in establishing or managing your QuickBooks Chart of Accounts.

Closure

Thus, we hope this text has supplied helpful insights into Mastering Your QuickBooks Funds: A Deep Dive into Chart of Accounts Templates. We hope you discover this text informative and useful. See you in our subsequent article!